By Leslie Josephs

Investors are starting to lose their appetite for food

stocks.

Last week's strong jobs report bolstered the case for a December

interest-rate rise in the U.S., prompting investors to move money

out of companies that have offered steady returns amid ultralow

interest rates and market swings, such as large packaged-food

companies. The shift comes as food stocks face other threats, such

as slowing sales as consumers shift toward less-processed

options.

The S&P 500's Food Products Index, which tracks companies

including Hershey Co., General Mills Inc. and Kraft Heinz Co., fell

3.1% last week, while the S&P 500 rose 1%.

"I think that ship has already sailed for now," said Tommy

Lackey, a portfolio manager at Barber Lackey Financial Group LLC in

Greensboro, Ga., which manages about $20 million of assets.

He said he sold part of a high-dividend mutual fund last month

that had a high concentration in consumer staples, including food

stocks. "The consumer is still strong, so this area will still

perform OK but not excel like others," he said.

The food-products index is up 5.7% so far this year, while the

S&P 500 is up 1%.

Analysts and investors noted that cost-cutting as well as

mergers and acquisitions have made the stocks attractive even

though some of the companies' sales have slipped.

Quarterly revenues for companies in the food-products index have

dropped 10.5% from a year earlier, with 57% of the companies having

reported, according to FactSet. Revenues of S&P 500 companies

have dropped 4.6%, with 85% of companies having reported.

Some food-company executives acknowledged changing consumer

tastes.

The carbonated soft-drink market "continues to be under pressure

from a volume perspective," said PepsiCo Inc. Chief Executive Indra

Nooyi in a call with investors on Oct. 6. She added that

noncarbonated drinks, such as water, "are really what's driving all

of the growth in the whole industry."

The revenue generated by soda and cereal in the U.S. has

contracted about 2% a year for the last two years, according to

market-research firm Euromonitor International.

"Without seeing topline growth, there's really only one way you

can grow, which is through cost-cutting," said Brett Hundley, a

food-stocks analyst at BB&T. "They've kind of run out of road

to cut cost."

Kraft Heinz, the combined Kraft Foods Group Inc. and H.J. Heinz

Co., plans to close seven plants and cut 2,600 jobs. In its first

report as a single company earlier this month, it said profit and

revenue shrank and it raised its quarterly dividend 4.5% to 57.5

cents a share. Kraft Heinz shares are down more than 4% over the

last month and down 2.4% since the combined company first traded in

July.

Shares of Mondelez International, the maker of Oreo cookies,

lost 1.4% over the past month but are up 22% this year. Revenue

fell 18% in the third quarter. Mondelez said profit jumped more

than 700% from a year earlier, to $7.27 billion, after it combined

its coffee business with D.E. Master Blenders 1753 B.V.

"Even though earnings haven't been growing considerably for food

in general, there's been a lot of consolidation," Mr. Hundley said.

"When a big deal gets done, that lifts all stock prices, because

people think 'who's. next?'"

But deals have slowed. There were 178 food-sector deals

announced in 2015 as of Nov. 4, down from 236 in 2014 and 265 at

their peak in 2012, according to Dealogic. And higher interest

rates down the road could mean higher borrowing costs for companies

looking to finance acquisitions.

Investors also say food stocks were becoming expensive compared

with the broader market. The S&P 500's Food Product Index

trades at 22.6 times its companies' past 12 months of earnings,

versus the S&P 500's 18.5 price/earnings ratio, according to

FactSet as of Friday.

Valuations are even more stretched in emerging markets, which

are vulnerable if the U.S. raises rates. "If another significant

emerging-markets downturn causes investors to abandon the asset

class en masse, these defensives stocks with stretched valuations

have the greatest distance to fall before putting in a floor," said

Joe Gubler, portfolio manager at Causeway Emerging Markets Fund,

with $2 billion in assets.

In addition, a five-year decline in commodity

prices--particularly for the cornerstone ingredients for many of

these companies' signature products--is starting to stabilize.

Some investors aren't deterred. These companies are still

strong, predictive cash-flow companies," said Peter Santoro, a

portfolio manager of Columbia Threadneedle's $7.9 billion Columbia

Dividend Income Fund.

He said he increased the fund's holdings of General Mills and

PepsiCo this year, drawn to the companies' cost-cutting strategies

and efforts to make products fit in with consumer trends, such as

offering gluten-free Cheerios or lower-fat potato chips.

"People have got to eat," said Hank Madden, co-founder of Madden

Advisory Services Inc. in Jacksonville Fla., who holds the

PowerShares Dynamic Food & Beverage ETF. "I don't care if it's

a good time or a bad time."

Julie Wernau contributed to this article.

Write to Leslie Josephs at leslie.josephs@wsj.com

Subscribe to WSJ: http://online.wsj.com?mod=djnwires

(END) Dow Jones Newswires

November 09, 2015 20:54 ET (01:54 GMT)

Copyright (c) 2015 Dow Jones & Company, Inc.

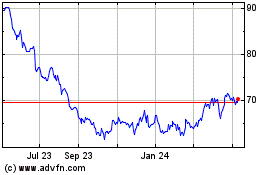

General Mills (NYSE:GIS)

Historical Stock Chart

From Mar 2024 to Apr 2024

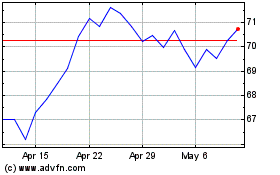

General Mills (NYSE:GIS)

Historical Stock Chart

From Apr 2023 to Apr 2024