UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

|

|

|

|

|

Date of Report (Date of Earliest Event Reported):

|

|

April 21, 2015

|

Genuine Parts Company

__________________________________________

(Exact name of registrant as specified in its charter)

|

|

|

|

|

Georgia

|

001-05690

|

58-0254510

|

_____________________

(State or other jurisdiction

|

_____________

(Commission

|

______________

(I.R.S. Employer

|

|

of incorporation)

|

File Number)

|

Identification No.)

|

|

|

|

|

|

2999 Circle 75 Pkwy, Atlanta, Georgia

|

|

30339

|

_________________________________

(Address of principal executive offices)

|

|

___________

(Zip Code)

|

|

|

|

|

|

Registrant’s telephone number, including area code:

|

|

770.953.1700

|

Not Applicable

______________________________________________

Former name or former address, if changed since last report

Check the appropriate box below if the Form 8-K filing is intended to

simultaneously satisfy the filing obligation of the registrant under any

of the following provisions:

[ ] Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

[ ] Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

[ ] Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

[ ] Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Item 2.02 Results of Operations and Financial Condition.

On April 21, 2015, Genuine Parts Company issued a press release announcing its results of operations for the first quarter ended March 31, 2015. A copy of the press release is furnished with this Current Report on Form 8-K as exhibit 99.1.

The information, including the exhibits attached hereto contained in this Current Report on Form 8-K of Genuine Parts Company is being "furnished" and shall not be deemed "filed" for the purposes of Section 18 of the Securities and Exchange Act of 1934, as amended, or otherwise subject to the liabilities of that Section. In accordance with General Instruction B.2 of Form 8-K, the information in Item 2.02 and Item 9.01 of this Current Report shall not be incorporated by reference into any registration statement or other document pursuant to the Securities Act of 1933, as amended, or into any filing or other document pursuant to the Securities Exchange Act of 1934, as amended, except as otherwise expressly stated in any such filing.

Item 9.01 Financial Statements and Exhibits.

(d) Exhibits

99.1 Press Release dated April 21, 2015

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the

registrant has duly caused this report to be signed on its behalf by the

undersigned hereunto duly authorized.

|

|

|

|

|

|

|

|

|

Genuine Parts Company

|

|

|

|

|

|

|

|

April 21, 2015

|

|

By:

|

|

Carol B. Yancey

|

|

|

|

|

|

|

|

|

|

|

|

Name: Carol B. Yancey

|

|

|

|

|

|

Title: Executive Vice President and CFO

|

Exhibit Index

|

|

|

|

|

Exhibit No.

|

|

Description

|

|

|

|

|

99.1

|

|

Press Release dated April 21, 2015

|

GENUINE PARTS COMPANY

NEWS RELEASE

FOR IMMEDIATE RELEASE

GENUINE PARTS COMPANY

REPORTS SALES AND EARNINGS

FOR THE FIRST QUARTER ENDED MARCH 31, 2015

- Sales Up 3% and EPS Up 3% -

Atlanta, Georgia, April 21, 2015 — Genuine Parts Company (NYSE: GPC) announced today first quarter

sales and earnings for the quarter ended March 31, 2015.

Sales for the first quarter ended March 31, 2015, increased 3% to $3.7 billion compared to sales of

$3.6 billion for the same period in 2014. Net income for the first quarter was $161.0 million, up

2% from $157.5 million recorded for the same period in the previous year. Earnings per share on a

diluted basis were $1.05, up 3% compared to $1.02 for the first quarter last year.

Tom Gallagher, Chairman and Chief Executive Officer, commented, “We are pleased to report a solid

start to 2015 and, although our sales and earnings growth rates moderated from the results reported

in recent quarters, we performed in line with our expectations. Our total sales increase of 3%

included approximately 4% underlying sales growth and a 1.5% contribution from acquisitions, offset

by a currency headwind of approximately 2%. Sales for the Automotive Group were flat with the

prior year and consisted of core automotive growth of approximately 3% and a slight benefit from

acquisitions, less the negative impact of currency of approximately 4%. Sales at Motion

Industries, our Industrial Group, were up approximately 3%, including 3% underlying growth and 1%

from acquisitions, offset by a currency headwind of approximately 1%. Sales at EIS, our

Electrical/Electronic Group, increased by 1% and included approximately 6% growth from

acquisitions, net of a 4% decrease in core sales and a 1% negative impact of copper pricing. Sales

for S. P. Richards, our Office Products Group, were up approximately 17%, consisting of 11%

underlying growth and 6% from acquisitions.”

Mr. Gallagher concluded, “Our sales and earnings growth in the quarter was supported by solid cash

flows and a strong balance sheet. As we move forward in the year, we are well positioned for

further progress across our operations and remain optimistic that 2015 will be another successful

year for the Company.”

