UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

Form 8-K

Current Report

Pursuant

to Section 13 or 15(d)

of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported) January 6, 2015

THE GREENBRIER COMPANIES, INC.

(Exact name of registrant as specified in its charter)

Commission

File No. 1-13146

|

|

|

| Oregon |

|

93-0816972 |

| (State of Incorporation) |

|

(I.R.S. Employer

Identification No.) |

|

|

|

| One Centerpointe Drive, Suite 200, Lake Oswego, OR |

|

97035 |

| (Address of principal executive offices) |

|

(Zip Code) |

(503) 684-7000

(Registrant’s telephone number, including area code)

Former name or former address, if changed since last report: N/A

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the

following provisions (see General Instruction A.2. below):

| ¨ |

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ¨ |

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ¨ |

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ¨ |

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Item 5.02 Departure of Directors or Certain Officers; Election of Directors; Appointment of Certain

Officers; Compensatory Arrangements of Certain Officers

As noted in Item 5.07 below, at the Annual Meeting of Shareholders of The

Greenbrier Companies, Inc. (the “Company”) held on January 7, 2015, the shareholders approved amendments to the Company’s 2010 Amended and Restated Stock Incentive Plan in the form of a 2014 Amended and Restated Stock Incentive

Plan (the “2014 Amended and Restated Plan”) to increase the dollar value of the automatic restricted stock grants made to non-employee directors immediately following each Annual Meeting of Shareholders, from $80,000 to $125,000.

A summary of the material terms of the 2014 Amended and Restated Plan is set forth on pages 42 to 48 of the Company’s Definitive Proxy

Statement on Schedule 14A, filed with the Securities and Exchange Commission on November 19, 2014, and is incorporated herein by reference. That summary and the foregoing description of the 2014 Amended and Restated Plan are qualified in their

entirety by reference to the text of the 2014 Amended and Restated Plan, which was filed as Appendix A to the Company’s Proxy Statement and is incorporated herein by this reference.

Item 5.07 Submission of Matters to a Vote of Security Holders

At the Annual Meeting of Shareholders of the Company held on January 7, 2015, five proposals were voted upon by the Company’s

shareholders. A brief discussion of each proposal voted upon at the Annual Meeting and the number of votes cast for, against, withheld, abstentions and broker non-votes to each proposal are set forth below.

A vote was taken at the Annual Meeting for the election of two directors of the Company to hold office until the Annual Meeting of

Shareholders to be held in 2018, or until their successors are elected and qualified. The Company’s Bylaws were amended on October 29, 2014, to decrease the number of directors from nine to eight, effective as of January 7, 2015. The

aggregate numbers of shares of Common Stock voted in person or by proxy for each nominee were as follows:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Nominee |

|

Votes for

Election |

|

|

Votes

Withheld |

|

|

Votes

Abstained |

|

|

Broker

Non-Votes |

|

| William A. Furman |

|

|

17,962,747 |

|

|

|

1,112,376 |

|

|

|

— |

|

|

|

5,140,450 |

|

| Charles J. Swindells |

|

|

18,714,220 |

|

|

|

360,903 |

|

|

|

— |

|

|

|

5,140,450 |

|

A vote was taken at the Annual Meeting to approve a non-binding advisory resolution regarding the 2014

compensation of the Company’s named executive officers. The aggregate number of shares of Common Stock in person or by proxy which voted for, voted against, abstained and broker non-votes from the vote were as follows:

|

|

|

|

|

|

|

| Votes for Approval |

|

Votes against Approval |

|

Votes Abstained |

|

Broker Non-Votes |

| 18,450,571 |

|

459,251 |

|

165,301 |

|

5,140,450 |

A vote was taken at the Annual Meeting on a proposal to approve amendments to the Company’s 2010 Amended

and Restated Stock Incentive Plan to increase the annual director stock compensation under the plan in the form of a 2014 Amended and Restated

2

Stock Incentive Plan. The aggregate number of shares of Common Stock in person or by proxy which voted for, voted against, abstained and broker non-votes from the vote were as follows:

|

|

|

|

|

|

|

| Votes for Approval |

|

Votes against Approval |

|

Votes Abstained |

|

Broker Non-Votes |

| 17,744,722 |

|

1,194,415 |

|

135,986 |

|

5,140,450 |

A vote was taken at the Annual Meeting on a proposal to approve the adoption of The Greenbrier Companies, Inc.

