Gannett Co., Inc. (NYSE:GCI) ("Gannett" or the "Company") today

urged Tribune Publishing Company’s (NYSE:TPUB) ("Tribune")

stockholders to “WITHHOLD” their votes in connection with the

election of directors at the Tribune 2016 Annual Meeting of

Stockholders to be held on June 2, 2016. Gannett encourages Tribune

stockholders to deliver a mandate to the Tribune Board that it

should engage constructively with Gannett regarding its $15.00 per

share all-cash premium offer to acquire Tribune. Gannett issued the

following statement:

The Gannett $15.00 per share all-cash premium

offer would provide Tribune stockholders with superior and certain

value for their shares. Gannett continues to believe a strong

“WITHHOLD” vote by Tribune stockholders on Tribune’s nominees would

send a clear message that the Tribune Board should immediately

engage with Gannett in a constructive manner regarding its offer to

acquire Tribune.

Gannett noted that multiple Tribune

stockholders have publicly voiced their objections to the behavior

of Tribune’s Board. A major stockholder, Towle & Co., wrote to

Tribune’s Board: “…[S]tacking the Board and ownership in favor of

one particular view is not good governance. In fact, your brazen

efforts of late have disrupted our belief in fair play. We now

believe your primary interest is self-interest. You have fully

demonstrated a lack of concern for the majority of unaffiliated

shareholders whom we believe want a fair and reasonable transaction

with Gannett.”1

On May 23, 2016, Tribune announced a

transaction in which it issued 4.7 million shares of Tribune common

stock to a single investor and appointed this investor to the

Tribune Board. Since February 2016, the Tribune Board has approved

the issuance of common stock to two stockholders which has

increased the number of outstanding shares by approximately 37

percent. This includes the issuance of 5.2 million shares of

Tribune common stock to an entity controlled by Tribune Chairman

Michael Ferro at $8.50 per share. The Tribune Board did not seek

stockholder approval for either of these issuances. In addition,

since February 2016, two-thirds of the Tribune Board has been

reconstituted with directors who appear to be hand-picked by Mr.

Ferro.

Gannett will review whether to proceed with

its acquisition offer taking into account the results of the

“WITHHOLD” vote at Tribune’s 2016 Annual Meeting and the latest

Tribune actions, including its response to Gannett’s $15.00 per

share offer.

Gannett’s revised $15.00 all-cash offer represents a premium of

99% to the $7.52 closing price of Tribune’s common stock on April

22, 2016, the last trading day before Gannett publicly announced

its initial offer for Tribune.

Gannett urges Tribune stockholders to vote the GOLD proxy card

to “WITHHOLD” votes from the election of all eight Tribune

directors: Carol Crenshaw, Justin C. Dearborn, David E. Dibble,

Michael W. Ferro, Jr., Philip G. Franklin, Eddy W. Hartenstein,

Richard A. Reck and Donald Tang.

Stockholders who need assistance in voting their shares or who

have other questions, may contact Innisfree M&A Incorporated,

Gannett’s proxy solicitor, toll-free at (888) 750-5834.

Methuselah Advisors is acting as the exclusive financial advisor

and Skadden, Arps, Slate, Meagher & Flom LLP is serving as

legal counsel.

ABOUT GANNETT

Gannett Co., Inc. (NYSE:GCI) is a next-generation media company

committed to strengthening communities across the nation. Through

trusted, compelling content and unmatched local-to-national reach,

the company touches the lives of more than 100 million people

monthly. With more than 120 markets internationally, it is known

for Pulitzer Prize-winning newsrooms, powerhouse brands such as USA

TODAY and specialized media properties. To connect with us, visit

www.gannett.com.

FORWARD LOOKING STATEMENTS

Certain statements in this communication may be forward looking

in nature or constitute “forward-looking statements” as defined in

the Private Securities Litigation Reform Act of 1995, including

statements regarding the proposed acquisition of Tribune by Gannett

and the benefits of the proposed acquisition. Forward-looking

statements include all statements that are not historical facts and

can typically be identified by words such as “believe,” “expect,”

“estimate,” “predict,” “target,” “potential,” “likely,” “continue,”

“ongoing,” “could,” “should,” “intend,” “may,” “might,” “plan,”

“seek,” “anticipate,” “project” and similar expressions, as well as

variations or negatives of these words. Any such statements speak

only as of the date the statements were made and are not guarantees

of future performance. The matters discussed in these

forward-looking statements are subject to a number of risks,

trends, uncertainties and other factors that could cause actual

results and developments to differ materially from those projected,

anticipated or implied in the forward-looking statements. These

factors include, among other things, the ability of Gannett and

Tribune to agree to the terms of the proposed transaction and, in

the event a definitive transaction agreement is executed, the

ability of the parties to obtain any necessary stockholder and

regulatory approvals, to satisfy any other conditions to the

closing of the transaction and to consummate the proposed

transaction on a timely basis, as well as changes in business

strategies, economic conditions affecting the newspaper publishing

business and Gannett’s ability to successfully integrate Tribune’s

operations and employees with Gannett’s existing business.

