Gannett Urges Tribune Shareholders Withhold Board Votes

May 02 2016 - 8:50AM

Dow Jones News

Gannett Co. on Monday urged Tribune Publishing Co. shareholders

not to back Tribune's slate of director nominees, saying that if

shareholders withhold their votes, it will send a "clear signal"

that investors want the two companies to engage in merger

talks.

Last week, Gannett went public with its proposal to acquire

Tribune in a deal valued at about $400 million that would combine

titles like USA Today, the Los Angeles Times and Chicago Tribune,

as the struggling print news industry increasingly

consolidates.

Since Gannett made its bid public last Monday, frustrated at

Tribune's lack of response, the situation has turned messy and

bitter.

"We believe a withhold vote on the company nominees would send a

clear signal that you, as a Tribune stockholder, want your board to

engage in a meaningful dialogue with us regarding a possible

business combination between our two companies," Gannett said in a

filing. Tribune's annual meeting is scheduled for June 2.

A Tribune representative wasn't immediately available for

comment.

Tribune officials haven't come out against a deal, but Chief

Executive Justin Dearborn has said many top shareholders believe

Gannett is lowballing Tribune with its $12.25-a-share offer.

Gannett also said it has submitted a request for Tribune's

shareholder records.

"We intend to give Tribune stockholders the opportunity to send

a clear message to the Tribune board that its lack of engagement

with our board and management team...is unacceptable," said Gannett

Chief Executive Robert Dickey.

Write to Anne Steele at Anne.Steele@wsj.com

(END) Dow Jones Newswires

May 02, 2016 08:35 ET (12:35 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

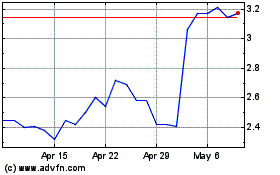

New Gannett (NYSE:GCI)

Historical Stock Chart

From Mar 2024 to Apr 2024

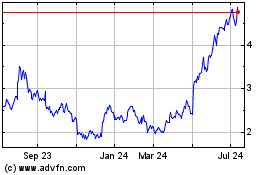

New Gannett (NYSE:GCI)

Historical Stock Chart

From Apr 2023 to Apr 2024