SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 6-K

REPORT OF FOREIGN ISSUER

PURSUANT TO RULE 13a-16 OR 15d-16 OF THE

SECURITIES EXCHANGE ACT OF 1934

For the month of August, 2015

(Commission File No. 001-33356),

Gafisa S.A.

(Translation of Registrant's name into English)

Av. Nações Unidas No. 8501, 19th floor

São Paulo, SP, 05425-070

Federative Republic of Brazil

(Address of principal executive office)

Indicate by check mark whether the registrant files or will file

annual reports under cover Form 20-F or Form 40-F.

Form 20-F ___X___ Form 40-F ______

Indicate by check mark if the registrant is submitting

the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(1)

Yes ______ No ___X___

Indicate by check mark if the registrant is submitting

the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(7):

Yes ______ No ___X___

Indicate by check mark whether by furnishing the information contained in this Form,

the Registrant is also thereby furnishing the information to the Commission pursuant

to Rule 12g3-2(b) under the Securities Exchange Act of 1934:

Yes ______ No ___X___

If “Yes” is marked, indicate below the file number assigned

to the registrant in connection with Rule 12g3-2(b): N/A

FOR IMMEDIATE RELEASE - São Paulo, August 7, 2015 – Gafisa S.A. (Bovespa: GFSA3; NYSE: GFA), one of Brazil’s leading homebuilders, today reported financial results for the second quarter ended June 30, 2015.

|

August 10, 2015

> 9:00 am US EST

In English (simultaneous translation

from Portuguese)

+ 1-516-3001066 US EST

Code: Gafisa

> 10:00 am Brasília Time

In Portuguese

Telephones:

+55-11-3728-5971 (Brazil)

Code: Gafisa

Replay:

+55-11-3127-4999 (Brazil)

Código: 54100222

+55-11-3127-4999 (USA)

Code: 80924629

IR Website:

www.gafisa.com.br/ri

Danilo Cabrera

Mariana Suarez

Phone: +55 11 3025-9242 / 9978

Email: ri@gafisa.com.br

IR Website:

www.gafisa.com.br/ri

Máquina da Notícia - Comunicação Integrada

Giovanna Bambicini

Phone: +55 11 3147-7414

Fax: +55 11 3147-7900

E-mail: gafisa@grupomaquina.com

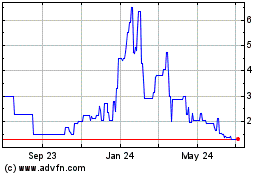

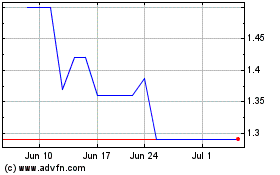

GFSA3 – Bovespa

GFA – NYSE

Total shares outstanding: : 378.066.1621

Average daily trading volume (90 days²):

R$8.9 million

(1) Including 10.074.707 treasury shares

(2) Until June 30, 2015

|

GAFISA RELEASES

2Q15 RESULTS

MANAGEMENT COMMENTS AND HIGHLIGHTS

The first half of 2015 brought Gafisa another step closer to solid levels of profitability. We are pleased to report that consolidated net income totaled R$60.1 million in the first six months of the year, reversing a loss of R$ 40.6 million recorded in the same period last year. In the second quarter specifically, consolidated net income was R$28.5 million. The Tenda segment accounted for R$20.0 million of the total, maintaining the previous quarter’s performance to end the first half of 2015 with net income of R$ 31.4 million. Tenda’s performance reflects its consolidation and the growing participation of new projects launched under its current business model. The Gafisa segment, in turn, recorded net income of R$8.5 million in the quarter and R$28.7 million in 1H15, as a result of targeted efforts to sell inventory and reduce the level of SG&A.

These results are aligned with the Company’s strategy of improving operating performance and increasing its profitability levels, despite the current market environment. In a period marked by a challenging macroeconomic conditions, the Company’s two brands faced very different operating environments. The performance of the Gafisa segment reflects difficult conditions in the middle and upper income markets, due to interest rate, inflation and exchange rate movements which are directly impacting both consumer and investor confidence. On the other hand, the Tenda segment’s performance remains supported by strong demand from the low income segment.

In this context, we would like to highlight the positive performance achieved by both Gafisa and Tenda’s projects in the quarter, which contributed to the Company’s consolidated results. The consolidated adjusted gross margin reached 33.9% in the quarter. The Gafisa segment is maintaining stable profitability levels in its projects, with an adjusted gross margin of 36.5% in the quarter. At the same time, the consolidation of the New Model within Tenda led the segment to record an adjusted gross margin of 30.1%.

In keeping with the shift to a more conservative strategy amid greater risk aversion in the market, the Gafisa segment launched two projects during the quarter. We would like to highlight once again the focus on reducing inventory levels, which accounted for approximately 72% of net pre-sales totaling R$242.2 million in the quarter. It is also worth noting strong delivery volumes in the Gafisa segment during the period: totaling 1,498 units and R$777.3 million in PSV. In the first half of 2015, 14 projects/phases were delivered, representing 3,345 units and R$1.3 billion in PSV. The level of cancellations, which reached R$115.6 million in 2Q15, reflected the impact of Brazil’s current economic stagnation against Gafisa’s strong volume of deliveries. |

1

We ended the second

quarter with R$2.1 billion in inventory in the Gafisa segment, with just 19.8%

related to completed projects. This percentage was impacted by the volume of

deliveries of corporate units and R$105.4 million of units located in

discontinued markets, resulting in a decrease of 52% y-o-y and 8% from the

previous quarter. The performance of inventory sales once again contributed to

the effective sales speed, which was 10.5% in 2Q15, and higher y-o-y.

Amid the continuation

of current economic conditions, we expect to take a conservative approach to

launch activity throughout the second half of the year. We will seek to balance

the placement of new products in the market, prioritizing those with more

liquidity, in order to achieve an adequate sales and profitability.

In the lower income

segment, Tenda was able to sustain positive results and reported net income for

the second consecutive quarter. These results reflect the increased operational

scale of the New Model and the greater level of efficiency and management of

both the financial and operational cycles.

In regards to the

expansion of Tenda’s operating volume, 6 projects/phases were launched in 2Q15,

accounting for R$229.4 million. The projects/phases are located in the states of

São Paulo, Rio de Janeiro, Rio Grande do Sul, Bahia and Pernambuco.

The highlight of the

quarter was the strong speed of sales result, which reached 28.2%. This is due

to greater product availability after three consecutive quarters of high launch

volumes, strong demand in the low income segment and a significant reduction in

the volume of dissolutions observed during the period. As a result, net

pre-sales increased significantly, totaling R$289.9 million, the highest level

since the 4Q10.

The Tenda segment

delivered 5 projects during the quarter, representing 1,240 units and accounting

for R$177.2 million in PSV, of which 77% (980 units, or R$137.2 million) were

under the New Model. In the 6M15, the segment delivered R$239.5 million, with

61% relating to the New Model.

Tenda’s solid operating

performance positively impacted its financial results, with adjusted gross

income reaching R$73.3 million in 2Q15. The adjusted gross margin remained in

the range of 28-30%, as it has since 2Q14.

Tenda has continued its

efforts to achieve greater economies of scale by increasing launches and

implementing strategies designed to ensure a strong speed of sales. Sustainable

operating results over the last three quarters reinforces our confidence in the

New Model.

On a consolidated

basis, Gafisa and Tenda launched R$482.0 million in 2Q15 and R$795.5 million in

6M15, with net pre-sales of R$532.1 million and R$955.5 million, respectively.

Adjusted gross profit was R$200.4 million, with a margin of 33.9% in the

quarter; over the first six months, adjusted gross profit was R$379.7

million.

A substantial reduction

in the volume of old projects and the adaptation to current market conditions

led Gafisa to concentrate on achieving greater stability in its cost and expense

structure. Selling and administrative expenses were R$89.7 million, down 9.9% on

a year-over-year basis. Year-to-date, these expenses totaled R$160.5 million,

down 11.7% from 6M14, attesting to the Company’s commitment to streamlining its

cost structure.

As a result of these

initiatives, consolidated net income totaled R$28.5 million in the quarter and

R$60.1 million in the 6M15.

At the end of the 6M15,

the Net Debt / Shareholder’s Equity ratio reached 50.4%, consistent with the

previous quarter. Excluding financing for projects, the Net Debt / Shareholder’s

Equity ratio was negative 11.7%. In the quarter, consolidated operating cash

generation reached R$13.1 million, also in line with the previous quarter.

The Company ended the

2Q15 with a net cash burn of R$28.1 million, totaling a cash burn of R$97.8

million in the first half. This level of cash burn came as a result of higher

disbursements related to Tenda’s land bank in 1Q15 and a slightly lower volume

of transfers in the Gafisa segment compared to that of the previous quarter, due

to the higher volume of corporate projects delivered in the second

half.

