UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

|

|

|

|

|

Date of Report (Date of Earliest Event Reported):

|

|

October 28, 2015

|

Corning Incorporated

__________________________________________

(Exact name of registrant as specified in its charter)

|

|

|

|

|

New York

|

1-3247

|

16-0393470

|

_____________________

(State or other jurisdiction

|

_____________

(Commission

|

______________

(I.R.S. Employer

|

|

of incorporation)

|

File Number)

|

Identification No.)

|

|

|

|

|

|

One Riverfront Plaza, Corning, New York

|

|

14831

|

_________________________________

(Address of principal executive offices)

|

|

___________

(Zip Code)

|

|

|

|

|

|

Registrant’s telephone number, including area code:

|

|

607-974-9000

|

Not Applicable

______________________________________________

Former name or former address, if changed since last report

Check the appropriate box below if the Form 8-K filing is intended to

simultaneously satisfy the filing obligation of the registrant under any

of the following provisions:

[ ] Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

[ ] Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

[ ] Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

[ ] Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Item 1.01 Entry into a Material Definitive Agreement.

As previously disclosed, on July 15, 2015, the Board of Directors (the "Board") of Corning Incorporated ("Corning") approved a $2 billion share repurchase program (the "July Repurchase Program") and on October 26, 2015 the Board approved an additional $4 billion share repurchase program (together with the July Repurchase Program, the "Repurchase Programs"). The Repurchase Programs permit Corning to effect repurchases from time to time through a combination of open market repurchases, privately negotiated transactions, advance repurchase agreements and/or other arrangements.

On October 28, 2015, Corning entered into an accelerated share repurchase agreement ("ASR") with Morgan Stanley & Co. LLC ("Morgan Stanley") to repurchase $1.25 billion of Corning’s common stock. The ASR was executed under the July Repurchase Program. Under the ASR, Corning will make a $1.25 billion payment to Morgan Stanley on October 29, 2015 and will receive an initial delivery of approximately 53.1 million shares of Corning common stock from Morgan Stanley on the same day. The total number of shares Corning will repurchase under the ASR will be based generally upon the average daily volume weighted average price of Corning’s common stock during a repurchase period, less a discount and subject to adjustments pursuant to the terms and conditions of the ASR. At settlement, under certain circumstances, Morgan Stanley may be required to deliver additional shares of common stock to Corning, or under certain circumstances, Corning may be required either to deliver shares of common stock or to make a cash payment to Morgan Stanley. Final settlement of the transaction under the ASR is expected to occur in the first quarter of 2016. The terms of the transaction under the ASR are subject to adjustment if Corning were to enter into or announce certain types of transactions or to take certain corporate actions.

Item 7.01 Regulation FD Disclosure.

On October 29, 2015, Corning issued a press release (the "Press Release"), which is furnished herewith as Exhibit 99.1. The information in the attached Press Release is furnished pursuant to Item 7.01 and shall not be deemed to be "filed" for purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the "Exchange Act"), or otherwise subject to the liabilities of that Section, and is not incorporated by reference in any filing under the Securities Act of 1933, as amended, or the Exchange Act regardless of any general incorporation language in such filing.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the

registrant has duly caused this report to be signed on its behalf by the

undersigned hereunto duly authorized.

|

|

|

|

|

|

|

|

|

Corning Incorporated

|

|

|

|

|

|

|

|

October 29, 2015

|

|

By:

|

|

/s/ Linda E. Jolly

|

|

|

|

|

|

|

|

|

|

|

|

Name: Linda E. Jolly

|

|

|

|

|

|

Title: Vice Presdient and Corporate Secretary

|

Exhibit Index

|

|

|

|

|

Exhibit No.

|

|

Description

|

|

|

|

|

99.1

|

|

Press Release

|

Exhibit 99.1

News Release

FOR RELEASE –– OCTOBER 29, 2015

Corning Announces $1.25 Billion Accelerated Share Repurchase

CORNING, N.Y. — Corning Incorporated (NYSE: GLW) today announced that it has entered into an

accelerated share repurchase agreement (ASR) with Morgan Stanley & Co. LLC to repurchase $1.25

billion of the company’s common stock. The ASR is executed pursuant to the $2 billion share

repurchase program authorized by Corning’s Board of Directors on July 15, 2015, which was

supplemented by an additional $4 billion share repurchase program authorized on October 26, 2015.

