Abercrombie's Sales Slip as Fewer Shoppers Visit Its Stores

May 26 2016 - 8:40AM

Dow Jones News

Abercrombie & Fitch Co.'s turnaround efforts were derailed

last quarter, as fewer shoppers visited its stores and the teen

retailer tried to hold the line on discounts.

Sales at stores open at least a year fell 4% in the fiscal first

quarter ended April 30, marking a reversal from the preceding

quarter, when the company reported its first gain in more than

three years. Analysts had expected a 1.5% increase.

Executive Chairman Arthur Martinez attributed the decline to

"traffic headwinds, particularly in international markets and in

our U.S. flagship and tourist stores." Same-store sales are

expected to remain challenged in the second quarter and improve in

the second half of the year.

The New Albany, Ohio, company said total revenue fell 3% to

$685.5 million for the quarter. Its net loss was $39.6 million, or

59 cents a share, compared with $63.2 million, or 91 cents, a year

ago. Analysts had expected a loss of 51 cents a share on $709

million of revenue, according to FactSet.

As in previous quarters, the company's Hollister brand performed

better than the flagship brand. Hollister sales at stores open at

least a year were flat, while that metric fell 8% at

Abercrombie.

Abercrombie has been hit hard by changing consumer preferences,

declining mall traffic and fierce competition from fast-fashion

players. After the company's highly sexual image cultivated by

former CEO Mike Jeffries started alienating shoppers, the retailer

began updating its merchandise assortment and revamping stores.

Mr. Martinez said the company has also pulled back on promotions

and is now selling more merchandise at full price. Even as many

retailers are anticipating a highly promotional environment in the

coming months, Mr. Martinez said he doesn't expect to change the

pricing strategy at Abercrombie. Passing up short-term gains from

promotions is a "price that needs to be paid" for the long-term

health of the company, he said in an interview.

Abercrombie joins a growing list of retailers reporting a weak

start to the year. Poor results at department stores and specialty

retailers have illustrated consumers' shift away from

brick-and-mortar stores. Amazon.com Inc., meanwhile, has made an

aggressive push into fashion and apparel sales.

"The traffic situation is a systemic problem for the industry,"

said Mr. Martinez. "Our job is to make the most of the traffic we

do get."

He said Abercrombie hasn't ruled out the option of selling

merchandise on Amazon. "As our brands come back to their status and

health, we will be looking for additional channels to take our

products," he said. "I would never say never to anything, but we

have an awful lot of work to do before we can think of anything

like that."

Last week, Gap Inc. CEO Art Peck said in response to an

investor's question at the annual shareholder meeting that the

company is open to selling merchandise on Amazon and other third

parties.

Abercrombie has been operating without a chief executive for

more than a year. Since Mr. Jeffries departed in December 2014, the

company has been run by an office of the chairman, which includes

Mr. Martinez.

The retailer recently promoted Hollister brand President Fran

Horowitz to the role of company president and chief merchandising

officer. Ms. Horowitz is seen as a top candidate for the CEO

job.

On Monday, the company named Target Corp. veteran Stacia

Andersen and Victoria's Secret veteran Kristin Scott to run the

Abercrombie and Hollister brands, respectively. Ms. Andersen will

replace Christos Angelides, who stepped down from his role in

December. The company's chief operating officer, Jonathan Ramsden,

is also departing from his role effective June 15.

Write to Khadeeja Safdar at khadeeja.safdar@wsj.com

(END) Dow Jones Newswires

May 26, 2016 08:25 ET (12:25 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

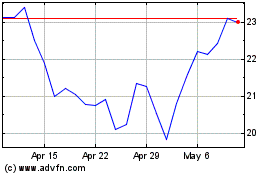

Gap (NYSE:GPS)

Historical Stock Chart

From Mar 2024 to Apr 2024

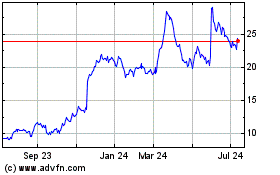

Gap (NYSE:GPS)

Historical Stock Chart

From Apr 2023 to Apr 2024