FORM 6-K

U.S. SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

REPORT OF FOREIGN PRIVATE ISSUER

PURSUANT TO RULE 13a-16 OR 15d-16 UNDER THE

SECURITIES EXCHANGE ACT OF 1934

Dated November 6, 2014

Commission File Number 1-14878

GERDAU S.A.

(Exact Name as Specified in its Charter)

N/A

(Translation of Registrant’s Name)

Av. Farrapos 1811

Porto Alegre, Rio Grande do Sul - Brazil CEP 90220-005

(Address of principal executive offices)

Indicate by check mark whether the registrant files or will file annual reports under cover Form 20-F or Form 40-F.

Form 20-F x Form 40-F o

Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(1): o

Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(7): o

Indicate by check mark whether by furnishing the information contained in this Form, the registrant is also thereby furnishing the information to the Commission pursuant to Rule 12g3-2(b) under the Securities Exchange Act of 1934.

Yes o No x

If “Yes” is marked, indicate below the file number assigned to the registrant in connection with Rule 12g3-2(b): Not applicable.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused the Report to be signed on its behalf by the undersigned, thereunto duly authorized.

Date: November 6, 2014

|

|

GERDAU S.A. |

|

|

|

|

|

|

|

|

By: |

/s/ André Pires de Oliveira Dias |

|

|

Name: André Pires de Oliveira Dias |

|

|

Title: Executive Vice President Investor Relations Officer |

2

EXHIBIT INDEX

|

Exhibit |

|

Description of Exhibit |

|

|

|

|

|

99.1 |

|

Quarterly Results 3Q14 |

|

|

|

|

|

99.2 |

|

Notice to Shareholders, November 5, 2014 |

3

Exhibit 99.1

Mission

To create value for our customers, shareholders, employees and communities by operating as a sustainable steel business.

Vision

To be a global organization and a benchmark in any business we conduct.

Values

Be the CUSTOMER’S choice

SAFETY above all

Respected, engaged and fulfilled EMPLOYEES

Pursuing EXCELLENCE with SIMPLICITY

Focus on RESULTS

INTEGRITY with all stakeholders

Economic, social and environmental SUSTAINABILITY

Gerdau is the leading manufacturer of long steel in the Americas and a major global supplier of special steel. In Brazil, also produces flat steel and iron ore, activities that are expanding its product mix and the competitiveness of its operations. With more than 45,000 employees, Gerdau has industrial operations in 14 countries — the Americas, Europe and Asia — with a combined installed capacity of more than 25 million tonnes of steel a year. It is also Latin America’s biggest recycler and, worldwide, transforms millions of tonnes of scrap metal into steel every year, reinforcing its commitment to sustainable development in the regions where it operates. With more than 120,000 shareholders, Gerdau’s shares are listed on the New York, São Paulo and Madrid stock exchanges.

Highlights in the third quarter of 2014

|

Key Information |

|

3rd Quarter

2014 |

|

3rd Quarter

2013 |

|

Variation

3Q14/3Q13 |

|

2nd Quarter

2014 |

|

Variation

3Q14/2Q14 |

|

9 Months

2014 |

|

9 Months

2013 |

|

Variation

9M14/9M13 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Steel |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Production of Crude Steel (1,000 tonnes) |

|

4,472 |

|

4,507 |

|

-0.8 |

% |

4,668 |

|

-4.2 |

% |

13,702 |

|

13,561 |

|

1.0 |

% |

|

Shipments (1,000 tonnes) |

|

4,558 |

|

4,775 |

|

-4.5 |

% |

4,524 |

|

0.8 |

% |

13,469 |

|

13,964 |

|

-3.5 |

% |

|

Net Sales (R$ million) |

|

10,706 |

|

10,494 |

|

2.0 |

% |

10,443 |

|

2.5 |

% |

31,703 |

|

29,542 |

|

7.3 |

% |

|

EBITDA (R$ million) |

|

1,224 |

|

1,413 |

|

-13.4 |

% |

1,170 |

|

4.6 |

% |

3,590 |

|

3,414 |

|

5.2 |

% |

|

Net Income (R$ million) |

|

262 |

|

642 |

|

-59.2 |

% |

393 |

|

-33.3 |

% |

1,095 |

|

1,202 |

|

-8.9 |

% |

|

Gross margin |

|

11.9 |

% |

14.6 |

% |

|

|

12.1 |

% |

|

|

12.2 |

% |

12.8 |

% |

|

|

|

EBITDA Margin |

|

11.4 |

% |

13.5 |

% |

|

|

11.2 |

% |

|

|

11.3 |

% |

11.6 |

% |

|

|

|

Shareholders’ equity (R$ million) |

|

33,208 |

|

31,136 |

|

|

|

31,706 |

|

|

|

33,208 |

|

31,136 |

|

|

|

|

Total Assets (R$ million) |

|

61,472 |

|

56,208 |

|

|

|

57,894 |

|

|

|

61,472 |

|

56,208 |

|

|

|

|

Gross debt / Total capitalization (1) |

|

35.0 |

% |

33.0 |

% |

|

|

34.0 |

% |

|

|

35.0 |

% |

33.0 |

% |

|

|

|

Net debt(2) / EBITDA (3) |

|

2.7 |

x |

2.8 |

x |

|

|

2.4 |

x |

|

|

2.7 |

x |

2.8 |

x |

|

|

(1) Total capitalization = shareholders’ equity + gross debt (principal)

(2) Net debt = gross debt (principal) - cash, cash equivalents and short-term investments

(3) EBITDA in the last 12 months

1

World Steel Market

|

Steel Industry Production

(1,000 tonnes) |

|

3rd Quarter

2014 |

|

3rd Quarter

2013 |

|

Variation

3Q14/3Q13 |

|

2nd Quarter

2014 |

|

Variation

3Q14/2Q14 |

|

9 Months

2014 |

|

9 Months

2013 |

|

Variation

9M14/9M13 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Crude Steel |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Brazil |

|

8,736 |

|

8,877 |

|

-1.6 |

% |

8,385 |

|

4.2 |

% |

25,486 |

|

25,830 |

|

-1.3 |

% |

|

North America (except Mexico) |

|

26,074 |

|

25,323 |

|

3.0 |

% |

25,098 |

|

3.9 |

% |

75,883 |

|

74,582 |

|

1.7 |

% |

|

Latin America (except Brazil) |

|

8,067 |

|

8,237 |

|

-2.1 |

% |

7,851 |

|

2.8 |

% |

23,770 |

|

23,454 |

|

1.3 |

% |

|

Europe |

|

40,123 |

|

39,959 |

|

0.4 |

% |

43,654 |

|

-8.1 |

% |

127,698 |

|

124,131 |

|

2.9 |

% |

|

India |

|

20,818 |

|

20,219 |

|

3.0 |

% |

20,778 |

|

0.2 |

% |

62,412 |

|

61,279 |

|

1.8 |

% |

|

China |

|

204,774 |

|

200,949 |

|

1.9 |

% |

208,564 |

|

-1.8 |

% |

614,384 |

|

600,670 |

|

2.3 |

% |

|

Others |

|

98,072 |

|

96,469 |

|

1.7 |

% |

101,456 |

|

-3.3 |

% |

297,512 |

|

291,503 |

|

2.1 |

% |

|

Total(1) |

|

406,664 |

|

400,033 |

|

1.7 |

% |

415,786 |

|

-2.2 |

% |

1,227,145 |

|

1,201,449 |

|

2.1 |

% |

Source: worldsteel and Gerdau

(1) Figures represent approximately 98% of total production in 65 countries.

· In 3Q14, world steel production grew in relation to 3Q13 (see table above), with China accounting for 50.4% of global production. Production performance in the regions where Gerdau operates was as follows: in developed markets, represented by North America and Europe, the increased production was due to the continued economic growth observed in particular in the United States; on the other hand, in Brazil and Latin America, steel production decreased in the period due to lower economic growth rates combined with higher imports. Capacity utilization in the world steel industry stood at 76.1% in September 2014.

