Actions to Drive Stronger Performance at Gap

North America, Coupled with Continued Global Growth and Digital

Innovation Central to Company’s Strategy

As part of its annual investor meeting, Gap Inc. (NYSE:GPS)

today will provide an overview of its strategic agenda designed to

best serve the ever-changing needs of consumers, while continuing

to drive long-term shareholder value and profitable growth across

its portfolio of brands.

“Our management team is aligned and focused on the key

priorities that will drive profitable growth for the company,” said

Art Peck, chief executive officer, Gap Inc. “Building upon the

strength of Old Navy, each brand within our portfolio is focused on

clear, near-team priorities and a strategy to capitalize on

long-term opportunities.”

Even before taking the helm of the company in February 2015,

Peck moved swiftly to assemble a team of proven leaders focused on

driving commercial success across its core brands. Additionally, as

demonstrated by yesterday’s announcement, Peck and Gap global

president Jeff Kirwan are implementing a series of strategic

actions designed to improve productivity and profitability at the

company’s namesake brand.

Today, the Gap Inc. management team will continue to reinforce

its strategies to drive loyalty and enhance growth.

Compelling Product

Collections: Led by Old Navy’s proven success

growing top-line sales by nearly $1 billion over the last three

fiscal years, Gap Inc.’s portfolio of brands will leverage its

transformed product operating model, Product 3.0, to more

consistently deliver on-trend product collections that customers

love. The company will highlight how this underlying engine mixes

the ‘art and science’ of bringing products to market, while working

alongside the company’s responsive supply chain to improve speed

and flexibility.

Industry-Leading Customer

Experiences: The company will also emphasize its

continued commitment to delivering exciting and seamless shopping

experiences across all channels. Recognizing that customers are

increasingly shopping and engaging with brands through online and

mobile, Gap Inc. will highlight its plans for new digital

capabilities, as well as mobile and personalization

initiatives.

Peck continued, “The retail industry is at a pivot point, where

digital experiences are redefining how customers shop and engage

with brands. We’re constantly testing and rolling out new

innovations to ensure we stay ahead of the customer and,

ultimately, thrive in a time of disruption.”

Continued Global Expansion:

Gap Inc. will emphasize its ongoing pursuit of global growth

opportunities, most notably through continued expansion in China,

where sales have grown to nearly $500 million in just over four

years and its Gap e-commerce sales expanded by about 60 percent

year-over-year between 2013 and 2014. The company also continues to

focus on growth through its global outlet and online channels, as

well as through the company’s Athleta brand in the United

States.

Strong Economic Model: Gap

Inc. will underscore its continued commitment to delivering against

its long-term financial objectives as evidenced by the company’s

five-year track record where it has:

- Grown sales by more than $2

billion;

- Achieved a 13 percent compound annual

growth rate in earnings per share;

- Generated nearly $6 billion in free

cash flow;

- Increased its dividend per share by

about 120 percent; and

- Distributed over $8.5 billion to

shareholders through share repurchases and dividends.

“Over the past five years, we’re pleased to have achieved an

earnings per share compound annual growth rate in the teens, while

consistently returning billions of dollars back to shareholders,”

said Sabrina Simmons, chief financial officer, Gap Inc. “Looking

ahead, we have a clear strategy and are well positioned to deliver

long-term shareholder value.”

In addition to Peck and Simmons, global brand presidents from

the company’s three largest brands will present updates to

investors, including: Jeff Kirwan from Gap; Andi Owen from Banana

Republic; and Stefan Larsson from Old Navy.

Gap Inc. Investor Meeting

A live webcast is accessible on Gap Inc.’s Financial News and

Events page at www.gapinc.com/investors from approximately 9:00

a.m. to 12:00 p.m. Pacific Time today. In addition, audio of this

meeting can be accessed by calling 1-855-5000-GPS or 855-500-0477

for domestic callers and 913-643-0954 for international callers.

The conference passcode is 9911599. A replay of the event will be

available on www.gapinc.com.

Follow the event on Twitter at http://twitter.com/gapinc. The

Twitter cashtag for the event is $GPS.

SEC Regulation G

This press release includes the non-GAAP measure free cash flow,

and the related investor day webcast includes the non-GAAP measures

free cash flow, adjusted debt to capital, earnings per share

excluding estimated pre-tax costs, foreign exchange impact on

operating income and earnings per share, and adjusted debt to

EBIDTAR. The description or reconciliation to GAAP of these

measures is included in the tables at the end of this release.

Forward-Looking Statements

This press release and related investor day webcast contain

forward-looking statements within the “safe harbor” provisions of

the Private Securities Litigation Reform Act of 1995. All

statements other than those that are purely historical are

forward-looking statements. Words such as “expect,” “anticipate,”

“believe,” “estimate,” “intend,” “plan,” “project,” and similar

expressions also identify forward-looking statements.

