Improving Revenue Trends

101 million Unique Domestic Digital

Visitors

Adjusted EBITDA of $97 million, Adjusted

Diluted EPS of $0.43, Free Cash Flow of $116 million

Gannett Co., Inc. (NYSE: GCI) ("Gannett" or "company" or "we")

today reported third quarter 2015 results of operations.

Recent highlights include:

- Announced the merger of Gannett and

Journal Media Group, Inc. (JMG), expected to close in Q1 2016, is

expected to add approximately $450 million in annual revenues and

approximately $60 million in adjusted EBITDA in the first full

year. Additional $25 million of synergies targeted for year

two.

- Achieved approximately 101 million

unique domestic digital visitors. Total digital revenues for the

third quarter were $159.9 million. Digital-only subscriptions grew

37%.

- Declared dividend of $0.16 per

share.

- Continued integration of acquired

properties in Texas, New Mexico, Pennsylvania and the UK, which is

progressing ahead of plan.

Robert J. Dickey, president and chief executive officer, said,

"After our first 120 days as a public company, Gannett has made

significant progress toward several of the key initiatives that we

outlined during our analyst day in June. Cost reduction initiatives

are progressing as planned, the integration of our recently

acquired properties in Texas, New Mexico, Pennsylvania and the UK

into our "One Gannett" operating model is ahead of schedule,

investments in our digital platform are resulting in continued

growth in unique visitors and digital revenues, and the announced

merger of Gannett and Journal Media Group will add significant

scale and synergy opportunity to drive revenue and earnings

growth."

Beginning with the period post-spin from the company's former

parent and in conjunction with the execution of new agreements with

the company's former parent and certain of its affiliates, the

company began reporting wholesale fees associated with sales of

certain third party (principally Cars.com and CareerBuilder)

digital advertising products and services on a net basis, as a

reduction of the associated digital advertising revenues, rather

than in operating expenses within our consolidated statements of

operations. This change has no impact on reported operating income,

operating cash flows, net income or earnings per share.

Operating revenues for the third quarter were $701.2 million

compared to $767.3 million in the third quarter of 2014, a decrease

of $66.1 million or 8.6%. This decline is partially due to

approximately $16.2 million related to the reporting of sales of

certain third party (principally Cars.com and CareerBuilder)

digital advertising products on a net basis (as described above),

$7.6 million of prior year revenues related to exited businesses as

well as $8.4 million of unfavorable foreign currency exchange rate

changes. Excluding these items, revenues declined $33.9 million, or

4.5%, primarily attributable to ongoing advertiser demand shifts

and the impact of the unfavorable affiliate agreement change with

CareerBuilder and its impact on classified employment revenues in

the quarter. These declines were partially offset by positive

revenue trends in Gannett's digital products as well as revenues

from businesses acquired late in the second quarter.

Weighing on the underlying digital growth rate are the

unfavorable post-spin changes to the CareerBuilder affiliate

agreement and the change in reporting for third party digital

revenues. Excluding CareerBuilder revenues from all periods and the

effect of the change in reporting for third party digital revenues,

digital revenues increased $6.2 million or 3.9% in the third

quarter. This increase is across the board, with the most

meaningful increases coming from desktop display, video and

sponsored links. Overall, reported digital revenues were $159.9

million in the third quarter of 2015 compared to $173.6 million in

the third quarter of 2014, a reduction of $13.7 million or

7.9%.

Adjusted EBITDA for the third quarter was $97.0 million compared

to $102.9 million, in the third quarter of 2014, a decrease of $5.9

million or 5.7%. The decline in third quarter adjusted EBITDA was

due to a $7.6 million reduced EBITDA contribution primarily

resulting from changes to the Cars.com affiliate agreement in

October 2014 and the CareerBuilder affiliate agreement in August

2015, $2.2 million in unfavorable foreign exchange rate changes and

declines in print advertising revenues, partially offset by cost

reductions and efficiency gains in operating expenses as well as

increases in digital revenues and a full quarter of operating

results from businesses acquired during the second quarter of

2015.

Earnings per share for the third quarter, on a fully diluted

basis, were $0.33 and includes $17.5 million of pre-tax severance,

acquisition-related and other charges. Before the impact of these

charges and adjusted for taxes, adjusted earnings per share on a

fully diluted basis would be $0.43. Fully diluted earnings per

share reflect a diluted share count of 118.2 million shares,

approximately 3.2 million higher than the end of the second quarter

of 2015 due to the addition of the dilutive effect of stock based

compensation, principally converted from the former parent at the

time of the spin. Additionally, during the quarter the company

purchased no shares under its $150 million share buyback

authorization. This was due to restrictions on trading while in

possession of material non-public information regarding the

potential merger transaction with Journal Media Group.