· On October 06, 2014, the World Steel Association released its latest Short Range Outlook containing growth forecasts for global apparent steel consumption in 2014 and 2015 of 2.0% for both years. The association expects weaker growth than the forecast announced in April 2014 (+3.1% in 2014 and +3.3% in 2015), due to lower-than-expected growth in both emerging and developing economies. China is expected to register slower consumption growth in the next two years (+1.0% in 2014 and +0.8% in 2015) due to the structural transformation of its economy. On the other hand, the continuous growth of the U.S. economy should support growth in that country’s apparent consumption of 6.7% in 2014 and 1.9% in 2015. Also in European Union, apparent consumption is expected to grow by 4.0% in 2014 and 2.9% in 2015. In short, apparent steel consumption in developed economies should grow by 4.3% in 2014 and 1.7% in 2015, while developing economies should grow by 1.2% in 2014 and 2.2% in 2015.

Gerdau’s performance in the third quarter of 2014

The Consolidated Financial Statements of Gerdau S.A. are presented in accordance with the International Financial Reporting Standards (IFRS) issued by the International Accounting Standards Board (IASB) and the accounting practices adopted in Brazil, which are fully aligned with the international accounting standards issued by the Accounting Pronouncement Committee (CPC).

The information in this report does not include data for jointly controlled entities and associate companies, except where stated otherwise.

Consolidated Information

Steel production and shipments

|

Consolidated

(1,000 tonnes) |

|

3rd Quarter

2014 |

|

3rd Quarter

2013 |

|

Variation

3Q14/3Q13 |

|

2nd Quarter

2014 |

|

Variation

3Q14/2Q14 |

|

9 Months

2014 |

|

9 Months

2013 |

|

Variation

9M14/9M13 |

|

|

Production of crude steel |

|

4,472 |

|

4,507 |

|

-0.8 |

% |

4,668 |

|

-4.2 |

% |

13,702 |

|

13,561 |

|

1.0 |

% |

|

Shipments of steel |

|

4,558 |

|

4,775 |

|

-4.5 |

% |

4,524 |

|

0.8 |

% |

13,469 |

|

13,964 |

|

-3.5 |

% |

· Consolidated crude steel production remained relatively stable in 3Q14 compared to 3Q13, with production growth in the North America Business Operation (BO) offsetting the reductions observed in the other BOs. Compared to 2Q14, production decreased in all BOs, as will be explained in the item “Business Operations (BO).”

· Consolidated shipments decreased in 3Q14 compared to 3Q13, reflecting the lower shipments, especially in the Brazil BO. Compared to 2Q14, shipments remained stable, with the performance at each BO varying.

2

Consolidated results

Net sales, cost and gross margin

|

Consolidated |

|

3rd Quarter

2014 |

|

3rd Quarter

2013 |

|

Variation

3Q14/3Q13 |

|

2nd Quarter

2014 |

|

Variation

3Q14/2Q14 |

|

9 Months

2014 |

|

9 Months

2013 |

|

Variation

9M14/9M13 |

|

|

Net Sales (R$ million) |

|

10,706 |

|

10,494 |

|

2.0 |

% |

10,443 |

|

2.5 |

% |

31,703 |

|

29,542 |

|

7.3 |

% |

|

Cost of Goods Sold (R$ million) |

|

(9,430 |

) |

(8,960 |

) |

5.2 |

% |

(9,179 |

) |

2.7 |

% |

(27,847 |

) |

(25,757 |

) |

8.1 |

% |

|

Gross profit (R$ million) |

|

1,276 |

|

1,534 |

|

-16.8 |

% |

1,264 |

|

0.9 |

% |

3,856 |

|

3,785 |

|

1.9 |

% |

|

Gross margin (%) |

|

11.9 |

% |

14.6 |

% |

|

|

12.1 |

% |

|

|

12.2 |

% |

12.8 |

% |

|

|

· In 3Q14, consolidated net sales increased compared to 3Q13, mainly due to the net sales growth recorded mainly by North America BO. Compared to 2Q14, consolidated net sales increased, with the performance of each BO varying.

· On a consolidated basis, gross profit and gross margin fell in 3Q14 compared to 3Q13 due to the weaker performance of the Brazil BO, which was partially offset by the better performance of the North America BO. Compared to 2Q14, the relative stability in consolidated gross profit and gross margin was due to the better performance of the North America BO, which offset the reductions observed in the other BOs.

Selling, general and administrative expenses

|

Consolidated

(R$ million) |

|

3rd Quarter

2014 |

|

3rd Quarter

2013 |

|

Variation

3Q14/3Q13 |

|

2nd Quarter

2014 |

|

Variation

3Q14/2Q14 |

|

9 Months

2014 |

|

9 Months

2013 |

|

Variation

9M14/9M13 |

|

|

Selling expenses |

|

172 |

|

177 |

|

-2.8 |

% |

180 |

|

-4.4 |

% |

525 |

|

494 |

|

6.3 |

% |

|

General and administrative expenses |

|

489 |

|

495 |

|

-1.2 |

% |

499 |

|

-2.0 |

% |

1,522 |

|

1,449 |

|

5.0 |

% |

|

Total |

|

661 |

|

672 |

|

-1.6 |

% |

679 |

|

-2.7 |

% |

2,047 |

|

1,943 |

|

5.4 |

% |

|

% of net sales |

|

6.2 |

% |

6.4 |

% |

|

|

6.5 |

% |

|

|

6.5 |

% |

6.6 |

% |

|

|

· Selling, general and administrative expenses as a ratio of net sales decreased slightly in relation to both comparison periods, demonstrating the Company’s efforts to rationalize these expenses.

Other operating income (expenses) and Equity income

|

Consolidated

(R$ million) |

|

3rd Quarter

2014 |

|

3rd Quarter

2013 |

|

Variation

3Q14/3Q13 |

|

2nd Quarter

2014 |

|

Variation

3Q14/2Q14 |

|

9 Months

2014 |

|

9 Months

2013 |

|

Variation

9M14/9M13 |

|

|

Other operating income (expenses) |

|

19 |

|

5 |

|

280.0 |

% |

17 |

|

11.8 |

% |

55 |

|

69 |

|

-20.3 |

% |

|

Equity in earnings of unconsolidated companies |

|

35 |

|

18 |

|

94.4 |

% |

27 |

|

29.6 |

% |

89 |

|

35 |

|

154.3 |

% |

· The jointly controlled entities and associate companies, whose results are calculated using the equity method, recorded steel shipments of 313,000 tonnes in 3Q14 based on their respective equity interests, resulting in net sales of R$ 612.5 million and equity income of R$ 35.2 million.

EBITDA

|

Breakdown of Consolidated EBITDA (1)

(R$ million) |

|

3rd Quarter

2014 |

|

3rd Quarter

2013 |

|

Variation

3Q14/3Q13 |

|

2nd Quarter

2014 |

|

Variation

3Q14/2Q14 |

|

9 Months

2014 |

|

9 Months

2013 |

|

Variation

9M14/9M13 |

|

|

Net income |

|

262 |

|

642 |

|

-59.2 |

% |

393 |

|

-33.3 |

% |

1,095 |

|

1,202 |

|

-8.9 |

% |

|

Net financial result |

|

575 |

|

206 |

|

179.1 |

% |

211 |

|

172.5 |

% |

886 |

|

946 |

|

-6.3 |

% |

|

Provision for income and social contribution taxes |

|

(168 |

) |

37 |

|

— |

|

25 |

|

— |

|

(30 |

) |

(202 |

) |

-85.1 |

% |

|

Depreciation and amortization |

|

555 |

|

528 |

|

5.1 |

% |

541 |

|

2.6 |

% |

1,639 |

|

1,468 |

|

11.6 |

% |

|

EBITDA |

|

1,224 |

|

1,413 |

|

-13.4 |

% |

1,170 |

|

4.6 |

% |

3,590 |

|

3,414 |

|

5.2 |

% |

|

EBITDA Margin |

|

11.4 |

% |

13.5 |

% |

|

|

11.2 |

% |

|

|

11.3 |

% |

11.6 |

% |

|

|

(1) Includes the results from jointly controlled entities and associate companies based on the equity income method.

