Current Report Filing (8-k)

February 24 2017 - 4:56PM

Edgar (US Regulatory)

UNITED STATES

SECURITIES

AND EXCHANGE COMMISSION

WASHINGTON,

D.C. 20549

FORM 8-K

CURRENT

REPORT

Pursuant to Section 13 or 15(d) of the

Securities Exchange Act of 1934

Date of report

(Date of earliest event reported):

February 21, 2017

GANNETT CO.,

INC.

(Exact name

of registrant as specified in charter)

|

Delaware

|

1-36874

|

47-2390983

|

(State or other jurisdiction

of incorporation)

|

(Commission

File Number)

|

(IRS Employer

Identification No.)

|

7950 Jones

Branch Drive, McLean, Virginia, 22107-0910

(Address of

principal executive offices, including zip code)

(703) 854-6000

(Registrant’s

telephone number, including area code)

N/A

(Former name

or former address, if changed since last report)

Check the appropriate box below

if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following

provisions:

|

☐

|

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

|

|

|

|

|

☐

|

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

|

|

|

|

|

☐

|

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

|

|

|

|

|

☐

|

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

|

|

Item 5.02

|

Departure of Directors or Certain Officers; Election of Directors; Appointment of Certain Officers; Compensatory Arrangements of Certain Officers.

|

On February

21, 2017, the Executive Compensation Committee of the Board of Directors (the “Committee”) of Gannett Co., Inc. (the

“Company”) approved the 2017 executive annual incentive plan (the “AIP”) and 2017 stretch goals (the “Stretch

Goals”) pursuant to which the Committee will determine the amount of cash incentive compensation payable for 2017 to each

of our executive officers under the Company’s 2015 Omnibus Incentive Compensation Plan (the “Omnibus Plan”).

2017 Executive Annual Incentive

Plan

The AIP establishes

the parameters according to which the Committee will determine the amount of annual cash incentive compensation payable to each

executive officer for 2017 pursuant to the Omnibus Plan. In the case of our CEO, the AIP provides that the bonus amount will be

determined by the Committee subject to ratification by the independent directors serving on our Board. Initially, the AIP fixes

an individual annual cash bonus target for each executive officer participating in the AIP, expressed as a percentage of the executive’s

eligible base salary. As further described below, the bonus amount payable to each executive will be based on the Company’s

performance relative to specified financial goals and the executive’s performance relative to specified individual and cultural

goals. Goals under the AIP will be independent of each other and structured such that executives may receive a portion of their

annual bonuses based upon achievement relative to one or more of the goals, even if required levels of performance are not met

for payments for other goals.

Company-Wide

Financial Goals

A portion of

the annual cash bonuses payable to our executive officers will be based on the extent to which the Company achieves the Company-wide

financial goals specified in the AIP. The financial goals are assigned an overall weight of 70% for the CEO and 60% for other executives.

The financial goals specified in the AIP are as follows:

|

|

·

|

2017 Adjusted EBITDA Budget

. Of the portion

of the bonus based on Company financial performance, 70% will be based on the Company’s achievement relative to an Adjusted

EBITDA Budget target. “Adjusted EBITDA Budget” is defined as the Company’s earnings before interest, taxes, depreciation

and amortization, excluding items approved by the Committee that are “one-time” in nature and affect the comparability

of the Company’s financial results. In addition, Adjusted EBITDA Budget will be calculated by fixing pension and medical

expenses at predetermined budgeted amounts and fixing the exchange rate for British pounds to U.S. dollars at a predetermined budgeted

rate. These further adjustments effectively will exclude from Adjusted EBITDA Budget significant positive or negative variances

in pension and medical expenses that may occur during the year, as well as significant variances in Newsquest’s EBITDA contributions

due to foreign exchange rate fluctuations.