2014 Employee Stock Purchase Plan. The aggregate number of shares of Common Stock in person or by proxy which voted for, voted against, abstained and broker non-votes from the vote were as follows:

|

|

|

|

|

|

|

| Votes for Approval |

|

Votes against Approval |

|

Votes Abstained |

|

Broker Non-Votes |

| 18,834,593 |

|

118,522 |

|

122,007 |

|

5,140,450 |

A vote was taken at the Annual Meeting on the proposal to ratify the appointment of KPMG LLP as the

Company’s independent auditors for the year ending August 31, 2015. The aggregate number of shares of Common Stock in person or by proxy which voted for, voted against, abstained and broker non-votes from the vote were as follows:

|

|

|

|

|

|

|

| Votes for Approval |

|

Votes against Approval |

|

Votes Abstained |

|

Broker Non-Votes |

| 23,930,961 |

|

140,722 |

|

143,889 |

|

— |

Item 8.01 Other Events.

Amendment of Audit Committee Charter

On

January 6, 2015, the Board of Directors adopted and approved amendments to the Audit Committee Charter, based on the recommendation of the Audit Committee.

The amended Audit Committee Charter is attached hereto as Exhibit 99.1 and will be posted in the Investor Relations section of the

Company’s website, www.gbrx.com, under Corporate Governance as soon as practicable.

New Audit Committee and Compensation Committee Chairs

On January 6, 2015, the Board of Directors appointed Graeme A. Jack as the Chairman of the Company’s Audit Committee, on the

recommendation of the Nominating and Corporate Governance Committee. Mr. Jack succeeds Duane C. McDougall, who served as Chairman of the Audit Committee since December 2004 and continues to serve as the Company’s Lead Director.

On January 6, 2015, the Board of Directors also appointed Victoria McManus as the Chairman of the Company’s Compensation Committee.

Ms. MacManus succeeds Mr. Jack, who served as Chairman of the Compensation Committee since November 2010 and, as noted above, has been appointed to serve as Chairman of the Audit Committee.

3

Executive Officer Promotions

On January 6, 2015, the Board of Directors appointed Alejandro Centurion (formerly President of North American Manufacturing Operations)

as Executive Vice President and President of Global Manufacturing Operations. In connection with his new position, Mr. Centurion’s responsibilities for manufacturing operations were expanded from North America to include global

manufacturing operations. The Board of Directors also appointed James T. Sharp as Executive Vice President of the Company in addition to his current position as President of Greenbrier Leasing Company LLC.

Item 9.01 Financial Statements and Exhibits

(d)

Exhibits

| 99.1 |

Audit Committee Charter |

4

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the Registrant has duly caused this report to be signed on its behalf by

the undersigned thereunto duly authorized.

|

|

|

|

|

|

|

|

|

|

|

THE GREENBRIER COMPANIES, INC. |

|

|

|

|

| Date: January 12, 2015 |

|

|

|

By: |

|

/s/ Martin R. Baker |

|

|

|

|

|

|

Martin R. Baker |

|

|

|

|

|

|

Senior Vice President, General Counsel and Chief Compliance Officer |

5

Exhibit 99.1

AUDIT COMMITTEE CHARTER

The Board of Directors of The Greenbrier Companies, Inc. (the “Company”) shall annually appoint from its members an Audit Committee.

This Charter of the Audit Committee supplements the provisions of Article III, Section 11(c) of the Company’s Amended and Restated Bylaws and further defines the role, authority and responsibility of the Audit Committee.

Purposes

The purposes of the Audit

Committee shall be to:

| |

• |

|

Assist the Board of Directors in the oversight of: |

| |

• |

|

the integrity of the Company’s financial statements, |

| |

• |

|

the Company’s compliance with legal and regulatory requirements, |

| |

• |

|

the independent auditor’s qualifications and independence, and |

| |

• |

|

the performance of the Company’s internal audit function and independent auditors. |

| |

• |

|

Serve as the Company’s Qualified Legal Compliance Committee (“QLCC”), as defined in 17 C.F.R. § 205.2(k). |

| |

• |

|

Annually prepare an Audit Committee Report in conformity with Item 407(d)(3)(i) of SEC Regulation S-K for inclusion in management’s proxy statement to stockholders in connection with the Company’s annual

meeting of stockholders. |

Number of Members and Appointment

The Audit Committee shall be composed of at least three members of the Board of Directors. Members of the Committee shall be appointed annually

by the Board of Directors and may be removed by the Board of Directors in its discretion. Vacancies shall be filled by the Board of Directors.

