Dow Corning Reports First Quarter 2016 Financial Performance

April 29 2016 - 10:11AM

Business Wire

Dow Corning Corp. today announced first quarter 2016 sales

of $1.32 billion, a three percent decrease compared to 2015, and

net income of $112 million. Adjusted net income in the first

quarter of 2016 was $116 million, a 14 percent increase compared

with the first quarter of 2015.

This Smart News Release features multimedia.

View the full release here:

http://www.businesswire.com/news/home/20160429005691/en/

J. Donald Sheets, executive vice

president and chief financial officer, Dow Corning Corporation

(Photo: Business Wire)

Adjusted net income for 2016 and 2015 excluded the impact of a

derivative contract and gains from long-term sales agreements.

Additional information about Dow Corning’s financial results:

First Quarter Results

- Dow Corning continued to increase sales

volumes in its most profitable specialty silicones product lines

with notable strength in the high performance building, packaging,

electronics, and health and beauty care industries.

- Sales from Dow Corning’s Polysilicon

segment continued to decrease as the timing of customers taking

product under long-term contracts resulted in fewer shipments.

Q1

2016 Q1 2015 % Change Sales (in billions) $

1.32 $ 1.36 -3 % Net income (in millions) $

112 $ 185 -40 % Adjusted net income* (in millions)

$ 116 $ 101 14 %

* Adjusted net income is a non-GAAP financial measure which

excludes certain unusual items. The reconciliation between GAAP and

non-GAAP measures is shown in the table following the news

release.

Comments from Dow Corning’s Executive Vice President and Chief

Financial Officer J. Donald Sheets:

- “Dow Corning had a strong first

quarter, with increased sales and profits in our Silicones segment

despite continued headwinds caused by a stagnant global

economy.”

- “Our first quarter 2015 results

included a large, one-time deferred revenue gain which masks the

growth we generated in the first quarter of 2016 and accounts for

the difference between net income and adjusted net income.”

- “We continue to see opportunities to

accelerate growth in our Silicones business upon completion of the

Dow Chemical and Corning Inc. transaction. The added power of Dow’s

brand, operational excellence, global scale and powerful innovation

and R&D engine will provide our customers with even greater

expertise and capabilities.”

- “We remain focused on growing our

business by delivering high quality and innovative silicone-based

products with the industry’s leading expertise and global

capabilities.”

About Dow Corning

Dow Corning (www.dowcorning.com) provides performance-enhancing

solutions to serve the diverse needs of more than 25,000 customers

worldwide. A global leader in silicones, silicon-based technology

and innovation, Dow Corning offers more than 7,000 products and

services via the company’s Dow Corning® and XIAMETER® brands. Dow

Corning is equally owned by The Dow Chemical Company and Corning,

Incorporated. More than half of Dow Corning’s annual sales are

outside the United States.

About Hemlock Semiconductor Group

Hemlock Semiconductor Group (hscpoly.com) is comprised of

several joint venture companies owned in majority by Dow Corning

Corporation. Hemlock Semiconductor is a leading provider of

polycrystalline silicon and other silicon-based products used in

the manufacturing of semiconductor devices and solar cells and

modules. Hemlock Semiconductor began its operations in 1961.

Dow Corning Corporation Selected Financial

Information (in millions of U. S. dollars)

(Unaudited)

Consolidated Income Statement Data Three Months

Ended March 31, 2016 2015 Net

Sales $ 1,316.4 $ 1,363.5

Net Income Attributable to Dow Corning $

111.7 $ 185.4 Adjustment for

Long-Term Sales Agreements $ - $

(97.9 ) Adjustment for Fair Value of

Derivative Contract $ 4.0 $ 13.6

Adjusted Net Income1 $

115.7 $ 101.1

1 Adjusted Net Income is a non-GAAP financial measure

which excludes certain unusual items and which reconciles to Net

Income as shown.

Consolidated Balance Sheet Data

March 31, 2016 December 31,

2015 Assets Current Assets $

4,591.8 $ 4,510.8 Property, Plant and

Equipment, Net 5,053.8 5,086.3 Other

Assets 996.6 977.2 $

10,642.2 $ 10,574.3 Liabilities and

Equity Current Liabilities $

1,967.1 $ 1,320.6 Other Liabilities

4,582.0 5,314.4 Equity 4,093.1

3,939.3 $ 10,642.2 $

10,574.3

View source

version on businesswire.com: http://www.businesswire.com/news/home/20160429005691/en/

Dow Corning Corp.Jarrod

ErpeldingJarrod.Erpelding@dowcorning.com989.496.1582

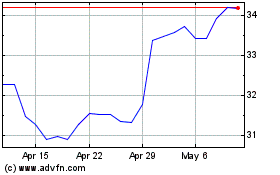

Corning (NYSE:GLW)

Historical Stock Chart

From Mar 2024 to Apr 2024

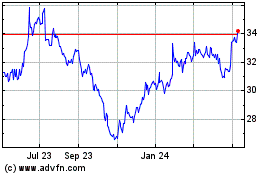

Corning (NYSE:GLW)

Historical Stock Chart

From Apr 2023 to Apr 2024