Report of Foreign Issuer (6-k)

January 22 2015 - 4:40PM

Edgar (US Regulatory)

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 6-K

REPORT OF FOREIGN ISSUER

PURSUANT TO RULE 13a-16 OR 15d-16 OF THE

SECURITIES EXCHANGE ACT OF 1934

For the month of January, 2015

(Commission File No. 001-33356),

Gafisa S.A.

(Translation of Registrant's name into English)

Av. Nações Unidas No. 8501, 19th floor

São Paulo, SP, 05425-070

Federative Republic of Brazil

(Address of principal executive office)

Indicate by check mark whether the registrant files or will file

annual reports under cover Form 20-F or Form 40-F.

Form 20-F ___X___ Form 40-F ______

Indicate by check mark if the registrant is submitting

the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(1)

Yes ______ No ___X___

Indicate by check mark if the registrant is submitting

the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(7):

Yes ______ No ___X___

Indicate by check mark whether by furnishing the information contained in this Form,

the Registrant is also thereby furnishing the information to the Commission pursuant

to Rule 12g3-2(b) under the Securities Exchange Act of 1934:

Yes ______ No ___X___

If “Yes” is marked, indicate below the file number assigned

to the registrant in connection with Rule 12g3-2(b): N/A

PREVIEW OF OPERATIONAL RESULTS 4Q14

Consolidated launches totaled R$241.5 million

and net sales reached R$303.9 million in 4Q14

Full year 2014 launches totaled R$1,636 million,

with net sales of R$1,207 million

FOR IMMEDIATE RELEASE - São Paulo, January 22, 2015 – Gafisa S.A. (Bovespa: GFSA3; NYSE: GFA), one of Brazil’s leading homebuilders with a focus on the residential market, today announced operational results for the fourth quarter ending December 31st, 2014.

Consolidated Launches

Fourth-quarter launches totaled R$241.5 million, a 69% decrease compared to 4Q13. The volume of projects launched in full year 2014 totaled R$1.6 billion, a 14.9% increase compared to the prior year.

In the quarter, 6 projects/phases were launched in the states of São Paulo, Rio de Janeiro and Bahia. Tenda accounted for 100% of launches in the period.

Table 1. Gafisa Group Launches (R$ thousand)

|

Launches |

4Q14 |

3Q14 |

Q/Q(%) |

4Q13 |

Y/Y(%) |

12M14 |

12M13 |

Y/Y(%) |

|

Gafisa Segment |

- |

419,134 |

-100% |

679,154 |

-100% |

1,023,012 |

1,085,341 |

-6% |

|

Tenda Segment |

241,549 |

91,294 |

165% |

88,379 |

173% |

613,299 |

338,776 |

81% |

|

Total |

241,549 |

510,428 |

-53% |

767,534 |

-69% |

1,636,311 |

1,424,117 |

15% |

2

Consolidated Pre-Sales

Fourth-quarter 2014 consolidated pre-sales totaled R$303.9 million, an increase of 31.7% compared to 3Q14. In the quarter, sales from launches represented 49.5% of the total, while sales from inventory comprised the remaining 50.5%.

Full year 2014 consolidated pre-sales totaled R$1,207 million, a decrease of 17% compared with the previous year. Sales from launches accounted for 43% of the total.

Table 2. Gafisa Group Pre-Sales (R$ thousand)

|

Pre-Sales |

4Q14 |

3Q14 |

Q/Q (%) |

4Q13 |

Y/Y (%) |

12M14 |

12M13 |

Y/Y (%) |

|

Gafisa Segment |

177,294 |

194,892 |

-9% |

454,457 |

-61% |

811,032 |

961,200 |

-16% |

|

Tenda Segment |

126,594 |

35,892 |

253% |

163,626 |

-23% |

395,981 |

490,403 |

-19% |

|

Total |

303,888 |

230,784 |

32% |

618,083 |

-51% |

1,207,013 |

1,451,603 |

-17% |

Consolidates Sales over Supply (SoS)

Consolidated sales over supply reached 8.9% in the 4Q14, up from 6.7% in the previous quarter. The consolidated speed of sales of fourth quarter launches reached 11.8%. SoS for 2014 launches was 31.7%.

