UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

PURSUANT TO SECTION 13 OR 15(d) OF THE

SECURITIES EXCHANGE ACT OF 1934

Date of Report (date of earliest event reported):

July 29, 2015

GANNETT CO., INC.

(Exact name of registrant as specified in charter)

|

| | |

| | |

Delaware | 1-36874 | 47-2390983 |

(State or other jurisdiction of incorporation) | (Commission File Number) | (I.R.S. Employer Identification No.) |

| | |

7950 Jones Branch Drive, McLean, Virginia | | 22107-0910 |

(Address of principal executive offices) | | (Zip Code) |

| (703) 854-6000 | |

| (Registrant's telephone number, including area code) | |

| | |

| Not Applicable | |

| (Former name or former address, if changed since last report.) | |

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

[ ] Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

[ ] Soliciting material pursuant to rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

[ ] Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

[ ] Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Item 2.02 Results of Operations and Financial Condition.

On July 29, 2015, Gannett Co., Inc. reported its combined financial results for the second quarter ended June 28, 2015. A copy of this press release is furnished with this report as an exhibit.

Item 9.01. Financial Statements and Exhibits.

(d) Exhibits

See Index to Exhibits attached hereto.

SIGNATURE

Pursuant to requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

| | |

| | Gannett Co., Inc. |

| | |

Date: July 29, 2015 | By: | /s/ Alison K. Engel |

| | Alison K. Engel |

| | Chief Financial Officer |

INDEX TO EXHIBITS

|

| | |

Exhibit No. | | Description |

| | |

99.1 | | Gannett Co., Inc. Earnings Press Release dated July 29, 2015. |

| | |

| | |

|

| |

FOR IMMEDIATE RELEASE | Wednesday, July 29, 2015 |

Gannett Reports Second Quarter 2015 Results of Operations

Revenues of $727 million

Diluted Earnings per Share of $0.46

Non-GAAP Adjusted EBITDA of $97 million

McLean, VA - Gannett Co., Inc. (NYSE: GCI) ("Gannett" or "Company" or "we") today reported results of operations derived from the consolidated financial statements and accounting records of the Company's former Parent and presented as if the Company were a separate entity.

Recent highlights include:

| |

• | Completed the spin from its former Parent, regular way trading commenced on June 29, 2015. |

| |

• | Completed the acquisition of the remaining 59.4% in the Texas-New Mexico Newspaper Partnership in the U.S. and the acquisition of Romanes Media Group in the U.K., resulting in annual revenues of approximately $100 million over the next twelve months. |

| |

• | Achieved 92 million unique domestic digital visitors, a 16% increase over the prior year. |

| |

• | Increased cost reduction estimate from $57 million to $67 million. Target run-rate to be reached in first half of 2016. |

| |

• | Hired high-profile digital and print advertising executive as Gannett's first-ever Chief Revenue Officer. |

| |

• | Declared first-ever dividend of $0.16 per share payable to shareholders of record as of September 4, 2015 and approved $150 million share buyback program. |

Robert J. Dickey, President and Chief Executive Officer, said "Gannett is laser focused on capturing the demographic led shift from print to digital by leveraging our industry-leading digital capabilities. We also are focused on providing greater value to our advertising customers through the introduction of innovative tools, such as the recently announced Gravity for Mobile, and the appointment of our first Chief Revenue Officer, Kevin Gentzel. Our competitive advantages, coupled with our newly refined content and advertising strategies, consolidation strategy and healthy balance sheet, position us to reverse recent revenue trends over time and deliver value to shareholders."

Operating revenues for the second quarter were $727.1 million compared to $796.5 million in the second quarter of 2014, a decrease of $69.4 million or 8.7%. This decline is partially due to approximately $12.0 million of prior year revenues related to exited businesses as well as $10.6 million of unfavorable foreign currency exchange rate changes. Before the impact of exited businesses and foreign currency, revenues were down $46.8 million, or 6.0%. This decline in revenues is primarily attributable to ongoing advertiser demand shifts, partially offset by positive revenue trends in Gannett's digital products as well as $9.3 million of revenues from businesses acquired late in the quarter. Before the impact of exited businesses, foreign currency and acquisitions, revenues were down 7.2%.