Conference Call

Genuine Parts Company will hold a conference call today at 11:00 a.m. EST to discuss the results of

the quarter and the future outlook. Interested parties may listen to the call on the Company’s

website, www.genpt.com, by clicking “Investors”, or by dialing 844-857-1770, conference ID

10259415. A replay will also be available on the Company’s website or at 855-859-2056, conference

ID 10259415, two hours after the completion of the call until 12:00 a.m. Eastern time on May 5,

2015.

Forward Looking Statements

Some statements in this report, as well as in other materials we file with the Securities and

Exchange Commission (SEC) or otherwise release to the public and in materials that we make

available on our website, constitute forward-looking statements that are subject to the safe harbor

provisions of the Private Securities Litigation Reform Act of 1995. Senior officers may also make

verbal statements to analysts, investors, the media and others that are forward-looking.

Forward-looking statements may relate, for example, to future operations, prospects, strategies,

financial condition, economic performance (including growth and earnings), industry conditions and

demand for our products and services. The Company cautions that its forward-looking statements

involve risks and uncertainties, and while we believe that our expectations for the future are

reasonable in view of currently available information, you are cautioned not to place undue

reliance on our forward-looking statements. Actual results or events may differ materially from

those indicated as a result of various important factors. Such factors may include, among other

things, slowing demand for the Company’s products, changes in general economic conditions,

including, unemployment, inflation or deflation, high energy costs, uncertain credit markets and

other macro-economic conditions, the ability to maintain favorable vendor arrangements and

relationships, disruptions in our vendors’ operations, competitive product, service and pricing

pressures, the Company’s ability to successfully implement its business initiatives in each of its

four business segments, the Company’s ability to successfully integrate its acquired businesses,

the uncertainties and costs of litigation, as well as other risks and uncertainties discussed in

the Company’s Annual Report on Form 10-K for 2014 and from time to time in the Company’s subsequent

filings with the SEC.

Forward-looking statements are only as of the date they are made, and the Company undertakes no

duty to update its forward-looking statements except as required by law. You are advised, however,

to review any further disclosures we make on related subjects in our subsequent Forms 10-K, 10-Q,

8-K and other reports to the SEC.

About Genuine Parts Company

Genuine Parts Company is a distributor of automotive replacement parts in the U.S., Canada, Mexico

and Australasia. The Company also distributes industrial replacement parts in the U.S., Canada and

Mexico through its Motion Industries subsidiary. S. P. Richards Company, the Office Products

Group, distributes business products in the U.S. and Canada. The Electrical/Electronic Group, EIS,

Inc., distributes electrical and electronic components throughout the U.S., Canada and Mexico.

