UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

_____________________

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of The Securities Exchange Act of 1934

__________________________________________

Date of Report

(Date of earliest event reported)

August 20, 2015

THE GAP, INC.

_______________________________________________________________

(Exact name of registrant as specified in its charter)

|

| | | | |

Delaware | | 1-7562 | | 94-1697231 |

(State of incorporation) | | (Commission File Number) | | (IRS Employer Identification No.) |

|

| | |

Two Folsom Street

San Francisco, California | | 94105 |

(Address of principal executive offices) | | (Zip Code) |

(415) 427-0100

(Registrant’s telephone number,

including area code)

N/A

_______________________________________________________________

(Former name or former address, if changed since last report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below):

[ ] Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

[ ] Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

| |

[ ] | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| |

[ ] | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Item 2.02. Results of Operations and Financial Condition

On August 20, 2015, The Gap, Inc. (the “Company”) issued a press release announcing the Company’s earnings for the second quarter ended August 1, 2015. A copy of this press release is attached hereto as Exhibit 99.1.

Item 9.01. Financial Statements and Exhibits

99.1 Press Release dated August 20, 2015 announcing the Company’s earnings for the second quarter ended August 1, 2015.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

| | | |

| THE GAP, INC. | |

| (Registrant) | |

| | | |

| | | |

Date: August 20, 2015 | By: | /s/ Sabrina L. Simmons | |

| | Sabrina L. Simmons | |

| | Executive Vice President and |

| | Chief Financial Officer | |

EXHIBIT INDEX

|

| | |

Exhibit Number | Description | |

99.1 Press Release dated August 20, 2015 announcing the Company’s earnings for the second quarter ended August 1, 2015.

GAP INC. REPORTS SECOND QUARTER RESULTS

SAN FRANCISCO - August 20, 2015 - Gap Inc. (NYSE: GPS) today reported second quarter fiscal year 2015 results and reaffirmed its full-year earnings per share guidance to be in the range of $2.75 to $2.80, excluding the impact from strategic actions previously announced on June 15, 2015.

“I remain confident in our strategies to improve business performance and drive loyalty going forward,” said Art Peck, chief executive officer, Gap Inc. “Our evolving product operating model is laying the foundation to more consistently deliver on-trend product collections across our portfolio.”

On a reported basis, Gap Inc.’s second quarter of fiscal year 2015 diluted earnings per share were $0.52, including the negative impacts associated with foreign currency fluctuations, West Coast port delays, and the strategic actions.

Excluding the negative impact of about $0.12 from the strategic actions, the company’s adjusted diluted earnings per share were $0.64 for the second quarter of fiscal year 2015. Please see the reconciliation of adjusted diluted earnings per share, a non-GAAP financial measure, from the GAAP financial measure in the table at the end of this press release.

In addition, Gap Inc. distributed about $800 million to shareholders through share repurchases and dividends fiscal year-to-date, reinforcing the company’s commitment to returning excess cash to shareholders.

First Half Fiscal Year 2015 Results

For the first half of fiscal year 2015, the company’s diluted earnings per share were $1.09. The company’s adjusted diluted earnings per share were $1.42, or an increase of approximately 12 percent compared with adjusted diluted earnings per share for the first half of fiscal year 2014, which excludes a $0.05 gain on asset sale. The company noted that its adjusted diluted earnings per share for the first half of fiscal year 2015 excludes the following negative impacts:

| |

• | $0.06 per share due to the estimated impact from foreign currency fluctuations; |

| |

• | $0.13 per share due to the estimated impact from West Coast port delays; and |

| |

• | $0.14 per share due to charges associated with strategic actions primarily at Gap brand, including lease buyouts, asset impairments, and employee-related costs. |

“We’re pleased to deliver earnings per share growth of about 12 percent on an adjusted basis for the first half of the year, while continuing to work through product challenges at two of our global brands,” said Sabrina Simmons, chief financial officer, Gap Inc.