2

The process of

separating the Gafisa and Tenda business units is moving forward. Since the

beginning of 2014, a number of steps have already been completed, while some of

the actions are still underway. These include defining the appropriate capital

structure for each of the business units. Considering that this is the most

crucial step in the separation process, it is still not possible to determine

when the potential separation will be concluded, with the possibility that it

could extend into 2016, as we have previously announced.

Finally, we would like

to highlight our satisfaction with the evolution of the business cycles at both

Gafisa and Tenda in this first half of 2015. In recent years, both companies

have strengthened and improved their operating and financial cycles, positioning

them well for the challenges facing the sector and region in 2015. The company

remains focused on achieving superior operating performance and continues to be

guided, at all times, by capital discipline, the achievement of higher

profitability and the generation of value for its shareholders and other

stakeholders.

|

Sandro

Gamba

Chief Executive

Officer – Gafisa S.A. |

Rodrigo

Osmo

Chief Executive

Officer – Tenda S.A. |

3

MAIN CONSOLIDATED FIGURES

Table 1. Operating and Financial Highlights – (R$000 and % Company)

|

|

2Q15 |

1Q15 |

Q/Q (%) |

2Q14 |

Y/Y (%) |

6M15 |

6M14 |

Y/Y (%) |

|

Launches |

481,951 |

313,581 |

54% |

413,744 |

16% |

795,532 |

949,123 |

-16% |

|

Launches, Units |

2,231 |

1,950 |

14% |

1,089 |

105% |

4,181 |

2,955 |

41% |

|

Net Pre-sales |

532,131 |

423,344 |

26% |

433,018 |

23% |

955,475 |

672,341 |

42% |

|

Pre-sales, Units |

2,395 |

1,908 |

26% |

1,628 |

47% |

4,303 |

2,395 |

80% |

|

Pre-sales of Launches |

108,001 |

59,716 |

81% |

158,633 |

-32% |

167,717 |

216,804 |

-23% |

|

Sales over Supply (SoS) |

15.9% |

12.8% |

310 bps |

12.6% |

330 bps |

25.4% |

18.2% |

720 bps |

|

Delivered projects (PSV) |

954,460 |

785,748 |

21% |

678,171 |

41% |

1,740,208 |

1,235,679 |

41% |

|

Delivered projects, Units |

2,738 |

3,534 |

-22% |

3,689 |

-26% |

6,272 |

5,485 |

14% |

|

Net Revenue |

591,529 |

519,501 |

14% |

574,830 |

3% |

1,111,030 |

1,007,531 |

10% |

|

Adjusted Gross Profit1 |

200,386 |

179,302 |

12% |

205,261 |

-2% |

379,688 |

337,354 |

12% |

|

Adjusted Gross Margin1 |

33.9% |

34.5% |

-60 bps |

35.7% |

-180 bps |

34.2% |

33.5% |

70 bps |

|

Adjusted EBITDA2 |

72,831 |

96,363 |

-24% |

89,838 |

-19% |

169,194 |

116,308 |

45% |

|

Adjusted EBITDA Margin2 |

12.3% |

18.6% |

-630 bps |

15.6% |

-330 bps |

15.2% |

11.5% |

370 bps |

|

Net Income (Loss) |

28,487 |

31,651 |

-10% |

(851) |

3.447% |

60,137 |

(40,640) |

248% |

|

Backlog Revenues |

901,383 |

930,601 |

-3% |

1,506,001 |

-40% |

901,383 |

1,506,001 |

-40% |

|

Backlog Results3 |

364,238 |

367,567 |

-1% |

531,924 |

-32% |

364,238 |

531,924 |

-32% |

|

Backlog Margin3 |

40.4% |

39.5% |

90 bps |

35.3% |

510 bps |

40.4% |

35.3% |

510 bps |

|

Net Debt + Investor Obligations |

1,563,283 |

1,535,215 |

2% |

1,408,283 |

11% |

1,563,283 |

1,408,283 |

11% |

|

Cash and cash equivalents |

876,813 |

1,116,168 |

-21% |

1,279,568 |

-31% |

876,813 |

1,279,568 |

-31% |

|

Shareholders’ Equity |

3,097,881 |

3,066,952 |

1% |

3,116,182 |

-1% |

3,097,881 |

3,116,182 |

-1% |

|

Shareholders’ Equity + Minority |

3,099,492 |

3,070,891 |

1% |

3,138,131 |

-1% |

3,099,492 |

3,138,131 |

-1% |

|

Total Assets |

7,072,546 |

7,333,898 |

-3% |

7,288,403 |

-3% |

7,072,546 |

7,288,403 |

-3% |

|

(Net Debt + Obligations) / (SE + Minority) |

50.4% |

50.0% |

40 bps |

44.9% |

550 bps |

50.4% |

44.9% |

550 bps |

1) Adjusted by capitalized interests.

2) Adjusted by expenses with stock option plans (non-cash), minority. Consolidated EBITDA considers the equity income from Alphaville.

3) Backlog results net of PIS/COFINS taxes – 3.65%, and excluding the impact of PVA (Present Value Adjustment) method according to Law 11,638

4

FINANCIAL

RESULTS

·

Net

revenue recognized by the “PoC” method was R$348.4 million in the Gafisa segment

and

R$243.1 million in the Tenda segment. This resulted in consolidated

revenue of R$591.5 million in the second quarter, up 2.9% year on year, and

13.9% from the previous quarter. In 6M15, consolidated net revenue reached R$1.1

billion, an increase of 10.3% compared to 6M14.

·

Adjusted

gross profit for 2Q15 was R$200.4 million, up from R$179.3 million in 1Q15 and

in line with R$205.3 million in the previous year. Adjusted gross margin reached

33.9% compared to 35.7% in the prior-year period and 34.5% in the 1Q15. Gafisa’s

contribution was an adjusted gross profit of R$127.1 million, with an adjusted

gross margin of 36.5%, while Tenda’s contribution was an adjusted gross profit

of R$73.3 million, with a margin of 30.1% in 2Q15. In the first half, adjusted

gross profit totaled R$379.7 million, versus R$337.4 million in the previous

year, with an adjusted gross margin of 34.2%.

·

Adjusted

EBITDA was R$72.8 million in 2Q15, with a margin of 12.3%. The Gafisa segment

reported adjusted EBITDA of R$52.4 million, while the Tenda segment’s adjusted

EBITDA was R$15.2 million. In 6M15 consolidated adjusted EBITDA was R$169.2

million, an increase of 45% from R$116.3 million in 6M14. Please note that

consolidated adjusted EBITDA includes Alphaville equity income, while the Gafisa

segment’s adjusted EBITDA is net of this effect.

·

The

Company reported positive net income of R$28.5 million in the second quarter.

Gafisa reported a net profit of R$8.5 million, while Tenda reported a profit of

R$20.0 million. In the first six months, net income reached R$60.1

million.

·

Operating cash generation totaled R$13.1 million in the

2Q15, closing the period with R$19.4 million. Net cash consumption of R$28.1

million was recorded in 2Q15, with accumulated consumption of

R$97.8 million

during 6M15.

OPERATING

RESULTS

·

Launches

totaled R$482.0 million in the 2Q15, comprising 8 projects in the states of São

Paulo, Rio de Janeiro, Rio Grande do Sul, Bahia and Pernambuco. This launch

volume was an increase over the R$313.6 million launched in 1Q15. The Gafisa

segment accounted for 52% of the first quarter launches, while the Tenda segment

accounted for the remaining 48%. The volume launched in the first half of the

year totaled R$795.5 million.

·

Net

pre-sales totaled R$532.1 million in 2Q15, of which R$242.2 million related to

Gafisa and

R$289.9 million related to Tenda. The result is well above net

pre-sales totaling R$433.0 million in the 2Q14. Consolidated sales from launches

in the quarter represented 19.3% of the total, while sales from inventory

comprised the remaining 80.7%. During 6M15, the Company had reached R$955.5

million in net pre- sales.

·

Consolidated sales over supply (SoS) reached 15.9% in

2Q15, compared to 12.8% in 1Q15 and 12.6%

y-o-y. On a trailing 12-month

basis, Gafisa’s SoS was 27.7%, while Tenda’s SoS was 48.5%.

·

Consolidated inventory at market value decreased R$60.7

million in the quarter to a value of R$2.8 billion. Gafisa’s inventory totaled

R$2.1 billion while Tenda’s inventory totaled R$738.4 million.

·

Throughout the second quarter, the Company delivered 10

projects/phases, totaling 2,738 units, accounting for R$954.5 million in PSV.