Audit Committee Charter - 1

Qualifications of Members

Each member of the Audit Committee shall be a Director who, in the judgment of the Board of Directors, is financially literate and possesses

the ability to read and understand the fundamental financial statements of the Company and its subsidiaries, including balance sheets, income statements and cash flow statements. At least one member of the Audit Committee shall, in the judgment of

the Board of Directors, have accounting or related financial management expertise, which may include employment experience in finance or accounting, certification in accounting or any other comparable experience, including being, or having been, a

chief executive officer or other senior officer with financial oversight responsibilities.

Independence of Members

Members of the Audit Committee shall be free from any relationship to the Company or its subsidiaries that, in the judgment of the Board of

Directors, may interfere with the exercise of their independence from management of the Company. Other than in their capacity as members of the Board of Directors, members of the Audit Committee may not be affiliated persons, officers or employees

of the Company or any of its subsidiaries and may not accept, directly or indirectly, from the Company or any of its subsidiaries any consulting, advisory or other compensatory fees. Appointments to the Audit Committee shall be consistent with

standards for determining independence promulgated by the SEC and the New York Stock Exchange, or such other national securities exchange as shall be the principal market for trading of the Company’s securities.

Meetings, Quorum, Informal Actions, Minutes

The Audit Committee shall meet on a regular basis. Special meetings may be called by the Chair of the Audit Committee. A majority of the

members of the Audit Committee shall constitute a quorum. Concurrence of a majority of the quorum (or, in case a quorum at the time consists of two members of the Committee, both members present) shall be required to take formal action of the Audit

Committee. Written minutes shall be kept for all formal meetings of the Committee.

As permitted by Sections 60.337 and 60.341 of the

Oregon Business Corporation Act, the Audit Committee may act by unanimous written consent, and may conduct meetings via conference telephone or similar communication equipment.

Members of the Audit Committee may meet informally with officers or employees of the Company and its subsidiaries and with the Company’s

independent auditors, and may conduct informal inquiries and studies without the necessity of formal meetings. The Audit Committee may delegate to its Chair or to one or more of its members the responsibility for performing routine functions as, for

example, review of press releases announcing results of operations.

Audit Committee Charter - 2

Audit Committee Authority and Responsibilities

Independent Auditors. The Company’s independent auditors shall report directly to the Audit Committee. The Audit

Committee shall be directly responsible for the appointment, compensation, retention and oversight of the work of the Company’s independent auditors (including resolution of disagreements between the independent auditors and the Company’s

management regarding financial reporting) for the purpose of performing or issuing an audit report, or performing other audit, review or attest services for the Company and, where appropriate, the termination or replacement of the Company’s

independent auditors. The Audit Committee shall pre-approve all audit services and all significant non-audit services to be provided to the Company by the independent auditors. The Board of Directors may, in its discretion, determine to submit to

the stockholders for approval or ratification the appointment of the Company’s independent auditors.

The Audit Committee shall

oversee and evaluate the independence, qualifications and performance of the Company’s independent auditors. The Audit Committee shall, at least annually, obtain and review the independent auditors’ report describing: (i) the

firm’s internal quality-control procedures; (ii) any material issues raised by the most recent internal quality-control review, peer review or Public Company Accounting Oversight Board review or inspection of the firm, or by any inquiry or

investigation by governmental or professional authorities, within the preceding five years, respecting one or more independent audits carried out by the firm, and any steps taken to deal with any such issues; (iii) (to assess) all relationships

between the independent auditors and the Company or any of its subsidiaries; and discuss with the independent auditors this report and any relationships or services that may impact the objectivity and independence of the auditors.

