Gap to Close Stores Amid Sales Slump -- WSJ

May 20 2016 - 3:03AM

Dow Jones News

By Maria Armental and Khadeeja S. Safdar

Gap Inc., under pressure to turn around operations amid a

prolonged sales slump, said it plans to close all its Old Navy

stores in Japan and some Banana Republics mostly outside of North

America by the end of its business year.

The San Francisco company also gave a cautious outlook for the

remainder of the year, saying it needed "trends in the apparel

retail environment" to improve from the first quarter to achieve

Wall Street's consensus earnings target for the year. On Thursday,

Gap reported its fifth straight quarter of lower revenue and

profit.

Altogether, Gap said it would close about 75 stores, largely

abroad, and said it would book about $300 million in restructuring

charges before taxes. It estimated the moves would save about $275

million a year.

The restructuring efforts, which follow dozens of store closings

in North America last year, weren't enough to protect the company's

investment grade credit rating. S&P Global Ratings downgraded

the retailer to junk status Thursday. Fitch Ratings downgraded Gap

to junk status last week.

"We believe meaningful industry headwinds have more than offset

the company's various operating initiatives and hurt the company's

competitive standing on a sustained basis," wrote S&P credit

analyst Helena Song, "as the company has weakened brand appeal and

lost share to fast fashion retailers, online competitors, and

off-price retailers."

The Old Navy budget brand, which until recently had been

performing better than Gap's other brands, has struggled in recent

quarters. In the first quarter, Old Navy sales at stores open at

least a year fell 6%, while Gap same-store sales fell 3% and Banana

Republic dropped 11%.

On a conference call, CEO Art Peck attributed the problems at

Old Navy to "too much fashion, too much duplication in the

assortment" and weak marketing in the first quarter. Mr. Peck said

the company is stepping up its TV commercials after pulling back in

April. "We had ineffective TV. TV is a big brand driver for Old

Navy," he said.

The changes come after Old Navy President Stefan Larsson, who

had been credited with turning around the brand, left the company

last year to become Ralph Lauren Corp.'s chief executive. Gap named

company veteran Sonia Syngal to replace him.

The retailer, which in February reported its first annual sales

decline since fiscal year 2011, has been adjusting its North

American operations, closing stores and laying off workers. The

Japan exit marks a reversal for the company, which earlier this

year had planned to open additional Old Navy stores in the

country.

For the quarter ended April 30, Gap reported a profit of $127

million, or 32 cents a share, down from $239 million, or 56 cents a

share, a year earlier. Revenue fell 6% to $3.44 billion. The

results were in line with the company's downbeat guidance released

earlier this month.

Write to Maria Armental at maria.armental@wsj.com

(END) Dow Jones Newswires

May 20, 2016 02:48 ET (06:48 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

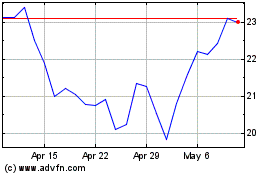

Gap (NYSE:GPS)

Historical Stock Chart

From Mar 2024 to Apr 2024

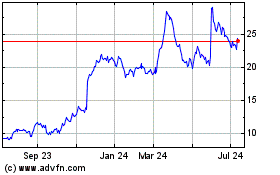

Gap (NYSE:GPS)

Historical Stock Chart

From Apr 2023 to Apr 2024