Note: EBITDA (Earnings Before Interest, Taxes, Depreciation and Amortization) is not a method used in accounting practices, does not represent cash flow for the periods in question and should not be considered an alternative to cash flow as an indicator of liquidity. The Company’s EBITDA was calculated pursuant to Instruction 527 of the CVM.

|

Conciliation of Consolidated EBITDA

(R$ million) |

|

3rd Quarter

2014 |

|

3rd Quarter

2013 |

|

2nd Quarter

2014 |

|

9 Months

2014 |

|

9 Months

2013 |

|

|

EBITDA (1) |

|

1,224 |

|

1,413 |

|

1,170 |

|

3,590 |

|

3,414 |

|

|

Depreciation and amortization |

|

(555 |

) |

(528 |

) |

(541 |

) |

(1,639 |

) |

(1,468 |

) |

|

OPERATING INCOME BEFORE FINANCIAL RESULT AND TAXES(2) |

|

669 |

|

885 |

|

629 |

|

1,951 |

|

1,946 |

|

(1) Non-accounting measurement adopted by the Company.

(2) Accounting measurement disclosed in consolidated Statements of Income.

3

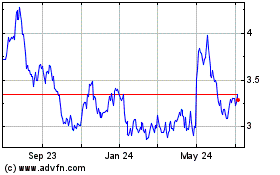

Consolidated EBITDA (R$ million) and EBITDA Margin (%)

· Consolidated EBITDA and EBITDA margin decreased in 3Q14 from 3Q13, mainly due to the weaker performance of the Brazil BO, which was partially offset by the better performance of the North America BO and by the higher equity income and gains in operating expenses. In the comparison with 2Q14, the increases in consolidated EBITDA and EBITDA margin were mainly due to the better performance of the North America BO.

Net Financial Result and Income

|

Consolidated

(R$ million) |

|

3rd Quarter

2014 |

|

3rd Quarter

2013 |

|

Variation

3Q14/3Q13 |

|

2nd Quarter

2014 |

|

Variation

3Q14/2Q14 |

|

9 Months

2014 |

|

9 Months

2013 |

|

Variation

9M14/9M13 |

|

|

Income before financial income (expenses) and taxes (1) |

|

669 |

|

885 |

|

-24.4 |

% |

629 |

|

6.4 |

% |

1,951 |

|

1,946 |

|

0.3 |

% |

|

Financial Result |

|

(575 |

) |

(206 |

) |

179.1 |

% |

(211 |

) |

172.5 |

% |

(886 |

) |

(946 |

) |

-6.3 |

% |

|

Financial income |

|

66 |

|

95 |

|

-30.5 |

% |

89 |

|

-25.8 |

% |

217 |

|

202 |

|

7.4 |

% |

|

Financial expenses |

|

(346 |

) |

(258 |

) |

34.1 |

% |

(371 |

) |

-6.7 |

% |

(1,005 |

) |

(773 |

) |

30.0 |

% |

|

Exchange variation, net |

|

(308 |

) |

(45 |

) |

584.4 |

% |

76 |

|

— |

|

(104 |

) |

(367 |

) |

-71.7 |

% |

|

Exchange variation on net investment hedge |

|

(260 |

) |

(15 |

) |

1633.3 |

% |

63 |

|

— |

|

(114 |

) |

(205 |

) |

-44.4 |

% |

|

Exchange variation - other lines |

|

(48 |

) |

(30 |

) |

60.0 |

% |

13 |

|

— |

|

10 |

|

(162 |

) |

— |

|

|

Gains (losses) on financial instruments, net |

|

13 |

|

2 |

|

550.0 |

% |

(5 |

) |

— |

|

6 |

|

(8 |

) |

— |

|

|

Income before taxes (1) |

|

94 |

|

679 |

|

-86.2 |

% |

418 |

|

-77.5 |

% |

1,065 |

|

1,000 |

|

6.5 |

% |

|

Income and social contribution taxes |

|

168 |

|

(37 |

) |

— |

|

(25 |

) |

— |

|

30 |

|

202 |

|

-85.1 |

% |

|

On net investment hedge |

|

260 |

|

15 |

|

1633.3 |

% |

(63 |

) |

— |

|

114 |

|

205 |

|

-44.4 |

% |

|

Other lines |

|

(92 |

) |

(52 |

) |

76.9 |

% |

38 |

|

— |

|

(84 |

) |

(3 |

) |

2700.0 |

% |

|

Consolidated Net Income (1) |

|

262 |

|

642 |

|

-59.2 |

% |

393 |

|

-33.3 |

% |

1,095 |

|

1,202 |

|

-8.9 |

% |

(1) Includes the results from jointly controlled entities and associate companies based on the equity income method.

· In 3Q14 compared to 3Q13, the higher negative financial result mainly reflects the higher negative net exchange variation on liabilities contracted in U.S. dollar (depreciation in the closing price of the Brazilian real against the U.S. dollar of 11.3% in 3Q14 and 0.6% in 3Q13) and higher financial expenses resulting from an increase in gross debt in the compared periods.

· Compared to 2Q14, the higher negative financial result was mainly due to the negative net exchange variation in 3Q14 compared to the positive exchange variation in 2Q14 (depreciation of 11.3% in 3Q14 and appreciation of 2.7% in 2Q14).

· Note that, in accordance with IFRS, the Company designated the bulk of its debt in foreign currency contracted by companies in Brazil as a hedge for a portion of the investments in subsidiaries located abroad. As a result, only the effect from exchange variation on the portion of debt not linked to investment hedge is recognized in the financial result, with this effect neutralized by the line “Income and Social Contribution taxes on net investment hedge.”

· Consolidated net income decreased in 3Q14 compared to 3Q13, which is explained by the lower operating income and higher negative financial result in the period, and the recognition of the effects from joining the Refis program on profits generated abroad in the net amount of R$ 87 million in 3Q14. Compared to 2Q14, the decrease in net income was mainly due to the higher negative financial result and the recognition of the Refis program in 3Q14 results.

4

Dividends

· The companies Metalúrgica Gerdau S.A. and Gerdau S.A., based on the results in 3Q14, approved the prepayment of the minimum mandatory dividend for fiscal year 2014, as shown below:

· Payment date: November 27, 2014

· Record date: close of trading on November 17, 2014

· Ex-dividend date: November 18, 2014

· Metalúrgica Gerdau S.A.

· Dividends: R$ 16.3 million (R$ 0.04 per share)

· Gerdau S.A.

· Interest on equity: R$ 85.2 million (R$ 0.05 per share)

· In the first nine months of 2014, Metalúrgica Gerdau S.A. and Gerdau S.A. distributed R$ 89.4 million and R$306.8 million in the form of dividends and interest on equity, respectively.

Investments

· In 3Q14, investments in fixed assets amounted to R$ 438.2 million. Of the amount invested in the quarter, 20.1% was allocated to the Brazil BO, 38.0% to the Special Steel BO, 16.0% to the North America BO, 16.5% to the Latin America BO and 9.4% to the Iron Ore BO.

· In the first nine months of 2014, investments in fixed assets amounted to R$ 1.6 billion. The Company continued to invest in its ongoing capacity expansion and productivity improvement projects, as well as in the maintenance actions scheduled for the period in both Brazil and abroad. Based on the investments already made and scheduled for the fourth quarter, Gerdau made a new review of its investment plan, planning to invest a total of R$ 2.1 billion in 2014.

Working capital and Cash conversion cycle

· In September 2014, the cash conversion cycle (working capital divided by daily net sales in the quarter) was stable in relation to June 2014, due to the growth in net sales and working capital in the same proportion.

· Note that the increase in working capital of R$ 320 million between June and September includes the effects of exchange variation, especially on the working capital of companies abroad. Excluding this variation, the cash effect on working capital was a reduction of R$ 277 million.