Please see the reconciliation of adjusted diluted earnings per share, a non-GAAP financial measure, from the GAAP financial measure in the table at the end of this press release.

Business Highlights

| |

• | On top of three consecutive years of growth, Old Navy delivered another quarter of positive comparable sales, demonstrating the continued success of its demand-driven and trend-predictive product pipeline in delivering aspirational collections that customers love. |

| |

• | Gap brand continues to make progress against its strategic actions, including right-sizing its North America store count to create a smaller, more vibrant fleet of stores. The brand’s leadership team remains focused on an aggressive agenda designed to improve business performance, including the implementation of a clear, on-brand product aesthetic framework and a new product operating model to increase speed, predictability and responsiveness. |

| |

• | The company continues to pursue its strategy to integrate physical and digital shopping experiences, redefining how customers shop and engage with Gap Inc.’s portfolio of brands. During the quarter, the company expanded its Reserve in Store service to all U.S. Athleta stores, while its Order in Store capabilities continued to offer more customers across its portfolio access to expanded inventories including broader size, color and style selections. |

Second Quarter 2015 Comparable Sales Results

Gap Inc.’s comparable sales for the second quarter of fiscal year 2015 were down 2 percent versus flat last year. Comparable sales by global brand for the second quarter were as follows:

| |

• | Gap Global: negative 6 percent versus negative 5 percent last year |

| |

• | Banana Republic Global: negative 4 percent versus flat last year |

| |

• | Old Navy Global: positive 3 percent versus positive 4 percent last year |

Second Quarter 2015 Net Sales Results

For the second quarter of fiscal year 2015, Gap Inc.’s net sales decreased 2 percent to $3.90 billion compared with $3.98 billion for the second quarter last year.

On a constant currency basis, net sales for the second quarter of fiscal year 2015 were about flat compared with last year. In calculating the net sales change on a constant currency basis, current year foreign exchange rates are applied to both current year and prior year net sales. This is done to enhance the visibility of underlying sales trends, excluding the impact of foreign currency exchange rate fluctuations.

The translation of net sales in foreign currencies into U.S. dollars negatively impacted the company’s reported sales for the second quarter of fiscal year 2015 by about $100 million, primarily due to the weakening Japanese yen and Canadian dollar.

The following table details the company’s second quarter 2015 net sales:

