Corning's Profit Quadruples, Boosted by Dow Corning Sale

July 27 2016 - 10:43AM

Dow Jones News

By Brittney Laryea

Glassmaker Corning Inc. reported higher-than-expected

third-quarter earnings, as the company realized gains from its June

sale of its stake in Dow Corning.

"The realignment of our interest in Dow Corning is a significant

milestone," Chief Executive Wendell Weeks said.

In June, Corning ended a 73-year joint venture with Dow Chemical

Co., after it sold the remainder of its stake in Dow Corning for

$4.8 billion in cash and 40% equity interest in Hemlock

Semiconductor Group.

Chief Financial Officer R. Tony Tripeny said the company was

confident its sales and earnings performance would improve for the

next two quarters--despite recent pressures.

"The mobile consumer electronics industry is experiencing lower

smartphone and tablet demand in 2016, driven by world-wide

macroeconomic conditions, fewer major product launches and longer

replacement cycles," said Corning, which makes parts of Apple Inc's

iPhone.

Over all, Corning posted a second-quarter profit of $2.21

billion, or $1.87 a share, about quadruple its profit of $496

million, or 36 cents, a year earlier. Adjusted to exclude

restructuring, the company reported $434 million in profit, or 37

cents a share, down from $522 million, or 38 cents a share a year

earlier.

Revenue rose 0.7% to $2.36 billion.

Analysts polled by Thomson Reuters expected 32 cents per-share

earnings on $2.38 billion in revenue.

The ligher-than-expected revenue contributed to Corning

stock--which has gained 13% over the past three months--falling

3.4% to $20.97 in morning trading in New York.

Sales in the display technologies business--which makes up about

34% of the company's sales--rose 1.5% to $801 million, helped by an

uptick in demand in the global market. The optical communications

segment, at about 33% of sales, fell 2.3% to $782 million,

reflecting a software issue during the quarter that impacted the

company's cable production.

Its third-largest segment, specialty materials, reported sales

fell 2.2% when compared to a year ago.

Corning announced a $2 billion accelerated share repurchase with

plans to distribute $12.5 billion to shareholders through 2019 and

increase its dividend annually by a double-digit percentage.

Write to Brittney Laryea at Brittney.Laryea@wsj.com

(END) Dow Jones Newswires

July 27, 2016 10:28 ET (14:28 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

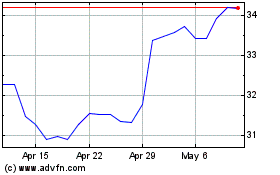

Corning (NYSE:GLW)

Historical Stock Chart

From Mar 2024 to Apr 2024

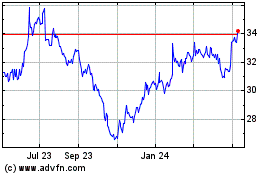

Corning (NYSE:GLW)

Historical Stock Chart

From Apr 2023 to Apr 2024