Acquisitions and Integration

In early October, the company announced that Gannett and Journal

Media Group entered into a definitive merger agreement under which

Gannett will acquire all of the outstanding common stock of Journal

Media Group for approximately $280 million, net of acquired

cash.

Under the terms of the transaction, which was unanimously

approved by the boards of directors of both companies and is

subject to Journal Media Group shareholder approval, Journal Media

Group shareholders will receive $12.00 per share in cash. Gannett

expects to finance the transaction through a combination of cash on

hand and borrowings under Gannett’s $500 million revolving credit

facility. "The publications of both Gannett and Journal Media Group

have a rich history, a commitment to journalism, and a dedication

to informing and being active members in the communities we serve.

Our merger will combine the best of each of our organizations to

create a journalism-led, investor-focused company which will

provide substantial value to the shareholders of both companies,"

Dickey said at the time the merger was announced.

In its first full year, the transaction is expected to add

approximately $450 million to Gannett's annual revenues and

approximately $60 million in adjusted EBITDA, through a combination

of JMG's solid base business and certain quickly attainable

synergies. The company expects approximately $25 million of

additional synergy opportunities in the second year.

In June 2015, the company completed the acquisition of the

remaining 59.4% interest in the Texas-New Mexico Newspapers

Partnership (TNP) that it did not own from Digital First Media,

which includes properties in Texas, New Mexico and Pennsylvania.

The deal was completed through the assignment of Gannett’s interest

in the California Newspapers Partnership and additional cash

consideration. The company has been actively integrating the

operations of TNP into the operating infrastructure of Gannett.

Already the company has completed the consolidation of cash

management, credit and collections, procurement and payment

systems, payroll, and integration of the management structure. Over

the next few weeks the integration of the circulation systems,

customer service, design operations, and the consolidation of these

properties onto the Gannett digital platform is also expected.

Cash Flow

Net cash flow from operating activities was $126.1 million in

the quarter. Capital expenditures in the third quarter were $10.3

million, primarily for technology investments and real estate

efficiency projects. The resulting cash balance at the end of the

third quarter was $142.8 million, an increase of $70.8 million

compared to the cash balance at December 28, 2014.

At the end of the third quarter of 2015, the underfunded pension

liability was $527.0 million, compared to $770.0 million as of

December 28, 2014, a reduction of $243.0 million or 31.6%. The

significant reduction in this liability is a result of year to date

contributions of $120.1 million, mostly made during the period

pre-spin. The remaining changes were primarily associated with

actuarial changes, including an increase in the discount rate,

resulting from a revaluation of the pension plan as of the date of

the spin of Gannett from its former parent.

On October 28, 2015, the company's Board of Directors declared a

regular quarterly cash dividend of $0.16 per common share. The

dividend will be payable on January 4, 2016 to shareholders of

record at the close of business on December 4, 2015.

Outlook

"We are experiencing trends similar to what we forecast at the

end of the second quarter: specifically, revenue trends in the

second half of the year that are improved over the first half of

the year, partially as a result of the acquisitions of TNP and

Romanes, and adjusted EBITDA margins that are modestly higher in

the second half than the first half. We expect this guidance to

hold for the remainder of the year, with normal seasonal patterns

indicating that the fourth quarter will be the highest revenue and

earnings quarter of the year," Dickey concluded.

Additionally for the fourth quarter of 2015, the company expects

the following:

- Capital expenditures of $32-$35

million

- Depreciation and amortization of

approximately $28 million

- Effective tax rate for the fourth

quarter of 28-30%

* * * *

Conference Call Information

As previously announced, the company will hold an earnings

conference call at 10:00 a.m. ET today. The call can be accessed

via a live webcast through the company's investor site,

http://investors.gannett.com/, or listen-only conference lines.

U.S. callers should dial 866-293-1610 and international callers

should dial 412-455-6204 at least 10 minutes prior to the scheduled

start of the call. The confirmation code for the conference call is

60179334.

Forward Looking Statements

Certain statements in this press release may be forward looking

in nature or constitute “forward-looking statements” as defined in

the Private Securities Litigation Reform Act of 1995.