The Gafisa segment delivered 1,498 units, while the Tenda segment delivered the

remaining 1,240 units. Over the past six months, 25 projects / phases and 6,272

units were delivered, accounting for 1.7 billion in PSV.

5

ANALYSIS OF RESULTS

GAFISA SEGMENT

Consistent Gross Margin and Reduction in General and Administrative Expenses

Table 2. Gafisa Segment – Operating and Financial Highlights – (R$000, and % Gafisa)

|

|

2Q15 |

1Q15 |

Q/Q (%) |

2Q14 |

Y/Y (%) |

6M15 |

6M14 |

Y/Y (%) |

|

Launches |

252,585 |

75,227 |

236% |

314,733 |

-20% |

327,812 |

668,667 |

-51% |

|

Net pre-sales |

242,185 |

179,807 |

35% |

251,290 |

-4% |

421,992 |

438,845 |

-4% |

|

Net pre-sales of Launches |

66,973 |

14,436 |

364% |

116,334 |

-42% |

81,409 |

154,249 |

-47% |

|

Sales over Supply (SoS) |

10.5% |

8.0% |

250 bps |

9.8% |

70 bps |

16.9% |

15.9% |

100 bps |

|

Delivered projects (Units) |

1,498 |

1,847 |

-19% |

1,504 |

0% |

3,345 |

2,028 |

65% |

|

Net Revenue |

348,392 |

340,058 |

2% |

397,907 |

-12% |

688,450 |

724,657 |

-5% |

|

Adjusted Gross Profit1 |

127,101 |

125,502 |

1% |

151,456 |

-16% |

252,603 |

267,976 |

-6% |

|

Adjusted Gross Margin1 |

36.5% |

36.9% |

-40 bps |

38.1% |

160 bps |

36.7% |

37.0% |

-30 bps |

|

Adjusted EBITDA2 |

52,400 |

58,289 |

-10% |

83,353 |

-37% |

110,689 |

138,163 |

-20% |

|

Adjusted EBITDA Margin2 |

15.0% |

17.1% |

-210 bps |

20.9% |

-590 bps |

16.1% |

19.1% |

-480 bps |

|

Net Income (Loss) |

8,452 |

20,205 |

-58% |

17,132 |

-51% |

28,657 |

14,801 |

94% |

|

Backlog Revenues |

664,074 |

742,154 |

-11% |

1,298,089 |

-49% |

664,074 |

1,298,089 |

-49% |

|

Backlog Results3 |

265,190 |

294,093 |

-10% |

470,361 |

-44% |

265,190 |

470,361 |

-44% |

|

Backlog Margin3 |

39.9% |

39.6% |

30 bps |

36.2% |

370 bps |

39.9% |

36.2% |

370 bps |

1) Adjusted by capitalized interests.

2) Adjusted by expenses with stock option plans (non-cash), minority. EBITDA from Gafisa segment does not consider the equity income from Alphaville.

3) Backlog results net of PIS/COFINS taxes – 3.65%, and excluding the impact of PVA (Present Value Adjustment) method according to Law 11,638.

Solid second quarter topline performance reflects maintenance in the level of revenues, supported by inventory sales, which represented 72.3% of net sales in the second quarter and 80.7% in 6M15. Another point worth highlighting is the reduction in selling, general and administrative expenses, which were 4.9% lower q-o-q and 12.5% lower y-o-y. This reflects ongoing efforts in the Gafisa segment to increase efficiencies and improve cost management.

2Q15 adjusted gross margin ended at 36.5%, in line with the average levels reported in previous quarters and marginally lower y-o-y, due to a higher recognition of swaps in the period. These profitability levels support the stability of the gross margin in the Gafisa segment, and also highlight the solid performance of the Gafisa segment projects, resulting from the continuous evolution of the Company's business cycle.

Net Income

Net income for the period was R$8.5 million, compared to R$17.1 million in the 2Q14. This decrease is due to a a slight reduction in gross margin, a higher volume of other operating expenses, and the lower contribution of AUSA equity income. 6M15 net income reached R$28.7 million compared to R$14.8 million in 6M14. Excluding the R$5.2 million in equity income from Alphaville, the Gafisa segment’s net income in 2Q15 was R$3.3 million, compared to R$8.7 million recorded in 2Q14. In 6M15, net income was R$6.5 million, compared to R$9.8 million in the previous year.

Table 3 – Gafisa Segment – Net Income (R$ Million)

|

Gafisa Segment (R$ 000) |

2Q15 |

1Q15 |

2Q14 |

6M15 |

6M14 |

|

Adjusted Gross Profit |

127.1 |

125.5 |

151.5 |

252,6 |

268,0 |

|

Adjusted Gross Margin |

36.5% |

36.9% |

38.1% |

36.7% |

37% |

|

Net Profit |

8.5 |

20.2 |

17.1 |

28.7 |

14.8 |

|

Equity Income from Alphaville¹ |

5.2 |

17.0 |

8.4 |

22.2 |

5.0 |

|

Net Profit Ex-Alphaville |

3.3 |

3.2 |

8.7 |

6.5 |

9.8 |

6

TENDA

SEGMENT

Evolution

in Revenue Levels and Increased Profitability Anchored in Operational

Consolidation of the New Model

Table 4. Tenda Segment –

Operating and Financial Highlights – (R$000 and % Tenda)

|

|

2Q15 |

1Q15 |

Q/Q (%) |

2Q14 |

Y/Y (%) |

6M15 |

6M14 |

Y/Y (%) |

|

Launches |

229,366 |

238,354 |

-4% |

99,011 |

132% |

467,720 |

280,456 |

67% |

|

Net pre-sales |

289,946 |

243,537 |

19% |

181,728 |

60% |

533,483 |

233,495 |

129% |

|

Net pre-sales of

Launches |

41,028 |

45,280 |

-9% |

42,299 |

-3% |

86,308 |

62,555 |

38% |

|

Sales over Supply

(SoS) |

28.2% |

23.3% |

490 bps |

20.8% |

740 bps |

41.9% |

25.2% |

1670

bps |

|

Delivered projects

(Units) |

1,240 |

1,687 |

-27% |

2,185 |

-43% |

2,927 |

3,457 |

-15% |

|

Net Revenue |

243,137 |

179,443 |

35% |

176,923 |

37% |

422,580 |

282,874 |

49% |

|

Adjusted Gross

Profit1 |

73,285 |

53,800 |

36% |

53,805 |

36% |

127,085 |

69,368 |

83% |

|

Adjusted Gross

Margin1 |

30.1% |

30.0% |

10 bps |

30.4% |

-30 bps |

30.1% |

24.5% |

560

bps |

|

Adjusted

EBITDA2 |

15,221 |

21,114 |

-28% |

(1,907) |

898% |

36,335 |

(26,820) |

235% |

|

Adjusted EBITDA

Margin2 |

6.3% |

11.8% |

-550 bps |

-1.1% |

740 bps |

8.6% |

-9.5% |

1,810

bps |

|

Net Income

(Loss) |

20,035 |

11,446 |

75% |

(17,983) |

211% |

31,481 |

(55,443) |

157% |

|

Backlog

Revenues |

237,309 |

188,447 |

26% |

207,912 |

14% |

237,309 |

207,912 |

14% |

|

Backlog

Results3 |

99,048 |

73,474 |

35% |

61,563 |

61% |

99,048 |

61,563 |

61% |

|

Backlog

Margin3 |

41.7% |

39.0% |

270 bps |

29.6% |

1,210 bps |

41.7% |

29.6% |

1,210

bps |

1) Adjusted by

capitalized interests.

2) Adjusted by expenses

with stock option plans (non-cash), minority. Tenda does not hold equity in

Alphaville.

3) Backlog results net

of PIS/COFINS taxes – 3.65%, and excluding the impact of PVA (Present Value

Adjustment) method according to Law 11,638.

The second quarter of

the year marked another step towards the consolidation of Tenda’s operational

cycle, supported by an increase in the number of launches in the segment and a

reduction in cancellations since the implementation of changes in the sales

process (August/2014). As a result, the financial results of the Tenda segment

improved significantly.

Tenda recorded a strong

increase in adjusted gross profit in the quarter, reaching R$73.3 million in

2Q15. In addition, the adjusted gross margin remained stable between 28 - 30%,

which is in line with the range observed since 2Q14. This reflects the

operational consolidation of projects executed under the New Model, which has

demonstrated improved performance and profitability, combined with the

decreasing contribution of legacy projects in the segment's revenue

mix.

Furthermore, as

observed in sequential quarters, adjustments in the cost and expense structure

to Tenda’s business cycle positively impacted the quarter’s results. General and

administrative expenses decreased by 13.6% compared to the prior year.

Importantly, the Tenda segment achieved a reduction in selling expenses despite

an increase in the number of launches and gross sales, of 131.7% and 14.8%,

respectively, versus the year-ago period.

