By Saabira Chaudhuri

Fast-fashion retailer Inditex SA reaffirmed its industry-leading

success with strong first-quarter results Wednesday, as its nimble

business model and move to slow store expansion continued to pay

off.

The Zara parent's report contrasted with softer-than-expected

sales at rival Hennes & Mauritz AB.

Currency volatility and weaker consumer spending have pressured

shares throughout retail in recent months. But Inditex--whose full

name is Industria de Diseño Textil SA--has retained its crown as

the darling of the fast-fashion world as its strategy allows it to

jump on big fashion trends.

Inditex's shares are roughly flat over the past year, compared

with a 50% decline at Gap Inc., a 36% decline at Marks &

Spencer Group PLC, a 25% drop at H&M and a 5.6% fall at Primark

owner Associated British Foods PLC.

"We believe that Inditex has the best business model in

apparel," said Bernstein analyst Jamie Merriman.

Analysts and investors see Inditex as sensibly adapting to

changing shopping habits. In March, the Arteixo, Spain-based

company ratcheted down its store-expansion target to a range of 6%

to 8% over the next several years from a previous target of 8% to

10%.

By contrast, H&M has stuck with a store-expansion target of

10% to 15% a year since going public in 2008 even as it has

invested in digital. The strategy has concerned analysts, who think

the Swedish retailer is cannibalizing its own store sales.

But H&M can't easily back away from continuing to open new

physical stores, Liberum analyst Tom Gadsby said. Its localized

business model means the Stockholm-based company is forced to

rapidly open stores in new markets to justify the cost of local

distribution centers, merchandising and property teams and other

infrastructure it opens in every market.

The strategy has squeezed profit margins. Liberum expects

H&M's margin on earnings before interest and taxes to slide to

13.2% this fiscal year from 16.9% in 2014. That compares with a

forecast margin of 17.8% for Inditex, about flat with 17.7% in

2014.

While Inditex has far more stores than H&M overall--about

7,000, compared with H&M's 4,000--they are divided among

several brands, including Stradivarius, Massimo Dutti and Bershka.

Flagship brand Zara has only about 2,000 stores.

In H&M's top 10 markets--including places like the U.S.,

U.K. and Germany--H&M has close to five times the number of

stores that Zara does, according to Bernstein.

Also, while Inditex's rivals produce mainly in Asia, the Zara

owner's operations are largely based in Spain, allowing it to

quickly make and ship garments to Europe, its biggest market. The

company keeps inventory low, shipping products according to demand,

meaning it needs to take fewer markdowns for things like bad

weather and changing consumer tastes, avoiding the kinds of

problems competitors like Gap and H&M regularly run into.

Last month, Gap said first-quarter comparable sales were down 5%

as the company entered April with more inventory than planned due

to weaker-than-expected traffic in late March. Gap, which has more

than 3,000 company-operated stores, has also said it intends to

streamline its operating model as sales move online.

Inditex, the world's largest fashion retailer by sales, said net

profit for the quarter ended April 30 rose to EUR554 million ($621

million) from EUR521 million a year earlier. Sales grew 12% to

EUR4.88 billion. The results exceeded market expectations. Analysts

polled by FactSet had expected net profit of EUR547 million on

sales of EUR4.84 billion.

The company reported a strong performance across a broad swath

of markets, including China. The country has been difficult for

many brands lately, particularly luxury players like Burberry Group

PLC and Ralph Lauren Corp. "We are very pleased with our

performance in China," said Inditex Chief Executive Pablo Isla on a

conference call with analysts. "We believe very much in the

market."

On Wednesday, H&M reported monthly sales growth of 9% for

May, strong on the surface but below analysts' estimates. The

result translated into a second-quarter decline of 4% in adjusted

like-for-like sales, according to Exane BNP Paribas.

"Unfortunately coinciding with the revenue strength reported by

Inditex today, this again highlights the differing momentum between

the two businesses and quality of the business models, unhelpful

for H&M sentiment," said Exane analyst Simon Bowler.

Société Générale analyst Anne Critchlow was blunter. "There are

some deep structural differences separating the product, business

model and likely future fortunes of these two fashion retailers, "

she said. "We must prefer Inditex, today, tomorrow and well into

the future."

Patricia Kowsmann contributed to this article.

Write to Saabira Chaudhuri at saabira.chaudhuri@wsj.com

(END) Dow Jones Newswires

June 15, 2016 09:48 ET (13:48 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

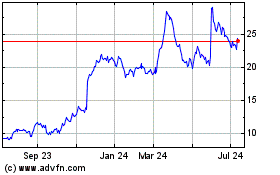

Gap (NYSE:GPS)

Historical Stock Chart

From Mar 2024 to Apr 2024

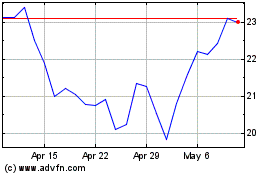

Gap (NYSE:GPS)

Historical Stock Chart

From Apr 2023 to Apr 2024