Dollar Stores Shine in Retail Tumult

May 26 2016 - 3:50PM

Dow Jones News

American shoppers haven't entirely given up on retail.

On Thursday, Dollar General Corp. and Dollar Tree Inc. both

reported sales growth and higher traffic. And executives from the

companies said they plan to expand their selection of discretionary

products -- those shoppers want but don't need -- like seasonal

party decorations, home goods and beauty products.

Shoppers are "back to work for the most part," said Dollar

General CEO Todd Vasos on Thursday, "Probably feeling a little more

confident and spending a little bit more on her non-consumables,"

like seasonal merchandise and home goods.

The strategy is a sign that they are confident their core

low-income consumers will continue to have extra spending power in

the foreseeable future and will use it in their locations. Their

customers typically come from households earning about $40,000 per

year.

Dollar stores have been a bright spot almost continuously since

the recession, with the two largest chains adding thousands of

stores.

Their results this quarter contrasts with those from traditional

apparel retailers like Gap Inc. and L Brands Inc. and department

stores including Macy's Inc. and Nordstrom Inc. which disappointed

investors.

"We are part of what I consider, in this economic environment,

the most attractive sector in retail," said Bob Sasser, chief

executive of Dollar Tree, the second-largest dollar store chain

after Dollar General.

Compared with big-box competitors like Wal-Mart Stores Inc.,

dollar stores are smaller and located in neighborhoods closer to

homes. They sell a combination of basic staples, like rice and

beans and toilet paper, along with "treasure hunt" products like

party decorations or children's toys, often in smaller package

sizes with low prices. Big consumer products companies have worked

to create more products that can be sold within the fast growing

format.

Other discount chains including TJX Cos. and Wal-Mart Stores

Inc. fared similarly well this quarter. Also on Thursday,

Burlington Stores Inc., which specializes in discounted branded

apparel and home goods, reported sales growth of 4.3% in stores

open at least a year for the quarter ending April 30.

Shares of Dollar Tree rose 13% on Thursday to $88.52, while

Dollar General's stock rose 4.8% to $88.11.

The April sales slowdown described by several retailers in

recent weeks due to the early Easter holiday and rainy spring

weather didn't shake sales from the dollar stores.

"While there is always weather and different phenomenons that

happen, we capitalize on whatever those phenomenons are," said Mr.

Vasos from Dollar General. "And we felt that we did a pretty good

job."

Same-store sales at Dollar General rose 2.2%, helped by

increases in both customer traffic and average transaction amount.

Profit rose to $295.1 million from $253.2 million, while sales

increased 7% to $5.27 billion.

Dollar General is focusing on expanding its selection of

perishable food, health and beauty care and party and stationery

supplies, as it plans to grow from almost 13,000 locations to

20,000 stores by 2020, said executives on a call with investors to

discuss earnings.

Dollar Tree, meanwhile, is expanding its frozen and refrigerated

selection by installing freezers and coolers in 400 more stores in

2016. Perishable food brings shoppers to stores more frequently. It

is also adding new stores and building its 11th new distribution

center to support its growth.

Dollar Tree reported a profit of $232.7 million, up from $69.5

million, thanks to the acquisition of Family Dollar, its smaller

competitor, last year. Revenue rose to $5.09 billion from $2.18

billion. Same-store sales rose 2.2% excluding foreign exchange

changes.

For 2016, Dollar Tree increased its financial forecast and now

expects earnings per share of $3.58 to $3.80, up from $3.35 to

$3.65.

Anne Steele contributed to this article.

Write to Sarah Nassauer at sarah.nassauer@wsj.com

(END) Dow Jones Newswires

May 26, 2016 15:35 ET (19:35 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

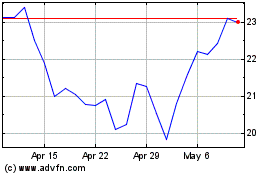

Gap (NYSE:GPS)

Historical Stock Chart

From Mar 2024 to Apr 2024

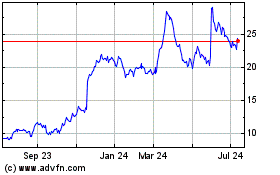

Gap (NYSE:GPS)

Historical Stock Chart

From Apr 2023 to Apr 2024