Adjusted EBITDA for the quarter was $97.0 million compared to $125.3 million in the second quarter of 2014, a decrease of $28.3 million or 22.6%. The decline in second quarter adjusted EBITDA was primarily due to declines in print advertising revenues and $6 million of increased Cars.com affiliate agreement costs, partially offset by cost reductions and efficiency gains in operating expenses as well as increases in digital revenues.

During the quarter the Company took several actions resulting in special charges of $20.5 million. Approximately $15.4 million, or 75.1%, was for workforce restructuring, while the remaining $5.1 million, or 24.9%, was for asset impairments and other related charges. "We are aggressively taking actions to improve the efficiency of our operations. This is an ongoing effort to help offset the declines the industry is experiencing in print advertising revenues, improve earnings and cash flows and continue to leverage faster growing parts of our business, particularly digital. In addition, we have identified an additional $10 million of efficiency opportunities that will be put in place in the second half of 2015, resulting in total expected savings from our current actions of approximately $67 million. We expect to achieve this run-rate during the first half of 2016 and provide improvements to our results in the second half of 2015, particularly late in the year," Dickey continued.

Acquisitions

In late May, the Company acquired the Romanes Media Group. Located in the United Kingdom, Romanes includes one daily and 28 weekly publications and their associated websites. The transaction was completed by Gannett subsidiary, Newsquest.

In June, the Company completed the acquisition of the remaining 59.4% interest in the Texas-New Mexico Newspapers Partnership that it did not own from Digital First Media. The deal was completed through the assignment of Gannett’s interest in the California Newspapers Partnership and additional cash consideration, and resulted in the Company recognizing a pre-tax gain on equity investment of $21.8 million. As a result, Gannett owns 100% of the Texas-New Mexico Newspapers Partnership and no longer has any ownership interest or continuing involvement in California Newspapers Partnership. The organizations acquired include:

| |

• | New Mexico -- Alamogordo Daily News; Carlsbad Current-Argus; The Daily Times in Farmington; Deming Headlight; Las Cruces Sun-News; Silver City Sun-News; |

| |

• | Pennsylvania -- Chambersburg Public Opinion; Hanover Evening Sun; Lebanon Daily News; and the York Daily Record. |

Combined, these two transactions are expected to contribute more than $100 million in revenues to the consolidated results of the Company over the next twelve months. The Company is actively working through a robust pipeline of additional acquisition opportunities.

Cash Flow

Net cash flow used for operating activities was $51.1 million in the quarter and reflects pre-spin pension contributions of $109.3 million, $93.5 million of which was a one-time contribution to the Gannett Retirement Plan (GRP). The Company will make additional pension contributions of $25 million per year to the GRP for the next five years, and $15 million in year six. The Company does not expect to make any additional pension contributions to the GRP or other U.S. plans in the second half of 2015. Negative free cash flow totaled $65.0 million, again reflecting the pension contributions. Before the impact of pension contributions, free cash flows would have been $44.3 million. Capital expenditures in the second quarter were $14.0 million, primarily for technology investments and real estate efficiency projects.

On July 28, 2015, the Company's Board of Directors declared its first-ever quarterly cash dividend of $0.16 per common share. The dividend will be payable on October 1, 2015 to shareholders of record on September 4, 2015.

Outlook

"Gannett owns the best overall set of local and national assets in the industry in both the U.S. and the U.K and we continue to leverage these assets and drive incremental efficiency in our base business. The actions we have put in place recently will result in approximately $67 million in reduced operating expenses by the first half of next year and will have an impact on the second half of 2015. Our continued strong cash flow easily supports our dividend and share buyback plan, and in fact our Board yesterday approved our first ever dividend of $0.16 per share, or $0.64 on an annualized basis, and is supportive of our current $150 million share buyback program. We are committed to ongoing returns of capital to our shareholders," Dickey concluded.

