GameStop Posts Decline in Revenue, Profit

May 26 2016 - 6:00PM

Dow Jones News

GameStop Inc. reported an 11% drop in earnings in the latest

quarter and provided a lackluster profit outlook, as the videogame

retailer races to keep pace in an increasingly digital market in

which games are downloaded.

Signs of struggle in its legacy business were visible in the

latest three-month period ended April 30. New videogame software

sales fell 7.6%, while sales of preowned and value games slipped

3.7%. Together, the two categories account for 58% of total

sales.

New videogame hardware sales also dropped 28.8%, though sales of

virtual-reality headsets or any new game-console releases could

help offset the sag in upcoming quarters.

The company's mobile and consumer electronics category, which

GameStop hopes will grow to offset losses linked to game-disks

sales, rose a robust 40%, but the category made up just under 10%

of total sales.

Shares of the company, down about 25% over the past year,

dropped more than 8% to $27.55 in after-hours trading.

For the current quarter, the company said it expects same-store

sales to fall between 4% and 7% with earnings on a per-share basis

between 23 cents and 30 cents. Analysts surveyed by Thomson Reuters

expected earnings of 33 cents.

The company has been trying to become less dependent on its

legacy videogame business. The retailer in the past fiscal year

reduced its videogame store count by 125 locations but expanded by

553 stores its Technology Brands segment, which sells mobile phones

and other electronics.

Company executives have said they would likely keep closing

GameStop locations at a 2% rate. But the transition is a work in

progress with electronics comprising only a fraction of total sales

for the foreseeable future.

Over all, for the latest quarter, GameStop reported a profit of

$65.8 million, or 63 cents a share, compared with a year-earlier

profit of $73.8 million, or 68 cents a share. Excluding certain

items, profit per share sagged to 66 cents from 68 cents a year

earlier.

Revenue slipped 4.3% to $1.97 billion. The Grapevine, Texas,

company had said overall sales would fall between 4% and 7% in the

latest quarter.

Same-store sales fell 6.2%, better than the company's estimate

for a decline between 7% and 9%. The decline was more accelerated

in the U.S., where same-store sales slipped 6.6%, compared with a

4.9% slide internationally.

Analysts surveyed by Thomson Reuters had expected earnings of 62

cents a share and revenue of $1.97 billion.

Write to Ezequiel Minaya at ezequiel.minaya@wsj.com

(END) Dow Jones Newswires

May 26, 2016 17:45 ET (21:45 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

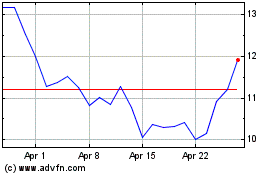

GameStop (NYSE:GME)

Historical Stock Chart

From Mar 2024 to Apr 2024

GameStop (NYSE:GME)

Historical Stock Chart

From Apr 2023 to Apr 2024