Report of Foreign Issuer (6-k)

January 27 2016 - 1:36PM

Edgar (US Regulatory)

FORM 6-K

U.S. SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

REPORT OF FOREIGN PRIVATE ISSUER

PURSUANT TO RULE 13a-16 OR 15d-16 UNDER THE

SECURITIES EXCHANGE ACT OF 1934

Dated January 27, 2016

Commission File Number 1-14878

GERDAU S.A.

(Exact Name as Specified in its Charter)

N/A

(Translation of Registrant’s Name)

Av. Farrapos 1811

Porto Alegre, Rio Grande do Sul - Brazil CEP 90220-005

(Address of principal executive offices)

Indicate by check mark whether the registrant files or will file annual reports under cover Form 20-F or Form 40-F.

Form 20-F x Form 40-F o

Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(1): o

Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(7): o

Indicate by check mark whether by furnishing the information contained in this Form, the registrant is also thereby furnishing the information to the Commission pursuant to Rule 12g3-2(b) under the Securities Exchange Act of 1934.

Yes o No x

If “Yes” is marked, indicate below the file number assigned to the registrant in connection with Rule 12g3-2(b): Not applicable.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused the Report to be signed on its behalf by the undersigned, thereunto duly authorized.

Date: January 27, 2016

|

|

GERDAU S.A. |

|

|

|

|

|

|

|

|

By: |

/s/ Harley Lorentz Scardoelli |

|

|

Name: Harley Lorentz Scardoelli |

|

|

Title: Investor Relations Director |

2

EXHIBIT INDEX

|

Exhibit |

|

Description of Exhibit |

|

|

|

|

|

99.1 |

|

Notice to the Market, January 27, 2016 |

3

Exhibit 99.1

NOTICE TO THE MARKET

Gerdau announces its plans to form a joint venture with the Japanese companies Sumitomo Corporation and The Japan Steel Works (JSW) to serve Brazil’s growing wind power industry. The project, which will require approval from anti-trust authorities, is expected to be located in Pindamonhangaba (São Paulo) and will supply parts for wind turbine towers starting in 2017.

The initiative was made possible by Gerdau 2022, a project launched in 2015 that aims to boost the competitiveness of the company’s entire operations guided by a long term strategic vision. Specific measure include streamlining internal operations and structures, modernizing the corporate culture, reassessing the potential profitability of assets and developing new business opportunities.

“We’re working to transform Gerdau into a more efficient and profitable company, given the current and future challenges of the global steel industry. We’re seeking to join forces with partners with recognized experience in their industries in order to create new business opportunities. With Sumitomo Corporation and JSW, we will develop high-tech products for our clients, which will enable them to generate higher profit margins,” said Gerdau’s CEO André B. Gerdau Johannpeter.

Joint venture to serve Brazil’s growing wind power industry

The new joint venture is expected to be formed by the partners Gerdau, Sumitomo Corporation and The Japan Steel Works (JSW) and will require R$280 million in investments for the acquisition of new production equipment. Gerdau will supply assets for the production of rolling mill rolls, without any expected cash expenditures. The project will be located at Gerdau’s mill in Pindamonhangaba, which will supply special steel for the manufacture of parts for wind turbine towers (main shaft and bearing rings). This project will create 100 new direct jobs.

Sumitomo Corporation and The Japan Steel Works (JSW) are Japanese companies with vast expertise in the global wind power industry and technological mastery of production processes for components for the industry. Gerdau’s joint efforts with the two companies will enable local production of parts for the construction of new wind farms in the country, supplying clients with high-quality products at competitive costs.

Gerdau’s interest in the joint venture should surpass 50%, making it a higher interest in the partnership. The interests of the other partners will be defined when executing the project’s agreement. In addition to equipment for the wind power industry, the new company will also manufacture rolling mill rolls for the steel and aluminum industry, which are products already made by Gerdau and marketed in over 30 countries. Total capacity for the production of parts for the wind power industry and of rolling mill rolls should reach 50,000 tonnes per year.

The prospects for Brazil’s wind power industry are promising. According to the Brazilian Wind Power Association, Brazil’s installed wind capacity currently accounts for 6% (8 GW) of the country’s electricity generation. By 2024, this figure is expected to reach 11% (24 GW), according to the Ten-Year Energy Expansion Plan of the Ministry of Mines and Energy. Wind power generation is especially well suited to the country’s Northeast and South, given the regions’ regular winds and favorable conditions for the installation of equipment. Furthermore, wind energy is a clean and sustainable form of power generation and avoids CO2 air emissions.

The execution and formalization of the joint venture is pending analyses and approval by the applicable authorities.

Porto Alegre, January 27, 2016.

Harley Lorentz Scardoelli

Executive Vice President

Investor Relations Director

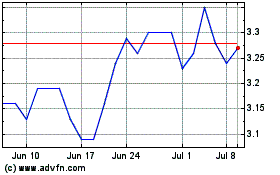

Gerdau (NYSE:GGB)

Historical Stock Chart

From Mar 2024 to Apr 2024

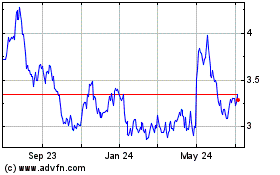

Gerdau (NYSE:GGB)

Historical Stock Chart

From Apr 2023 to Apr 2024