|

| | | | | | | | | | | | | | | | | | | | | | | |

($ in millions) | | Gap Global | | Old Navy Global | | Banana

Republic Global | | Other (2) | | Total | | Percentage of Net Sales |

Quarter Ended August 1, 2015 | | | | | | |

U.S. (1) | | $ | 795 |

| | $ | 1,500 |

| | $ | 563 |

| | $ | 177 |

| | $ | 3,035 |

| | 78 | % |

Canada | | 88 |

| | 124 |

| | 59 |

| | 1 |

| | 272 |

| | 7 | % |

Europe | | 176 |

| | — |

| | 20 |

| | — |

| | 196 |

| | 5 | % |

Asia | | 270 |

| | 49 |

| | 27 |

| | — |

| | 346 |

| | 9 | % |

Other regions | | 39 |

| | 2 |

| | 8 |

| | — |

| | 49 |

| | 1 | % |

Total | | $ | 1,368 |

| | $ | 1,675 |

| | $ | 677 |

| | $ | 178 |

| | $ | 3,898 |

| | 100 | % |

($ in millions) | | Gap Global | | Old Navy Global | | Banana

Republic Global | | Other (3) | | Total | | Percentage of Net Sales |

Quarter Ended August 2, 2014 | | | | | | |

U.S. (1) | | $ | 850 |

| | $ | 1,460 |

| | $ | 576 |

| | $ | 185 |

| | $ | 3,071 |

| | 77 | % |

Canada | | 95 |

| | 127 |

| | 58 |

| | 1 |

| | 281 |

| | 7 | % |

Europe | | 206 |

| | — |

| | 26 |

| | — |

| | 232 |

| | 6 | % |

Asia | | 274 |

| | 35 |

| | 37 |

| | — |

| | 346 |

| | 9 | % |

Other regions | | 44 |

| | — |

| | 7 |

| | — |

| | 51 |

| | 1 | % |

Total | | $ | 1,469 |

| | $ | 1,622 |

| | $ | 704 |

| | $ | 186 |

| | $ | 3,981 |

| | 100 | % |

| |

(1) | U.S. includes the United States, Puerto Rico, and Guam. |

| |

(2) | Includes Athleta and Intermix. |

| |

(3) | Includes Piperlime, Athleta and Intermix. |

Additional Second Quarter Results and 2015 Outlook

Earnings per Share and Operating Margin

On a reported basis, second quarter of fiscal year 2015 diluted earnings per share were $0.52, including the negative impacts associated with foreign currency fluctuations, West Coast port delays, and the strategic actions.

Excluding the negative impact of about $0.12 from the strategic actions, the company’s adjusted diluted earnings per share were $0.64 for the second quarter of fiscal year 2015. Please see the reconciliation of adjusted diluted earnings per share, a non-GAAP financial measure, from the GAAP financial measure in the table at the end of this press release.

The company also noted that the estimated impact from foreign currency fluctuations reduced the company’s diluted earnings per share growth rate in the second quarter of fiscal year 2015 by about $0.04 or about 5 percentage points.1

The company reaffirmed its full-year earnings per share guidance to be in the range of $2.75 to $2.80 for fiscal year 2015, excluding the negative impact associated with the strategic actions. The company updated its estimate of the charges associated with the strategic actions to approximately $130 million to $140 million, from the previously announced range of $140 million to $160 million. This guidance is provided to enhance visibility into the company’s expectations regarding its ongoing business, excluding the strategic actions.

The company continues to expect operating margin, excluding the impact associated with the strategic actions, to be down about 1 percentage point in fiscal year 2015 compared with fiscal year 2014.

Operating Expenses

Second quarter operating expenses were $1.09 billion, compared with $1.00 billion in the second quarter of last year. Marketing expenses for the second quarter were $131 million, down $11 million from last year.

Effective Tax Rate

The effective tax rate was 38 percent for the second quarter of fiscal year 2015. The company continues to expect its full-year fiscal 2015 effective tax rate to be about 38 percent.

Inventory

At the end of the second quarter of fiscal year 2015, inventory dollars per store were up about 1 percent on a year-over-year basis, in line with the company’s previously communicated guidance.

At the end of the third quarter of fiscal year 2015, the company expects year-over-year inventory dollars per store to be down slightly compared with last year.

Cash and Cash Equivalents

The company ended the second quarter of fiscal year 2015 with $1.04 billion in cash and cash equivalents. Year-to-date free cash flow, defined as net cash provided by operating activities less purchases of property and equipment, was an inflow of $341 million. Please see the reconciliation of free cash flow, a non-GAAP financial measure, from the GAAP financial measure in the tables at the end of this press release.

Cash Distribution

During the quarter, Gap Inc. repurchased 10 million shares for about $375 million and ended the second quarter of fiscal year 2015 with 410 million shares outstanding.

Including the company’s dividend, shareholder distributions totaled about $800 million for the first half of fiscal year 2015, underscoring the company’s commitment to returning excess cash to shareholders.

The company paid a dividend of $0.23 per share during the second quarter of fiscal year 2015. In addition, on August 13, 2015, the company announced that its Board of Directors authorized a third quarter dividend of $0.23 per share.

Capital Expenditures

Fiscal year-to-date capital expenditures were $301 million. For fiscal year 2015, the company continues to expect capital spending to be approximately $800 million.

Depreciation and Amortization

The company continues to expect depreciation and amortization expense, net of amortization of lease incentives, to be about $525 million for fiscal year 2015.

Real Estate

The company ended the second quarter of fiscal year 2015 with 3,751 store locations in 51 countries, of which 3,309 were company-operated.