Contacts

Carol B. Yancey, Executive Vice President and CFO – (770) 612-2044

Sidney G. Jones, Vice President — Investor Relations – (770) 818-4628

1

GENUINE PARTS COMPANY and SUBSIDIARIES

CONDENSED CONSOLIDATED STATEMENTS OF INCOME

| |

|

|

|

|

|

|

|

|

| |

|

Three Months Ended March 31, |

| |

|

2015 |

|

2014 |

| |

|

(Unaudited) |

| |

|

(in thousands, except per share data) |

Net sales |

|

$ |

3,736,051 |

|

|

$ |

3,624,897 |

|

Cost of goods sold |

|

|

2,623,232 |

|

|

|

2,540,267 |

|

|

|

|

|

|

|

|

|

|

Gross profit |

|

|

1,112,819 |

|

|

|

1,084,630 |

|

Operating expenses: |

|

|

|

|

|

|

|

|

Selling, administrative & other expenses |

|

|

825,554 |

|

|

|

803,802 |

|

Depreciation and amortization |

|

|

35,884 |

|

|

|

36,856 |

|

|

|

|

|

|

|

|

|

|

|

|

|

861,438 |

|

|

|

840,658 |

|

Income before income taxes |

|

|

251,381 |

|

|

|

243,972 |

|

Income taxes |

|

|

90,371 |

|

|

|

86,488 |

|

|

|

|

|

|

|

|

|

|

Net income |

|

$ |

161,010 |

|

|

$ |

157,484 |

|

|

|

|

|

|

|

|

|

|

Basic net income per common share |

|

$ |

1.05 |

|

|

$ |

1.02 |

|

Diluted net income per common share |

|

$ |

1.05 |

|

|

$ |

1.02 |

|

Weighted average common shares outstanding |

|

|

152,656 |

|

|

|

153,729 |

|

Dilutive effect of stock options and |

|

|

|

|

|

|

|

|

non-vested restricted stock awards |

|

|

918 |

|

|

|

1,067 |

|

|

|

|

|

|

|

|

|

|

Weighted average common shares outstanding – assuming dilution |

|

|

153,574 |

|

|

|

154,796 |

|

|

|

|

|

|

|

|

|

|

2

GENUINE PARTS COMPANY and SUBSIDIARIES

SEGMENT INFORMATION AND FINANCIAL HIGHLIGHTS

| |

|

|

|

|

|

|

|

|

| |

|

Three Months Ended March 31, |

| |

|

2015 |

|

2014 |

| |

|

(Unaudited) |

| |

|

(in thousands) |

Net sales: |

|

|

|

|

|

|

|

|

Automotive |

|

$ |

1,898,508 |

|

|

$ |

1,898,515 |

|

Industrial |

|

|

1,181,823 |

|

|

|

1,143,274 |

|

Office Products |

|

|

490,298 |

|

|

|

418,098 |

|

Electrical/Electronic Materials |

|

|

182,046 |

|

|

|

180,331 |

|

Other (1) |

|

|

(16,624 |

) |

|

|

(15,321 |

) |

|

|

|

|

|

|

|

|

|

Total net sales |

|

$ |

3,736,051 |

|

|

$ |

3,624,897 |

|

|

|

|

|

|

|

|

|

|

Operating profit: |

|

|

|

|

|

|

|

|

Automotive |

|

$ |

150,641 |

|

|

$ |

150,110 |

|

Industrial |

|

|

87,769 |

|

|

|

83,050 |

|

Office Products |

|

|

36,524 |

|

|

|

33,946 |

|

Electrical/Electronic Materials |

|

|

15,463 |

|

|

|

15,529 |

|

|

|

|

|

|

|

|

|

|

Total operating profit |

|

|

290,397 |

|

|

|

282,635 |

|

Interest expense, net |

|

|

(5,327 |

) |

|

|

(6,206 |

) |

Intangible amortization |

|

|

(8,604 |

) |

|

|

(8,876 |

) |

Other, net |

|

|

(25,085 |

) |

|

|

(23,581 |

) |

|

|

|

|

|

|

|

|

|

Income before income taxes |

|

$ |

251,381 |

|

|

$ |

243,972 |

|

|

|

|

|

|

|

|

|

|

Capital expenditures |

|

$ |

16,427 |

|

|

$ |

18,387 |

|

|

|

|

|

|

|

|

|

|

Depreciation and amortization |

|

$ |

35,884 |

|

|

$ |

36,856 |

|

|

|

|

|

|

|

|

|

|

(1) Represents the net effect of discounts, incentives and freight billed reported as a component

of net sales.

