A.M. Best has removed from under review with developing

implications and affirmed the financial strength rating of A-

(Excellent) and the issuer credit ratings (ICR) of “a-” of the key

life/health subsidiaries of Genworth Financial, Inc.

(Genworth) (Richmond, VA) [NYSE:GNW]. Additionally, the ICR of

“bbb-” of Genworth and its existing issue ratings have been removed

from under review and affirmed. Concurrently, A.M. Best has

assigned ratings to Genworth’s shelf registration, effective May

2015, which replaced the previously expired shelf. The outlook

assigned to all ratings is negative.

On May 1, 2015, A.M. Best placed Genworth’s ratings under review

with developing implications in response to the company’s public

disclosure that it was assessing the market interest and

considering the merits of selling its life and annuity businesses.

The removal of the under review status follows Genworth’s public

announcement, during the second quarter 2015 earnings call on Aug.

5, 2015, that the company has terminated the proposed strategic

divestiture of its life and annuity businesses. However, there

remains potential that the company may pursue smaller, targeted

block transactions. As such, A.M. Best will continue to closely

monitor the overall diversification of insurance risks within the

organization.

The assignment of the negative outlook reflects A.M. Best’s

concerns with the volatility of earnings, lack of growth in its

life and annuity operations and the organizations’ challenge to

improve sales following the recent strategic uncertainty, as well

as the inherent volatility of the long-term care business. Further

divestiture in its non-insurance operations, which provide a steady

stream of dividends to the Genworth organization, may reduce

financial flexibility.

A.M. Best notes that as of second quarter 2015, Genworth has

positioned itself to be compliant with Private Mortgage Insurer

Eligibility Requirements (PMIERS) within the required timeframe.

The company continues to report good financial flexibility at the

holding company, with $1.2 billion of cash and invested assets, and

financial leverage was approximately 27% as of June 30, 2015. A.M.

Best expects that Genworth management will continue to refrain from

taking dividends from the life/health companies in the medium term,

servicing holding company needs from its global mortgage insurance

subsidiaries.

The FSR of A- (Excellent) and the ICRs of “a-” for the following

subsidiaries of Genworth Financial, Inc. have been affirmed

and assigned a negative outlook:

- Genworth Life Insurance

Company

- Genworth Life Insurance Company of

New York

- Genworth Life and Annuity Insurance

Company

The ICRs of “bbb-” of Genworth Financial, Inc. and

Genworth Holdings, Inc. have been affirmed and assigned a

negative outlook.

The following indicative issue ratings on securities available

under universal shelf registration have been assigned with a

negative outlook:

Genworth Financial, Inc.—

-- “bbb-” on senior unsecured debt

-- “bb+” on subordinated debt

-- “bb” on preferred stock

Genworth Holdings, Inc.—

-- “bbb-” on senior unsecured debt

-- “bb+” on subordinated debt

-- “bb” on preferred stock

The following issue ratings have been affirmed and assigned a

negative outlook:

Genworth Holdings, Inc. (guaranteed by Genworth

Financial, Inc.) —

-- “bbb-” on $300 million 8.625% senior unsecured notes, due

2016

-- “bbb-” on $600 million 6.515% senior unsecured notes, due

2018

-- “bbb-” on $400 million 7.70% senior unsecured notes, due

2020

-- “bbb-” on $400 million 7.20% senior unsecured notes, due

2021

-- “bbb-” on $750 million 7.625% senior unsecured notes, due

2021

-- “bbb-” on $400 million 4.9% senior unsecured notes, due

2023

-- “bbb-” on $400 million 4.8% senior unsecured notes, due

2024

-- “bbb-” on $300 million 6.50% senior unsecured notes, due

2034

-- “bb” on $600 million fixed/floating rate junior subordinated

notes, due 2066

Genworth Global Funding Trusts— “a-” program rating

-- “a-” on all outstanding notes issued under the program

This press release relates to rating(s) that have been

published on A.M. Best's website. For all rating information

relating to the release and pertinent disclosures, including

details of the office responsible for issuing each of the

individual ratings referenced in this release, please visit A.M.

Best’s Ratings & Criteria Center.

A.M. Best Company is the world's oldest and most

authoritative insurance rating and information source. For more

information, visit www.ambest.com.

Copyright © 2015 by A.M. Best Company,

Inc. ALL RIGHTS RESERVED.

View source

version on businesswire.com: http://www.businesswire.com/news/home/20150805006718/en/

A.M. Best CompanyKate Steffanelli, 908-439-2200, ext.

5063Senior Financial

Analystkate.steffanelli@ambest.comorSally Rosen,

908-439-2200, ext. 5280Assistant Vice

Presidentsally.rosen@ambest.comorChristopher Sharkey,

908-439-2200, ext. 5159Manager, Public

Relationschristopher.sharkey@ambest.comorJim Peavy,

908-439-2200, ext. 5644Assistant Vice President, Public

Relationsjames.peavy@ambest.com

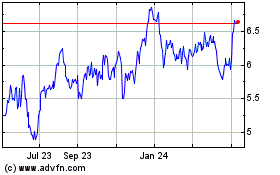

Genworth Financial (NYSE:GNW)

Historical Stock Chart

From Mar 2024 to Apr 2024

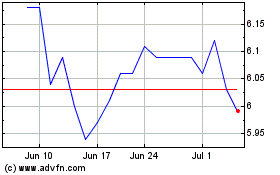

Genworth Financial (NYSE:GNW)

Historical Stock Chart

From Apr 2023 to Apr 2024