UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

_____________________

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of The Securities Exchange Act of 1934

Date of Report

(Date of earliest event reported)

February 8, 2016

THE GAP, INC.

(Exact name of registrant as specified in its charter)

|

| | | | |

Delaware | | 1-7562 | | 94-1697231 |

(State of incorporation) | | (Commission File Number) | | (IRS Employer Identification No.) |

|

| | |

Two Folsom Street

San Francisco, California | | 94105 |

(Address of principal executive offices) | | (Zip Code) |

(415) 427-0100

(Registrant’s telephone number,

including area code)

N/A

(Former name or former address, if changed since last report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below):

[ ] Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

[ ] Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

[ ] Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR

240.14d-2(b))

[ ] Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR

240.13e-4(c))

Item 2.02. Results of Operations and Financial Condition

On February 8, 2016, The Gap, Inc. (the “Company”) issued a press release announcing the Company’s sales for the fiscal month and quarter ended January 30, 2016. A copy of this press release is attached hereto as Exhibit 99.1.

Item 9.01. Financial Statements and Exhibits

99.1 Press Release dated February 8, 2016

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

| | | | | |

| THE GAP, INC. | |

| (Registrant) | |

| | | |

| | | |

Date: | February 8, 2016 | | By: | /s/ Sabrina L. Simmons | |

| | Sabrina L. Simmons | |

| | Executive Vice President and |

| | Chief Financial Officer | |

EXHIBIT INDEX

|

| | |

Exhibit Number | Description | |

| |

99.1 | Press Release dated February 8, 2016 |

GAP INC. REPORTS JANUARY AND FOURTH QUARTER SALES RESULTS

Company Guides to the High End of its Fiscal 2015 Earnings per Share Range

SAN FRANCISCO - February 8, 2016 - Gap Inc. (NYSE: GPS) today reported that net sales for the four-week period ended January 30, 2016 were $813 million compared with net sales of $888 million for the four-week period ended January 31, 2015. For the fourth quarter of fiscal year 2015, Gap Inc.’s net sales were $4.39 billion compared with $4.71 billion for the fourth quarter last year.

On a constant currency basis, Gap Inc. net sales decreased 5 percent for the fourth quarter of fiscal year 2015. In calculating net sales growth on a constant currency basis, current year foreign exchange rates are applied to both current year and prior year net sales. This is done to enhance the visibility of underlying business trends, excluding the impact of foreign currency exchange rate fluctuations.

“We are pleased to guide to the high end of our previously announced full-year earnings per share range,” said Sabrina Simmons, chief financial officer of Gap Inc. “As we kick-off fiscal year 2016, our brands look forward to introducing their new Spring collections to customers.”

January Comparable Sales Results

Gap Inc.’s comparable sales for January 2016 were down 8 percent versus negative 3 percent last year. Comparable sales by global brand for January 2016 were as follows:

| |

• | Gap Global: negative 6 percent versus negative 9 percent last year |

| |

• | Banana Republic Global: negative 17 percent versus positive 2 percent last year |

| |

• | Old Navy Global: negative 6 percent versus positive 3 percent last year |

Fourth Quarter Comparable Sales Results

Gap Inc.’s comparable sales for the fourth quarter of fiscal year 2015 were down 7 percent versus positive 2 percent last year. Comparable sales by global brand for the fourth quarter were as follows:

| |

• | Gap Global: negative 3 percent versus negative 6 percent last year |

| |

• | Banana Republic Global: negative 14 percent versus positive 1 percent last year |

| |

• | Old Navy Global: negative 8 percent versus positive 11 percent last year |

Full-Year and Fourth Quarter Guidance

The company narrowed its full-year adjusted diluted earnings per share guidance range for fiscal year 2015 to $2.41 to $2.42, excluding the one-time negative impact from the previously announced strategic actions of about $0.20 per diluted share, for fiscal year 2015.

For the fourth quarter of fiscal year 2015, the company expects adjusted diluted earnings per share to be in the range of $0.56 to $0.57.

Please see the reconciliations of adjusted diluted earnings per share, a non-GAAP financial measure, from the GAAP financial measure in the table at the end of this press release.