Table 3. Gafisa Group Sales over Supply (SoS)

|

SOS |

4Q14 |

3Q14 |

Q/Q (%) |

4Q13 |

Y/Y (%) |

12M14 |

12M13 |

Y/Y (%) |

|

Gafisa Segment |

7.2% |

7.2% |

0 bps |

17.8% |

-1060 bps |

26.1% |

31.4% |

-530 bps |

|

Tenda Segment |

13.3% |

4.6% |

850 bps |

20.9% |

-760 bps |

32.3% |

44.2% |

-1190 bps |

|

Total |

8.9% |

6.7% |

220 bps |

18.5% |

-960 bps |

27.9% |

34.8% |

-690 bps |

Delivered Projects

During the fourth quarter, the Company delivered 15 projects/phases encompassing 3,036 units (1,412 Gafisa units and 1,624 units from the Tenda segment), totaling R$726.2 million. The delivery date is based on the “Delivery Meeting” that takes place with customers, and not physical completion, which is prior to the Delivery Meeting.

For the year, 53 projects/phases and 10,070 units were delivered, amounting to R$2.3 billion.

3

Inventory (Properties for Sale)

In the fourth quarter, consolidated inventory at market value decreased R$85.2 million to R$3.1 billion. Of 4Q14 sales, approximately 50.5% were from inventory, comprising R$119.5 million from Gafisa and R$33.9 million from Tenda.

The market value of Gafisa inventory, which represents 73.5% of total inventory, was R$2.3 billion at the end of 4Q14, compared to R$2.5 billion at the end of 3Q14. Tenda’s inventory was R$828.7 million at the end of 4Q14, compared to R$712.4 million at the end of the 3Q14.

Table 4. Inventory at Market Value 4Q14 x 3Q14 (R$)

|

|

3Q14 |

Launches |

Dissolutions |

Gross Sales |

Price Adjustments |

4Q14 |

Q/Q (%) |

|

Gafisa Segment |

2,496,761 |

- |

84,876 |

(262,170) |

(24,271) |

2,295,197 |

-8.1% |

|

Tenda Segment |

712,358 |

241,549 |

66,285 |

(192,879) |

1,353 |

828,665 |

16.3% |

|

Total |

3,209,119 |

241,549 |

151,161 |

(455,049) |

(22,918) |

3,123,862 |

-2.7% |

GAFISA SEGMENT

|

Focuses on residential developments within the upper, upper-middle, and middle-income segments, with unit prices exceeding R$500,000. |

Gafisa Launches

The Gafisa segment did not launch any projects in the fourth quarter. As previously anticipated with the revision of the full year guidance, while projects were approved and met necessary launch conditions, the Company determined that prevailing market conditions did not meet the parameters required for product placement. As such, launches were postponed to 2015, when we expect a more positive scenario, thereby allowing for more profitable projects.

Accordingly, full year 2014 launches for the Gafisa segment reached R$1,023 million, which is slightly below the guidance range of R$1,100-R$1,200 million. This result includes the impact of the cancellation of a project launched in 1Q14.

Gafisa Pre-Sales

Gafisa segment 4Q14 gross pre-sales totaled R$262.2 million. Dissolutions reached R$84.9 million and net pre-sales totaled R$177.3 million. During the year, net sales totaled R$811.0 million.

Due to the absence of launches in the quarter, the Company focused its efforts on the sale of existing units. Approximately 54.2% of net sales for the period related to projects launched before 2012, resulting in reduction in the average age of the segment’s inventory.

Out of the 852 Gafisa segment units cancelled and returned to inventory during the year, 68.2% were resold in the same period.

4

Gafisa Delivered Projects

The strong volume of deliveries in this last quarter deserves highlight. Gafisa delivered 8 projects/phases in 4Q14, representing 1,412 units and R$520.0 million in PSV. This was the quarter with the largest delivery volume in terms of sales value of the year. In the full year 2014, 23 projects/ phases were delivered, representing 3,806 units and R$1.6 billion in PSV.

TENDA SEGMENT

|

Focuses on affordable residential developments, classified within the Range II of Minha Casa, Minha Vida Program. |

Tenda Launches

Fourth-quarter launches totaled R$241.5 million and included 6 projects/phases in the states of São Paulo, Rio de Janeiro and Bahia. The brand accounted for 100% of 4Q14 consolidated launches. In the full year 2014, Tenda Segment reached R$ 613.3 million in launches, which is within the guidance range announced in the beginning of the year.

Tenda Pre-Sales

During 4Q14, gross sales reached R$192.9 million, while net pre-sales totaled R$126.6 million. For the FY14, net sales totaled R$396.0 million.

Sales from units launched during 4Q14 represented 22.4% of total sales, while in the full year 2014, sales from launches accounted for 44.7% of total sales. In 4Q14, sales velocity (sales over supply) was 13.3%.