Net

Income

In 2Q15 the Tenda

segment achieved net income of R$20.0 million, substantially higher than net

income of R$11.4 million in 1Q15 and a net loss of R$18.0 million in 2Q14. In

6M15, net income was R$31.4 million, compared to a net loss of R$55.4 million in

the previous year, reflecting the improved operating and financial performance

of the Tenda segment. Table 5 – Tenda Segment – Net Income (R$

Million)

|

Tenda Segment (R$

million) |

2Q15 |

1Q15 |

2Q14 |

6M15 |

6M14 |

|

Adjusted Gross Profit

|

73.3 |

53.8 |

53.8 |

127.1 |

69.4 |

|

Adjusted Gross

Margin |

30.1% |

30.0% |

30.4% |

30.1% |

24.5% |

|

Net Profit |

20.0 |

11.4 |

(18.0) |

31.4 |

(55.4) |

7

RECENT

EVENTS

UPDATED

STATUS OF THE SPIN-OFF PROCESS AND RECENT DEVELOPMENTS

In the 2Q15, the

Company progressed with the evaluation of the potential separation of the Gafisa

and Tenda business units. Since commencing the spin-off process in February

2014, a variety of activities have been executed in order to make the two

business units independent of one another from both an operational perspective,

as well as a capital structure perspective. We highlight the following actions

that have already been completed: (i) separation of the administrative

structures, with implementation of the necessary changes required to processes

and systems, (ii) definition of policies and corporate governance, (iii)

preparation for Tenda’s shares to be traded on the market, and (iv) performance

of due diligence and studies of the various impacts the separation could have on

operational, organizational, financial and market-related aspects of the two

Companies.

Over the last quarter,

the Company advanced the separation procedures related to Information Technology

(IT), one of the last remaining joint administrative structures. Currently,

besides the IT area, the only business units operating on a joint basis are

those that will split at the time of the official separation. These business

units include Investor Relations, Corporate Legal, Internal Audit and Internal

Controls.

Definition of the

appropriate capital structure is one main processes that is still ongoing. The

Company continues to work with financial institutions in order to achieve the

conditions deemed necessary for the desired capital structure model, which takes

into consideration the business cycles of each of the business units.

As previously

communicated in a Material Fact released to the market on April 29, these

discussions are ongoing and are taking longer than had been initially expected.

As a result, and considering that the achievement of an appropriate capital

structure is a necessary step in the separation process, it is not yet possible

to determine when the potential separation will be concluded, and it is possible

that the process could extend into 2016.

Additionally, in the

same Material Fact, the Company informed the market that it had been contacted

by groups interested in evaluating the potential acquisition of an equity stake

in Gafisa and Tenda, either together or separately. During the last quarter,

there has been no change in this subject.

The Administrations of

Gafisa and Tenda, in accordance with their fiduciary duties, will evaluate any

proposals that could result in the creation of value for the Companies and will

communicate to their shareholders and the market in general any evolution in

these discussions through presentation of a formal proposal.

The Company will keep

its shareholders and the market informed of any developments related to the

subjects mentioned above.

8

GAFISA SEGMENT

Focuses on

residential developments within the upper, upper-middle, and middle-income

segments, with average unit prices above R$250,000..

Operating

Results

Launches

and Pre-Sales

Second quarter 2015

launches totaled R$252.6 million, representing 2 projects/phases located in the

city of São Paulo. The sales speed of these launches reached 24.4%. In the first

6M15, the Gafisa segment totaled R$ 327.8 million in launches, representing

41.2% of consolidated launches.

The Gafisa segment’s

2Q15 gross pre-sales totaled R$357.8 million. Dissolutions reached R$115.6

million and net pre-sales reached R$242.2 million, an increase of 34.7% compared

to 1Q15 and stable compared to the previous year. In the first half of the year,

the volume of dissolutions was R$ 240.5 million and net sales ended the 6M15 at

R$422.0 million. In the quarter, the sales over supply (SoS) of the Gafisa

segment was 10.5%, higher than that of 1Q15 and the previous year.

The Company continues

to concentrate its efforts on the sale of remaining units. As a result,

approximately 53.0% of net sales during the period related to projects launched

through 2013, resulting in an improvement in the inventory profile of the Gafisa

segment.

9

Table 6. Gafisa Segment

– Launches and Pre-sales (R$000)

|

|

2Q15 |

1Q15 |

Q/Q (%) |

2Q14 |

Y/Y (%) |

6M15 |

6M14 |

Y/Y (%) |

|

Launches |

252,585 |

75,227 |

236% |

314,733 |

-20% |

327,812 |

668,667 |

-51% |

|

Pre-Sales |

242,185 |

179,807 |

35% |

251,290 |

-4% |

421,992 |

438,845 |

-4% |

Sales

over Supply (SoS)

The sales velocity was

10.5% in 2Q15, above the 8.0% recorded in 1Q15 and above 9.8% in the previous

year. On a trailing 12 month basis, Gafisa’s SoS reached 27.7%.

Dissolutions

The weak economic

conditions during the first half of 2015 directly affected consumer confidence

and, accordingly, the level of dissolutions. This scenario has persisted since

the end of 2014. Due to the challenging operating environment, the level of

dissolutions in the Gafisa segment reached R$115.6 million in 2Q15, a decrease

compared to R$124.8 million in 1Q15 and R$119.9 million in the previous year. It

is also worth noting that the level of dissolutions in 6M15 has also been

impacted by the increased volume of deliveries in the quarter. 1,498 units were

delivered in this 2Q15, corresponding to R$777.3 million in PSV; in the first

half of the year deliveries totaled 3,165 units and R$1.3 billion in

PSV.

Over the last three

years, the Company has been working on initiatives to achieve a higher quality

of credit analysis in its sales. In doing so, the Company hopes to reduce the

level of dissolutions throughout the construction and delivery cycle. A

comprehensive approach in the credit review process at the time of the sale has

generated greater efficiency in the process of transferring Gafisa customers to

financial institutions. This progress has occurred despite deteriorating

macroeconomic conditions, especially from the second half of 2014.

In 2Q15, 486 Gafisa

units were cancelled and 253 units were already resold in the period.

10

Inventory

Gafisa is maintaining

its focus on inventory reduction initiatives. Projects launched until 2014

represented 72.3% of net sales in the period. In 6M15, inventory as a percentage

of sales reached 80.7%. The market value of the Gafisa segment inventory

remained stable compared at R$2.1 billion compared to the previous quarter.

Finished units outside of core markets accounted for R$105.4 million, or 5.1% of

total inventory.

Table 7. Gafisa Segment

– Inventory at Market Value (R$000)

|

|

Inventories BoP 1Q15 |

Launches |

Dissolutions |

Gross Sales |

Adjustments1 |

Inventories BoP 2Q15 |

% Q/Q |

|

São Paulo |

1,467,350 |

252,585 |

90,578 |

301,659 |

26,210 |

1,482,644 |

1.0% |

|

Rio de Janeiro |

488,251 |

- |

19,680 |

43,308 |

22,334 |

496,985 |

-0.3% |

|

Other Markets |

115,036 |

- |

5,389 |

12,864 |

2,126 |

105,435 |

-8.3% |

|

Total |

2,070,637 |

252,585 |

115,647 |

357,832 |

6,001 |

2,075,036 |

0.2% |

* The period adjustments

are a reflection of updates related to the project scope, release date and

inflationary update in the period.

During the same period,

finished units comprised R$410.7 million, or 19.8% of total inventory. Inventory

from projects launched outside core markets, currently exclusively comprised of

finished units, represent

R$105.4 million, down 52.3% when compared to the

R$220.9 million recorded last year and down 8.3% from 1Q15. The Company

estimates that by early 2016, it will have monetized a large portion of its

inventory in non-core markets, based on the sales rate observed in these markets

over the past few quarters.

The inventory of

completed units increased as a result of more deliveries of corporate projects

during the quarter, representing approximately R$474.7 million or 61.1% of PSV

delivered. The increase was due to lower liquidity levels for these types of

projects.

It is worth noting that

the largest share of Gafisa’s inventory, approximately 59% or R$1.2 billion, is

concentrated in projects that are to be delivered in the second quarter of 2016.

This will be reflected in the sale of inventory in the coming quarters, rather

than finished units.

Table 8. Gafisa Segment

– Inventory at Market Value – Construction Status (R$000)

|

|

Not Initiated |

Up to 30% built |

30% to 70% built |

More than 70% built |

Finished units¹ |

Total 2Q15 |

|

São Paulo |

253,797 |

- |

920,704 |

221,013 |

87,130 |

1,482,644 |

|

Rio de Janeiro |

- |

41,492 |

113,277 |

114,049 |

218,141 |

486,958 |

|

Other Markets |

- |

- |

- |

- |

105,435 |

105,435 |

|

Total |

253,797 |

41,492 |

1,033,980 |

335,062 |

410,705 |

2,075,036 |

1) Inventory at market

value includes projects in partnership. This indicator is not comparable to the

accounting inventory, due to the implementation of new accounting practices on

behalf of CPCs 18, 19 and 36.