5

Financial liabilities

|

Debt composition

(R$ million) |

|

09.30.2014 |

|

06.30.2014 |

|

12.31.2013 |

|

|

Short Term |

|

1,949 |

|

1,299 |

|

1,838 |

|

|

Local Currency (Brazil) |

|

35 |

|

109 |

|

491 |

|

|

Foreign Currency (Brazil) |

|

281 |

|

298 |

|

262 |

|

|

Companies abroad |

|

1,633 |

|

892 |

|

1,085 |

|

|

Long Term |

|

16,516 |

|

15,415 |

|

14,869 |

|

|

Local Currency (Brazil) |

|

4,245 |

|

3,365 |

|

2,927 |

|

|

Foreign Currency (Brazil) |

|

9,395 |

|

8,966 |

|

8,725 |

|

|

Companies abroad |

|

2,876 |

|

3,084 |

|

3,217 |

|

|

Gross Debt (principal + interest) |

|

18,465 |

|

16,714 |

|

16,707 |

|

|

Interest on the debt |

|

(340 |

) |

(283 |

) |

(391 |

) |

|

Gross Debt (principal) |

|

18,125 |

|

16,431 |

|

16,316 |

|

|

Cash, cash equivalents and short-term investments |

|

4,671 |

|

3,963 |

|

4,222 |

|

|

Net Debt(1) |

|

13,454 |

|

12,468 |

|

12,094 |

|

(1) Net debt = gross debt (principal) - cash, cash equivalents and short-term investments

· On September 30, 2014, the composition of gross debt (principal) was 8.9% short term and 91.1% long term. The foreign currency exposure of gross debt (principal + interest) stood at 76.8% on September 30, 2014.

· The increase in the cash position of R$ 708 million between June and September 2014 was driven mainly by cash generation in the quarter, as well as by exchange variation in the period. On September 30, 2014, 50.6% of this cash was held by Gerdau companies abroad and denominated mainly in U.S. dollar.

· The 7.9% increase in net debt on September 30, 2014 compared to June 30, 2014 is explained by the effect of exchange variation on gross debt, which was partially offset by the higher cash position.

· On September 30, 2014, the nominal weighted average cost of gross debt (principal) was 6.5%, or 9.1% for the portion denominated in Brazilian real, 5.9% plus foreign exchange variation for the portion denominated in U.S. dollar contracted by companies in Brazil, and 5.8% for the portion contracted by subsidiaries abroad. On September 30, 2014, the average gross debt term was 7.2 years.

· The Company’s main debt indicators are shown below:

|

Indicators |

|

09.30.2014 |

|

06.30.2014 |

|

12.31.2013 |

|

|

Gross debt / Total capitalization (1) |

|

35 |

% |

34 |

% |

34 |

% |

|

Net debt(2) / EBITDA (3) |

|

2.7 |

x |

2.4 |

x |

2.5 |

x |

|

EBITDA (3) / Net financial expenses (3) |

|

5.2 |

x |

6.0 |

x |

6.3 |

x |

(1) Total capitalization = shareholders’ equity + gross debt (principal)

(2) Net debt = gross debt (principal) - cash, cash equivalents and short-term investments

(3) Last 12 months

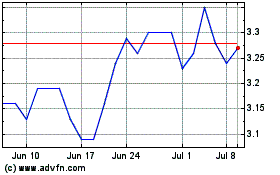

Indebtedness

(R$ billion)

6

· On September 30, 2014, the gross debt (principal) payment schedule was as follows:

Amortization schedule of gross debt (principal)

|

Short Term |

|

R$ million |

|

|

4th quarter of 2014 |

|

326 |

|

|

1st quarter of 2015 |

|

339 |

|

|

2nd quarter of 2015 |

|

227 |

|

|

3rd quarter of 2015 |

|

718 |

|

|

Total |

|

1,610 |

|

|

|

|

|

|

|

Long Term |

|

R$ million |

|

|

4th quarter of 2015 |

|

131 |

|

|

2016 |

|

836 |

|

|

2017 |

|

2,994 |

|

|

2018 and after |

|

12,555 |

|

|

Total |

|

16,516 |

|

Subsequent Events

Assets sale in USA

· On October 8, 2014, Gerdau and ArcelorMittal jointly completed the sale of their respective 50% interests in Gallatin Steel Company to Nucor Corporation for total cash consideration of US$ 770 million. Gallatin is a flat rolled mini-mill located in Gallatin County, Kentucky, USA with annual production capacity of 1.8 million short tons. The sale of Gallatin is aligned with the Company’s strategy of focusing its efforts on improving the returns on its core assets. In addition, this initiative will strengthen Gerdau’s balance sheet, due to the increase in the cash position.

Merger of operations in Dominican Republic

· On October 7, 2014, Gerdau and Complexo Metalúrgico Dominicano S.A. confirmed the merger of operations of its companies Industrias Nacionales and METALDOM, becoming denominated Gerdau Metaldom. This merger aims more efficiency and competitiveness in the Caribbean and Central America region and assures the supply of steel products for construction sector in the Dominicam Republic.

7

Business Operations (BO)

The information in this report is divided into five Business Operations (BO), in accordance with Gerdau’s corporate governance, as follows:

· Brazil BO — includes the steel operations in Brazil (except special steel) and the metallurgical and coking coal operation in Colombia;

· North America BO — includes all North American operations, except Mexico and special steel;

· Latin America BO — includes all Latin American operations, except the operations in Brazil and the metallurgical and coking coal operation in Colombia;

· Special Steel BO — includes the special steel operations in Brazil, Spain, United States and India.

· Iron Ore BO — includes the iron ore operations in Brazil.

8

Brazil BO

Production and shipments

|

Brazil BO

(1,000 tonnes) |

|

3rd Quarter

2014 |

|

3rd Quarter

2013 |

|

Variation

3Q14/3Q13 |

|

2nd Quarter

2014 |

|

Variation

3Q14/2Q14 |

|

9 Months

2014 |

|

9 Months

2013 |

|

Variation

9M14/9M13 |

|

|

Production of crude steel |

|

1,603 |

|

1,794 |

|

-10.6 |

% |

1,621 |

|

-1.1 |

% |

4,838 |

|

5,272 |

|

-8.2 |

% |

|

Shipments of steel |

|

1,660 |

|

1,913 |

|

-13.2 |

% |

1,588 |

|

4.5 |

% |

4,845 |

|

5,489 |

|

-11.7 |

% |

|

Domestic Market |

|

1,369 |

|

1,544 |

|

-11.3 |

% |

1,372 |

|

-0.2 |

% |

4,182 |

|

4,466 |

|

-6.4 |

% |

|

Exports |

|

291 |

|

369 |

|

-21.1 |

% |

216 |

|

34.7 |

% |

663 |

|

1,023 |

|

-35.2 |

% |

· In 3Q14 compared to 3Q13, crude steel production decreased, mainly due to the lower shipments in the period.

· Steel shipments decreased in 3Q14 compared to 3Q13, due to weaker demand caused by slower growth in the construction and manufacturing industries, reflecting the country’s weak GDP growth. Compared to 2Q14, shipments in 3Q14 registered growth due to higher exports, driven by improvement in the international market for semi-finished products.

Operating result

|

Brazil BO |

|

3rd Quarter

2014 |

|

3rd Quarter

2013 |

|

Variation

3Q14/3Q13 |

|

2nd Quarter

2014 |

|

Variation

3Q14/2Q14 |

|

9 Months

2014 |

|

9 Months

2013 |

|

Variation

9M14/9M13 |

|

|

Net Sales (R$ million) |

|

3,559 |

|

3,967 |

|

-10.3 |

% |

3,446 |

|

3.3 |

% |

10,661 |

|

11,090 |

|

-3.9 |

% |

|

Domestic Market |

|

3,131 |

|

3,454 |

|

-9.4 |

% |

3,105 |

|

0.8 |

% |

9,596 |

|

9,688 |

|

-0.9 |

% |

|

Exports(1) |

|

428 |

|

513 |

|

-16.6 |

% |

341 |

|

25.5 |

% |

1,065 |

|

1,402 |

|

-24.0 |

% |

|

Cost of Goods Sold (R$ million) |

|

(2,967 |

) |

(3,017 |

) |

-1.7 |

% |

(2,852 |

) |

4.0 |

% |

(8,726 |

) |

(8,901 |

) |

-2.0 |

% |

|

Gross profit (R$ million) |

|

592 |

|

948 |

|

-37.6 |

% |

594 |

|

-0.3 |

% |

1,935 |

|

2,189 |

|

-11.6 |

% |

|

Gross margin (%) |

|

16.6 |

% |

23.9 |

% |

|

|

17.2 |

% |

|

|

18.2 |

% |

19.7 |

% |

|

|

|

EBITDA (R$ million) |

|

587 |

|

933 |

|

-37.1 |

% |

598 |

|

-1.8 |

% |

1,916 |

|

2,131 |

|

-10.1 |

% |

|

EBITDA margin (%) |

|

16.5 |

% |

23.5 |

% |

|

|

17.4 |

% |

|

|

18.0 |

% |

19.2 |

% |

|

|

(1) Includes coking coal and coke net sales.

