Ralph Lauren to Book $400 Million in Restructuring Charges

June 07 2016 - 10:10AM

Dow Jones News

Ralph Lauren Corp. unveiled a broad restructuring that will save

hundreds of millions of dollars, but also dent sales as the company

reduces merchandise sold to department stores and closes some of

its own retail locations.

The luxury apparel and accessories maker warned Tuesday that

sales in the current fiscal year would fall around 12% after

slipping 3% to $7.41 billion in the 12 months ended April 2.

In morning trading, the stock fell 9% to $87. As of Monday's

close, the shares are down nearly 30% over the past year.

The restructuring is the first significant step by new Chief

Executive Stefan Larsson to fix problems that have weighed on the

company's financial results, as the Journal previously reported.

They include too many brands and retail stores, and a reliance on

department stores, where shoppers are hooked on discounts. The

company also has bloated costs and inefficient sourcing.

The New York-based company said Tuesday that it expects to incur

a charge of up to $400 million for its restructuring efforts,

including a $150 million charge to liquidate excess inventory.

The moves are expected to result in $180 million to $220 million

in annual savings. This is in addition to $125 million that the

company previously said it would save from realigning its

management around global brands rather than by region.

Mr. Larsson, a former executive at the Gap Inc.'s Old Navy unit

and at H&M Hennes & Mauritz AB, was named CEO in September.

The post had previously been held by Ralph Lauren, the company's

founder, for all of its 49-year-history.

"Our performance has been disappointing over the last three

years, and it doesn't match the strength of the brand," Mr. Larsson

said in an interview. His fix-it strategy includes speeding the

production cycle of items, eliminating several layers of management

and cutting about 1,000 jobs.

Revenue is expected to fall as the company pulls back

merchandise shipped to department stores and closes about 50 of its

retail stores. Operating margin for the year is expected to be

about 10%, as the cost savings will offset expenses to open new

stores and currency fluctuations.

Write to Suzanne Kapner at Suzanne.Kapner@wsj.com

(END) Dow Jones Newswires

June 07, 2016 09:55 ET (13:55 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

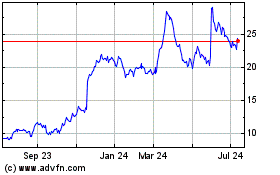

Gap (NYSE:GPS)

Historical Stock Chart

From Mar 2024 to Apr 2024

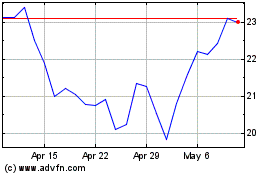

Gap (NYSE:GPS)

Historical Stock Chart

From Apr 2023 to Apr 2024