Forward-looking statements include statements regarding the

following:

- improving business performance,

profitable growth, and driving productivity improvements;

- growth initiatives, including Athleta

growth, outlet growth, online growth, and international growth,

including growth in Asia and Mexico;

- advances in the product operating model

and increased product acceptance;

- digital, mobile and omni-channel

innovations and growth;

- delivering shareholder value and

distributing cash to shareholders;

- positive comps, expanding margins, and

leveraging expenses;

- earnings per share growth;

- impact of West Coast ports slowdowns

and shutdowns on financial results;

- foreign exchange impact on financial

results;

- Gap China profitability;

- number of future Gap brand stores, and

number of Gap brand store closures;

- workforce reductions;

- financial impact of store closures and

workforce reductions, including sales impact, annualized savings,

and the amount, type, and timing of expected one-time costs;

- earnings per share for fiscal year

2015; and

- sales per square foot and store

contribution rates.

Because these forward-looking statements involve risks and

uncertainties, there are important factors that could cause the

company’s actual results to differ materially from those in the

forward-looking statements. These factors include, without

limitation, the following:

- the risk that the company or its

franchisees will be unsuccessful in gauging apparel trends and

changing consumer preferences;

- the risk that changes in global

economic conditions or consumer spending patterns could adversely

impact the company’s results of operations;

- the highly competitive nature of the

company’s business in the United States and internationally;

- the risk that if the company is unable

to manage its inventory effectively, its gross margins will be

adversely affected;

- the risks to the company’s efforts to

expand internationally, including its ability to operate under a

global brand structure, foreign exchange fluctuations, and

operating in regions where it has less experience;

- the risks to the company’s business,

including its costs and supply chain, associated with global

sourcing and manufacturing;

- the risks to the company’s reputation

or operations associated with importing merchandise from foreign

countries, including failure of the company’s vendors to adhere to

its Code of Vendor Conduct;

- the risk that trade matters could

increase the cost or reduce the supply of apparel available to the

company and adversely affect its business, financial condition, and

results of operations;

- the risk that the company’s

franchisees’ operation of franchise stores is not directly within

the company’s control and could impair the value of its

brands;

- the risk that the company or its

franchisees will be unsuccessful in identifying, negotiating, and

securing new store locations and renewing, modifying, or

terminating leases for existing store locations effectively;

- the risk that the company is subject to

data or other security breaches that may result in increased costs,

violations of law, significant legal and financial exposure, and a

loss of confidence in the company’s security measures, which could

have an adverse effect on the company’s results of operations and

reputation;

- the risk that the failure to attract

and retain key personnel, or effectively manage succession, could

have an adverse impact on the company’s results of operations;

- the risk that the company’s investments

in omni-channel shopping initiatives may not deliver the results

the company anticipates;

- the risk that comparable sales and

margins will experience fluctuations;

- the risk that changes in the company’s

credit profile or deterioration in market conditions may limit the

company’s access to the capital markets and adversely impact its

financial results or business initiatives;

- the risk that updates or changes to the

company’s information technology (“IT”) systems may disrupt its

operations;

- the risk that natural disasters, public

health crises, political crises, or other catastrophic events could

adversely affect the company’s operations and financial results, or

those of its franchisees or vendors;

- the risk that changes in the regulatory

or administrative landscape could adversely affect the company’s

financial condition, strategies, and results of operations;

- the risk that the company does not

repurchase some or all of the shares it anticipates purchasing

pursuant to its repurchase program; and

- the risk that the company will not be

successful in defending various proceedings, lawsuits, disputes,

claims, and audits.

Additional information regarding factors that could cause

results to differ can be found in the company’s Annual Report on

Form 10-K for the fiscal year ended January 31, 2015, as well as

the company’s subsequent filings with the Securities and Exchange

Commission.

These forward-looking statements are based on information as of

June 16, 2015. The company assumes no obligation to publicly update

or revise its forward-looking statements even if experience or

future changes make it clear that any projected results expressed

or implied therein will not be realized.

About Gap Inc.

Gap Inc. is a leading global retailer offering clothing,

accessories, and personal care products for men, women, and

children under the Gap, Banana Republic, Old Navy, Athleta, and

Intermix brands. Fiscal year 2014 net sales were $16.4 billion. Gap

Inc. products are available for purchase in more than 90 countries

worldwide through about 3,300 company-operated stores, over 400

franchise stores, and e-commerce sites. For more information,

please visit www.gapinc.com.

The Gap, Inc. NON-GAAP FINANCIAL MEASURES

UNAUDITED FREE CASH FLOW Free cash flow

is a non-GAAP financial measure. We believe free cash flow is an

important metric because it represents a measure of how much cash a

company has available for discretionary and non-discretionary items

after the deduction of capital expenditures, as we require regular

capital expenditures to build and maintain stores and purchase new

equipment to improve our business. We use this metric internally,

as we believe our sustained ability to generate free cash flow is

an important driver of value creation. However, this non-GAAP

financial measure is not intended to supersede or replace our GAAP

results.

