RIO DE JANEIRO—As Brazil claws its way out of a brutal

recession, it is bearing an extra burden: its biggest

companies.

The country's best-known corporate names, including Petrobras,

Vale and Odebrecht, thrived during Brazil's economic rise,

delivering sizzling growth, investment and employment.

Now, many of those businesses are struggling, tainted by

corruption, mired in debt, fending off bankruptcy, or sometimes all

three. The scandals transcend borders and industries, and include

privately held, state-controlled and publicly listed companies.

What they have in common is the damage they have collectively

inflicted on Brazil and its global reputation. "Segments of the

corporate sector are seen as radioactive," said Gustavo Franco,

chairman of asset manager Rio Bravo and a former president of

Brazil's central bank.

In the past two years, corruption scandals have chased away

investors and thrown Brazil's political system into disarray,

dragging the economy into its worst downturn in at least a century.

Gross domestic product has likely contracted 7.1%, and economists

on Monday downgraded their 2017 growth forecast to just 0.7%.

"What Brazil really needs right now is a transformation in terms

of corporate governance, in terms of business ethics and values,"

says Cassia Carvalho, executive director of the Brazil-U.S.

Business Council.

Brazil's recovery prospects remain clouded by the troubles of

its behemoths. State-run Petró leo Brasileiro SA, or Petrobras, is

a case in point. In 2014, prosecutors uncovered a bid-rigging and

bribery ring that looted billions of reais from the oil giant over

the course of a decade.

In exchange for inflated contracts, crooked contractors funneled

kickbacks to Petrobras executives and dirty politicians. Several

hundred million reais have been paid back to the company from the

Swiss bank accounts of several participants in the scheme.

Petrobras says it was a victim of the scheme and is cooperating

with authorities.

Even so, Petrobras has written off some $37 billion to reflect

corruption-related losses, overvalued assets and falling oil

prices. It has slowed new projects drastically and is scrambling to

sell off assets to finance a debt load of $123 billion, the largest

in the global oil industry.

Since March 2011, Petrobras has lost $181 billion in market

capitalization, more than any company in the world. The runner-up,

mining giant Vale SA, is headquartered a few blocks away and has

shed $130 billion, according to FactSet. Vale has been roiled by

volatile commodity markets and is fighting a nearly $50 billion

lawsuit related to a dam failure at its Samarco joint venture that

killed 19 people last November.

Big construction companies, including Odebrecht SA, are accused

of forming a cartel to bilk Petrobras and remain blacklisted from

doing business with the government agencies they depend on for

contracts. Some have filed for bankruptcy protection; others are

watching their credit ratings spiral downward.

Odebrecht apologized on Dec. 1 for "improper practices in its

business activity" and said it "has learned several lessons from

its mistakes."

Among those enmeshed in various criminal investigations are

Brazil's biggest electric utility, state-run Centrals Elé tricas

Brasileiras SA, its two largest private-sector banks, Banco

Bradesco and Itaú Unibanco, as well as its largest steelmaker,

Gerdau SA, and executives from the world's largest meatpacker, JBS

SA.

Embraer SA, the homegrown aircraft maker that Brazilians have

long held up as an example of how they can compete globally, agreed

in October to pay $205 million to settle a U.S. foreign-bribery

investigation.

Eletrobras says it is aiding federal authorities, who are

focusing on its employees, contractors and suppliers.

Bradesco, Itau and Gerdau have denied wrongdoing. JBS says the

company the company itself isn't a target of investigations, and

its executives have denied wrongdoing.

Embraer says it "deeply regrets" the conduct of its employees

and agents who paid bribes in multiple countries and created false

records to conceal the payments.

Confidence in the Brazilian economy has rebounded since

left-leaning President Dilma Rousseff was impeached in August and

replaced by former Vice President Michel Temer, who is viewed as

pro-business. And investors appear to believe that authorities have

at least identified all the parties likely to be involved in the

corruption purge.

But for Brazil, kick-starting economic growth could prove a tall

order without help from its biggest companies, which have long

played an outsize role in driving investment. In 2013, Petrobras

alone accounted for almost 10% of total investment in the Brazilian

economy. As it slashed spending in subsequent years to stem its

soaring debt, Brazil's gross fixed investment dwindled for 10

consecutive quarters, deepening the recession.

Such carnage has ominous implications. The country's pervasive

red tape, a labor code that dates to the 1930s, and a Byzantine tax

system create formidable barriers to entry for outsiders or

startups that can't afford to employ armies of lawyers and

accountants. And double-digit interest rates make capital too

costly for companies without the reach to issue debt overseas.

Brazil's corporate giants have left the banking system saddled

with bad debt. Nobody knows the full extent of the problem, but

Credit Suisse said in September pegged the "troubled" debt of the

country's big companies at an unprecedented 818 billion reais. The

total doesn't include Petrobras's 398-billion-real debt pile.

Marcelo Telles, who wrote the Credit Suisse report, says

Brazilian companies will likely take several years to pare their

debt, assuming the economy rebounds. If they fail, Brazil could

face a credit crunch, he said.

To avoid the worst, "the economy needs to grow next year," Mr.

Telles said. "We need to take this very seriously."

(END) Dow Jones Newswires

December 13, 2016 08:25 ET (13:25 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

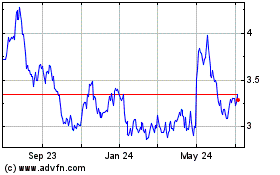

Gerdau (NYSE:GGB)

Historical Stock Chart

From Mar 2024 to Apr 2024

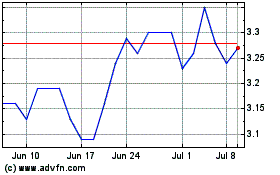

Gerdau (NYSE:GGB)

Historical Stock Chart

From Apr 2023 to Apr 2024