Forward-looking statements include all statements that are not

historical facts and can typically be identified by words such as

“believe,” “expect,” “estimate,” “predict,” “target,” “potential,”

“likely,” “continue,” “ongoing,” “could,” “should,” “intend,”

“may,” “might,” “plan,” “seek,” “anticipate,” “project” and similar

expressions, as well as variations or negatives of these words.

Examples of forward-looking statements include, but are not limited

to, statements concerning the company’s business strategies, market

potential and future financial performance. Any such statements

speak only as of the date the statements were made and are not

guarantees of future performance.

The matters discussed in these forward-looking statements are

subject to a number of risks, trends, uncertainties and other

factors that could cause actual results to differ materially from

those projected, anticipated or implied in the forward-looking

statements. These factors include, among other things: (1)

competitive pressures in the markets in which we operate; (2)

increased consolidation among major retailers or other events which

may adversely affect business operations of major customers and

depress the level of local and national advertising; (3)

macroeconomic trends and conditions; (4) economic downturns leading

to a continuing or accelerated decrease in circulation or local,

national or classified advertising; (5) potential disruption or

interruption of our operations due to accidents, extraordinary

weather events, civil unrest, political events, terrorism or cyber

security attacks; (6) an accelerated decline in general print

readership and/or advertiser patterns as a result of competitive

alternative media or other factors; (7) our ability to adapt to

technological changes or grow our online business; (8) an increase

in newsprint costs over the levels anticipated; (9) labor

relations, including, but not limited to, labor disputes which may

cause revenue declines or increased labor costs; (10) risks and

uncertainties related to the proposed merger with JMG, including

uncertainty of regulatory approvals, our and JMG’s ability to

satisfy the merger agreement conditions and consummate the

transaction on a timely basis and our ability to successfully

integrate JMG’s operations and employees with our existing

business; (11) our ability to realize benefits or synergies from

other acquisitions of new businesses or dispositions of existing

businesses, or to operate businesses effectively following

acquisitions or divestitures; (12) our ability to attract and

retain employees; (13) rapid technological changes and frequent new

product introductions prevalent in electronic publishing; (14)

weakening in the British pound to U.S. dollar exchange rate; (15)

volatility in financial and credit markets which could affect our

ability to raise funds through debt or equity issuances and

otherwise affect our ability to access the credit and capital

markets at the times and in the amounts needed and on acceptable

terms; (16) changes in the regulatory environment which could

encumber or impede our efforts to improve operating results or the

value of assets; (17) adverse outcomes in proceedings with

governmental authorities or administrative agencies; (18) an other

than temporary decline in operating results and enterprise value

that could lead to non-cash goodwill, other intangible asset,

investment or property, plant and equipment impairment charges;

(19) our inability to engage in certain corporate transactions

following our separation from our former parent; and (20) any

failure to realize expected benefits from our separation from our

former parent.

A further description of these and other important risks,

trends, uncertainties and other factors are discussed in the

company’s filings with the U.S. Securities and Exchange Commission,

including the company’s registration statement on Form 10. Any

forward-looking statements should be evaluated in light of these

important risk factors. The company is not responsible for updating

or revising any forward-looking statements, whether as a result of

new information, future events or otherwise, except as required by

law.

Non-GAAP Financial Measures

This press release also contains a discussion of certain

non-GAAP financial measures that the company presents to allow

investors and analysts to measure, analyze and compare its

financial condition and results of operations in a meaningful and

consistent manner. A reconciliation of these non-GAAP financial

measures to the most directly comparable GAAP measures can be found

in the tables accompanying this press release.

About Gannett

Gannett Co., Inc. (NYSE: GCI) is a next-generation media

company committed to strengthening communities across our network.

Through trusted, compelling content and unmatched local-to-national

reach, Gannett touches the lives of more than 100 million people

monthly. With more than 110 markets internationally, it is known

for Pulitzer Prize-winning newsrooms, powerhouse brands such as USA

TODAY and specialized media properties. To connect with us, visit

www.gannett.com.