1 In calculating earnings per share excluding the impact of foreign exchange, the company estimates current gross margins using the appropriate prior year rates (including the impact of merchandise-related hedges), translates current period foreign earnings at prior year rates, and excludes the year-over-year earnings impact of balance sheet remeasurement and gains or losses from non-merchandise-related foreign currency hedges. This is done in order to enhance the visibility of business results excluding the direct impact of foreign currency exchange rate fluctuations.

While the company continues to pursue its previously stated growth initiatives with a focus on Asia, global outlets and Athleta in the U.S., it now expects its overall store count and square footage to remain flat in fiscal year 2015, as compared to last year due to Gap brand store closures.

Store count, openings, closings, and square footage for our stores are as follows:

|

| | | | | | | | | | | | | | |

| 13 Weeks Ended August 1, 2015 |

| Store Locations Beginning of Q2 | | Store Locations Opened | | Store Locations Closed | | Store Locations End of Q2 | | Square Feet (millions) |

| | | |

Gap North America | 963 |

| | 6 |

| | 26 |

| | 943 |

| | 9.9 |

|

Gap Asia | 281 |

| | 6 |

| | 1 |

| | 286 |

| | 2.8 |

|

Gap Europe | 188 |

| | 3 |

| | 2 |

| | 189 |

| | 1.6 |

|

Old Navy North America | 1,010 |

| | 7 |

| | 4 |

| | 1,013 |

| | 17.1 |

|

Old Navy Asia | 50 |

| | 1 |

| | — |

| | 51 |

| | 0.8 |

|

Banana Republic North America | 612 |

| | 4 |

| | 2 |

| | 614 |

| | 5.1 |

|

Banana Republic Asia | 46 |

| | 2 |

| | — |

| | 48 |

| | 0.2 |

|

Banana Republic Europe | 11 |

| | — |

| | — |

| | 11 |

| | 0.1 |

|

Athleta North America | 105 |

| | 6 |

| | — |

| | 111 |

| | 0.5 |

|

Intermix North America | 43 |

| | — |

| | — |

| | 43 |

| | 0.1 |

|

Company-operated stores total | 3,309 |

| | 35 |

| | 35 |

| | 3,309 |

| | 38.2 |

|

Franchise | 440 |

| | 7 |

| | 5 |

| | 442 |

| | N/A |

|

Total | 3,749 |

| | 42 |

| | 40 |

| | 3,751 |

| | 38.2 |

|

Webcast and Conference Call Information

Jack Calandra, senior vice president of Corporate Finance and Investor Relations at Gap Inc., will host a summary of the company’s second quarter fiscal year 2015 results during a conference call and webcast from approximately 2:00 p.m. to 2:45 p.m. Pacific Time today. Mr. Calandra will be joined by Art Peck, Gap Inc. chief executive officer, and Sabrina Simmons, Gap Inc. chief financial officer.

The conference call can be accessed by calling 1-855-5000-GPS or 1-855-500-0477 (participant passcode: 7779269). International callers may dial 913-643-0954. The webcast can be accessed at www.gapinc.com.

August Sales

The company will report August sales on September 3, 2015.

Forward-Looking Statements

This press release and related conference call and webcast contain forward-looking statements within the “safe harbor” provisions of the Private Securities Litigation Reform Act of 1995. All statements other than those that are purely historical are forward-looking statements. Words such as “expect,” “anticipate,” “believe,” “estimate,” “intend,” “plan,” “project,” and similar expressions also identify forward-looking statements. Forward-looking statements include statements regarding the following:

| |

• | improving business performance, driving loyalty and delivering on-trend product collections; |

| |

• | earnings per share for fiscal year 2015; |

| |

• | impact of strategic actions; |

| |

• | operating margin for fiscal year 2015; |

| |

• | effective tax rate for fiscal year 2015; |

| |

• | inventory dollars per store at the end of the third quarter of fiscal year 2015; |

