Gannett Co., Inc. (NYSE: GCI) ("Gannett" or the "Company") today

announced that, based on the advice of its proxy solicitor, it

believes the shares voted that are unaffiliated with Tribune

Publishing Company (NYSE: TPUB)("Tribune") or its Chairman Michael

Ferro were cast as follows at the Tribune annual meeting of

stockholders:

- Approximately 49% withheld their

support from the entire slate of director nominees;

- More than 50% withheld their support

from Mr. Ferro, Tribune’s Chief Executive Officer Justin Dearborn

and Director Eddy Hartenstein;

- Approximately 58% withheld their

support from the election of two other director nominees, David

Dibble and Philip Franklin;

- Five of eight director nominees

received less than 50% support; and

- Four of Tribune’s largest independent

stockholders withheld support from Tribune’s director

nominees.

Gannett noted that only three of the eight director nominees

standing for election, Messrs. Ferro, Dearborn and Franklin, were

in attendance at the annual meeting.

Gannett appreciates Tribune stockholders’ willingness to

withhold their votes to urge Tribune to negotiate in good faith

with Gannett regarding its $15.00 per share all-cash premium offer

to acquire Tribune. Due to Tribune’s plurality voting provision in

its corporate bylaws, only a single affirmative vote is necessary

for each Tribune nominee to be elected to the Tribune Board.

At the meeting held today, Michael Dickerson, Vice President of

Investor Relations & Real Estate at Gannett, addressed Tribune

stockholders with the following statement:

Good morning. My name is Michael Dickerson. I

am the Vice President of Investor Relations and Real Estate for

Gannett. Thank you for the opportunity to speak here today.

First and foremost, let me convey Gannett’s

respect for the outstanding journalism and service Tribune

employees provide to the communities they serve. Our admiration for

Tribune’s great work is what prompted Gannett’s interest in

acquiring Tribune and its 11 iconic daily publications.

We appreciate the support of many Tribune

shareholders for withholding their votes today, and thereby

expressing their desire for Tribune to constructively engage with

Gannett on our $15.00 all-cash premium offer. Despite our efforts

to engage in a customary transaction process, the Tribune Board has

regrettably taken a series of steps to prevent our proposal from

moving forward.

For the record, we never intended to engage

in a public fight for Tribune. Instead we anticipated having

constructive discussions with your Board. However, rather than

engaging with Gannett, the Tribune board has adopted an unproven

strategy, implemented various delay tactics and ultimately effected

a transaction that significantly diluted Tribune’s outstanding

shares.

Gannett leads the US publishing business in

circulation, operational expertise and innovation. While we believe

Gannett and Tribune both value the importance of preserving local,

independent investigative journalism, Gannett has a clearly defined

path forward. Through our national-to-local USA TODAY NETWORK

strategy, we are coupling ambitious editorial goals with the

technology and digital innovations needed to support that

journalism.

At the same time, Gannett is quickly

developing new products that respond to consumers' demands for

greater coverage in new and exciting ways. The foundation of these

efforts is built upon well-developed sales, distribution and

content management systems that would bring immediate value to

Tribune publications. Integrating Tribune publications on Presto,

our proprietary content management system that enables nation-wide

collaboration among our journalists and delivers increasingly

personalized content, is only one example of the synergies and

efficiencies that our proposed acquisition could achieve.

The opportunities and challenges of the

publishing industry’s digital transformation demand an immediate

response. Today, scale and efficiency are crucial to preserving the

profitability needed to invest in great journalism and content.

Gannett has the scale to succeed independently well into the

future. An acquisition of Tribune would better position Tribune’s

worthy publications to withstand the ongoing industry

challenges.

Can Tribune navigate these challenges alone?

We do not believe so. Gannett continues to have faith in the value

of all of Tribune’s assets as part of Gannett. Our $15.00 per share

offer would deliver superior and certain value for Tribune's owners

at a tumultuous time for the Company.

Again, we appreciate the support for our

proxy proposal. Thank you for your time today.

Gannett is reviewing whether to proceed with its acquisition

offer taking into account the results of the “withhold” vote at

Tribune’s 2016 Annual Meeting and the latest Tribune actions,

including its response to Gannett’s $15.00 per share offer.

Methuselah Advisors is acting as the exclusive financial advisor

and Skadden, Arps, Slate, Meagher & Flom LLP is serving as

legal counsel.

ABOUT GANNETT

Gannett Co., Inc. (NYSE: GCI) is a next-generation media company

committed to strengthening communities across the nation. Through

trusted, compelling content and unmatched local-to-national reach,

the company touches the lives of more than 100 million people

monthly. With more than 120 markets internationally, it is known

for Pulitzer Prize-winning newsrooms, powerhouse brands such as USA

TODAY and specialized media properties. To connect with us, visit

www.gannett.com.