Additional insight into Gap Inc.’s sales performance is available by calling 1-800-GAP-NEWS (1-800-427-6397). International callers may call 706-902-4949. The recording will be available at approximately 1:15 p.m. Pacific Time on February 8, 2016 and available for replay until 1:15 p.m. Pacific Time on February 12, 2016.

Fourth Quarter Earnings

Gap Inc. will release its fourth quarter earnings results via press release on February 25, 2016 at 1:15 p.m. Pacific Time. In addition, the company will host a summary of Gap Inc.’s fourth quarter results during a live conference call and webcast on February 25, 2016 from approximately 2:00 p.m. to 3:00 p.m. Pacific Time. The conference call can be accessed by calling 1-855-5000-GPS or 1-855-500-0477 (participant passcode: 2809688). International callers may dial 913-643-0954. The webcast can be accessed at www.gapinc.com.

February Sales

The company will report February sales at 1:15 p.m. Pacific Time on March 3, 2016.

Forward-Looking Statements

This press release and related sales recording contain forward-looking statements within the "safe harbor" provisions of the Private Securities Litigation Reform Act of 1995. All statements other than those that are purely historical are forward-looking statements. Words such as "expect," "anticipate," "believe," "estimate," "intend," "plan," "project," and similar expressions also identify forward-looking statements. Forward-looking statements include statements regarding:

| |

• | earnings per share for the full year and the fourth quarter of fiscal year 2015. |

Because these forward-looking statements involve risks and uncertainties, there are important factors that could cause the company's actual results to differ materially from those in the forward-looking statements. These factors include, without limitation, the following:

| |

• | the risk that additional information may arise during the company’s close process or as a result of subsequent events that would require the company to make adjustments to its financial expectations. |

Additional information regarding factors that could cause results to differ can be found in the company’s Annual Report on Form 10-K for the fiscal year ended January 31, 2015, as well as the company’s subsequent filings with the Securities and Exchange Commission.

These forward-looking statements are based on information as of February 8, 2016. The company assumes no obligation to publicly update or revise its forward-looking statements even if experience or future changes make it clear that any projected results expressed or implied therein will not be realized.

About Gap Inc.

Gap Inc. is a leading global retailer offering clothing, accessories, and personal care products for men, women, and children under the Gap, Banana Republic, Old Navy, Athleta, and Intermix brands. Fiscal year 2015 net sales were $15.8 billion. Gap Inc. products are available for purchase in more than 90 countries worldwide through about 3,300 company-operated stores, over 400 franchise stores, and e-commerce sites. For more information, please visit www.gapinc.com.

|

| |

Investor Relations Contact: Jack Calandra (415) 427-1726 Investor_relations@gap.com | Media Relations Contact: Kari Shellhorn (415) 521-0595 Press@gap.com |

The Gap, Inc.

NON-GAAP FINANCIAL MEASURES

UNAUDITED

ADJUSTED EXPECTED EARNINGS PER SHARE RANGE

Adjusted expected diluted earnings per share is a non-GAAP financial measure. This guidance is provided to enhance visibility into the company's expected results excluding impact from its strategic actions primarily related to Gap brand.

|

| | | | | | | | | | | | | | | |

| 13 Weeks Ended | | | | |

| January 30, 2016 | | Fiscal Year 2015 |

| Low End | | High End | | Low End | | High End |

Expected earnings per share - diluted | $ | 0.52 |

| | $ | 0.53 |

| | $ | 2.21 |

| | $ | 2.22 |

|

Add: Impact from strategic actions | 0.04 |

| | 0.04 |

| | 0.20 |

| | 0.20 |

|

Adjusted expected earnings per share - diluted | $ | 0.56 |

| | $ | 0.57 |

| | $ | 2.41 |

| | $ | 2.42 |

|

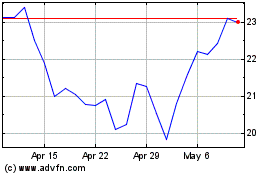

Gap (NYSE:GPS)

Historical Stock Chart

From Mar 2024 to Apr 2024

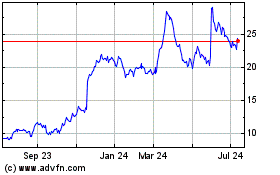

Gap (NYSE:GPS)

Historical Stock Chart

From Apr 2023 to Apr 2024