· The lower net sales in 3Q14 compared to 3Q13 was mainly due to the lower shipments in both the domestic and export markets. Compared to 2Q14, the increase in net sales was mainly due to higher exports in the period and a better product mix in the domestic market.

· Cost of goods sold decreased in 3Q14 compared to 3Q13, though at a slower pace than the decline in shipments. This effect was mainly due to the reduced dilution of fixed costs. The reduction in net sales to a greater degree than the reduction in cost of goods sold led to a reduction in gross margin in the period. The reduction in gross margin compared to 2Q14 was due to the poorer mix of markets resulting from the higher exports in the period.

· The lower EBITDA in 3Q14 compared to 3Q13 was due to the decrease in gross profit in the period and led to a reduction in EBITDA margin.

9

EBITDA (R$ million) and EBITDA Margin (%)

North America BO

Production and shipments

|

North America BO

(1,000 tonnes) |

|

3rd Quarter

2014 |

|

3rd Quarter

2013 |

|

Variation

3Q14/3Q13 |

|

2nd Quarter

2014 |

|

Variation

3Q14/2Q14 |

|

9 Months

2014 |

|

9 Months

2013 |

|

Variation

9M14/9M13 |

|

|

Production of crude steel |

|

1,705 |

|

1,457 |

|

17.0 |

% |

1,787 |

|

-4.6 |

% |

5,140 |

|

4,571 |

|

12.4 |

% |

|

Shipments of steel |

|

1,648 |

|

1,608 |

|

2.5 |

% |

1,652 |

|

-0.2 |

% |

4,752 |

|

4,669 |

|

1.8 |

% |

· Production increased in 3Q14 compared to 3Q13, mainly due to the lower production in 3Q13, a period marked by increased efforts to optimize inventories.

· Shipments increased in 3Q14 compared to 3Q13, driven by continued strong demand from the industrial sector and continued growth in non-residential construction.

Operating result

|

North America BO |

|

3rd Quarter

2014 |

|

3rd Quarter

2013 |

|

Variation

3Q14/3Q13 |

|

2nd Quarter

2014 |

|

Variation

3Q14/2Q14 |

|

9 Months

2014 |

|

9 Months

2013 |

|

Variation

9M14/9M13 |

|

|

Net Sales (R$ million) |

|

3,694 |

|

3,443 |

|

7.3 |

% |

3,581 |

|

3.2 |

% |

10,533 |

|

9,460 |

|

11.3 |

% |

|

Cost of Goods Sold (R$ million) |

|

(3,346 |

) |

(3,295 |

) |

1.5 |

% |

(3,304 |

) |

1.3 |

% |

(9,809 |

) |

(8,955 |

) |

9.5 |

% |

|

Gross profit (R$ million) |

|

348 |

|

148 |

|

135.1 |

% |

277 |

|

25.6 |

% |

724 |

|

505 |

|

43.4 |

% |

|

Gross margin (%) |

|

9.4 |

% |

4.3 |

% |

|

|

7.7 |

% |

|

|

6.9 |

% |

5.3 |

% |

|

|

|

EBITDA (R$ million) |

|

337 |

|

129 |

|

161.2 |

% |

281 |

|

19.9 |

% |

688 |

|

435 |

|

58.2 |

% |

|

EBITDA margin (%) |

|

9.1 |

% |

3.7 |

% |

|

|

7.8 |

% |

|

|

6.5 |

% |

4.6 |

% |

|

|

· Net sales increased in 3Q14 compared to 3Q13, due to the increase in net sales per tonne sold and higher volumes. The increase in net sales to a higher degree than the increase in cost of goods sold supported gross margin expansion in the period.

· Gross margin expanded in 3Q14 compared to 2Q14, due to the increase in net sales per tonne sold and, to a lesser degree, the lower cost of scrap used in the period.

· The higher EBITDA recorded in 3Q14 compared to both 3Q13 and 2Q14 is explained by the increase in gross profit, which supported EBITDA margin expansion in both comparison periods.

10

EBITDA (R$ million) and EBITDA Margin (%)

Latin America BO

Production and shipments

|

Latin America BO

(1,000 tonnes) |

|

3rd Quarter

2014 |

|

3rd Quarter

2013 |

|

Variation

3Q14/3Q13 |

|

2nd Quarter

2014 |

|

Variation

3Q14/2Q14 |

|

9 Months

2014 |

|

9 Months

2013 |

|

Variation

9M14/9M13 |

|

|

Production of crude steel |

|

386 |

|

444 |

|

-13.1 |

% |

399 |

|

-3.3 |

% |

1,227 |

|

1,299 |

|

-5.5 |

% |

|

Shipments of steel |

|

647 |

|

720 |

|

-10.1 |

% |

631 |

|

2.5 |

% |

1,959 |

|

2,092 |

|

-6.4 |

% |

· Production and shipments in 3Q14 decreased compared to 3Q13, due to the growth in imports and the region’s slower economic growth.

Operating result

|

Latin America BO |

|

3rd Quarter

2014 |

|

3rd Quarter

2013 |

|

Variation

3Q14/3Q13 |

|

2nd Quarter

2014 |

|

Variation

3Q14/2Q14 |

|

9 Months

2014 |

|

9 Months

2013 |

|

Variation

9M14/9M13 |

|

|

Net Sales (R$ million) |

|

1,428 |

|

1,426 |

|

0.1 |

% |

1,302 |

|

9.7 |

% |

4,129 |

|

3,902 |

|

5.8 |

% |

|

Cost of Goods Sold (R$ million) |

|

(1,277 |

) |

(1,264 |

) |

1.0 |

% |

(1,154 |

) |

10.7 |

% |

(3,646 |

) |

(3,506 |

) |

4.0 |

% |

|

Gross profit (R$ million) |

|

151 |

|

162 |

|

-6.8 |

% |

148 |

|

2.0 |

% |

483 |

|

396 |

|

22.0 |

% |

|

Gross margin (%) |

|

10.6 |

% |

11.4 |

% |

|

|

11.4 |

% |

|

|

11.7 |

% |

10.1 |

% |

|

|

|

EBITDA (R$ million) |

|

109 |

|

131 |

|

-16.8 |

% |

109 |

|

0.0 |

% |

361 |

|

293 |

|

23.2 |

% |

|

EBITDA margin (%) |

|

7.6 |

% |

9.2 |

% |

|

|

8.4 |

% |

|

|

8.7 |

% |

7.5 |

% |

|

|

· Net sales remained stable in 3Q14 compared to 3Q13, which is explained by the exchange variation impact resulting from the depreciation in the average price of the Brazilian real against the currencies of the countries where Gerdau operates, despite the reduction in shipments. Compared to 2Q14, the increase in net sales was due to the exchange variation, increase in net sales per tonne sold and higher shipments in the period.

· Cost of goods sold increased slightly in 3Q14 compared to 3Q13 due to the exchange variation, despite the lower shipments. Compared to 2Q14, cost of goods sold increased, driven by the higher raw materials costs, higher shipments and exchange variation in the period. In 3Q14, gross margin remained relatively stable in relation to both 3Q13 and 2Q14 due to the proportionate increases in net sales and cost of goods sold in the comparison periods.

· EBITDA decreased in 3Q14 compared to 3Q13 due to the lower gross profit and an increase in operating expenses, which also impacted EBITDA margin in the period. In relation to 2Q14, the EBITDA remained stable.