11

Landbank

The Gafisa segment land

bank, with a PSV of approximately R$5.9 billion, is comprised of 30 potential

projects/ phases, amounting to nearly 10.8 thousand units, of which 77% are

located in São Paulo and 23% in Rio de Janeiro. The largest portion of land acquired through swap

agreements is in Rio de Janeiro, impacting the total percentage of land

acquired, which reached 59%.

Table 9. Gafisa Segment

– Landbank (R$000)

|

|

PSV

(% Gafisa) |

%Swap

Total |

%Swap

Units |

%Swap

Financial |

Potential Units

(% Gafisa) |

Potential Units

(100%) |

|

São Paulo |

4,532,063 |

45.9% |

45.0% |

0.9% |

9,063

|

11,117 |

|

Rio de Janeiro |

1,339,778 |

84.2% |

84.2% |

0.0% |

1,741 |

2,142 |

|

Total |

5,871,842 |

58.6% |

58.0% |

0.6% |

10,805 |

13,259 |

Table 10. Gafisa Segment

– Changes in the Landbank (1Q15 x 2Q15 - R$000)

|

|

Initial Landbank |

Land

Acquisition |

Launches |

Dissolutions |

Adjustments |

Final Landbank |

|

São Paulo |

4,802,512 |

- |

252,585 |

- |

(17,863) |

4,532,063 |

|

Rio de Janeiro |

1,315,335 |

85,872 |

- |

(58,370) |

(3,058) |

1,339,778

|

|

Total |

6,117,847 |

85,872 |

252,585 |

(58,370) |

(20,922) |

5,871,842 |

The adjustments of the

quarter reflect updates related to project scope, expected launch date, and

inflationary adjustments to the land bank during the period.

Gafisa

Vendas

During 6M15, Gafisa

Vendas, the Company’s independent sales unit, with operations in São Paulo and

Rio de Janeiro, accounted for 63% of gross sales of the quarter. Gafisa Vendas

currently has a team of 700 highly trained, dedicated consultants, in addition

to an online sales force.

Delivered

Projects

During 2Q15, Gafisa

delivered 5 projects/phases totaling 1,498 units and accounting for R$777.3

million in PSV. In 6M15, 14 projects / phases were delivered, representing 3,345

units and R$ 1.3 billion in PSV.

Currently, Gafisa has

30 projects under construction, all of them on schedule in regards to the

Company’s business plan.

Transfers

Over the past few

years, the Company has been taking steps to improve the performance of its

receivables / transfer process, in an attempt to achieve higher rates of return

on invested capital. Currently, our plan is to transfer 90% of eligible units up

to 90 days after the delivery of the project. In accordance with this policy,

transfers reached R$169.8 million in PSV in the second quarter.

Of second quarter

deliveries, of R$777.3 million, 61.1% comprised corporate projects. Financing

arrangements for corporate projects differ from that of residential projects,

resulting in a smaller contribution to transfer volumes, which impacted cash

generation in the quarter.

12

Table 11. Gafisa Segment

– Delivered Project

|

|

2Q15 |

1Q15 |

Q/Q (%) |

2Q14 |

Y/Y (%) |

6M15 |

6M14 |

Y/Y (%) |

|

PSV Transferred

¹ |

169,829 |

198,014

|

-14% |

210,677 |

-19% |

367,843 |

442,753 |

-17% |

|

Delivered

Projects |

5 |

9 |

0% |

8 |

-38% |

14 |

12 |

-17% |

|

Delivered Units |

1,498 |

1,847 |

-19% |

1,504 |

0% |

3,345 |

2,038 |

65% |

|

Delivered PSV² |

777,258 |

569,459 |

36% |

454,880 |

71% |

1,346,717 |

913,300 |

47% |

1) PSV refers to

potential sales value of the units transferred to financial

institutions.

2) PSV = Potential sales

value of delivered units.

Financial

Results

Revenues

2Q15 net revenues for

the Gafisa segment totaled R$348.4 million, an increase of 2.5% q-o-q and a

decrease of 12.4% y-o-y. The decrease compared to the 2Q14 is related to

projects whose construction works are more advanced.

In 2Q15, approximately

99.6% of Gafisa segment revenues were derived from projects located in Rio de

Janeiro/São Paulo, while 0.4% were derived from projects in non-core markets.

The table below provides additional details.

Table 12. Gafisa Segment

– Revenue Recognition (R$000)

|

|

|

2Q15 |

|

|

|

2Q14 |

|

|

|

Launches |

Pre-sales |

%

Sales |

Revenue |

% Revenue |

Pre-sales |

%

Sales |

Revenue |

% Revenue |

|

2015 |

66,973 |

27.7% |

- |

0% |

- |

- |

- |

- |

|

2014 |

57,530 |

23.8% |

54,173 |

15.5% |

116,334 |

46.3% |

5,711 |

1.4% |

|

2013 |

39,878 |

16.5% |

76,279 |

21.9% |

11,977 |

4.8% |

63,529 |

16.0% |

|

≤ 2012 |

77,804 |

32.1% |

217,939 |

62.6% |

122,979 |

48.9% |

328,667 |

82.6% |

|

Total |

242,185 |

100% |

348,391 |

100% |

251,290 |

100% |

397,907 |

100% |

|

SP + RJ |

234,710 |

96.9% |

346,948 |

99.6% |

216,338 |

86.1% |

388,504 |

97.6% |

|

Other Markets |

7,475 |

3.1% |

1,443 |

0.4% |

34,952 |

13.9% |

9,402 |

2.4% |

Gross

Profit & Margin

Gross profit for the

Gafisa segment in 2Q15 was R$90.3 million, compared to the R$98.1 million in

1Q15, and R$119.1 million in the prior year period. The second quarter gross

margin of 25.9% was impacted by an R$11.0 million increase in revenue from

projects comprising a higher number of swapped units. In keeping with accounting rules, the gross margin on these projects is lower initially, before normalizing

over time.

Excluding financial

impacts, the adjusted gross margin reached 36.5% in 2Q15 compared to 36.9% in

the 1Q15 and 38.1% in the prior year, reaffirming the maintenance in the levels

of profitability in the Gafisa segment. This is a result of the strategic

consolidation in the metropolitan regions of São Paulo and Rio de Janeiro and

the completion of older projects in other non-core markets.

The table below

contains more details on the breakdown of Gafisa’s gross margin in

2Q15.

13

Table 13. Gafisa Segment

– Gross Margin (R$000)

|

|

2Q15 |

1Q15 |

Q/Q (%) |

2Q14 |

Y/Y (%) |

6M15 |

6M14 |

Y/Y (%) |

|

Net Revenue |

348,392 |

340,058 |

2% |

397,907 |

-12% |

688,450 |

724,657 |

-5% |

|

Gross Profit |

90,268 |

98,147 |

-8% |

119,135 |

-24% |

188,415 |

208,025 |

-9% |

|

Gross Margin |

25.9% |

28.9% |

-300

bps |

29.9% |

-400

bps |

27.4% |

28.7% |

130

bps |

|

(-) Financial

Costs |

(36,833) |

(27,355) |

35% |

(32,321) |

14% |

(64,188) |

(59,961) |

7% |

|

Adjusted Gross

Profit |

127,101 |

125,502 |

1% |

151,456 |

-16% |

252,603 |

267,986 |

-6% |

|

Adjusted Gross Margin |

36.5% |

36.9% |

-40 bps |

38.1% |

-160 bps |

36.7% |

37.0% |

-30

bps |

Table 14. Gafisa Segment

– Gross Margin Composition (R$000)

|

|

SP + RJ |

Other Markets |

2Q15 |

|

Net Revenue |

346,948 |

1,443 |

348,391 |

|

Adjusted Gross

Profit |

127,144 |

(43) |

127,101 |

|

Adjusted Gross

Margin |

36.6% |

-3.0% |

36.5% |

| |

|

|

|

Selling,

General and Administrative Expenses (SG&A)

SG&A expenses

totaled R$50.4 million in the 2Q15, a decrease of 15.7% y-o-y and an increase of

17.4% q-o-q. This came as a result of a higher level of selling expenses due to

the higher volume of launches compared to 1Q15 and the additional marketing

effort required in the current market scenario. In the first half, these

expenses totaled R$93.4 million, 16.1% below the R$111.3 million the previous

year.

