Gap Reports Downbeat Profit Guidance, Drop in September Sales--Update

October 08 2015 - 10:01PM

Dow Jones News

By George Stahl

Gap Inc. said total sales in September fell 1%, hurt by the

stronger dollar and weakness at Banana Republic, and gave downbeat

guidance on the company's expected profitability in the current

quarter.

The retailer said it now expects its gross margin rate for the

third quarter to be similar to the second quarter. In the July

quarter, Gap had a gross margin of 37.4%; analysts were expecting

39.6% for the current quarter.

Shares of Gap, down 31% over the past 12 months, fell 5.9% to

$27.25 in after-hours trading.

Total sales for the five weeks ended Saturday was $1.46 billion,

down from $1.48 billion a year ago. On a constant-currency basis,

September sales rose 2% from a year ago.

Chief Financial Officer Sabrina Simmons called the month

"challenging" in the company's news release.

Excluding stores newly opened or closed, sales at Gap Inc.

stores slipped 1%, better than the 1.6% drop estimated by data

tracker RetailMetrics.

At the company's different brands, same-store sales were flat at

the namesake Gap stores, fell 10% at Banana Republic and rose 4% at

Old Navy.

RetailMetrics had projected same-store sales to fall 6.2% at

Gap's namesake stores, drop 5.6% at Banana Republic and rise 5.6%

at Old Navy. The firm noted that the Gap stores had their strongest

same-store sales result since April, while Banana Republic had its

third-straight double-digit percentage decline.

Write to George Stahl at george.stahl@wsj.com

Subscribe to WSJ: http://online.wsj.com?mod=djnwires

(END) Dow Jones Newswires

October 08, 2015 21:46 ET (01:46 GMT)

Copyright (c) 2015 Dow Jones & Company, Inc.

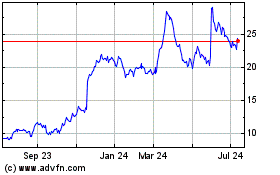

Gap (NYSE:GPS)

Historical Stock Chart

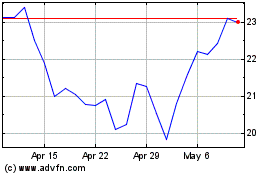

From Mar 2024 to Apr 2024

Gap (NYSE:GPS)

Historical Stock Chart

From Apr 2023 to Apr 2024