11

EBITDA (R$ million) and EBITDA Margin (%)

Special Steel BO

Production and shipments

|

Special Steel BO

(1,000 tonnes) |

|

3rd Quarter

2014 |

|

3rd Quarter

2013 |

|

Variation

3Q14/3Q13 |

|

2nd Quarter

2014 |

|

Variation

3Q14/2Q14 |

|

9 Months

2014 |

|

9 Months

2013 |

|

Variation

9M14/9M13 |

|

|

Production of crude steel |

|

778 |

|

812 |

|

-4.2 |

% |

861 |

|

-9.6 |

% |

2,497 |

|

2,419 |

|

3.2 |

% |

|

Shipments of steel |

|

710 |

|

713 |

|

-0.4 |

% |

749 |

|

-5.2 |

% |

2,217 |

|

2,146 |

|

3.3 |

% |

· The decrease in crude steel production in 3Q14 compared to 3Q13 was driven by lower production at the units in Brazil, where inventories were adjusted to the weaker demand from the automotive industry. Compared to 2Q14, the decrease in production occurred mainly at the units in Spain due to seasonality (summer vacation).

· Shipments remained stable in 3Q14 compared to 3Q13, with the higher shipments at units outside of Brazil offset the weaker demand in the country. Compared to 2Q14, shipments decreased mainly due to the vacation period in Spain.

Operating result

|

Special Steel BO |

|

3rd Quarter

2014 |

|

3rd Quarter

2013 |

|

Variation

3Q14/3Q13 |

|

2nd Quarter

2014 |

|

Variation

3Q14/2Q14 |

|

9 Months

2014 |

|

9 Months

2013 |

|

Variation

9M14/9M13 |

|

|

Net Sales (R$ million) |

|

2,095 |

|

2,045 |

|

2.4 |

% |

2,182 |

|

-4.0 |

% |

6,540 |

|

5,979 |

|

9.4 |

% |

|

Cost of Goods Sold (R$ million) |

|

(1,921 |

) |

(1,823 |

) |

5.4 |

% |

(1,989 |

) |

-3.4 |

% |

(6,011 |

) |

(5,398 |

) |

11.4 |

% |

|

Gross profit (R$ million) |

|

174 |

|

222 |

|

-21.6 |

% |

193 |

|

-9.8 |

% |

529 |

|

581 |

|

-9.0 |

% |

|

Gross margin (%) |

|

8.3 |

% |

10.9 |

% |

|

|

8.8 |

% |

|

|

8.1 |

% |

9.7 |

% |

|

|

|

EBITDA (R$ million) |

|

231 |

|

273 |

|

-15.4 |

% |

230 |

|

0.4 |

% |

664 |

|

704 |

|

-5.7 |

% |

|

EBITDA margin (%) |

|

11.0 |

% |

13.3 |

% |

|

|

10.5 |

% |

|

|

10.2 |

% |

11.8 |

% |

|

|

· Net sales increased in 3Q14 compared to 3Q13, mainly due to the increase in net sales per tonne sold at most operations. Compared to 2Q14, net sales decreased due to the lower shipments in the period.

· Cost of goods sold in 3Q14 compared to 3Q13 increased due to higher shipments at units outside of Brazil, where costs are higher, and the lower shipments at the units in Brazil. The increase in cost of goods sold was proportionately higher than the increase in net sales, leading to a reduction in gross margin. Compared to 2Q14,

12

the decrease in gross margin was mainly due to lower shipments at units in Spain and Brazil, which were partially offset by higher shipments in the United States.

· The lower EBITDA recorded in 3Q14 compared to 3Q13 was due to the decrease in gross profit and resulted in a reduction in EBITDA margin. Compared to 2Q14, the increase in EBITDA margin with a decrease in gross margin was mainly due to the gain of R$12 million from the divestment of Forjanor, a unit located in Spain.

EBITDA (R$ million) and EBITDA Margin (%)

13

Iron Ore BO

Production and shipments

|

Iron Ore BO

(1,000 tonnes) |

|

3rd Quarter

2014 |

|

3rd Quarter

2013 |

|

Variation

3Q14/3Q13 |

|

2nd Quarter

2014 |

|

Variation

3Q14/2Q14 |

|

9 Months

2014 |

|

9 Months

2013 |

|

Variation

9M14/9M13 |

|

|

Production |

|

2,219 |

|

1,568 |

|

41.5 |

% |

1,988 |

|

11.6 |

% |

5,942 |

|

3,743 |

|

58.7 |

% |

|

Shipments |

|

1,981 |

|

1,072 |

|

84.8 |

% |

1,735 |

|

14.2 |

% |

5,716 |

|

2,878 |

|

98.6 |

% |

|

Gerdau units |

|

1,289 |

|

965 |

|

33.6 |

% |

1,020 |

|

26.4 |

% |

3,122 |

|

2,687 |

|

16.2 |

% |

|

Third parties |

|

692 |

|

107 |

|

546.7 |

% |

715 |

|

-3.2 |

% |

2,594 |

|

191 |

|

1258.1 |

% |

· Production and shipments increased in 3Q14 compared to 3Q13 due to the startup of the new iron ore treatment unit in September 2013. Compared to 2Q14, the increase in iron ore production and shipments was driven by higher utilization rates at the Ouro Branco unit.

Operating result

|

Iron Ore BO |

|

3rd Quarter

2014 |

|

3rd Quarter

2013 |

|

Variation

3Q14/3Q13 |

|

2nd Quarter

2014 |

|

Variation

3Q14/2Q14 |

|

9 Months

2014 |

|

9 Months

2013 |

|

Variation

9M14/9M13 |

|

|

Net Sales (R$ million) |

|

207 |

|

127 |

|

63.0 |

% |

216 |

|

-4.2 |

% |

739 |

|

330 |

|

123.9 |

% |

|

Gerdau units |

|

107 |

|

108 |

|

-0.9 |

% |

118 |

|

-9.3 |

% |

331 |

|

297 |

|

11.4 |

% |

|

Third parties |

|

100 |

|

19 |

|

426.3 |

% |

98 |

|

2.0 |

% |

408 |

|

33 |

|

1136.4 |

% |

|

Cost of Goods Sold (R$ million) |

|

(198 |

) |

(72 |

) |

175.0 |

% |

(165 |

) |

20.0 |

% |

(560 |

) |

(209 |

) |

167.9 |

% |

|

Gross profit (R$ million) |

|

9 |

|

55 |

|

-83.6 |

% |

51 |

|

-82.4 |

% |

179 |

|

121 |

|

47.9 |

% |

|

Gross margin (%) |

|

4.3 |

% |

43.3 |

% |

|

|

23.6 |

% |

|

|

24.2 |

% |

36.7 |

% |

|

|

|

EBITDA (R$ million) |

|

10 |

|

49 |

|

-79.6 |

% |

53 |

|

-81.1 |

% |

184 |

|

109 |

|

68.8 |

% |

|

EBITDA margin (%) |

|

4.8 |

% |

38.6 |

% |

|

|

24.5 |

% |

|

|

24.9 |

% |

33.0 |

% |

|

|

· Net sales grew in 3Q14 compared to 3Q13 driven by higher shipments, which were partially offset by the decrease in net sales per tonne sold due to the lower prices in international markets. Compared to 2Q14, the decrease in net sales is explained by the lower prices practiced in international markets.

· Cost of goods sold increased in 3Q14 compared to 3Q13 due to higher shipments, especially to third parties (domestic and export markets), which led to higher freight costs. Compared to 2Q14, the increase in costs was caused mainly by the higher shipments in 3Q14. The combination of lower international prices and higher costs of goods sold led to reductions in gross profit and gross margin in 3Q14 compared to both 3Q13 and 2Q14.

· EBITDA decreased in 3Q14 compared to both 3Q13 and 2Q14, accompanying the behavior of gross profit. Given the price and cost effects explained above, EBITDA margin decreased in relation to the comparison periods.

EBITDA (R$ million) and EBITDA Margin (%)

14

Corporate Governance

Transparency Awards

· Gerdau was one of the winners of the 18th Anefac-Fipecafi-Serasa Transparency Awards for its 2013 financial statements, marking the 15th consecutive time it has figured among the top ten companies presenting the best financial statements. The award researches the largest and best companies based in Brazil in the retail, industrial and services sectors (excluding financial services) that report their financial statements to the market.

