General Mills Needs to Stir Its Yogurt -- WSJ

September 19 2016 - 3:03AM

Dow Jones News

By Annie Gasparro

General Mills Inc. has a mess in the dairy aisle.

The maker of Cheerios cereal and Betty Crocker cake mix has been

selling Yoplait yogurt in the U.S. since 1977. But as shoppers

switch to thicker, low-carb Greek-style yogurt, the sweeter

American varieties, including General Mills' Yoplait, are falling

out of favor.

General Mills is set to report quarterly earnings on Wednesday,

shedding light on its effort to revive yogurt sales -- one of its

biggest businesses globally.

In a July presentation to investors, General Mills called out

its $2.8 billion global yogurt business as needing a makeover,

after it spent significant time and money reviving its U.S. cereal

business last year.

The Minneapolis food giant said that while cereal sales

improved, sales of its yogurt in the U.S. fell 7% in fiscal 2016,

which ended in May -- a sharp reversal from 5% growth the prior

year.

At an investor conference this month, General Mills warned that

its sales in the recent quarter fell more than 2% on a comparable

basis, largely because of its struggles with yogurt.

Part of its problem is that General Mills doesn't have a strong

foothold in the fastest growing segments within yogurt -- namely,

organic. The company is aiming to fix that by offering more

varieties of organic yogurt under the Annie's Homegrown brand it

bought two years ago.

Chief Operating Officer Jeff Harmening has said he will also add

yogurt smoothies to shelves, since drinkable yogurts are becoming

more popular, and he is pushing new brands, such as Go Big yogurt

pouches for children that outgrow Go-Gurt tubes from General

Mills.

Still, Wall Street analysts are skeptical the company can win

back customers that are looking for more natural and more

nutritious yogurt.

For one, Yoplait doesn't sound like an authentic Greek yogurt

brand the way that Dannon's Oikos does, notes CLSA analyst Michael

Lavery. General Mills is "fighting out of a deep hole," and a

comeback "looks like a monumental challenge," he said.

On average, analysts expect General Mills to report a 7% decline

in quarterly revenue to $3.91 billion, and a 5% decline in earnings

per share to 75 cents, according to Thomson Reuters.

According to market research, the majority of its recent sales

decline was due to discontinuing various products, particularly

varieties and sizes of Cheerios and Chex cereals. RBC Capital

Markets analyst David Palmer said such moves provide a needed boost

to General Mills' gross profit margin.

While the company will likely highlight its plans and progress

in yogurt on Wednesday, investors will also be looking for details

around its cost-cutting program, the sustainability of its sales

increases in cereal, and whether it remains on track to meet its

goals for the full fiscal year.

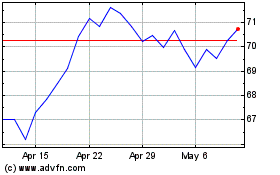

General Mills' stock has risen about 13% this year. Shares of

several food companies have benefited from takeover talk amid an

active merger-and-acquisition environment in recent years.

Write to Annie Gasparro at annie.gasparro@wsj.com

(END) Dow Jones Newswires

September 19, 2016 02:48 ET (06:48 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

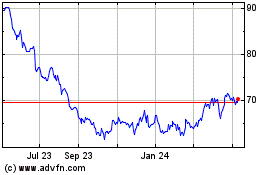

General Mills (NYSE:GIS)

Historical Stock Chart

From Mar 2024 to Apr 2024

General Mills (NYSE:GIS)

Historical Stock Chart

From Apr 2023 to Apr 2024