| |

• | returning excess cash to shareholders; |

| |

• | capital expenditures for fiscal year 2015; |

| |

• | depreciation and amortization for fiscal year 2015; |

| |

• | overall store count and square footage for fiscal year 2015; |

| |

• | growth for Old Navy; and |

| |

• | long-term growth opportunity in China. |

Because these forward-looking statements involve risks and uncertainties, there are important factors that could cause the company’s actual results to differ materially from those in the forward-looking statements. These factors include, without limitation, the following:

| |

• | the risk that additional information may arise during the company’s close process or as a result of subsequent events that would require the company to make adjustments to the financial information; |

| |

• | the risk that the adoption of new accounting pronouncements will impact future results; |

| |

• | the risk that the company or its franchisees will be unsuccessful in gauging apparel trends and changing consumer preferences; |

| |

• | the risk that changes in global economic conditions or consumer spending patterns could adversely impact the company’s results of operations; |

| |

• | the highly competitive nature of the company’s business in the United States and internationally; |

| |

• | the risk that if the company is unable to manage its inventory effectively, its gross margins will be adversely affected; |

| |

• | the risks to the company’s efforts to expand internationally, including its ability to operate under a global brand structure, foreign exchange fluctuations, and operating in regions where it has less experience; |

| |

• | the risks to the company’s business, including its costs and supply chain, associated with global sourcing and manufacturing; |

| |

• | the risks to the company’s reputation or operations associated with importing merchandise from foreign countries, including failure of the company’s vendors to adhere to its Code of Vendor Conduct; |

| |

• | the risk that trade matters could increase the cost or reduce the supply of apparel available to the company and adversely affect its business, financial condition, and results of operations; |

| |

• | the risk that the company’s franchisees’ operation of franchise stores is not directly within the company’s control and could impair the value of its brands; |

| |

• | the risk that the company or its franchisees will be unsuccessful in identifying, negotiating, and securing new store locations and renewing, modifying, or terminating leases for existing store locations effectively; |

| |

• | the risk that the company is subject to data or other security breaches that may result in increased costs, violations of law, significant legal and financial exposure, and a loss of confidence in the company’s security measures, which could have an adverse effect on the company’s results of operations and reputation; |

| |

• | the risk that the failure to attract and retain key personnel, or effectively manage succession, could have an adverse impact on the company’s results of operations; |

| |

• | the risk that the company’s investments in omni-channel shopping initiatives may not deliver the results the company anticipates; |

| |

• | the risk that comparable sales and margins will experience fluctuations; |

| |

• | the risk that changes in the company’s credit profile or deterioration in market conditions may limit the company’s access to the capital markets and adversely impact its financial results or business initiatives; |

| |

• | the risk that updates or changes to the company’s information technology (“IT”) systems may disrupt its operations; |

| |

• | the risk that natural disasters, public health crises, political crises, or other catastrophic events could adversely affect the company’s operations and financial results, or those of its franchisees or vendors; |

| |

• | the risk that changes in the regulatory or administrative landscape could adversely affect the company’s financial condition, strategies, and results of operations; |

| |

• | the risk that the company does not repurchase some or all of the shares it anticipates purchasing pursuant to its repurchase program; and |

| |

• | the risk that the company will not be successful in defending various proceedings, lawsuits, disputes, claims, and audits. |

Additional information regarding factors that could cause results to differ can be found in the company’s Annual Report on Form 10-K for the fiscal year ended January 31, 2015, as well as the company’s subsequent filings with the Securities and Exchange Commission.

These forward-looking statements are based on information as of August 20, 2015. The company assumes no obligation to publicly update or revise its forward-looking statements even if experience or future changes make it clear that any projected results expressed or implied therein will not be realized.

About Gap Inc.

Gap Inc. is a leading global retailer offering clothing, accessories, and personal care products for men, women, and children under the Gap, Banana Republic, Old Navy, Athleta, and Intermix brands. Fiscal year 2014 net sales were $16.4 billion. Gap Inc. products are available for purchase in more than 90 countries worldwide through about 3,300 company-operated stores, over 400 franchise stores, and e-commerce sites. For more information, please visit www.gapinc.com.