Selling expenses

decreased 19.2% compared to 2Q14 and increased by 63.0% from 1Q15, also due to

the partial recognition of expenses related to the launch held at the end of

1Q15, which were recorded in 2Q15. For the first half of the year, selling

expenses decreased by 21.8% compared to the same period last year.

The segment’s general

and administrative expenses reached R$27.5 million in 2Q15, a decrease of 4.9%

compared to the previous quarter and 12.5% y-o-y. In 6M15, general and

administrative expenses reached R$56.4 million compared to R$63.9 million in

6M14.

The reduction in the

level of SG&A expenses in the Gafisa segment reflects the Company's

commitment to improve operational efficiency and achieve a level of costs and

expenses that are appropriate for the current status of the business cycle and

business outlook.

Table 15. Gafisa Segment

– SG&A Expenses (R$000)

|

|

2Q15 |

1Q15 |

Q/Q (%) |

2Q14 |

Y/Y (%) |

6M15 |

6M14 |

Y/Y (%) |

|

Selling

Expenses |

22,976 |

14,092 |

63% |

28,425 |

-19% |

37,068 |

47,420 |

-22% |

|

G&A

Expenses |

27,466 |

28,887 |

-5% |

31,406 |

-13% |

56,351 |

63,855 |

-12% |

|

Total SG&A

Expenses |

50,442 |

42,979 |

17% |

59,831 |

-16% |

93,419

|

111,275 |

-16% |

|

Launches |

252,585 |

75,227 |

236% |

314,733 |

-20% |

327,812 |

668,667 |

-51% |

|

Net Pre-Sales |

242,185 |

179,807 |

35% |

251,290 |

-4% |

421,992 |

438,845 |

-4% |

|

Net Revenue |

348,392 |

340,058 |

2% |

397,907 |

-12% |

688,450 |

724,657 |

-5% |

| |

|

|

|

|

|

|

|

|

|

Other Operating

Revenues/Expenses reached R$21.4 million in 2Q15, a decrease of 25.0% compared

to the 1Q15, and a decrease of 12.2% compared to the previous year.

It is worth noting that

if the impact of R$ 13.9 million recorded in 2Q14 related to the provisioning of

Alphaville’s stock option plan is excluded, this item would have shown an

increase of 88.5% over the same period last year, totaling R$49.9 million in

6M15.

14

This increase reflects

the higher level of litigation expenses related to increased deliveries of older

projects held in 2012, 2013 and 2014.

The Company continues

to be more proactive and to mitigate risks associated with potential

contingencies. Taking such approach into consideration, this line had a R$ 11.5

million impact in 2Q15.

The table below

contains more details on the breakdown of this expense.

Table 16. Gafisa Segment

– Other Operating Revenues/ Expenses (R$000)

|

|

2Q15 |

1Q15 |

Q/Q(%) |

2Q14 |

Y/Y (%) |

6M15 |

6M14 |

Y/Y(%) |

|

Litigation

expenses |

(24,622) |

(19,965) |

23% |

(10,667) |

131% |

(44,587) |

(26,669) |

67% |

|

Expenses w/ updating the

balance of the stock options program for AUSA shares |

- |

- |

- |

(13,863) |

- |

- |

(13,863) |

- |

|

Other |

3,244 |

(8,556) |

138% |

179 |

1.712% |

(5,312) |

192 |

-2,867% |

|

Total |

(21,378) |

(28,521) |

-25% |

(24,351) |

-12% |

(49,899) |

(40,340) |

24% |

A higher volume of

deliveries over the past three years, due to the delivery of delayed projects in

discontinued markets, led to an increase in the level of contingencies. The

Gafisa segment has since concentrated its operations only in the metropolitan

regions of São Paulo and Rio de Janeiro. This new strategic positioning,

combined with improved internal processes, is expected to result in fewer future

legal claims and a subsequent decrease in the amount of expenses related to

contingencies.

Adjusted

EBITDA

Adjusted EBITDA for the

Gafisa segment totaled R$52.4 million in 2Q15, a decrease of 37.1% compared to

R$83.4 million in the prior year period and down 10.1% compared to R$58.3

million recorded in 1Q15. Adjusted EBITDA for the period was R$110.7 million

compared to R$138.2 million in 1H14. Y-o-Y, 2Q15 EBITDA was impacted by the

following factors: (i) especially due to a decrease in revenues; (ii) slight

decrease in the level of gross margin; and (iii) the addition of R$14.0 million

in expenses related to contingencies, recognized as Other Revenues/Expenses. It

is worth noting that adjusted EBITDA for the Gafisa segment does not include

equity income from Alphaville.

The adjusted EBITDA

margin, using the same criteria, declined to 15.0%, compared with a margin of

20.9% in the previous year, and 17.1% in 1Q15. In 6M15, the EBITDA margin

reached 16.1% versus 19.1% the previous year.

Table 17. Gafisa Segment

– Adjusted EBITDA (R$000)

|

|

2Q15 |

1Q15 |

Q/Q (%) |

2Q14 |

Y/Y (%) |

6M15 |

6M14 |

Y/Y (%) |

|

Net (Loss)

Profit |

8,452 |

20,205 |

-58% |

17,132 |

-51% |

28,656 |

14,801 |

94% |

|

(+) Financial

Results |

2,966 |

9,744 |

-70% |

4,405 |

-33% |

12,710 |

12,229 |

4% |

|

(+) Income

taxes |

278 |

7,350 |

-96% |

7,208 |

-96% |

7,628 |

11,230 |

-32% |

|

(+) Depreciation &

Amortization |

8,079 |

8,279 |

-2% |

11,311 |

-29% |

16,358 |

22,517 |

-27% |

|

(+) Capitalized

interests |

36,833 |

27,355 |

35% |

32,321 |

14% |

64,187 |

59,961 |

7% |

|

(+) Expense w Stock Option

Plan |

1,850 |

2,090 |

-11% |

20,809 |

-91% |

3,940 |

24,379 |

-84% |

|

(+) Minority

Shareholders |

(848) |

228 |

-472% |

(1,441) |

-41% |

(620) |

(1,989) |

-69% |

|

(-) Alphaville Effect

Result |

(5,210) |

(16,960) |

-69% |

(8,392) |

-38% |

(22,170) |

(4,965) |

242% |

|

Adjusted

EBITDA |

52,400 |

58,289 |

-10% |

83,353 |

-37% |

110,689 |

138,163 |

-16% |

|

Net Revenue |

348,392

|

340,058 |

2% |

397,907 |

-12% |

688,450 |

724,657 |

94% |

|

Adjusted EBITDA Margin

|

15.0% |

17.1% |

-210 bps |

20.9% |

-590 bps |

16.1% |

19.1% |

-230

bps |

1) EBITDA is adjusted by

expenses associated with stock option plans, as this is a non-cash

expense.

15

Backlog

of Revenues and Results

The backlog of results

to be recognized under the PoC method was R$265.2 million in 2Q15. The

consolidated margin for the quarter was 39.9%, an increase of 370 bps compared

to the result posted last year.

Table 18. Gafisa Segment

– Results to be recognized (REF) (R$000)

|

|

2Q15 |

1Q15 |

Q/Q (%) |

2Q14 |

Y/Y (%) |

|

Revenues to be

recognized |

664.074 |

742,154

|

-11% |

1,298,089 |

-49% |

|

Costs to be recognized (units

sold) |

(398.884) |

(448,061) |

-11% |

(827,728) |

-52% |

|

Results to be

recognized |

265.190

|

294,093 |

-10% |

470,361 |

-44% |

|

Backlog Margin |

39,9% |

39.6% |

30

bps |

36.2% |

370

bps |

16

TENDA

SEGMENT

Focuses on

affordable residential developments, classified within the Range II of Minha

Casa, Minha Vida Program.500.

Operating

Results

Launches

and Sales

Second quarter launches

totaled R$229.4 million and included 6 projects/phases in the states of São

Paulo, Rio de Janeiro, Rio Grande do Sul, Bahia and Pernambuco. The Tenda

segment accounted for 47.6% of launches in the quarter. In the first six months

of the year, launch volumes reached R$ 467.7 million.

During 2Q15, gross

sales reached R$343.7 million and dissolutions were R$53.8 million, totaling net

pre-sales of R$289.9 million, an increase of 19.1% compared to the previous

quarter and an increase of 59.6% y-o-y. In 6M15, the volume of dissolutions was

R$110.1 million and net pre-sales totaled R$533.5 million, 128.5% higher in

comparison to 6M14.

Sales from units

launched during 2Q15 accounted for 14.2% of total sales.