CONDENSED COMBINED STATEMENTS OF INCOME

Gannett Co., Inc. and Subsidiaries

Unaudited, in thousands (except per share

amounts)

Table No. 1 Three months

ended Nine months ended Sept. 27, 2015 Sept. 28, 2014 Sept. 27,

2015 Sept. 28, 2014

Operating revenues: Advertising $

384,149 $ 442,088 $ 1,191,902 $ 1,358,504 Circulation 265,227

274,542 802,389 829,872 Other 51,860 50,661

151,377 164,570

Total operating

revenues 701,236 767,291

2,145,668 2,352,946

Operating expenses:

Cost of sales and operating expenses 426,725 486,770 1,375,100

1,510,980 Selling, general and administrative expenses 192,668

180,550 547,881 551,020 Depreciation 25,291 24,925 73,677 73,767

Amortization 3,096 3,461 10,103 10,448 Facility consolidation and

asset impairment charges 1,343 5,390

7,989 24,413

Total operating expenses

649,123 701,096 2,014,750

2,170,628

Operating income 52,113

66,195 130,918 182,318

Non-operating income (expense): Equity income in

unconsolidated investees, net 609 2,737 11,411 9,995 Other

non-operating items (3,415 ) (1,851 ) 18,022

(1,172 )

Total non-operating income (expense)

(2,806 ) 886 29,433 8,823

Income before income taxes 49,307 67,081 160,351 191,141

Provision for income taxes 10,141 16,524

34,611 47,296

Net income $

39,166 $ 50,557 $ 125,740 $ 143,845

Earnings per share - basic $ 0.34 $ 0.44 $ 1.09 $ 1.25

Earnings per share - diluted $ 0.33 $ 0.44 $ 1.08 $ 1.25

Weighted average number of common shares outstanding:

Basic 115,186 114,959 115,035 114,959 Diluted 118,168 114,959

116,029 114,959

REVENUE COMPARISONS

Gannett Co., Inc. and Subsidiaries

Unaudited

Table No. 2 Third quarter 2015

year-over-year comparisons:

DomesticPublishing

Newsquest(in pounds)

Total(constant currency)

Total

Retail (8.7%) 2.9% (10.7%) (8.1%) National (19.3%) 10.6%

(16.6%) (17.2%) Classified (19.6%) (6.0%) (16.3%) (17.8%) Total

advertising (14.1%) (1.3%) (13.7%) (13.1%) Circulation (3.0%) 0.5%

(2.9%) (3.4%) Other revenue 6.3% (9.7%) 3.7% 2.4% Total (8.6%)

(1.5%) (8.7%) (8.6%)

Year-to-date 2015

year-over-year comparisons:

DomesticPublishing

Newsquest(in pounds)

Total(constant currency)

Total

Retail (9.3%) 1.4% (7.9%) (9.0%) National (26.4%) 2.1%

(24.0%) (24.5%) Classified (10.2%) (6.8%) (9.3%) (11.3%) Total

advertising (12.5%) (3.1%) (11.0%) (12.3%) Circulation (2.5%)

(1.7%) (2.5%) (3.3%) Other revenue (8.2%) 1.6% (6.8%) (8.0%) Total

(8.5%) (2.4%) (7.7%) (8.8%)

USE OF NON-GAAP

INFORMATION

The company uses non-GAAP financial performance and liquidity

measures to supplement the financial information presented on a

GAAP basis. These non-GAAP financial measures should not be

considered in isolation from or as a substitute for the related

GAAP measures, and should be read together with financial

information presented on a GAAP basis.

Adjusted EBITDA is a non-GAAP financial performance measure that

the company believes offers a useful view of the overall operation

of our business. The company considers adjusted EBITDA, which may

not be comparable to a similarly titled measure reported by other

companies, to be defined as net income before (1) income

taxes, (2) equity income, (3) other non-operating items,

(4) severance related charges (including early retirement

programs), (5) other transformation items, (6) asset

impairment charges, (7) depreciation and

(8) amortization. The most directly comparable GAAP financial

measure is net income.

Adjusted diluted earnings per share ("EPS") is a non-GAAP

financial performance measure that the company believes offers a

useful view of the overall operation of our business. The company

considers adjusted EPS, which may not be comparable to a similarly

titled measure reported by other companies, to be defined as EPS

before tax-effected (1) severance related charges (including

early retirement programs), (2) other transformation items,

(3) asset impairment charges and (4) acquisition related

expenses (gains). The tax impact on these non-GAAP tax deductible

adjustments is based on the estimated statutory tax rate for the

United Kingdom of 20% and the United States of 38.7%. The most

directly comparable GAAP financial measure is diluted EPS.

Free cash flow is a non-GAAP liquidity measure that adjusts our

reported GAAP results for items that we believe are critical to the

ongoing success of our business, which results in a free cash flow

figure available for use in operations, additional investment and

return to shareholders. The company considers free cash flow, which

may not be comparable to a similarly titled measure reported by

other companies, to be defined as net cash flow from (used for)

operating activities as reported on the statement of cash flows

less capital expenditures. The most directly comparable GAAP

financial measure is net cash from operating activities.

