Gannett Co. Chief Executive Bob Dickey didn't waste any

time.

On Gannett's first full day as an independent newspaper company

following a spinoff last year, Mr. Dickey called Journal Media

Group Chairman Steven Smith to say he wanted to buy the

company.

Journal Media had completed its own spinoff only three months

earlier and Mr. Smith said such talk might be premature, according

to a regulatory filing detailing the conversation. But Mr. Dickey

wouldn't take no for an answer. Within three months, the deal was

signed for Gannett to acquire Journal Media's 15 daily papers,

including the Milwaukee Journal Sentinel, for $280 million.

Gannett's pursuit of Journal Media proved to be a template for

its next target: Tribune Publishing Co., owner of the Los Angeles

Times and Chicago Tribune. Just days after the Journal Media deal

closed in April, Mr. Dickey approached Tribune with an unsolicited

offer of $12.25 a share, a 63% premium at the time. Tribune, which

had just installed a new management team, rejected the

"opportunistic" offer, but that hasn't stopped Mr. Dickey.

On Monday, Gannett boosted its bid to $15 a share, valuing

Tribune at about $475 million, plus the assumption of debt. Tribune

shares rose 23% to $14.10 in midday trading.

The newfound aggressiveness has become the hallmark for Gannett

after its June split from TV properties. The publisher of USA Today

has been transformed under Mr. Dickey from a corporate giant often

derided for churning out "McPapers" into a rapacious acquirer of

vulnerable rivals.

"Bob has a mandate from his board to make Gannett a major player

in the consolidation of this industry," said a person who was

involved in the Journal Media negotiations. "He had a list of

companies they were interested in right from day one."

Buying print publications might seem counterintuitive for an

industry in steep decline, but Mr. Dickey believes there is value

in building a bigger network of brands that can share more costs

and serve as a more powerful platform for advertisers both in print

and online. Plus, newspaper prices are at record lows.

Mr. Dickey, who started his career at Gannett in ad sales nearly

30 years ago, also has a sense of urgency. Gannett hasn't been

spared in the industry's upheaval as readers and advertising shift

online. The company's ad revenue fell 12% in the first quarter,

dragging down earnings even as Gannett slashed overhead costs.

A soft-spoken and detail-oriented news executive, the

58-year-old Mr. Dickey's emergence as a hard-driving deal-maker has

raised eyebrows among many who know him.

"Bob has a reputation as a conservative and collegial operator,

and many in the industry have been surprised to find Gannett

involved in a takeover" attempt of Tribune, said Jim Friedlich,

head of Empirical Media, a media consultancy group. "That said, the

business logic and benefit of this merger are so strong that they

appear to have overcome any reservations about going hostile."

Pursuing Tribune was something of a course alteration for

Gannett after Mr. Dickey said last year the company would pursue

papers in smaller markets. But while doing due diligence for the

Journal Media deal, Gannett decided to adjust its approach.

"The great thing about strategies is that they can be changed,"

Mr. Dickey said shortly after making the offer to Tribune.

With its 107 small- and mid-market dailies, Gannett already is

by far the largest newspaper publisher by circulation in the

country. Adding Tribune's papers would give it control of nearly

20% of a market in which 41 million papers are sold every day,

according to the Alliance for Audited Media.

Tribune says it is reviewing the sweetened offer. The two sides

exchanged nasty letters after Gannett's initial bid became public

and didn't meet in person until last week. Mr. Dickey and Gannett

Chairman John Jeffry Louis flew to Chicago to sit down with

Tribune's new chairman, Michael W. Ferro Jr., and its new CEO,

Justin Dearborn, at the offices of Tribune's lawyers, Kirkland

& Ellis LLP.

Over the course of the two-hour meeting, Messrs. Ferro and

Dearborn detailed their digital turnaround strategy. Mr. Ferro said

he was willing to consider a merger in which he became the largest

single shareholder, a person familiar with the matter said. In an

email, Mr. Ferro said, "I learned a lot and thought it was pretty

productive for all parties."

Mr. Dickey said his team walked away feeling the meeting was

unproductive. "We did listen to Michael and his strategy and

frankly we did not come away with a lot of confidence that what he

has outlined can be done effectively," Mr. Dickey said in an

interview.

He said that as much as Gannett wants the Tribune deal to go

through, the company is "looking at other opportunities," although

Tribune remains "our primary focus."

Given Tribune's adoption of a so-called poison pill to help fend

off hostile takeovers, the only way Gannett can force the issue is

by waiting until next year to nominate a slate of directors.

Gannett already missed the deadline for this year.

Gannett has been urging Tribune shareholders to withhold their

votes for the board at the annual meeting in June, to pressure

management to enter negotiations.

One major Tribune shareholder, Oaktree Capital Group, has

publicly urged Tribune's board to engage in talks.

Write to Lukas I. Alpert at lukas.alpert@wsj.com

(END) Dow Jones Newswires

May 16, 2016 15:45 ET (19:45 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

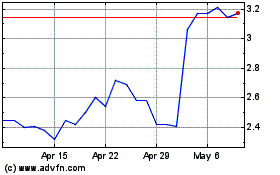

New Gannett (NYSE:GCI)

Historical Stock Chart

From Mar 2024 to Apr 2024

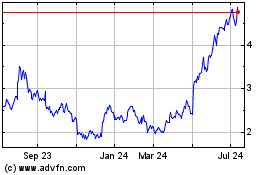

New Gannett (NYSE:GCI)

Historical Stock Chart

From Apr 2023 to Apr 2024