Table 19. Tenda Segment

– Launches and Pre-sales (R$000)

|

|

2Q15 |

1Q15 |

Q/Q (%) |

2Q14 |

Y/Y (%) |

6M15 |

6M14 |

Y/Y (%) |

|

Launches |

229,366 |

238,354 |

-4% |

99,011 |

132% |

467,720 |

280,456 |

67% |

|

Pre-Sales |

289,946 |

243,537 |

19% |

181,728 |

60% |

533,483 |

233,495 |

129% |

17

Sales

over Supply (SoS)

In 2Q15, sales velocity

(sales over supply) was 28.2%, and on a trailing 12 month basis, Tenda SoS ended

2Q15 at 48.5%.

Below is a breakdown of

Tenda SoS, broken down by both legacy and New Model projects throughout

2Q15.

Table 20. SoS Gross

Revenue (Ex-Dissolutions)

|

|

2Q14 |

3Q14 |

4Q14 |

1Q15 |

2Q15 |

|

New Model |

25.3% |

11.8% |

18.8% |

30.9% |

35.2% |

|

Legacy Projects |

17.7% |

-2.0% |

5.0% |

7.0% |

12.0% |

|

Total |

20.8% |

4.8% |

13.3% |

23.3% |

28.2% |

Table 21. SoS Net

Revenue

|

|

2Q14 |

3Q14 |

4Q14 |

1Q15 |

2Q15 |

|

New Model |

32.2% |

20.3% |

22.0% |

32.7% |

37.4% |

|

Legacy Projects |

35.8% |

28.3% |

17.5% |

20.1% |

24.3% |

|

Total |

34.3% |

24.4% |

20.2% |

28.6% |

33.4% |

Dissolutions

The level of

dissolutions in the Tenda segment totaled R$53.8 million in 2Q15, down 4.6% from

1Q15 and down 54.3% compared to 2Q14.

As expected, the

amendment in new sales processing, established in August 2014, reduced the level

of dissolutions during the period. Approximately 71% of the dissolutions in the

period were related to old projects.

Table 22. PSV

Dissolutions – Tenda Segment (R$ thousand and % of gross sales by

model)

|

|

2Q14 |

% GS |

3Q14 |

% GS |

4Q14 |

% GS |

1Q15 |

% GS |

2Q15 |

% GS |

|

New Model |

24,977 |

21.5% |

31,640 |

42.1% |

18,003 |

14.3% |

12,594 |

4.2% |

15,648 |

4.5% |

|

Legacy Projects |

92,637 |

50.6% |

114,697 |

107.1% |

48,281 |

71.7% |

43,737 |

14.6% |

38,115 |

11.1% |

|

Total |

117,614 |

39.3% |

146,337 |

80.3% |

66,285 |

34.4% |

56,332 |

18.8% |

53,763 |

15.6% |

18

Table 23. Tenda Segment

– Net Pre-sales by Market (R$ million)

|

|

1Q12 |

2Q12 |

3Q12 |

4Q12 |

1Q13 |

2Q13 |

3Q13 |

4Q13 |

1Q14 |

2Q14 |

3Q14 |

4Q14 |

1Q15 |

2Q15 |

|

New Model |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Gross Sales |

- |

- |

- |

- |

13.6 |

57.0 |

59.7 |

84.5 |

94.3 |

116.3 |

75.2 |

125.6 |

232.6 |

268,5 |

|

Dissolutions |

- |

- |

- |

- |

- |

(2.1) |

(7.4) |

(6.3) |

(34.2) |

(25.1) |

(31.6) |

(18.0) |

(12.6) |

(15,7) |

|

Net Sales |

- |

- |

- |

- |

13.6 |

54.9 |

52.3 |

78.2 |

60.2 |

91.2 |

43.5 |

107.6 |

220.0 |

252,8 |

|

Legacy

Projects |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Gross Sales |

249.1 |

344.9 |

293.8 |

287.9 |

225.6 |

270.7 |

223.9 |

154.2 |

150.6 |

183.0 |

107.1 |

67.3 |

67.3 |

75,2 |

|

Dissolutions |

(339.6) |

(329.1) |

(263.7) |

(317.6) |

(232.5) |

(155.7) |

(126.0) |

(68.8) |

(159.0) |

(92.5) |

(114.7) |

(48.3) |

(43.7) |

(38,1) |

|

Net Sales |

(90.4) |

15.7 |

30.0 |

(29.7) |

(6.9) |

115.0 |

97.9 |

85.4 |

(8.4) |

90.6 |

(7.6) |

19.0 |

23.5 |

37,1 |

|

Total |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Dissolutions

(Units) |

3.157 |

2.984 |

2.202 |

2.509 |

1.700 |

1.172 |

924 |

491 |

1.270 |

820 |

948 |

428 |

367 |

373 |

|

Gross Sales |

249.1 |

344.9 |

293.8 |

287.9 |

239.3 |

327.7 |

283.6 |

238.7 |

244.9 |

299.3 |

182.2 |

192.9 |

299.9 |

343,7 |

|

Dissolutions |

(339.6) |

(329.1) |

(263.7) |

(317.6) |

(232.5) |

(157.8) |

(133.5) |

(75.1) |

(193.2) |

(117.6) |

(146.3) |

(66.3) |

(56.3) |

(53,8) |

|

Net Sales |

(90.4) |

15.7 |

30.0 |

(29.7) |

6.8 |

169.8 |

150.1 |

163.6 |

51.8 |

181.7 |

35.9 |

126.6 |

243.5 |

289,9 |

|

Total (R$) |

(90.4) |

15.7 |

30.0 |

(29.7) |

6.8 |

169.8 |

150.1 |

163.6 |

51.8 |

181.7 |

35.9 |

126.6 |

243.5 |

289,9 |

|

MCMV |

(95.7) |

21.5 |

8.0 |

(3.6) |

36.2 |

142.6 |

119.2 |

122.4 |

57.2 |

151.4 |

39.0 |

116.7 |

217.7 |

260,0 |

|

Out of MCMV |

6.3 |

(5.7) |

22.1 |

(26.0) |

(29.4) |

29.2 |

30.9 |

41.2 |

(5.4) |

30.3 |

(3.1) |

9.9 |

25.8 |

29,9 |

Tenda remains focused

on the completion and delivery of legacy projects and is dissolving contracts

with ineligible clients, so as to sell the units to new qualified customers.

Tenda had 373 units

cancelled and returned to inventory in the second quarter, and 167 units which

were already in inventory were resold to qualified customers during the same

period. The sale and transfer process plays an important role in the New Tenda

Business Model. It is expected that within a period of up to 90 days, the

effective sale and transfer process will be complete.

Tenda

Segment Transfers

In the 2Q15, 2,019

units were transferred to financial institutions, representing R$254.0 million

in net pre-sales.

Table 24. Tenda Segment

– PSV Transferred – Tenda (R$000)

|

|

1Q13 |

2Q13 |

3Q13 |

4Q13 |

1Q14 |

2Q14 |

3Q14 |

4Q14 |

1Q15 |

2Q15 |

|

New Model |

- |

26,609 |

52,466 |

42,921 |

49,776 |

69,563 |

59,736 |

67,621 |

114,939 |

200,902 |

|

Legacy Projects |

274,358 |

249,699

|

230,613 |

145,038 |

139,721 |

154,155 |

100,361 |

74,773 |

59,110 |

53,112 |

|

PSV

transferred1 |

274,358 |

276,308

|

283,079 |

187,959 |

189,497 |

223,717 |

160,097 |

142,393 |

174,049 |

254,014 |

1) PSV transferred refers to the conclusion of the

transfer operation. 2) PSV = Potential sales volume of the units.

Tenda

Segment Delivered Projects

During 2Q15, Tenda

delivered 5 projects/phases and 1,240 units, reaching a PSV of R$177.2 million,

ending 6M15 with 2,927 units delivered and a PSV of R$ 393.5 million. It is

worth noting that there are only two remaining construction sites from Tenda’s

legacy projects, with 640 remaining units to be delivered in the next

months.

19

Inventory

The market value of

Tenda inventory was R$738.4 million at the end of the 2Q15, down 8.1% when

compared to R$803.5 million at the end of 4Q14. Inventory related to the

remaining units for the Tenda segment totaled R$272.9 million or 37.0% of the

total, down 12.5% versus 1Q15 and 35.3% as compared to 2Q14. During the

quarter,

inventory comprising units within the Minha Casa Minha Vida program totaled

R$596.5 million, or 80.8% of total inventory, while units outside the program

totaled R$141.8 million, a decrease of 18.8% q-o-q and 30.0%

y-o-y.