Table 5. SoS Gross Sales (Ex-Dissolutions)

|

|

1Q14 |

2Q14 |

3Q14 |

4Q14 |

|

New Model |

29.8% |

32.2% |

20.3% |

22.0% |

|

Legacy |

30.9% |

35.8% |

28.3% |

17.5% |

|

Total |

30.5% |

34.3% |

24.4% |

20.2% |

Table 6. SoS Net Sales

|

|

1Q14 |

2Q14 |

3Q14 |

4Q14 |

|

New Model |

18.8% |

25.3% |

11.8% |

18.8% |

|

Legacy |

-1.6% |

17.7% |

-2.0% |

5.0% |

|

Total |

6.4% |

20.8% |

4.8% |

13.3% |

Tenda remains focused on the completion and delivery of legacy projects, and is dissolving contracts with ineligible clients, so as to sell the units to qualified customers. Cancellations presented a decrease of 54.7% versus 3Q14 and of 11.6% compared with 4Q13.

As expected, the change in accounting policy for Tenda’s new sales, which was undertaken in August 2014, allowed for a reduction in the volume of dissolutions in the period. Nearly 72.8% of cancellations relate to legacy projects.

Of the 3,337 Tenda units cancelled in the year and returned to inventory, 63.6% were resold to qualified customers during the same period. Similarly, 80.1% of dissolutions related to Tenda’s New Model were also resold during 2014.

5

Table 7. Cancelled PSV Tenda Segment (R$ thousand and % over Gross Sales per Model)

|

|

1T14 |

% GS |

2T14 |

% GS |

3T14 |

% GS |

4T14 |

% GS |

|

New Model |

34,715 |

36.8% |

24,977 |

21.5% |

31,640 |

42.1% |

18,003 |

14.3% |

|

Legacy |

158,450 |

105.2% |

92,637 |

50.6% |

114,697 |

107.1% |

48,281 |

71.7% |

|

Total |

193,164 |

78.9% |

117,614 |

39.3% |

146,337 |

80.3% |

66,285 |

34.4% |

All new projects under the Tenda brand are being developed in phases, in which all pre-sales are contingent on the ability to pass mortgages onto financial institutions. During 4Q14, 1,066 units, representing R$142.4 million in net pre-sales, were transferred to financial institutions. In the FY2014, 5,522 units were transferred, reaching R$715.7 million.

Tenda Delivered Projects

In 4Q14, Tenda delivered 7 projects/phases and 1,624 units, representing R$206.2 million in PSV, being 560 units and R$81.2 million in PSV relating to the New Model. In the full year 2014, 30 projects/phases were delivered representing 6,264 units, totaling R$650.4 million in PSV, with the New Model accounting for 1,700 units and R$213.8 million in PSV.

About Gafisa

Gafisa is a leading diversified national homebuilder serving all demographic segments of the Brazilian market. Established 60 years ago, we have completed and sold more than 1,100 developments and built more than 12 million square meters of housing, more than any other residential development company in Brazil. Recognized as one of the foremost professionally managed homebuilders, "Gafisa" is also one of the most respected and best-known brands in the real estate market, recognized among potential homebuyers, brokers, lenders, landowners, competitors, and investors for its quality, consistency, and professionalism. Our pre-eminent brands include Tenda, serving the affordable/entry-level housing segment, Gafisa and a stake in Alphaville, which offer a variety of residential options to the mid- to higher-income segments. Gafisa S.A. is traded on the Novo Mercado of the BM&FBOVESPA (BOVESPA:GFSA3) and on the New York Stock Exchange (NYSE:GFA).

This release contains forward-looking statements relating to the prospects of the business, estimates for operating and financial results, and those related to growth prospects of Gafisa. These are merely projections and, as such, are based exclusively on the expectations of management concerning the future of the business and its continued access to capital to fund the Company’s business plan. Such forward-looking statements depend, substantially, on changes in market conditions, government regulations, competitive pressures, the performance of the Brazilian economy and the industry, among other factors; therefore, they are subject to change without prior notice.

6

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

Date: January 22, 2015

|

Gafisa S.A. |

|

| |

|

By: |

|

| |

Name: Sandro Gamba

Title: Chief Executive Officer |

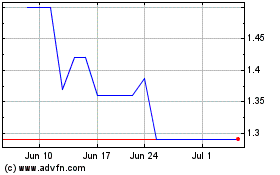

Gafisa (PK) (USOTC:GFASY)

Historical Stock Chart

From Mar 2024 to Apr 2024

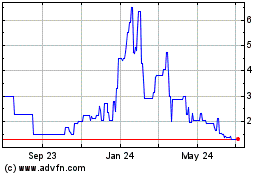

Gafisa (PK) (USOTC:GFASY)

Historical Stock Chart

From Apr 2023 to Apr 2024