For the second half of 2015, the Company expects the following:

| |

• | Capital expenditures of $50 - $55 million, including $10 million one-time spin-related and TNP expenditures |

| |

• | Pension contributions of $6 - $8 million, to its U.K. plans |

| |

• | Depreciation and amortization of approximately $54 million |

* * * *

Conference Call Information

As previously announced, the Company will hold an earnings conference call at 10:00 a.m. ET today. The call can be accessed via a live webcast through the company's investor site, http://investors.gannett.com/, or listen-only conference lines. U.S. callers should dial 1-866-293-1610 and international callers should dial 1-412-455-6204 at least 10 minutes prior to the scheduled start of the call. The confirmation code for the conference call is 87083213.

Forward Looking Statements

Certain statements in this press release may be forward looking in nature or constitute “forward-looking statements” as defined in the Private Securities Litigation Reform Act of 1995. The words “believe,” “expect,” “estimate,” “could,” “should,” “intend,” “may,” “plan,” “seek,” “anticipate,” “project” and similar expressions, among others, generally identify “forward-looking statements,” which speak only as of the date the statements were made. The matters discussed in these forward-looking statements are subject to a number of risks, trends and uncertainties that could cause actual results to differ materially from those projected, anticipated or implied in the forward-looking statements. A number of those risks, trends and uncertainties are discussed in the Company’s filings with the U.S. Securities and Exchange Commission, including the Company’s registration statement on Form 10. Any forward-looking statements should be evaluated in light of these important risk factors. The Company is not responsible for updating or revising any forward-looking statements, whether as a result of new information, future events or otherwise, except as required by law.

Non-GAAP Financial Measures

This press release also contains a discussion of certain non-GAAP financial measures that the Company presents in order to allow investors and analysts to measure, analyze and compare its financial condition and results of operations in a meaningful and consistent manner. A reconciliation of these non-GAAP financial measures to the most directly comparable GAAP measures can be found in the tables accompanying this press release.

About Gannett

Gannett Co., Inc. (NYSE: GCI) is a next-generation media company committed to strengthening communities across our network. Through trusted, compelling content and unmatched local-to-national reach, Gannett touches the lives of nearly 100 million people monthly. With more than 110 markets internationally, it is known for Pulitzer Prize-winning newsrooms, powerhouse brands such as USA TODAY and specialized media properties. To connect with us, visit www.gannett.com.

|

| | |

For media inquiries, contact: | | For investor inquiries, contact: |

Amber Allman | | Michael P. Dickerson |

Vice President, Corporate Communications | | Vice President, Investor Relations |

703-854-5358 | | 703-854-6185 |

aallman@gannett.com | | mdickerson@gannett.com |

# # #

CONDENSED COMBINED STATEMENTS OF INCOME Gannett Co., Inc. and Subsidiaries Unaudited, in thousands (except per share amounts) |