Institutional Investor Magazine Ranking 2014

· Gerdau was recognized by the 2014 edition of the ranking sponsored by the Institutional Investor Magazine in the Metals & Mining category for Latin American companies. The ranking is based on an annual survey of buy and sell side analysts and aims to identify the best IR, CEO and CFO professionals, as well as the best IR program. For more awards and recognitions go to the company’s IR website at http://ri.gerdau.com/static/enu/premios-reconhecimentos.asp?idioma=enu#

Gerdau is a highlight among the best companies to work for

· Gerdau once again was recognized by the “Você S/A Exame Guide — Best Companies to Work For.” The Company ranked first in the Metal and Steel industry, maintaining the top spot garnered in previous years. Sponsored every year by the magazines Você S/A and Exame in partnership with the business school Fundação Instituto de Administração (FIA), the ranking is based on two surveys, one completed by the organization and the other by its employees. The questionnaires take into account the level of satisfaction of the teams as well as the practices, consistency, sustainability and scope of action of the organization’s People department.

Gerdau is a highlight at World Steel Association Awards

· In Moscow, Gerdau received two important recognitions during the 48th Conference of the World Steel Association, which brings together the most important companies in the world steel industry. For the first time ever Gerdau was recognized in the Steelie Awards, winning the Excellence in Sustainability category for its project to foster the sustainable development of its supply chain for scrap, one of the main raw materials it uses to make steel. In addition, Gerdau was recognized again in the Safety and Health Excellence Recognition award, which assesses successful programs implemented in the steel industry in the areas of occupational health and safety. In this year’s edition, the Company was awarded for the process entitled “Safety behavior management assessment,” which measures employees’ level of commitment to Gerdau’s safety and health practices.

THE MANAGEMENT

This document contains forward-looking statements. These statements are based on estimates, information or methods that may be incorrect or inaccurate and that may not occur. These estimates are also subject to risk, uncertainties and assumptions that include, among other factors: general economic, political and commercial conditions in Brazil and in the markets where we operate and existing and future government regulations. Potential investors are cautioned that these forward-looking statements do not constitute guarantees of future performance, given that they involve risks and uncertainties. Gerdau does not undertake and expressly waives any obligation to update any of these forward-looking statements, which are valid only on the date on which they were made.

15

GERDAU S.A.

CONSOLIDATED BALANCE SHEETS

In thousands of Brazilian reais (R$)

(Unaudited)

|

|

|

September 30, 2014 |

|

December 31, 2013 |

|

|

CURRENT ASSETS |

|

|

|

|

|

|

Cash and cash equivalents |

|

2,872,095 |

|

2,099,224 |

|

|

Short-term investments |

|

|

|

|

|

|

Held for Trading |

|

1,798,506 |

|

2,123,168 |

|

|

Trade accounts receivable - net |

|

4,363,781 |

|

4,078,806 |

|

|

Inventories |

|

9,311,613 |

|

8,499,691 |

|

|

Tax credits |

|

649,365 |

|

716,806 |

|

|

Income and social contribution taxes recoverable |

|

531,520 |

|

367,963 |

|

|

Unrealized gains on financial instruments |

|

13,179 |

|

319 |

|

|

Assets available for sale |

|

288,695 |

|

— |

|

|

Other current assets |

|

454,746 |

|

291,245 |

|

|

|

|

20,283,500 |

|

18,177,222 |

|

|

|

|

|

|

|

|

|

NON-CURRENT ASSETS |

|

|

|

|

|

|

Tax credits |

|

90,394 |

|

103,469 |

|

|

Deferred income taxes |

|

2,334,000 |

|

2,056,445 |

|

|

Related parties |

|

68,917 |

|

87,159 |

|

|

Judicial deposits |

|

1,290,102 |

|

1,155,407 |

|

|

Other non-current assets |

|

359,819 |

|

220,085 |

|

|

Prepaid pension cost |

|

738,937 |

|

555,184 |

|

|

Investments in associates and jointly-controlled entities |

|

1,331,119 |

|

1,590,031 |

|

|

Goodwill |

|

11,776,371 |

|

11,353,045 |

|

|

Other Intangibles |

|

1,504,843 |

|

1,497,919 |

|

|

Property, plant and equipment, net |

|

21,694,405 |

|

21,419,074 |

|

|

|

|

41,188,907 |

|

40,037,818 |

|

|

|

|

|

|

|

|

|

TOTAL ASSETS |

|

61,472,407 |

|

58,215,040 |

|

16

GERDAU S.A.

CONSOLIDATED BALANCE SHEETS

In thousands of Brazilian reais (R$)

(Unaudited)

|

|

|

September 30, 2014 |

|

December 31, 2013 |

|

|

CURRENT LIABILITIES |

|

|

|

|

|

|

Trade accounts payable |

|

3,506,687 |

|

3,271,419 |

|

|

Short-term debt |

|

1,949,579 |

|

1,810,783 |

|

|

Debentures |

|

— |

|

27,584 |

|

|

Taxes payable |

|

494,402 |

|

473,773 |

|

|

Income and social contribution taxes payable |

|

229,661 |

|

177,434 |

|

|

Payroll and related liabilities |

|

779,608 |

|

655,962 |

|

|

Dividends payable |

|

— |

|

119,455 |

|

|

Employee benefits |

|

48,438 |

|

50,036 |

|

|

Environmental liabilities |

|

21,603 |

|

15,149 |

|

|

Unrealized losses on financial instruments |

|

— |

|

274 |

|

|

Other current liabilities |

|

530,451 |

|

634,761 |

|

|

|

|

7,560,429 |

|

7,236,630 |

|

|

|

|

|

|

|

|

|

NON-CURRENT LIABILITIES |

|

|

|

|

|

|

Long-term debt |

|

16,130,512 |

|

14,481,497 |

|

|

Debentures |

|

385,187 |

|

386,911 |

|

|

Related parties |

|

37 |

|

43 |

|

|

Deferred income taxes |

|

1,156,888 |

|

1,187,252 |

|

|

Unrealized losses on financial instruments |

|

4,594 |

|

3,009 |

|

|

Provision for tax, civil and labor liabilities |

|

1,489,134 |

|

1,294,598 |

|

|

Environmental liabilities |

|

93,531 |

|

90,514 |

|

|

Employee benefits |

|

832,134 |

|

942,319 |

|

|

Other non-current liabilities |

|

611,755 |

|

571,510 |

|

|

|

|

20,703,772 |

|

18,957,653 |

|

|

|

|

|

|

|

|

|

EQUITY |

|

|

|

|

|

|

Capital |

|

19,249,181 |

|

19,249,181 |

|

|

Treasury stocks |

|

(234,636 |

) |

(238,971 |

) |

|

Capital reserves |

|

11,597 |

|

11,597 |

|

|

Retained earnings |

|

11,397,960 |

|

10,472,752 |

|

|

Operations with non-controlling interests |

|

(1,732,962 |

) |

(1,732,962 |

) |

|

Other reserves |

|

2,750,359 |

|

2,577,482 |

|

|

EQUITY ATTRIBUTABLE TO THE EQUITY HOLDERS OF THE PARENT |

|

31,441,499 |

|

30,339,079 |

|

|

|

|

|

|

|

|

|

NON-CONTROLLING INTERESTS |

|

1,766,707 |

|

1,681,678 |

|

|

|

|

|

|

|

|

|

EQUITY |

|

33,208,206 |

|

32,020,757 |

|

|

|

|

|

|

|

|

|

TOTAL LIABILITIES AND EQUITY |

|

61,472,407 |

|

58,215,040 |

|

17

GERDAU S.A.