Investor Relations Contact:

Jack Calandra

(415) 427-1726

Investor_relations@gap.com

Media Relations Contact:

Kari Shellhorn

(415) 427-1805

Press@gap.com

The Gap, Inc.

CONDENSED CONSOLIDATED BALANCE SHEETS

UNAUDITED

|

| | | | | | | |

($ in millions) | August 1,

2015 | | August 2,

2014 |

ASSETS | | | |

Current assets: | | | |

Cash and cash equivalents | $ | 1,043 |

| | $ | 1,518 |

|

Merchandise inventory | 2,005 |

| | 1,948 |

|

Other current assets | 899 |

| | 778 |

|

Total current assets | 3,947 |

| | 4,244 |

|

Property and equipment, net | 2,740 |

| | 2,739 |

|

Other long-term assets | 600 |

| | 695 |

|

Total assets | $ | 7,287 |

| | $ | 7,678 |

|

| | | |

LIABILITIES AND STOCKHOLDERS' EQUITY | | | |

Current liabilities: | | | |

Current maturities of debt | $ | 20 |

| | $ | 24 |

|

Accounts payable | 1,206 |

| | 1,227 |

|

Accrued expenses and other current liabilities | 954 |

| | 985 |

|

Income taxes payable | 4 |

| | 26 |

|

Total current liabilities | 2,184 |

| | 2,262 |

|

Long-term liabilities: | | | |

Long-term debt | 1,328 |

| | 1,369 |

|

Lease incentives and other long-term liabilities | 1,104 |

| | 1,101 |

|

Total long-term liabilities | 2,432 |

| | 2,470 |

|

Total stockholders' equity | 2,671 |

| | 2,946 |

|

Total liabilities and stockholders' equity | $ | 7,287 |

| | $ | 7,678 |

|

The Gap, Inc.

CONDENSED CONSOLIDATED STATEMENTS OF INCOME

UNAUDITED

|

| | | | | | | | | | | | | | | |

| 13 Weeks Ended | | 26 Weeks Ended |

($ and shares in millions except per share amounts) | August 1,

2015 | | August 2,

2014 | | August 1,

2015 | | August 2,

2014 |

Net sales | $ | 3,898 |

| | $ | 3,981 |

| | $ | 7,555 |

| | $ | 7,755 |

|

Cost of goods sold and occupancy expenses | 2,440 |

| | 2,412 |

| | 4,715 |

| | 4,720 |

|

Gross profit | 1,458 |

| | 1,569 |

| | 2,840 |

| | 3,035 |

|

Operating expenses | 1,089 |

| | 1,002 |

| | 2,085 |

| | 2,025 |

|

Operating income | 369 |

| | 567 |

| | 755 |

| | 1,010 |

|

Interest, net | 16 |

| | 18 |

| | 20 |

| | 35 |

|

Income before income taxes | 353 |

| | 549 |

| | 735 |

| | 975 |

|

Income taxes | 134 |

| | 217 |

| | 277 |

| | 383 |

|

Net income | $ | 219 |

| | $ | 332 |

| | $ | 458 |

| | $ | 592 |

|

Weighted-average number of shares - basic | 417 |

| | 439 |

| | 419 |

| | 442 |

|

Weighted-average number of shares - diluted | 418 |

| | 443 |

| | 421 |

| | 447 |

|

Earnings per share - basic | $ | 0.53 |

| | $ | 0.76 |

| | $ | 1.09 |

| | $ | 1.34 |

|

Earnings per share - diluted | $ | 0.52 |

| | $ | 0.75 |

| | $ | 1.09 |

| | $ | 1.32 |

|

The Gap, Inc.