| | | | | | | | | | | | | | | | |

| | | | | | | | |

Table No. 1 | | | | | | | | |

| | Three months ended | | Six months ended |

| | June 28, 2015 | | June 29, 2014 | | June 28, 2015 | | June 29, 2014 |

Operating revenues: | | | | | | | | |

Advertising | | $ | 410,487 |

| | $ | 463,976 |

| | $ | 807,753 |

| | $ | 916,416 |

|

Circulation | | 265,904 |

| | 275,482 |

| | 537,162 |

| | 555,330 |

|

Other | | 50,681 |

| | 57,064 |

| | 99,517 |

| | 113,909 |

|

Total operating revenues | | 727,072 |

| | 796,522 |

| | 1,444,432 |

| | 1,585,655 |

|

| | | | | | | | |

Operating expenses: | | | | | | | | |

Cost of sales and operating expenses | | 468,531 |

| | 509,742 |

| | 948,375 |

| | 1,024,210 |

|

Selling, general and administrative expenses | | 176,884 |

| | 182,105 |

| | 355,213 |

| | 370,470 |

|

Depreciation | | 23,958 |

| | 24,403 |

| | 48,386 |

| | 48,842 |

|

Amortization of intangible assets | | 3,608 |

| | 3,475 |

| | 7,007 |

| | 6,987 |

|

Facility consolidation and asset impairment charges | | 5,097 |

| | 9,479 |

| | 6,646 |

| | 19,023 |

|

Total operating expenses | | 678,078 |

| | 729,204 |

| | 1,365,627 |

| | 1,469,532 |

|

Operating income | | 48,994 |

| | 67,318 |

| | 78,805 |

| | 116,123 |

|

| | | | | | | | |

Non-operating income: | | | | | | | | |

Equity income in unconsolidated investees, net | | 4,495 |

| | 3,083 |

| | 10,802 |

| | 7,258 |

|

Other non-operating items | | 22,895 |

| | 488 |

| | 21,437 |

| | 679 |

|

Total non-operating income | | 27,390 |

| | 3,571 |

| | 32,239 |

| | 7,937 |

|

| | | | | | | | |

Income before income taxes | | 76,384 |

| | 70,889 |

| | 111,044 |

| | 124,060 |

|

Provision for income taxes | | 23,057 |

| | 18,780 |

| | 24,470 |

| | 30,772 |

|

Net income | | $ | 53,327 |

| | $ | 52,109 |

| | $ | 86,574 |

| | $ | 93,288 |

|

| | | | | | | | |

Earnings per share - basic and diluted | | $ | 0.46 |

| | $ | 0.45 |

| | $ | 0.75 |

| | $ | 0.81 |

|

| | | | | | | | |

Weighted average number of common shares outstanding: | | | | | | |

Basic and diluted | | 114,959 |

| | 114,959 |

| | 114,959 |

| | 114,959 |

|

REVENUE COMPARISONS Gannett Co., Inc. and Subsidiaries Unaudited |

| | | | | | | |

| | | | | | | |

Table No. 2 | | | | | | | |

| | | | | | | |

Second quarter 2015 year-over-year comparisons: | | | | |

| Domestic Publishing | | Newsquest (in pounds) | | Total (constant currency) | | Total |

| | | | | | | |

Retail | (10.6%) | | 2.3% | | (12.4%) | | (13.4%) |

National | (13.9%) | | (2.9%) | | (12.8%) | | (13.6%) |

Classified | (5.3%) | | (8.0%) | | (6.1%) | | (8.3%) |

Total advertising | (9.3%) | | (3.8%) | | (10.1%) | | (11.5%) |

Circulation | (2.4%) | | (1.1%) | | (2.5%) | | (3.5%) |

Other revenue | (12.8%) | | 8.5% | | (9.7%) | | (11.0%) |

Total | (7.0%) | | (2.2%) | | (7.4%) | | (8.7%) |

| | | | | | | |

| | | | | | | |

Year-to-date 2015 year-over-year comparisons: | | | | |

| Domestic Publishing | | Newsquest (in pounds) | | Total (constant currency) | | Total |

| | | | | | | |

Retail | (9.6%) | | 0.7% | | (12.2%) | | (13.2%) |

National | (18.0%) | | (1.9%) | | (16.5%) | | (17.2%) |

Classified | (5.5%) | | (7.2%) | | (6.0%) | | (8.1%) |

Total advertising | (9.5%) | | (3.9%) | | (10.5%) | | (11.9%) |

Circulation | (2.1%) | | (2.8%) | | (2.4%) | | (3.3%) |

Other revenue | (14.4%) | | 7.5% | | (11.4%) | | (12.6%) |

Total | (7.1%) | | (2.8%) | | (7.7%) | | (8.9%) |

USE OF NON-GAAP INFORMATION

The Company uses non-GAAP financial performance and liquidity measures to supplement the financial information presented on a GAAP basis. These non-GAAP financial measures should not be considered in isolation from or as a substitute for the related GAAP measures, and should be read together with financial information presented on a GAAP basis.

Adjusted EBITDA is a non-GAAP financial performance measure that the Company believes offers a useful view of the overall operation of our business. The Company considers adjusted EBITDA, which may not be comparable to a similarly titled measure reported by other companies, to be defined as net income before (1) income taxes, (2) equity income, (3) other non-operating items, (4) workforce restructuring, (5) other transformation items, (6) asset impairment charges, (7) depreciation and (8) amortization. The most directly comparable GAAP financial measure is net income.

