Gannett Raises Bid for Tribune Publishing

May 16 2016 - 8:50AM

Dow Jones News

Gannett Co. said Monday that it raised its all-cash offer for

Tribune Publishing Co. to about $475 million, just two weeks after

Tribune's board rejected a lower bid.

Gannett raised its offer to $15 a share, a proposal valued at

about $475 million when excluding about $385 million of outstanding

debt.

The revised offer represents a 22% increase over its prior bid

and a nearly 100% premium over Tribune Publishing's share price of

$7.52 on April 22, the last trading day before Gannett made public

its initial offer of $12.25 a share April 25. Gannett's first

proposal was valued at about $400 million plus the assumption of

debt.

"Our increased offer demonstrates our commitment to engaging in

serious and meaningful negotiations with the Tribune Board to reach

a mutually agreeable transaction where Gannett acquires all of

Tribune," Gannett Chairman John Jeffry Louis said. "It is evident

from our discussions with Tribune shareholders that there is

overwhelming support for the companies to engage immediately."

A representative from Tribune Publishing wasn't immediately

available for comment. The company has said the initial bid

undervalued the company.

Tribune and Gannett have sent increasingly terse public letters

back and forth since Gannett first went public with its offer.

Tribune has accused Gannett of "playing games" and calling its

approach "aggressive and hostile." Gannett has urged Tribune's

shareholders not to back Tribune's slate of board nominees at the

annual meeting June 2 to send a message to the company to engage in

talks.

Last week, Tribune approved a so-called poison pill as part of

its defense to try to stop Gannett from acquiring the publisher of

the Los Angeles Times and other newspapers. Gannett owns USA Today

and 107 other U.S. dailies. Shareholder rights plans, or poison

pills, are designed to dilute the value of a stock by flooding the

market with additional shares if certain conditions are met, making

it expensive for an investor to acquire a controlling stake.

Shares of Tribune Publishing rose 22% to $14 in premarket

trading.

Write to Joshua Jamerson at joshua.jamerson@wsj.com

(END) Dow Jones Newswires

May 16, 2016 08:35 ET (12:35 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

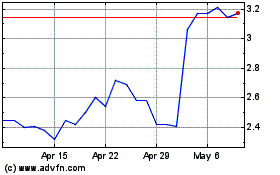

New Gannett (NYSE:GCI)

Historical Stock Chart

From Mar 2024 to Apr 2024

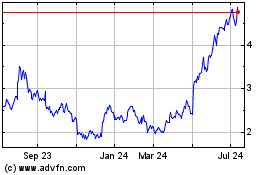

New Gannett (NYSE:GCI)

Historical Stock Chart

From Apr 2023 to Apr 2024