Additional Authority and Responsibility. Without limiting the generality of the foregoing, the Audit Committee shall

also:

| |

• |

|

the scope of proposed audits to be performed with respect to the Company’s financial statements in the context of the Company’s particular characteristics and requirements; |

| |

• |

|

major issues regarding accounting principles and financial statement presentations, including any significant changes in the Company’s selection or application of accounting principles, and major issues as to the

adequacy of the Company’s internal controls and any special audit steps adopted in light of material control deficiencies; |

| |

• |

|

analyses prepared by management and/or the independent auditors setting forth significant financial reporting issues and judgments made in connection with the preparation of the financial statements, including analyses

of the effects of alternative GAAP methods on the financial statements; |

Audit Committee Charter - 3

| |

• |

|

the effect of regulatory and accounting initiatives, as well as off-balance sheet structures, on the financial statements of the Company; |

| |

• |

|

the type and presentation of information to be included in earnings press releases (paying particular attention to any use of “pro forma,” or “adjusted” non-GAAP, information), as well as review any

financial information and earnings guidance provided to analysts and rating agencies; |

| |

• |

|

with the independent auditors, the results of the auditing engagement and any recommendations the auditors may have with respect to the Company’s financial, accounting or auditing systems; |

| |

• |

|

with management and the independent auditors, changes in accounting standards or rules proposed by the Financial Accounting Standards Board or the Securities and Exchange Commission that may affect the Company’s

financial statements; |

| |

• |

|

with staff performing internal auditing functions and with the independent auditors, the adequacy of the internal financial and operational controls of the Company; and |

| |

• |

|

with the Company’s independent auditors, any audit problems or difficulties as well as management’s responses. |

| |

• |

|

Keep the Company’s independent auditors informed of the Committee’s understanding of the Company’s relationships and transactions with related parties that are significant to the Company and review and

discuss with the Company’s independent auditors the auditors’ evaluation of the Company’s identification of, accounting for, and disclosure of its relationships and transactions with related parties, including any significant matters

arising from the audit regarding the Company’s relationships and transactions with related parties. |

| |

• |

|

Require a letter from the independent auditors concerning significant weaknesses or breaches of internal controls encountered during the course of the audit. |

| |

• |

|

Inquire of management and the independent auditors whether any significant financial reporting issues were discussed during the course of the audit and, if so, how they were resolved. |

| |

• |

|

Request an explanation from management and the independent auditors concerning the effects of significant changes in accounting practices or policies. |

| |

• |

|

Inquire about significant contingencies or estimates which may affect the Company’s financial statements and the basis for the Company’s presentation of such matters. |

| |

• |

|

Review and approve the appointment, termination or replacement (including budget and staffing) and compensation by management of a Director of Internal Audit. Direct the scope of the duties, responsibilities and

activities of the Director of Internal Audit and periodically meet and review with the Director of Internal Audit the regular internal reports to management prepared by the internal auditing department and management’s responses and the

progress of activities, recommendations and any findings of major significance stemming from internal audits. |

Audit Committee Charter - 4

| |

• |

|

Meet separately, periodically and privately with management, with the independent auditors, with the internal auditors (or other personnel responsible for the internal audit function). |

| |

• |

|

Review with management the significant findings on internal audits during the year and management’s responses thereto, any difficulties the internal audit team encountered in the course of their audits, including

any restrictions on the scope of their work or access to required information. |

| |

• |

|

At least annually, conduct an executive session with the independent auditors. |

| |

• |

|

Discuss the Company’s annual audited financial statements and quarterly financial statements with management and the independent auditors, including the Company’s disclosures under “Management’s

Discussion and Analysis of Financial Condition and Results of Operations.” |

| |

• |

|

Discuss the Company’s earnings press releases, as well as financial information and any earnings guidance which may be provided to analysts and rating agencies. |

| |

• |

|

Discuss policies with respect to risk assessment and risk management. |

| |

• |

|

Set clear hiring policies for employees or former employees of the independent auditors. |

| |

• |

|

Review and assess the adequacy of this Charter and the performance of the Audit Committee on an annual basis. |

| |

• |

|

Take other actions as required by law or as may be requested by the Board of Directors. |

Accounting and Auditing Complaints and Concerns. The committee shall establish procedures for:

| |

• |

|

the receipt, retention, and treatment of complaints received by the Company regarding accounting, internal accounting controls or auditing matters; and |

| |

• |

|

the confidential, anonymous submission by employees of the Company of concerns regarding questionable accounting or auditing matters. |

Reporting. The Audit Committee shall report regularly to the Board of Directors and shall annually prepare and submit,

for inclusion in management’s proxy statement to stockholders in connection with the annual meeting of stockholders, a report in conformity with Item 407(d)(3)(i) of SEC Regulation S-K.

