By Eric Morath and Suzanne Kapner

Consumers boosted spending in April to the highest levels in

more than a year, accelerating their turn toward online shopping

and widening the divide between in-store retailers and Internet

outlets pitching lower prices and convenience.

While data from the Commerce Department on Friday showed overall

retail sales rose 1.3% in April from a month earlier, the category

that includes shopping on Amazon.com Inc. and rival websites and

apps grew 2.4%. And in the past year, Internet and catalog sales

have grown more than three times as fast as overall sales, up

10.2%. Department-store sales, meanwhile, sank 1.7% over the past

12 months.

Results from the retail sector this past week showed how the

shift is knocking down major companies despite resilience in the

broader economy. Major retailers including Macy's Inc., Kohl's

Corp. and Nordstrom Inc. this week reported sharply lower sales and

profits, while Gap Inc. said it was considering closing more stores

after sales continued to sink.

Amazon is now the second-largest apparel seller in the U.S.,

behind Wal-Mart Stores Inc., according to Morgan Stanley. That

category was once dominated by department stores.

"Just like bookstores and music stores and hardware stores

before them, apparel retailers are underestimating how fast Amazon

is going to eat their lunch," said Joel Bines, co-head of

consulting firm AlixPartners LLP's retail practice. "We've seen

this movie before."

Executives at traditional large retailers struggled to explain

the slump, which for some companies was their worst since the

recession. Some pointed to a decrease in mall traffic, while others

said shoppers were spending more on items their stores don't sell

such as entertainment, travel and food.

"The consumer was simply spending their hard-earned dollars in

experiences, entertainment and to beautify their home," J.C. Penney

Co. Chief Executive Marvin Ellison said Friday after reporting

lower-than-expected sales. The chain is responding by adding

appliances and other home goods to its stores.

For economists, Friday's data offered a glimmer of optimism, no

matter where the money was being spent. Consumers remain the

primary driver of the U.S. economy, accounting for more than

two-thirds of economic output. A spending slowdown in the first

three months of the year was partly responsible for economic growth

nearly stalling, climbing at just a 0.5% seasonally adjusted annual

rate.

Economists say April's spending surge points to faster growth,

as measured by gross domestic product, this spring. Forecasting

firm Macroeconomic Advisers raised its expectation for

second-quarter GDP growth to a 2.3% annualized advance from 2%.

Barclays raised its forecast to 2.2% from 2%.

The Federal Reserve Bank of Atlanta's real-time estimate of

economic growth moved Friday to a 2.8% gain, from the prior

estimate of 2.2%.

If consumers can spur stronger economic growth in the coming

months, that could influence the Federal Reserve's decision on when

to raise its benchmark interest rate. After the Fed in December

raised rates from near-zero, a choppy economic performance so far

this year has led the central bank to delay a second increase.

Policy makers next meet in mid-June.

"With diminished headwinds from abroad and consumers responding

to growing household income and wealth, consumer spending should

improve over the course of the second quarter," Boston Fed

President Eric Rosengren said Thursday.

Large department stores were once bellwethers of consumer

behavior, but there has been a clear and growing divergence in

recent years.

Improved online sales is driving revenue growth at Blair Candy

Co., said owner Pamela Macharola. The business has shifted from

only supplying the region around its Altoona, Pa., warehouse to

reaching a national customer base nostalgic for classic treats such

as Lemonheads and Atomic Fireballs.

"We're doing very well and we attribute a lot of that to gas

prices going down," she said. "When people feel good, and have more

money at the end of the week, they're willing to spend."

But larger retailers seem to be struggling to make a similar

pivot, even though they are getting an increasing amount of revenue

from their own e-commerce operations.

Executives at Nordstrom, which gets 20% of its sales online,

cited weak traffic to malls as well as aggressive discounting

online for its slump. "There is a lot of excess product out in the

marketplace. It's certainly easy to shop online. There is some

heavy, heavy discounting going on, and we're seeing that effect in

our business," said co-president Erik Nordstrom.

The global economy is ratcheting up price pressures as well.

Consumer prices for apparel, homewares and other goods often

imported from overseas have flattened or fallen due to a stronger

dollar. In some cases that means retailers' margins shrink between

placing orders and stocking their shelves, IHS economist Chris G.

Christopher said.

Even higher-priced luxury retailers haven't been immune.

Hudson's Bay Co. on Friday warned of weaker-than-expected sales for

its recent quarter, dragged down by its Saks Fifth Avenue

chain.

Foot traffic to apparel stores declined 7.2% in April, according

to John Kernan, an analyst with Cowen & Co. And Nordstrom

finance chief Michael Koppel said Thursday that "we continue to see

traffic falling off in malls."

When shoppers do visit malls, they are increasingly spending

money on entertainment such as movies and bowling and services such

as hair salons and fitness centers, according to Liz Holland, chief

executive of Abbell Associates, a real-estate redevelopment firm.

Despite Amazon's rise, not all traditional retailers are

struggling. Fast-fashion chains such as H&M Hennes &

Mauritz AB have been posting strong sales recently, as have

specialty retailers like Foot Locker Inc.

Amazon, meanwhile, continues to expand into new categories such

as grocery and fashion. The web retailer's sales jumped 28% in the

latest quarter, its fastest growth since 2012, and the company

booked its fourth straight profitable quarter with expanded margins

in its core retail business.

Analysts are expecting strong results this coming week from Home

Depot Inc. and Lowe's Cos., which are benefiting from strength in

the housing market. And off-price retailer TJX Cos. is expected to

post sales increases as well.

But earnings from Wal-Mart and Target Corp. are likely to come

under pressure from higher wages and ecommerce investments.

With the unemployment rate at a historically low level -- 5% in

April -- and wages showing signs of increasing even beyond the

retail sector, consumers are positioned to spend. But they remain

cautious nearly seven years after the recession ended. Two-thirds

of their outlays go to services, from rent to doctor visits to

Netflix subscriptions.

"The consumer sector is the strongest sector in this economy,"

IHS's Mr. Christopher said. "Discount stores are doing well and

online stores are doing well, but these department stores are

getting just pounded."

Write to Eric Morath at eric.morath@wsj.com

(END) Dow Jones Newswires

May 14, 2016 02:47 ET (06:47 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

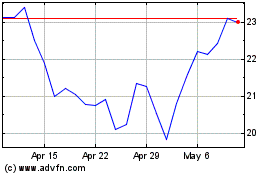

Gap (NYSE:GPS)

Historical Stock Chart

From Mar 2024 to Apr 2024

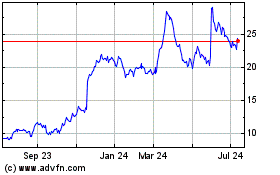

Gap (NYSE:GPS)

Historical Stock Chart

From Apr 2023 to Apr 2024