Fiscal Year (number of weeks) ($ in

millions) 2014 (52) 2013 (52) 2012 (53)

2011 (52) 2010 (52) Net cash provided by operating

activities $ 2,129 $ 1,705 $ 1,936 $ 1,363 $ 1,744 Less: Purchases

of property and equipment (714 ) (670 ) (659 )

(548 ) (557 ) Free cash flow $ 1,415 $ 1,035

$ 1,277 $ 815 $ 1,187

The Gap, Inc. NON-GAAP FINANCIAL MEASURES

UNAUDITED ADJUSTED DEBT TO CAPITAL

Adjusted debt to capital is a non-GAAP financial measure. We

believe adjusted debt to capital is an important metric in

evaluating the total amount of leverage in our capital structure

including off-balance sheet lease obligations. However, this

non-GAAP financial measure is not intended to supersede or replace

our GAAP results.

($ in millions) January

31, 2015 Total long-term debt $ 1,353 Add: Estimated

capitalized operating lease obligations (a) 6,595

Lease adjusted debt $ 7,948

($ and shares in

millions except stock price) Stock price as of June 9, 2015 $

37.52 Number of shares outstanding as of May 29, 2015 417

Market capitalization 15,659 Add: Lease adjusted debt

7,948 Adjusted capital $ 23,607 Adjusted debt

to capital 34 % (a) Calculated as rent expense for fiscal

year ended January 31, 2015 multiplied by five. The multiple of

five times rent expense is a commonly used method of estimating the

debt we would record for our leases that are classified as

operating if they had met the criteria for a capital lease, or we

had purchased the property.

The Gap, Inc.

NON-GAAP FINANCIAL MEASURES UNAUDITED

ADJUSTED DEBT TO EBITDAR Adjusted debt to earnings

before interest, income taxes, depreciation, amortization, and rent

("EBITDAR") is a non-GAAP financial measure. We believe adjusted

debt to EBITDAR is an important metric in evaluating our credit

worthiness, which could impact our credit rating and borrowing

costs. However, this non-GAAP financial measure is not intended to

supersede or replace our GAAP results.

($ in

millions) January 31, 2015 Total long-term debt $ 1,353

Add: Estimated capitalized operating lease obligations (a)

6,595 Lease adjusted debt $ 7,948

($ in

millions) Fiscal 2014 Net income $ 1,262 Add: Income

taxes 751 Add: Interest expense, net 70 Earnings before

interest and income taxes 2,083 Add: Depreciation and

amortization expenses (b) 500 Add: Rent expense 1,319

EBITDAR $ 3,902 Adjusted debt to EBITDAR 2.0 (a)

Calculated as rent expense for fiscal year ended January 31, 2015

multiplied by five. The multiple of five times rent expense is a

commonly used method of estimating the debt we would record for our

leases that are classified as operating if they had met the

criteria for a capital lease, or we had purchased the property. (b)

Depreciation and amortization is net of amortization of lease

incentives.

The Gap, Inc. NON-GAAP

FINANCIAL MEASURES UNAUDITED ADDITIONAL

INFORMATION REGARDING FOREIGN EXCHANGE In calculating

the impact of foreign exchange to the company’s operating income

and earnings per share, the company estimates current gross margins

using the appropriate prior year rates (including the impact of

merchandise-related hedges), translates current period foreign

earnings at prior year rates, and excludes the year-over-year

earnings impact of balance sheet remeasurement and gains or losses

from non-merchandise-related foreign currency hedges. This is done

in order to enhance the visibility of business results excluding

the direct impact of foreign currency exchange rate fluctuations.

The Gap, Inc. NON-GAAP FINANCIAL

MEASURES UNAUDITED ADDITIONAL INFORMATION

REGARDING GUIDANCE The fiscal year 2015 diluted earnings

per share guidance of $2.75 to $2.80 excludes pre-tax charges of

$140 million to $160 million (approximately $0.21 to $0.24 per

diluted share) primarily related to the Gap brand optimization

effort. This guidance is provided to enhance visibility into the

company's expectations regarding its ongoing business excluding the

Gap brand optimization effort.

View source

version on businesswire.com: http://www.businesswire.com/news/home/20150616005712/en/

Gap Inc.Investor Relations Contact:David Davick,

415-427-2164Investor_relations@gap.comMedia Relations

Contact:Kari Shellhorn, 415-427-1805Press@gap.com

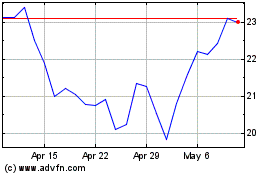

Gap (NYSE:GPS)

Historical Stock Chart

From Mar 2024 to Apr 2024

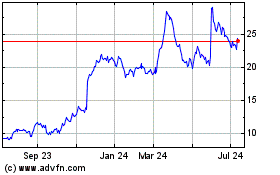

Gap (NYSE:GPS)

Historical Stock Chart

From Apr 2023 to Apr 2024