QLCC Authority and Responsibilities

In

serving as the Company’s Qualified Legal Compliance Committee, the Audit Committee shall have the authority and responsibility to:

| |

• |

|

Inform the Company’s Senior Vice President, General Counsel and Chief Compliance Officer and its President and Chief Executive Officer of any report of evidence of a material violation (“Material

Violation”) of SEC Rule 205.3 except in the circumstances described in §205.3(b)(4); |

Audit Committee Charter - 5

| |

• |

|

Determine whether an investigation is necessary regarding any report of evidence of a Material Violation by the Company, its officers, directors, employees or agents and, if it determines an investigation is necessary

or appropriate, to: |

| |

• |

|

Notify the Board of Directors; and |

| |

• |

|

Initiate an investigation, which may be conducted either by the Senior Vice President, General Counsel and Chief Compliance Officer or by outside attorneys; and |

| |

• |

|

Retain such additional expert personnel as the Audit Committee deems necessary; and |

| |

• |

|

At the conclusion of any such investigation, to: |

| |

• |

|

Recommend that the Company implement an appropriate response to evidence of a Material Violation; and |

| |

• |

|

Inform the Senior Vice President, General Counsel and Chief Compliance Officer and the President and Chief Executive Officer and the Board of Directors of the results of any such investigation and the appropriate

remedial measures to be adopted; and |

| |

• |

|

Take all other appropriate action, including the authority to notify the SEC in the event that the Company fails in any material respect to implement an appropriate response that the Audit Committee (acting in its

capacity as QLCC) has recommended the Company to take in respect of evidence of a Material Violation. |

Authority to Review and Approve

Swap Transactions

The Audit Committee shall have the authority to review and approve any decision by the Company or any of its

subsidiaries to enter into swap transactions, as defined in 7 U.S.C. § 1a (47) and the rules and regulations of the Commodity Futures Trading Commission thereunder, including any decision to enter into swaps, on a swap-by-swap or an

annual basis, that are exempt from the clearing and execution requirements of sections 2(h)(1) and 2(h)(8) of the Commodity Exchange Act for the purpose of satisfying the requirements necessary to elect the end-user exception to such clearing and

execution requirements as provided for by 17 C.F.R. § 39.6. Any annual approval issued by the Audit Committee as described above must be reviewed at least annually.

Audit Committee Charter - 6

Committee Resources

The Audit Committee is authorized to employ the services of such counsel, consultants, experts and personnel, including persons already

employed or engaged by the Company, as the Committee may deem reasonably necessary to enable it to fully perform its duties and fulfill its responsibilities. The Audit Committee shall determine the appropriate funding that the Company shall provide

for payments of compensation to the independent auditors, and to any experts or advisors employed by the Audit Committee, and payments for ordinary administrative expenses of the Audit Committee that are necessary or appropriate in carrying out its

duties.

Adopted by the Board of Directors April 4, 2000

Amended:

November 5, 2002

July 8, 2003

July 13, 2004

January 8, 2007

April 8, 2008

January 8, 2010

January 7, 2011

June 27, 2013

January 6, 2015

Audit Committee Charter - 7

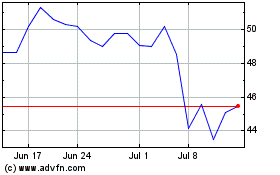

Greenbrier Companies (NYSE:GBX)

Historical Stock Chart

From Mar 2024 to Apr 2024

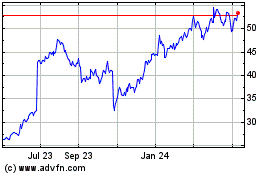

Greenbrier Companies (NYSE:GBX)

Historical Stock Chart

From Apr 2023 to Apr 2024