Free cash flow is a non-GAAP liquidity measure that adjusts our reported GAAP results for items that we believe are critical to the ongoing success of our business, which results in a free cash flow figure available for use in operations, additional investment and return to shareholders. The Company considers free cash flow, which may not be comparable to a similarly titled measure reported by other companies, to be defined as net cash flow from (used for) operating activities as reported on the statement of cash flows less capital expenditures. The most directly comparable GAAP financial measure is net cash from operating activities.

The Company uses non-GAAP financial performance measures for purposes of evaluating our performance and liquidity. Therefore, the Company believes that each of the non-GAAP measures presented provides useful information to investors by allowing them to view our businesses through the eyes of our management and Board of Directors, facilitating comparison of results across historical periods, and providing a focus on the underlying ongoing operating performance of our business. Many of our peer group companies present similar non-GAAP measures to better facilitate industry comparisons.

NON-GAAP FINANCIAL INFORMATION ADJUSTED EBITDA Gannett Co., Inc. and Subsidiaries Unaudited, in thousands of dollars |

| | | | | | | | | | | | | | | |

| | | | | | | |

Table No. 3 | | | | | | | |

| | | | | | | |

| Three months ended | | Six months ended |

| June 28, 2015 | | June 29, 2014 | | June 28, 2015 | | June 29, 2014 |

| | | | | | | |

Net income (GAAP basis) | $ | 53,327 |

| | $ | 52,109 |

| | $ | 86,574 |

| | $ | 93,288 |

|

Provision for income taxes | 23,057 |

| | 18,780 |

| | 24,470 |

| | 30,772 |

|

Equity income in unconsolidated investees, net | (4,495 | ) | | (3,083 | ) | | (10,802 | ) | | (7,258 | ) |

Other non-operating items | (22,895 | ) | | (488 | ) | | (21,437 | ) | | (679 | ) |

Operating income (GAAP basis) | 48,994 |

| | 67,318 |

| | 78,805 |

| | 116,123 |

|

Workforce restructuring | 15,369 |

| | 20,655 |

| | 27,314 |

| | 24,120 |

|

Other transformation items | 1,479 |

| | 9,479 |

| | 3,028 |

| | 19,023 |

|

Asset impairment charges | 3,618 |

| | — |

| | 3,618 |

| | — |

|

Adjusted operating income (non-GAAP basis) | 69,460 |

| | 97,452 |

| | 112,765 |

| | 159,266 |

|

Depreciation | 23,958 |

| | 24,403 |

| | 48,386 |

| | 48,842 |

|

Amortization | 3,608 |

| | 3,475 |

| | 7,007 |

| | 6,987 |

|

Adjusted EBITDA (non-GAAP basis) | $ | 97,026 |

| | $ | 125,330 |

| | $ | 168,158 |

| | $ | 215,095 |

|

NON-GAAP FINANCIAL INFORMATION FREE CASH FLOW Gannett Co., Inc. and Subsidiaries Unaudited, in thousands of dollars |

| | | | | | | | |

| | | | |

Table No. 4 | | | | |

| | | | |

| Three months ended

June 28, 2015 | | Six months ended

June 28, 2015 | |

| | | | |

Net cash flow from (used for) operating activities | $ | (51,058 | ) | | $ | 26,695 |

| |

Capital expenditures | (13,959 | ) | | (20,617 | ) | |

Free cash flow | $ | (65,017 | ) | | $ | 6,078 |

| |

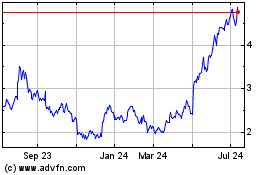

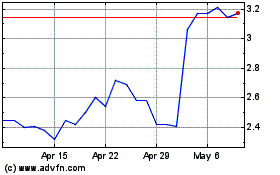

New Gannett (NYSE:GCI)

Historical Stock Chart

From Mar 2024 to Apr 2024

New Gannett (NYSE:GCI)

Historical Stock Chart

From Apr 2023 to Apr 2024