Additional information regarding risks, trends, uncertainties and

other factors that may cause actual results to differ materially

from these forward-looking statements is available in Gannett’s

filings with the U.S. Securities and Exchange Commission, including

Gannett’s annual report on Form 10-K. Any forward-looking

statements should be evaluated in light of these important risk

factors. Gannett is not responsible for updating or revising any

forward-looking statements, whether as a result of new information,

future events or otherwise, except as required by law.

ADDITIONAL INFORMATION

This communication does not constitute an offer to buy or

solicitation of an offer to sell any securities. This communication

relates to a proposal that Gannett has made for a business

combination transaction with Tribune. In furtherance of this

proposal and subject to future developments, Gannett (and, if a

negotiated transaction is agreed, Tribune) may file one or more

proxy statements or other documents with the SEC. This

communication is not a substitute for any proxy statement or other

document Gannett and/or Tribune may file with the SEC in connection

with the proposed transaction.

INVESTORS AND SECURITY HOLDERS OF TRIBUNE ARE URGED TO READ

THE PROXY STATEMENTS OR OTHER DOCUMENTS FILED WITH THE SEC WITH

RESPECT TO THE PROPOSED TRANSACTION CAREFULLY IN THEIR ENTIRETY IF

AND WHEN THEY BECOME AVAILABLE AS THEY WILL CONTAIN IMPORTANT

INFORMATION ABOUT THE PROPOSED TRANSACTION. Any definitive

proxy statement with respect to the proposed transaction (if and

when available) will be mailed to stockholders of Tribune.

Investors and security holders will be able to obtain free copies

of these documents (if and when available) and other documents

filed with the SEC through the web site maintained by the SEC at

http://www.sec.gov.

This communication does not constitute a solicitation of a proxy

from any stockholder with respect to the proposed transaction.

However, Gannett and/or Tribune and their respective directors,

executive officers and other employees may be deemed to be

participants in the solicitation of proxies in respect of the

proposed transaction. You can find information about Gannett’s

directors and executive officers in Gannett’s definitive proxy

statement for its 2016 annual meeting of stockholders, which was

filed with the SEC on March 23, 2016, and Gannett’s annual report

on Form 10-K for the fiscal year ended December 27, 2015, which was

filed with the SEC on February 25, 2016. You can find information

about Tribune’s directors and executive officers in Tribune’s

definitive proxy statement for its 2016 annual meeting of

stockholders, which was filed with the SEC on April 19, 2016.

Additional information regarding the interests of such potential

participants will be included in one or more proxy statements or

other relevant documents filed with the SEC if and when they become

available. You may obtain free copies of these documents using the

sources indicated above.

1 Towle & Co., Letter to Tribune Board of Directors, 24 May

2016. None of the persons or entities quoted are a party to or have

endorsed Gannett’s proxy solicitation. Gannett has neither sought

nor obtained the consent of persons or entities to use quotations

in its proxy solicitation.

View source

version on businesswire.com: http://www.businesswire.com/news/home/20160526005613/en/

FOR MEDIA INQUIRIES:Amber Allman, 703-854-5358Vice

President, Corporate Communicationsaallman@gannett.comorJoele

Frank, Wilkinson Brimmer KatcherJoele Frank / Michael Freitag / Ed

Trissel, 212-355-4449orFOR INVESTOR INQUIRIES:Michael

Dickerson, 703-854-6185Vice President, Investor

Relationsmdickerson@gannett.comorInnisfree M&A IncorporatedArt

Crozier / Jennifer Shotwell / Larry Miller, 212-750-5833

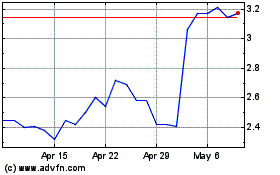

New Gannett (NYSE:GCI)

Historical Stock Chart

From Mar 2024 to Apr 2024

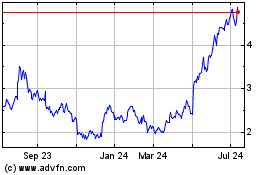

New Gannett (NYSE:GCI)

Historical Stock Chart

From Apr 2023 to Apr 2024