The company uses non-GAAP financial performance measures for

purposes of evaluating our performance and liquidity. Therefore,

the company believes that each of the non-GAAP measures presented

provides useful information to investors by allowing them to view

our businesses through the eyes of our management and Board of

Directors, facilitating comparison of results across historical

periods, and providing a focus on the underlying ongoing operating

performance of our business. Many of our peer group companies

present similar non-GAAP measures to better facilitate industry

comparisons.

NON-GAAP FINANCIAL INFORMATION ADJUSTED EBITDA

Gannett Co., Inc. and Subsidiaries

Unaudited, in thousands

Table No. 3 Three months

ended Nine months ended Sept. 27, 2015 Sept. 28, 2014 Sept. 27,

2015 Sept. 28, 2014 Net income (GAAP basis) $ 39,166 $

50,557 $ 125,740 $ 143,845 Provision for income taxes 10,141 16,524

34,611 47,296 Equity income in unconsolidated investees, net (609 )

(2,737 ) (11,411 ) (9,995 ) Other non-operating items 3,415

1,851 (18,022 ) 1,172

Operating income (GAAP basis) 52,113 66,195 130,918 182,318 Early

retirement program 10,572 — 18,373 — Severance related charges

5,872 2,885 25,386 13,180 Other transformation items 66 5,390 3,093

38,239 Asset impairment charges — —

3,618 — Adjusted operating income

(non-GAAP basis) 68,623 74,470 181,388 233,737 Depreciation 25,291

24,925 73,677 73,767 Amortization 3,096 3,461

10,103 10,448 Adjusted EBITDA

(non-GAAP basis) $ 97,010 $ 102,856 $ 265,168

$ 317,952

NON-GAAP FINANCIAL

INFORMATION ADJUSTED DILUTED EPS

Gannett Co., Inc. and Subsidiaries

Unaudited, in thousands (except per share

amounts)

Table No. 4 Three months

ended Nine months ended Sept. 27, 2015 Sept. 28, 2014 Sept. 27,

2015 Sept. 28, 2014 Early retirement program $ 10,572 $ — $

18,373 $ — Severance related charges 5,872 2,885 25,386 13,180

Other transformation items 66 5,390 3,093 38,239 Asset impairment

charges — — 3,618 — Acquisition related expenses (gain)

1,022 — (19,599 ) —

Pretax impact 17,532 8,275 30,871 51,419 Income tax impact of above

items (6,373 ) (2,000 ) (10,337 )

(18,500 ) Impact of items affecting comparability on net income $

11,159 $ 6,275 $ 20,534 $ 32,919

Net income $ 39,166 $ 50,557 $ 125,740 $ 143,845 Impact of items

affecting comparability on net income 11,159

6,275 20,534 32,919 Adjusted net

income $ 50,325 $ 56,832 $ 146,274 $ 176,764

Earnings per share - diluted $ 0.33 $ 0.44 $ 1.08 $

1.25 Impact of items affecting comparability on net income

0.10 0.05 0.18 0.29

Adjusted earnings per share - diluted $ 0.43 $ 0.49

$ 1.26 $ 1.54 Diluted weighted average number

of common shares outstanding 118,168 114,959 116,029 114,959

NON-GAAP FINANCIAL INFORMATION FREE CASH FLOW

Gannett Co., Inc. and Subsidiaries

Unaudited, in thousands

Table No. 5

Three months endedSept. 27, 2015

Nine months endedSept. 27, 2015

Net cash flow from operating activities $ 126,119 $ 152,814

Capital expenditures (10,328 ) (30,945 ) Free cash flow $ 115,791

$ 121,869

View source

version on businesswire.com: http://www.businesswire.com/news/home/20151029005767/en/

Gannett Co., Inc.For investor inquiries, contact:Michael P.

DickersonVice President, Investor

Relations703-854-6185mdickerson@gannett.comorFor media inquiries,

contact:Amber AllmanVice President, Corporate

Communications703-854-5358aallman@gannett.com

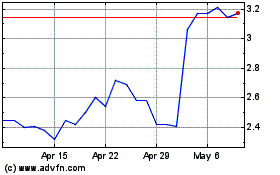

New Gannett (NYSE:GCI)

Historical Stock Chart

From Mar 2024 to Apr 2024

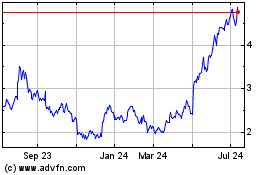

New Gannett (NYSE:GCI)

Historical Stock Chart

From Apr 2023 to Apr 2024