Under the terms of the ASR, Corning has agreed to repurchase in total $1.25 billion of its common

stock from Morgan Stanley & Co. LLC, with an initial delivery of approximately 53.1 million shares

based on current market prices. The final number of shares to be repurchased will be based on

Corning’s volume-weighted average stock price during the term of the transaction. The program is

expected to be completed in the first quarter of 2016. The company expects to finance the ASR with

cash on hand.

Year to date through October 29, 2015, Corning has repurchased nearly 151.5 million shares,

including the initial delivery of shares under this ASR.

Forward-Looking and Cautionary Statements

This press release contains “forward-looking statements” (within the meaning of the Private

Securities Litigation Reform Act of 1995), which are based on current expectations and assumptions

about Corning’s financial results and business operations, that involve substantial risks and

uncertainties that could cause actual results to differ materially. These risks and uncertainties

include: the effect of global political, economic and business conditions; conditions in

the financial and credit markets; currency fluctuations; tax rates; product demand and industry

capacity; competition; reliance on a concentrated customer base; manufacturing efficiencies; cost

reductions; availability of critical components and materials; new product commercialization;

pricing fluctuations and changes in the mix of sales between premium and non-premium products; new

plant start-up or restructuring costs; possible disruption in commercial activities due to

terrorist activity, armed conflict, political or financial instability, natural disasters, adverse

weather conditions, or major health concerns; adequacy of insurance; equity company activities;

acquisition and divestiture activities; the level of excess or obsolete inventory; the rate of

technology change; the ability to enforce patents; product and components performance issues;

retention of key personnel; stock price fluctuations; and adverse litigation or regulatory

developments. These and other risk factors are detailed in Corning’s filings with the Securities

and Exchange Commission. Forward-looking statements speak only as of the day that they are made,

and Corning undertakes no obligation to update them in light of new information or future events.

Digital Media Disclosure

In accordance with guidance provided by the SEC regarding the use of company websites and social

media channels to disclose material information, Corning Incorporated (“Corning”) wishes to notify

investors, media, and other interested parties that it intends to use its website

(http://www.corning.com/worldwide/en/about-us/news-events.html) to publish important

information about the company, including information that may be deemed material to investors. The

list of websites and social media channels that the company uses may be updated on Corning’s media

and website from time to time. Corning encourages investors, media, and other interested parties to

review the information Corning may publish through its website and social media channels as

described above, in addition to the company’s SEC filings, press releases, conference calls, and

webcasts.

About Corning Incorporated

Corning (www.corning.com) is one of the world’s leading innovators in materials science. For more

than 160 years, Corning has applied its unparalleled expertise in specialty glass, ceramics, and

optical physics to develop products that have created new industries and transformed people’s

lives. Corning succeeds through sustained investment in R&D, a unique combination of material and

process innovation, and close collaboration with customers to solve tough technology challenges.

Corning’s businesses and markets are constantly evolving. Today, Corning’s products enable diverse

industries such as consumer electronics, telecommunications, transportation, and life sciences.

They include damage-resistant cover glass for smartphones and tablets; precision glass for advanced

displays; optical fiber, wireless technologies, and connectivity solutions for high-speed

communications networks; trusted products that accelerate drug discovery and manufacturing; and

emissions-control products for cars, trucks, and off-road vehicles.

Media Relations Contact:

Daniel F. Collins

(607) 974-4197

collinsdf@corning.com

Investor Relations Contact:

Ann H.S. Nicholson

(607) 974-6716

nicholsoas@corning.com

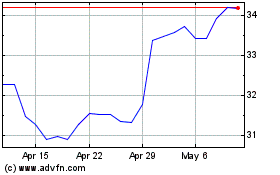

Corning (NYSE:GLW)

Historical Stock Chart

From Mar 2024 to Apr 2024

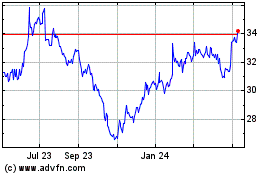

Corning (NYSE:GLW)

Historical Stock Chart

From Apr 2023 to Apr 2024