Cost Cuts Boost Margins At General Mills

March 24 2016 - 3:02AM

Dow Jones News

(FROM THE WALL STREET JOURNAL 3/24/16)

By Annie Gasparro

Cost-cutting helped General Mills Inc. book a higher profit in

its latest quarter, but the Cheerios maker is still struggling with

weakening U.S. demand for its cereal and yogurt.

The Minneapolis-based company's sales fell 8% to $4 billion for

the three months ended Feb. 28, trimmed by the sale of its Green

Giant vegetable business and foreign-exchange headwinds that cut

the value of overseas revenue.

But its effort to close factories and reduce corporate spending

helped lift profit by 5.4% to $361.7 million, beating analysts'

expectations.

Cost-cutting efforts "have been very effective as we're seeing

nice [profit] margin expansion this year," Chief Executive Ken

Powell said in an interview Wednesday. "But you can't sustain the

business on cost-cutting alone."

The 150-year-old food company says restoring growth for its U.S.

cereal sales is a priority. Consumers are eating less of processed

oats and grains for breakfast, switching to higher-protein,

portable meals such as Greek yogurt and breakfast sandwiches.

In January, General Mills replaced traditional varieties of

Golden Grahams, Trix and four other cereals with more-natural

versions that don't use artificial food dyes.

Sales of those cereals rose 6% in January and February from a

year earlier, compared with a 6% decline in fiscal 2015.

"We're in an environment where the consumer attitudes about food

are changing very rapidly," Mr. Powell said. "Now would not be a

good time to cut your innovation. If anything, you should

accelerate it."

General Mills said it expects to close out its fiscal year

ending in May with a rise in U.S. cereal sales on a comparable

basis, following a 3.3% decline last year.

The company also has to tackle challenges to its dairy business.

Yogurt sales, driven by its Yoplait brand, fell 10% in the latest

quarter.

With milk costs down, other yogurt brands offered significant

discounts, while General Mills said it held pricing steady to

protect profitability.

Mr. Powell said that in the next couple of months it will become

more competitive on pricing and hopes to regain shelf space in

retailers.

General Mills reported fiscal third-quarter earnings of $361.7

million, or 59 cents a share, up from $343.2 million, or 56 cents,

a year earlier. Excluding certain items, adjusted earnings fell to

65 cents a share from 70 cents.

---

Anne Steele contributed to this article

(END) Dow Jones Newswires

March 24, 2016 02:47 ET (06:47 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

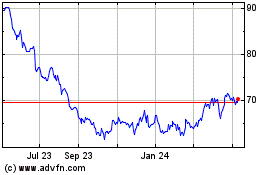

General Mills (NYSE:GIS)

Historical Stock Chart

From Mar 2024 to Apr 2024

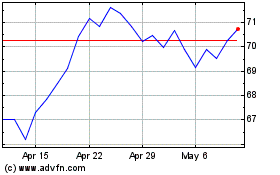

General Mills (NYSE:GIS)

Historical Stock Chart

From Apr 2023 to Apr 2024