CONSOLIDATED STATEMENTS OF INCOME

In thousands of Brazilian reais (R$)

(Unaudited)

|

|

|

For the three-month period ended |

|

For the nine-month period ended |

|

|

|

|

September 30, 2014 |

|

September 30, 2013 |

|

September 30, 2014 |

|

September 30, 2013 |

|

|

|

|

|

|

|

|

|

|

|

|

|

NET SALES |

|

10,705,945 |

|

10,494,025 |

|

31,702,543 |

|

29,542,040 |

|

|

Cost of sales |

|

(9,430,085 |

) |

(8,959,637 |

) |

(27,847,263 |

) |

(25,757,117 |

) |

|

GROSS PROFIT |

|

1,275,860 |

|

1,534,388 |

|

3,855,280 |

|

3,784,923 |

|

|

Selling expenses |

|

(172,206 |

) |

(177,393 |

) |

(525,337 |

) |

(493,622 |

) |

|

General and administrative expenses |

|

(488,796 |

) |

(494,686 |

) |

(1,521,545 |

) |

(1,448,994 |

) |

|

Other operating income |

|

64,091 |

|

46,229 |

|

152,563 |

|

145,552 |

|

|

Other operating expenses |

|

(45,369 |

) |

(41,257 |

) |

(97,257 |

) |

(76,373 |

) |

|

Equity in earnings of unconsolidated companies |

|

35,228 |

|

18,363 |

|

88,851 |

|

34,664 |

|

|

INCOME BEFORE FINANCIAL INCOME (EXPENSES) AND TAXES |

|

668,808 |

|

885,644 |

|

1,952,555 |

|

1,946,150 |

|

|

Financial income |

|

66,056 |

|

95,041 |

|

216,763 |

|

202,300 |

|

|

Financial expenses |

|

(345,768 |

) |

(258,098 |

) |

(1,005,079 |

) |

(773,495 |

) |

|

Exchange variations, net |

|

(308,418 |

) |

(45,145 |

) |

(104,425 |

) |

(367,537 |

) |

|

Gain and losses on financial instruments, net |

|

13,234 |

|

2,043 |

|

5,533 |

|

(7,683 |

) |

|

INCOME BEFORE TAXES |

|

93,912 |

|

679,485 |

|

1,065,347 |

|

999,735 |

|

|

Current |

|

(208,473 |

) |

(113,680 |

) |

(325,688 |

) |

(250,509 |

) |

|

Deferred |

|

376,512 |

|

75,804 |

|

355,721 |

|

452,869 |

|

|

Income and social contribution taxes |

|

168,039 |

|

(37,876 |

) |

30,033 |

|

202,360 |

|

|

|

|

|

|

|

|

|

|

|

|

|

NET INCOME |

|

261,951 |

|

641,609 |

|

1,095,380 |

|

1,202,095 |

|

|

|

|

|

|

|

|

|

|

|

|

|

ATTRIBUTABLE TO: |

|

|

|

|

|

|

|

|

|

|

Owners of the parent |

|

252,222 |

|

595,060 |

|

1,005,901 |

|

1,133,637 |

|

|

Non-controlling interests |

|

9,729 |

|

46,549 |

|

89,479 |

|

68,458 |

|

|

|

|

261,951 |

|

641,609 |

|

1,095,380 |

|

1,202,095 |

|

18

GERDAU S.A.

CONSOLIDATED STATEMENTS OF CASH FLOWS

In thousands of Brazilian reais (R$)

(Unaudited)

|

|

|

For the nine-month period ended |

|

|

|

|

September 30, 2014 |

|

September 30, 2013 |

|

|

|

|

|

|

|

|

|

Cash flows from operating activities |

|

|

|

|

|

|

Net income for the period |

|

1,095,380 |

|

1,202,095 |

|

|

Adjustments to reconcile net income for the period to net cash provided by operating activities |

|

|

|

|

|

|

Depreciation and amortization |

|

1,637,322 |

|

1,468,004 |

|

|

Equity in earnings of unconsolidated companies |

|

(88,851 |

) |

(34,664 |

) |

|

Exchange variation, net |

|

104,425 |

|

367,537 |

|

|

(Gains) Losses on financial instruments, net |

|

(5,533 |

) |

7,683 |

|

|

Post-employment benefits |

|

131,398 |

|

87,489 |

|

|

Stock based remuneration |

|

27,788 |

|

25,223 |

|

|

Income tax |

|

(30,033 |

) |

(202,360 |

) |

|

Gains on disposal of property, plant and equipment and investments, net |

|

(42,830 |

) |

(39,840 |

) |

|

Allowance for doubtful accounts |

|

40,178 |

|

41,248 |

|

|

Provision for tax, labor and civil claims |

|

195,039 |

|

167,124 |

|

|

Interest income on investments |

|

(102,820 |

) |

(83,311 |

) |

|

Interest expense on loans |

|

862,452 |

|

652,990 |

|

|

Interest on loans with related parties |

|

(2,368 |

) |

(1,522 |

) |

|

Provision for net realizable value adjustment in inventory |

|

56,240 |

|

30,573 |

|

|

Release of allowance for inventory against cost upon sale of the inventory |

|

(45,640 |

) |

(54,016 |

) |

|

|

|

3,832,147 |

|

3,634,253 |

|

|

Changes in assets and liabilities |

|

|

|

|

|

|

Increase in trade accounts receivable |

|

(266,869 |

) |

(522,228 |

) |

|

(Increase) Decrease in inventories |

|

(803,200 |

) |

1,125,335 |

|

|

Increase in trade accounts payable |

|

247,435 |

|

28,498 |

|

|

Increase in other receivables |

|

(450,665 |

) |

(163,439 |

) |

|

(Decrease) Increase in other payables |

|

(122,745 |

) |

274,840 |

|

|

Dividends from associates and jointly-controlled entities |

|

89,694 |

|

36,296 |

|

|

Purchases of trading securities |

|

(1,859,764 |

) |

(2,170,059 |

) |

|

Proceeds from maturities and sales of trading securities |

|

2,298,537 |

|

1,793,347 |

|

|

Cash provided by operating activities |

|

2,964,570 |

|

4,036,843 |

|

|

|

|

|

|

|

|

|

Interest paid on loans and financing |

|

(632,887 |

) |

(554,605 |

) |

|

Income and social contribution taxes paid |

|

(378,810 |

) |

(274,499 |

) |

|

Net cash provided by operating activities |

|

1,952,873 |

|

3,207,739 |

|

|

|

|

|

|

|

|

|

Cash flows from investing activities |

|

|

|

|

|

|

Additions to property, plant and equipment |

|

(1,593,616 |

) |

(1,921,005 |

) |

|

Proceeds from sales of property, plant and equipment, investments and other intangibles |

|

110,744 |

|

122,091 |

|

|

Additions to other intangibles |

|

(52,693 |

) |

(115,327 |

) |

|

Advance for capital increase in jointly-controlled entity |

|

— |

|

(77,103 |

) |

|

Payment for business acquisitions, net of cash of acquired entities |

|

— |

|

(55,622 |

) |

|

Net cash used in investing activities |

|

(1,535,565 |

) |

(2,046,966 |

) |

|

|

|

|

|

|

|

|

Cash flows from financing activities |

|

|

|

|

|

|

Reduction of capital by non-controlling interests in subsidiaries |

|

— |

|

348,823 |

|

|

Proceeds from exercise of shares |

|

3,932 |

|

3,050 |

|

|

Dividends and interest on capital paid |

|

(339,019 |

) |

(237,617 |

) |

|

Proceeds from loans and financing |

|

2,382,268 |

|

4,039,613 |

|

|

Repayment of loans and financing |

|

(1,777,613 |

) |

(4,223,637 |

) |

|

Intercompany loans, net |

|

20,603 |

|

50,992 |

|

|

Increase in controlling interest in subsidiaries |

|

— |

|

(33,090 |

) |

|

Put-Options on non-controlling interest |

|

— |

|

(599,195 |

) |

|

Net cash provided (used) in financing activities |

|

290,171 |

|

(651,061 |

) |

|

|

|

|

|

|

|

|

Exchange variation on cash and cash equivalents |

|

65,392 |

|

18,504 |

|

|

|

|

|

|

|

|

|

Increase in cash and cash equivalents |

|

772,871 |

|

528,216 |

|

|

Cash and cash equivalents at beginning of period |

|

2,099,224 |

|

1,437,235 |

|

|

Cash and cash equivalents at end of period |

|

2,872,095 |

|

1,965,451 |

|

19

Exhibit 99.2

NOTICE TO SHAREHOLDERS

PAYMENT OF INTEREST ON CAPITAL STOCK