|

|

|

·

|

2017 Digital Revenue

. Of the portion of the

bonus based on Company financial performance, 30% will be based on the Company’s achievement relative to a digital revenue

target. “Digital Revenue” is defined as digital advertising revenues plus revenues generated from sales of digital-only

subscriptions. Digital advertising revenues include revenues generated by (a) selling display and video advertising on desktop

and mobile platforms, (b) selling classifieds on third-party platforms, and (c) selling other digital products and services such

as search engine marketing and optimization, social and email advertising, directories, digital syndication, archives, and software

and web-presence products. Digital-only subscriptions generally include digital-only newspaper subscriptions on desktop, mobile

web or native apps. For these purposes, Newsquest’s contributions to digital revenue will be calculated using the predetermined

pounds-to-dollars exchange rate described above.

|

In determining

actual bonus amounts payable relative to the Company-wide financial goals, the Committee will evaluate threshold, target and maximum

levels of performance for each goal as follows:

|

|

·

|

Threshold: Achievement of 75% of target results in

a 50% payout.

|

|

|

·

|

Target: Achievement of target results in a 100% payout.

|

|

|

·

|

Maximum: Achievement of 120% of target results in

a 150% payout.

|

No bonus will be paid pursuant to either

goal if the threshold level of performance for that goal is not met, and no amounts will be payable over the maximum for either

goal. Amounts between threshold, target and maximum will be interpolated on a straight-line basis.

Individual

Performance and Cultural Goals

In

addition to the Company-wide financial goals, the Committee believes that strategic individual performance and cultural goals

relative to predetermined objectives should play a role in the cash bonus payable to each executive officer. Accordingly, the

Committee has determined that 15% of the overall cash bonus for the CEO and 25% of the overall cash bonus for each other

executive officer for 2017 will be based upon the Committee’s assessment the executive’s achievement of

individual performance goals. The individual performance goals will be specific to each executive based on his or her role

within the Company and particular areas of responsibility, and consist of non-financial goals that advance the

Company’s business strategy (such as expanding the Company’s footprint, optimizing the use of existing assets

and transitioning to digital). In addition, 15% of the overall cash bonus for the CEO and each other executive

officer will be based on the Committee’s assessment of the officer’s achievement of cultural goals. The cultural

goals also will be specific to each executive and relate to his or her contributions towards promoting the Company’s

cultural values (such as diversity and inclusiveness). The maximum amount payable in respect of the individual performance

goals and culture goals will be 150% of each executive’s target amount for such goals. The Committee will retain full

discretion in respect of all amounts awarded under this portion of the AIP. No executive officer is guaranteed an award and,

if performance is unsatisfactory, no bonus will be paid under the individual performance or cultural components of the

AIP.

2017 Stretch Goals

In addition

to the AIP, the Committee approved three Stretch Goals for 2017, pursuant to which our executive officers have an opportunity to

earn additional cash incentive compensation under the Omnibus Plan if, by the end of 2017, the Company achieves certain strategic

milestones related to our digital transformation. As with the AIP, achievement of each Stretch Goal will be evaluated independently

of the others. Executives will receive a payment equal to 8.33% of their annual base salaries if any one goal is met, a payment

equal to 16.66% of their annual base salaries if any two goals are met, and a payment equal to 25% of their annual base salaries

if all three goals are met.

SIGNATURES

Pursuant to

the requirements of the Securities Exchange Act of 1934, as amended, the registrant has duly caused this report to be signed on

its behalf by the undersigned hereunto duly authorized.

|

|

|

|

|

|

|

|

|

|

|

|

|

Gannett Co., Inc.

|

|

|

|

|

|

|

Date: February 24, 2017

|

|

|

|

By:

|

|

/s/ Barbara W. Wall

|

|

|

|

|

|

|

|

Barbara W. Wall

|

|

|

|

|

|

|

|

Senior Vice President and Chief Legal Officer

|

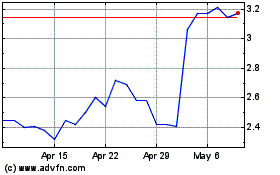

New Gannett (NYSE:GCI)

Historical Stock Chart

From Mar 2024 to Apr 2024

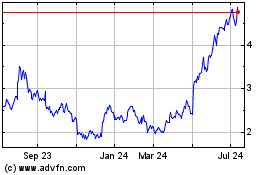

New Gannett (NYSE:GCI)

Historical Stock Chart

From Apr 2023 to Apr 2024