CONDENSED CONSOLIDATED STATEMENTS OF CASH FLOWS

UNAUDITED

|

| | | | | | | |

| 26 Weeks Ended |

($ in millions) | August 1,

2015 | | August 2,

2014 |

Cash flows from operating activities: |

| |

|

Net income | $ | 458 |

| | $ | 592 |

|

Depreciation and amortization (a) | 263 |

| | 240 |

|

Change in merchandise inventory | (124 | ) | | (18 | ) |

Other, net | 45 |

| | 182 |

|

Net cash provided by operating activities | 642 |

| | 996 |

|

Cash flows from investing activities: |

| |

|

Purchases of property and equipment | (301 | ) | | (328 | ) |

Proceeds from sale of property and equipment | — |

| | 121 |

|

Other | (1 | ) | | (1 | ) |

Net cash used for investing activities | (302 | ) | | (208 | ) |

Cash flows from financing activities: | | | |

Issuances under share-based compensation plans, net | (15 | ) | | (4 | ) |

Repurchases of common stock | (622 | ) | | (608 | ) |

Excess tax benefit from exercise of stock options and vesting of stock units | 24 |

| | 25 |

|

Cash dividends paid | (192 | ) | | (194 | ) |

Other | (1 | ) | | — |

|

Net cash used for financing activities | (806 | ) | | (781 | ) |

Effect of foreign exchange rate fluctuations on cash and cash equivalents | (6 | ) | | 1 |

|

Net increase (decrease) in cash and cash equivalents | (472 | ) | | 8 |

|

Cash and cash equivalents at beginning of period | 1,515 |

| | 1,510 |

|

Cash and cash equivalents at end of period | $ | 1,043 |

| | $ | 1,518 |

|

(a) Depreciation and amortization is net of amortization of lease incentives.

The Gap, Inc.

NON-GAAP FINANCIAL MEASURES

UNAUDITED

FREE CASH FLOW

Free cash flow is a non-GAAP financial measure. We believe free cash flow is an important metric because it represents a measure of how much cash a company has available for discretionary and non-discretionary items after the deduction of capital expenditures, as we require regular capital expenditures to build and maintain stores and purchase new equipment to improve our business. We use this metric internally, as we believe our sustained ability to generate free cash flow is an important driver of value creation. However, this non-GAAP financial measure is not intended to supersede or replace our GAAP results.

|

| | | | | | | |

| 26 Weeks Ended |

($ in millions) | August 1,

2015 | | August 2,

2014 |

Net cash provided by operating activities | $ | 642 |

| | $ | 996 |

|

Less: purchases of property and equipment | (301 | ) | | (328 | ) |

Free cash flow | $ | 341 |

| | $ | 668 |

|

The Gap, Inc.

NON-GAAP FINANCIAL MEASURES

UNAUDITED

ADJUSTED EARNINGS PER SHARE FOR THE SECOND QUARTER OF FISCAL YEAR 2015

Adjusted diluted earnings per share is a non-GAAP financial measure. Adjusted diluted earnings per share for the second quarter of fiscal year 2015 is provided to enhance visibility into the company's underlying results for the period excluding impact from its strategic actions primarily related to Gap brand. However, this non-GAAP financial measure is not intended to supersede or replace our GAAP results.

|

| | | |

| 13 weeks ended |

| August 1, 2015 |

Earnings per share - diluted | $ | 0.52 |

|

Add: Impact from strategic actions (a) | 0.12 |

|

Adjusted earnings per share - diluted | $ | 0.64 |

|

__________

(a) Represents the earnings per share impact of previously announced strategic actions primarily related to Gap brand. The charges associated with the strategic actions primarily include lease termination fees, store asset impairments, inventory impairment, and employee related costs.

The Gap, Inc.

