Report of Foreign Issuer (6-k)

April 30 2015 - 6:20AM

Edgar (US Regulatory)

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 6-K

REPORT OF FOREIGN ISSUER

PURSUANT TO RULE 13a-16 OR 15d-16 OF THE

SECURITIES EXCHANGE ACT OF 1934

For the month of April, 2015

(Commission File No. 001-33356),

Gafisa S.A.

(Translation of Registrant's name into English)

Av. Nações Unidas No. 8501, 19th floor

São Paulo, SP, 05425-070

Federative Republic of Brazil

(Address of principal executive office)

Indicate by check mark whether the registrant files or will file

annual reports under cover Form 20-F or Form 40-F.

Form 20-F ___X___ Form 40-F ______

Indicate by check mark if the registrant is submitting

the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(1)

Yes ______ No ___X___

Indicate by check mark if the registrant is submitting

the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(7):

Yes ______ No ___X___

Indicate by check mark whether by furnishing the information contained in this Form,

the Registrant is also thereby furnishing the information to the Commission pursuant

to Rule 12g3-2(b) under the Securities Exchange Act of 1934:

Yes ______ No ___X___

If “Yes” is marked, indicate below the file number assigned

to the registrant in connection with Rule 12g3-2(b): N/A

|

GAFISA S.A.

CNPJ/MF No. 01.545.826/0001-07

NIRE 35.300.147.952

Publicly-Held Company |

CONSTRUTORA TENDA S.A.

CNPJ/MF No. 71.476.527/0001-75

NIRE 35.300.348.206

Publicly-Held Company |

MATERIAL FACT

GAFISA S.A. (Bovespa, GFSA3; NYSE, GFA) (“Gafisa”) and CONSTRUTORA TENDA S.A. (“Tenda”, and together with Gafisa, “Companies”) hereby inform shareholders and the market that, in accordance with the Material Fact released on February 7, 2014, studies surrounding the potential separation of the Gafisa and Tenda business units are ongoing, with the aim of achieving the conditions deemed necessary for their separation into two independent publicly traded companies.

Since the process commenced in February 2014, a number of initiatives have been undertaken in order to separate the two business units. These have taken the form of operational changes and modifications to capital structures, including the following highlights to the already finalized processes: (i) separation of administrative structures, with implementation of required changes to processes and systems, (ii) determination of policies and corporate governance practices, (iii) preparation of Tenda for the trading of its shares in the market, and (iv) performance of due diligence and studies of the various impacts the separation could have on operational, organizational, financial and market related factors for the Companies.

The process of determining appropriate capital structures is ongoing, and the Companies are working with financial institutions in order to achieve the conditions deemed necessary for the required capital structures, taking into account the business cycles of each of the Companies. These discussions are ongoing and have taken longer than had been expected at the outset. As a result of this delay, and considering the necessity of this issue to the separation process, it is not yet possible to determine when the potential separation will be concluded, with the possibility that it could extend into 2016.

Simultaneously, the Administrations of the Companies have been contacted by groups interested in evaluating the potential acquisition of equity interests in Gafisa and Tenda, either together or separately. At this time, no proposals are in force or any contracts have been entered into by the Companies, with the exception of confidentiality agreements following the request for information by parties involved in such studies. The Administrations, in accordance with its fiduciary responsibilities, will evaluate any proposals that could result in the creation of value for the Companies, and will communicate to shareholders and the market any material developments in these studies through the presentation of any kind of proposal.

These discussions have no impact on the work related to the potential separation of Gafisa and Tenda, the continuity of the Company’s business plans and current initiatives for creating value already in course, which seek to maximize shareholder returns while improving financial performance.

The Companies are continuously evaluating new opportunities to further develop their businesses and assets, with the objective of identifying alternatives that could generate greater value for Gafisa’s shareholders in the long-term, and will evaluate any potential opportunities that may arise with the same level of diligence.

São Paulo, April 29, 2015.

|

GAFISA S.A.

André Bergstein

Investor Relations Officer

|

CONSTRUTORA TENDA S.A.

Felipe David Cohen

Investor Relations Officer

|

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

Date: April 29, 2015

|

Gafisa S.A. |

|

| |

|

By: |

|

| |

Name: Sandro Gamba

Title: Chief Executive Officer |

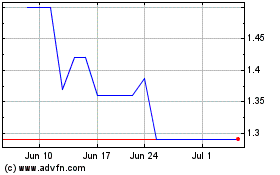

Gafisa (PK) (USOTC:GFASY)

Historical Stock Chart

From Mar 2024 to Apr 2024

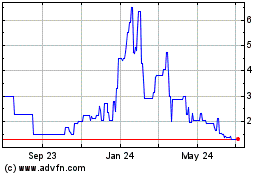

Gafisa (PK) (USOTC:GFASY)

Historical Stock Chart

From Apr 2023 to Apr 2024