3

GENUINE PARTS COMPANY and SUBSIDIARIES

CONDENSED CONSOLIDATED BALANCE SHEETS

| |

|

|

|

|

|

|

|

|

| |

|

March 31, |

|

March 31, |

| |

|

2015 |

|

2014 |

| |

|

(Unaudited) |

| |

|

(in thousands) |

ASSETS |

|

|

|

|

|

|

|

|

CURRENT ASSETS |

|

|

|

|

|

|

|

|

Cash and cash equivalents |

|

$ |

166,495 |

|

|

$ |

103,472 |

|

Trade accounts receivable, net |

|

|

1,978,233 |

|

|

|

1,828,309 |

|

Merchandise inventories, net |

|

|

3,007,295 |

|

|

|

2,974,306 |

|

Prepaid expenses and other current assets |

|

|

482,676 |

|

|

|

440,344 |

|

|

|

|

|

|

|

|

|

|

TOTAL CURRENT ASSETS |

|

|

5,634,699 |

|

|

|

5,346,431 |

|

Goodwill and other intangible assets, less

accumulated amortization |

|

|

1,346,336 |

|

|

|

1,409,812 |

|

Deferred tax assets |

|

|

144,112 |

|

|

|

92,539 |

|

Other assets |

|

|

467,092 |

|

|

|

468,903 |

|

Net property, plant and equipment |

|

|

646,116 |

|

|

|

664,689 |

|

|

|

|

|

|

|

|

|

|

TOTAL ASSETS |

|

$ |

8,238,355 |

|

|

$ |

7,982,374 |

|

|

|

|

|

|

|

|

|

|

|

LIABILITIES AND EQUITY |

|

|

|

|

|

|

|

|

CURRENT LIABILITIES |

|

|

|

|

|

|

|

|

Trade accounts payable |

|

$ |

2,608,491 |

|

|

$ |

2,335,327 |

|

Current portion of debt |

|

|

393,697 |

|

|

|

399,756 |

|

Income taxes payable |

|

|

26,479 |

|

|

|

76,682 |

|

Dividends payable |

|

|

93,844 |

|

|

|

88,421 |

|

Other accrued expenses |

|

|

636,850 |

|

|

|

522,552 |

|

|

|

|

|

|

|

|

|

|

TOTAL CURRENT LIABILITIES |

|

|

3,759,361 |

|

|

|

3,422,738 |

|

Long-term debt |

|

|

500,000 |

|

|

|

500,000 |

|

Pension and other post-retirement benefit liabilities |

|

|

275,470 |

|

|

|

137,638 |

|

Deferred tax liabilities |

|

|

67,672 |

|

|

|

87,726 |

|

Other long-term liabilities |

|

|

444,810 |

|

|

|

423,063 |

|

Common stock |

|

|

152,325 |

|

|

|

153,604 |

|

Retained earnings |

|

|

3,855,295 |

|

|

|

3,641,920 |

|

Accumulated other comprehensive loss |

|

|

(827,682 |

) |

|

|

(393,762 |

) |

|

|

|

|

|

|

|

|

|

TOTAL PARENT EQUITY |

|

|

3,179,938 |

|

|

|

3,401,762 |

|

Noncontrolling interests in subsidiaries |

|

|

11,104 |

|

|

|

9,447 |

|

|

|

|

|

|

|

|

|

|

TOTAL EQUITY |

|

|

3,191,042 |

|

|

|

3,411,209 |

|

|

|

|

|

|

|

|

|

|

TOTAL LIABILITIES AND EQUITY |

|

$ |

8,238,355 |

|

|

$ |

7,982,374 |

|

|

|

|

|

|

|

|

|

|

4

GENUINE PARTS COMPANY and SUBSIDIARIES

CONDENSED CONSOLIDATED STATEMENTS OF CASH FLOWS

| |

|

|

|

|

|

|

|

|

| |

|

Three Months Ended March 31, |

| |

|

2015 |

|

2014 |

| |

|

(Unaudited) |

| |

|

(in thousands) |

OPERATING ACTIVITIES: |

|

|

|

|

|

|

|

|

Net income |

|

$ |

161,010 |

|

|

$ |

157,484 |

|

Adjustments to reconcile net income to net cash

provided by operating activities: |

|

|

|

|

|

|

|

|

Depreciation and amortization |

|

|

35,884 |

|

|

|

36,856 |

|

Share-based compensation |

|

|

3,316 |

|

|

|

3,073 |

|

Excess tax benefits from share-based compensation |

|

|

(3,734 |

) |

|

|

(4,106 |

) |

Changes in operating assets and liabilities |

|

|

(73,964 |

) |

|

|

(133,528 |

) |

|

|

|

|

|

|

|

|

|

NET CASH PROVIDED BY OPERATING ACTIVITIES |

|

|

122,512 |

|

|

|

59,779 |

|

INVESTING ACTIVITIES: |

|

|

|

|

|

|

|

|

Purchases of property, plant and equipment |

|

|

(16,427 |

) |

|

|

(18,387 |

) |

Acquisitions and other investing activities |

|

|

(30,129 |

) |

|

|

(156,853 |

) |

|

|

|

|

|

|

|

|

|

NET CASH USED IN INVESTING ACTIVITIES |

|

|

(46,556 |

) |

|

|

(175,240 |

) |

FINANCING ACTIVITIES: |

|

|

|

|

|

|

|

|

Proceeds from debt |

|

|

779,910 |

|

|

|

740,012 |

|

Payments on debt |

|

|

(650,000 |

) |

|

|

(610,604 |

) |

Share-based awards exercised, net of taxes paid |

|

|

(3,804 |

) |

|

|

(4,736 |

) |

Excess tax benefits from share-based compensation |

|

|

3,734 |

|

|

|

4,106 |

|

Dividends paid |

|

|

(88,039 |

) |

|

|

(82,750 |

) |

Purchase of stock |

|

|

(84,252 |

) |

|

|

(22,709 |

) |

|

|

|

|

|

|

|

|

|

NET CASH (USED IN) PROVIDED BY FINANCING ACTIVITIES |

|

|

(42,451 |

) |

|

|

23,319 |

|

EFFECT OF EXCHANGE RATE CHANGES ON CASH |

|

|

(4,740 |

) |

|

|

(1,279 |

) |

|

|

|

|

|

|

|

|

|

NET INCREASE (DECREASE) IN CASH AND CASH EQUIVALENTS |

|

|

28,765 |

|

|

|

(93,421 |

) |

CASH AND CASH EQUIVALENTS AT BEGINNING OF PERIOD |

|

|

137,730 |

|

|

|

196,893 |

|

|

|

|

|

|

|

|

|

|

CASH AND CASH EQUIVALENTS AT END OF PERIOD |

|

$ |

166,495 |

|

|

$ |

103,472 |

|

|

|

|

|

|

|

|

|

|

5

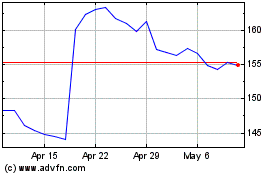

Genuine Parts (NYSE:GPC)

Historical Stock Chart

From Mar 2024 to Apr 2024

Genuine Parts (NYSE:GPC)

Historical Stock Chart

From Apr 2023 to Apr 2024