NON-GAAP FINANCIAL MEASURES

UNAUDITED

ADJUSTED OPERATING EXPENSES

Adjusted operating expenses is a non-GAAP financial measure. We believe this is an important metric because it excludes items that we do not consider to be part of the company's ordinary operating results, as well as the impact from foreign currency exchange rate fluctuations. We believe this measure provides an important perspective of underlying business trends and results and provides a more comparable measure of year-over-year operating expenses. However, this non-GAAP financial measure is not intended to supersede or replace our GAAP results.

|

| | | | | | | |

| 13 Weeks Ended |

($ in millions) | August 1,

2015 | | August 2,

2014 |

Operating expenses | $ | 1,089 |

| | $ | 1,002 |

|

Add: Estimated impact from foreign exchange (a) | 28 |

| | — |

|

Add: Gain from sale of corporate asset (b) | — |

| | 39 |

|

Less: Impact from strategic actions (c) | (71 | ) | | — |

|

Adjusted operating expenses | $ | 1,046 |

| | $ | 1,041 |

|

__________

(a) In estimating the impact from foreign currency exchange rate fluctuations on operating expenses, the company translates current period foreign operating expenses at prior year rates and excludes the year-over-year impact of balance sheet remeasurement and gains or losses from non-merchandise-related foreign currency hedges.

(b) Represents the gain recognized in the second quarter of fiscal year 2014 related to the sale of a building.

(c) Represents the costs associated with the previously announced strategic actions primarily related to Gap brand, and primarily include lease termination fees, store asset impairments, and employee related costs.

The Gap, Inc.

NON-GAAP FINANCIAL MEASURES

UNAUDITED

ADJUSTED EARNINGS PER SHARE FOR THE FIRST HALF OF FISCAL YEARS 2015 AND 2014

Adjusted diluted earnings per share is a non-GAAP financial measure. Adjusted diluted earnings per share for the first half of fiscal years 2015 and 2014 exclude items that we do not consider to be part of the company's ordinary operating results, as well as the impact from foreign currency exchange rate fluctuations. We believe this measure provides an important perspective of underlying business trends and results and provide a more comparable measure of year-over-year earnings per share growth. However, this non-GAAP financial measure is not intended to supersede or replace our GAAP results.

|

| | | | | | | |

| 26 Weeks Ended |

| August 1,

2015 | | August 2,

2014 |

Earnings per share - diluted | $ | 1.09 |

| | $ | 1.32 |

|

Add: Estimated impact from foreign exchange (a) | 0.06 |

| | — |

|

Add: Estimated impact from delayed merchandise receipts at West Coast ports (b) | 0.13 |

| | — |

|

Add: Impact from strategic actions (c) | 0.14 |

| | — |

|

Less: Gain from sale of corporate asset (d) | — |

| | (0.05 | ) |

Adjusted earnings per share - diluted | $ | 1.42 |

| | $ | 1.27 |

|

| | | |

Adjusted earnings per share growth | 12 | % | | |

__________

(a) In estimating the earnings per share impact from foreign currency exchange rate fluctuations, the company estimates current gross margins using the appropriate prior year rates (including the impact of merchandise-related hedges), translates current period foreign earnings at prior year rates, and excludes the year-over-year earnings impact of balance sheet remeasurement and gains or losses from non-merchandise-related foreign currency hedges.

(b) Represents the estimated earnings per share impact of West Coast port congestion in the first half of fiscal year 2015. In estimating the earnings per share impact, the company's calculation primarily includes estimated sales loss and margin deterioration due to the delayed or canceled receipts of merchandise, as well as an increase in shipping costs.

(c) Represents the earnings per share impact of previously announced strategic actions primarily related to Gap brand. The charges associated with the strategic actions primarily includes lease termination fees, store asset impairments, inventory impairment, and employee related costs.

(d) Represents the earnings per share impact of gain recognized in the second quarter of fiscal year 2014 related to the sale of a building.

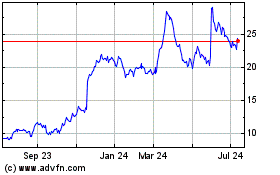

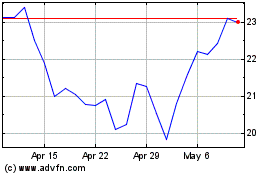

Gap (NYSE:GPS)

Historical Stock Chart

From Mar 2024 to Apr 2024

Gap (NYSE:GPS)

Historical Stock Chart

From Apr 2023 to Apr 2024