Table 25. Tenda Segment

– Inventory at Market Value (R$000) – by Region

|

|

Inventories FP 1Q15 |

Launches |

Dissolutions |

Pre-Sales |

Price Adjustment + Others |

Inventories FP 2Q15 |

% Q/Q |

|

São Paulo |

238,898 |

26,487 |

10,174 |

(104,321) |

7,047 |

178,284 |

-25.4% |

|

Rio Grande do

Sul |

19,805 |

46,400 |

6,814 |

(29,474) |

(144) |

43,401 |

119.1% |

|

Rio de Janeiro |

201,420 |

40,292 |

9,371 |

(81,920) |

(5,431) |

163,732 |

-18.7% |

|

Bahia |

129,260 |

69,660 |

4,297 |

(56,410) |

2,699 |

149,507 |

15.7% |

|

Pernambuco |

52,603 |

46,527 |

1,962 |

(23,446) |

(3,579) |

74,068 |

40.8% |

|

Minas Gerais |

94,900 |

- |

12,973 |

(38,335) |

(4,820) |

64,718 |

-31.8% |

|

Others |

66,609 |

- |

8,171 |

(9,802) |

(331) |

64,648 |

-2.9% |

|

Total Tenda |

803,495

|

229,366 |

53,763 |

(343,709) |

(4,557) |

738,358

|

-8.1% |

|

MCMV |

628,909 |

229,366 |

26,221 |

(286,255) |

(1,709) |

596,533 |

-5.1% |

|

Out of MCMV |

174,586 |

- |

27,542 |

(57,454) |

(2,848) |

141,825 |

-18.8% |

¹ The quarter adjustments reflect updates related to

project scope, expected launch date and inflationary adjustments to landbank

during the period.

Table 26. Tenda Segment

– Inventory at Market Value (R$000) – Construction Status

|

|

Not Initiated |

Up to 30%

built |

30% to 70% built |

More than 70% built |

Finished Units¹ |

Total 2Q15 |

|

New Model -

MCMV |

158,791 |

192,052 |

84,680 |

27,961 |

2,020 |

465,505 |

|

Legacy – MCMV |

- |

- |

58,751 |

134 |

72,143 |

131,027 |

|

Legacy – Out of

MCMV |

- |

- |

- |

7,397 |

134,428 |

141,825 |

|

Total Tenda |

158,791 |

192,052 |

143,431 |

35,492 |

208,591 |

738,358 |

1) Inventory at market

value includes projects in partnership. This indicator is not comparable to the

accounting inventory, due to the implementation of new accounting practices on

behalf of CPC’s 18, 19 and 36.

Tenda Segment

Landbank

The Tenda segment land

bank, with a PSV of approximately R$4.0 billion, is comprised of 110 different

projects/phases, of which 18% are located in São Paulo, 12% in Rio Grande do

Sul, 29% in Rio de Janeiro, 5% in Minas Gerais, 30% in Bahia, and 6% in

Pernambuco. In total these amount to more than 28,000 units.

Table 27. Tenda Segment – Landbank (R$000)

|

|

PSV

(%

Tenda) |

% Swap

Total |

% Swap Units |

% Swap Financial |

Potential Units

(% Tenda) |

Potential Units

(100%) |

|

São Paulo |

714,679 |

0.0% |

0.0% |

0.0% |

4,612 |

4,612 |

|

Rio Grande do Sul |

471,559 |

16.3% |

0.0% |

16.3% |

3,340 |

3,340 |

|

Rio de Janeiro |

1,176,586 |

17.4% |

17.4% |

0.0% |

8,105 |

8,223 |

|

Bahia |

1,199,945 |

11.5% |

11.5% |

0.0% |

9,499 |

9,560 |

|

Pernambuco |

242,818 |

15.5% |

15.5% |

0.0% |

1,863 |

1,888 |

|

Minas Gerais |

191,035 |

56.4% |

56.4% |

0.0% |

1,190 |

1,272 |

|

Total |

3,996,623 |

15.2% |

12.4% |

2.7% |

28,609 |

28,895 |

20

Table 28. Tenda Segment – Changes in the Landbank (1Q15 x

2Q15 - R$000)

|

|

Initial

Landbank |

Land

Acquisition |

Launches |

Adjustments |

Final

Landbank |

|

São Paulo |

663,898 |

80,959 |

26,487

|

(3,690) |

714,679 |

|

Rio Grande do

Sul |

518,399 |

- |

46,400

|

(440) |

471,559 |

|

Rio de Janeiro |

1,136,324 |

81,337 |

40,292 |

(782) |

1,176,586 |

|

Bahia |

1,278,855 |

- |

69,660 |

(9,250) |

1,199,945 |

|

Pernambuco |

285,985 |

- |

46,527 |

3,360 |

242,818 |

|

Minas Gerais |

191,035 |

- |

- |

- |

191,035 |

|

Total |

4,074,495 |

162,296 |

229,366 |

(10,802) |

3,996,623 |

In 2Q15, the Company

acquired 4 new land plots with potential PSV of R$162.3 million, representing an

acquisition cost of R$20.2 million. The acquisition was financed by 54% cash and

46% swap agreements.

New Model Update and

Turnaround

During 2015, Tenda

launched projects under its New Business Model, which is based on three pillars:

operational efficiency, risk management, and capital discipline.

Currently, the Company

continues to operate in six macro regions: São Paulo, Rio de Janeiro, Belo

Horizonte, Porto Alegre, Salvador and Recife, with a total of 33 projects and a

launched PSV of R$1,394.9 million to date. Below is a brief description of the

performance of these projects, except for projects launched at the end of

2Q15.

It is worth noting that

the Tenda segment has delivered 11 projects, totaling 3,539 units and R$467.5

million in PSV, all of them attaining the performance and profitability drivers

established for the New Model.

Table 29. Tenda – New

Model Monitoring 2013, 2014 and 2015

|

|

Novo Horizonte |

Vila Cantuária |

Itaim Paulista |

Verde Vida F1 |

Jaraguá |

Viva Mais |

Campo Limpo |

|

Launch |

mar/13 |

mar/13 |

may/13 |

jul/13 |

aug/13 |

nov/13 |

dec/13 |

|

State |

SP |

BA |

SP |

BA |

SP |

RJ |

SP |

|

Units |

580 |

440 |

240 |

339 |

260 |

300 |

300 |

|

Total PSV

(R$000) |

67.8 |

45.9 |

33.1 |

37.9 |

40.9 |

40.4 |

48.0 |

|

Sales |

580 |

436 |

240 |

334 |

260 |

290 |

299 |

|

% Sales |

100% |

99% |

100% |

99% |

100% |

97% |

100% |

|

SoS Avg (Month) |

14% |

6% |

8% |

5% |

12% |

6% |

10% |

|

Transferred |

580 |

435 |

240 |

321 |

260 |

206 |

298 |

|

% Transferred

(Sales) |

100% |

99% |

100% |

95% |

100% |

69% |

99% |

|

Work Progress |

100% |

100% |

100% |

100% |

100% |

100% |

100% |

21

|

|

Verde Vida F2 |

Pq. Rio

Maravilha |

Candeias |

Pq das Flores |

Palácio Imperial |

Vila Florida |

Rio da

Prata |

Recanto Abrantes |

Monte Alegre |

Pq. Santo

André |

Res. das

Palmeiras |

Terra

Brasilis |

Vila

Atlântica |

Reserva das

Árvores |

|

Launch |

fev/14 |

mar/14 |

mar/14 |

apr/14 |

may/14 |

mai/14 |

aug/14 |

sep/14 |

oct/14 |

nov/14 |

dec/14 |

dec/14 |

dec/14 |

dez/14 |

|

State |

BA |

RJ |

PE |

SP |

RJ |

MG |

RJ |

BA |

SP |

SP |

SP |

BA |

BA |

RJ

|

|

Units |

340 |

440 |

432 |

100 |

259 |

432 |

312 |

340 |

200 |

160 |

260 |

300 |

240 |

500 |

|

Total

PSV (R$ 000) |

42.4 |

63.8 |

58.8 |

16.4 |

38.6 |

60.4 |

49.6 |

41.7 |

31.0 |

28.8 |

41.6 |

36.8 |

30.6 |

72.8 |

|

Sales |

335 |

412 |

417 |

96 |

140 |

336 |

252 |

295 |

193 |

150 |

250 |

153 |

182 |

229 |

|

%

Sales |

99% |

94% |

97% |

96% |

54% |

78% |

81% |

87% |

97% |

94% |

96% |

51% |

76% |

46% |

|

SoS

Avg (Month) |

5% |

6% |

7% |

9% |

4% |

6% |

7% |

10% |

13% |

12% |

15% |

8% |

13% |

8% |

|

Transferred |

315 |

317 |

322 |

98 |

45 |

266 |

137 |

197 |

173 |

127 |

219 |

128 |

81 |

29 |

|

%

Transferred (Sales) |

93% |

72% |

75% |

98% |

17% |

62% |

44% |

58% |

87% |

79% |

84% |

43% |

34% |

6% |

|

Work

Progress |

100% |

100% |

68% |

100% |

15% |

28% |

88% |

76% |

100% |

81% |