FORWARD LOOKING STATEMENTS

Certain statements in this communication may be forward looking

in nature or constitute “forward-looking statements” as defined in

the Private Securities Litigation Reform Act of 1995, including

statements regarding the proposed acquisition of Tribune by Gannett

and the benefits of the proposed acquisition. Forward-looking

statements include all statements that are not historical facts and

can typically be identified by words such as “believe,” “expect,”

“estimate,” “predict,” “target,” “potential,” “likely,” “continue,”

“ongoing,” “could,” “should,” “intend,” “may,” “might,” “plan,”

“seek,” “anticipate,” “project” and similar expressions, as well as

variations or negatives of these words. Any such statements speak

only as of the date the statements were made and are not guarantees

of future performance. The matters discussed in these

forward-looking statements are subject to a number of risks,

trends, uncertainties and other factors that could cause actual

results and developments to differ materially from those projected,

anticipated or implied in the forward-looking statements. These

factors include, among other things, the ability of Gannett and

Tribune to agree to the terms of the proposed transaction and, in

the event a definitive transaction agreement is executed, the

ability of the parties to obtain any necessary stockholder and

regulatory approvals, to satisfy any other conditions to the

closing of the transaction and to consummate the proposed

transaction on a timely basis, as well as changes in business

strategies, economic conditions affecting the newspaper publishing

business and Gannett’s ability to successfully integrate Tribune’s

operations and employees with Gannett’s existing business.

Additional information regarding risks, trends, uncertainties and

other factors that may cause actual results to differ materially

from these forward-looking statements is available in Gannett’s

filings with the U.S. Securities and Exchange Commission, including

Gannett’s annual report on Form 10-K. Any forward-looking

statements should be evaluated in light of these important risk

factors. Gannett is not responsible for updating or revising any

forward-looking statements, whether as a result of new information,

future events or otherwise, except as required by law.

ADDITIONAL INFORMATION

This communication does not constitute an offer to buy or

solicitation of an offer to sell any securities. This communication

relates to a proposal that Gannett has made for a business

combination transaction with Tribune. In furtherance of this

proposal and subject to future developments, Gannett (and, if a

negotiated transaction is agreed, Tribune) may file one or more

proxy statements or other documents with the SEC. This

communication is not a substitute for any proxy statement or other

document Gannett and/or Tribune may file with the SEC in connection

with the proposed transaction.

INVESTORS AND SECURITY HOLDERS OF TRIBUNE ARE URGED TO READ

THE PROXY STATEMENTS OR OTHER DOCUMENTS FILED WITH THE SEC WITH

RESPECT TO THE PROPOSED TRANSACTION CAREFULLY IN THEIR ENTIRETY IF

AND WHEN THEY BECOME AVAILABLE AS THEY WILL CONTAIN IMPORTANT

INFORMATION ABOUT THE PROPOSED TRANSACTION. Any definitive

proxy statement with respect to the proposed transaction (if and

when available) will be mailed to stockholders of Tribune.

Investors and security holders will be able to obtain free copies

of these documents (if and when available) and other documents

filed with the SEC through the web site maintained by the SEC at

http://www.sec.gov.

This communication does not constitute a solicitation of a proxy

from any stockholder with respect to the proposed transaction.

However, Gannett and/or Tribune and their respective directors,

executive officers and other employees may be deemed to be

participants in the solicitation of proxies in respect of the

proposed transaction. You can find information about Gannett’s

directors and executive officers in Gannett’s definitive proxy

statement for its 2016 annual meeting of stockholders, which was

filed with the SEC on March 23, 2016, and Gannett’s annual report

on Form 10-K for the fiscal year ended December 27, 2015, which was

filed with the SEC on February 25, 2016. You can find information

about Tribune’s directors and executive officers in Tribune’s

definitive proxy statement for its 2016 annual meeting of

stockholders, which was filed with the SEC on April 19, 2016.

Additional information regarding the interests of such potential

participants will be included in one or more proxy statements or

other relevant documents filed with the SEC if and when they become

available. You may obtain free copies of these documents using the

sources indicated above.

View source

version on businesswire.com: http://www.businesswire.com/news/home/20160602006454/en/

FOR MEDIA INQUIRIES:Gannett Co., Inc.Amber Allman,

703-854-5358Vice President, Corporate

Communicationsaallman@gannett.comorJoele Frank, Wilkinson Brimmer

KatcherJoele Frank / Michael Freitag / Ed Trissel,

212-355-4449orFOR INVESTOR INQUIRIES:Michael Dickerson,

703-854-6185Vice President, Investor

Relationsmdickerson@gannett.comorInnisfree M&A IncorporatedArt

Crozier / Jennifer Shotwell / Larry Miller, 212-750-5833

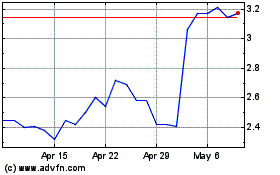

New Gannett (NYSE:GCI)

Historical Stock Chart

From Mar 2024 to Apr 2024

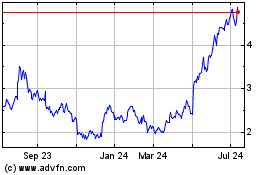

New Gannett (NYSE:GCI)

Historical Stock Chart

From Apr 2023 to Apr 2024