Greatbatch, Inc. (NYSE:GB) today announced results for its fourth

quarter and full-year ended January 1, 2016.

| |

Three Months Ended |

|

Year End |

| |

January 1, |

|

January 2, |

|

% |

|

January 1, |

|

January 2, |

|

% |

| (Dollars

in thousands, except per share data) |

2016 |

|

2015 |

|

Change |

|

2016 |

|

2015 |

|

Change |

| Sales |

$ |

317,567 |

|

|

$ |

169,726 |

|

|

87 |

% |

|

$ |

800,414 |

|

|

$ |

687,787 |

|

|

16 |

% |

| Organic Constant

Currency Sales Growth |

7 |

% |

|

(5 |

)% |

|

|

|

|

(2 |

)% |

|

3 |

% |

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| GAAP Diluted EPS |

$ |

(0.85 |

) |

|

$ |

0.54 |

|

|

(257 |

)% |

|

$ |

(0.29 |

) |

|

$ |

2.14 |

|

|

(114 |

)% |

| Adjusted Diluted

EPS* |

$ |

0.92 |

|

|

$ |

0.77 |

|

|

19 |

% |

|

$ |

2.90 |

|

|

$ |

2.86 |

|

|

1 |

% |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| EBITDA* |

$ |

5,592 |

|

|

$ |

27,871 |

|

|

(80 |

)% |

|

$ |

62,445 |

|

|

$ |

118,028 |

|

|

(47 |

)% |

| Adjusted EBITDA* |

$ |

69,005 |

|

|

$ |

36,295 |

|

|

90 |

% |

|

$ |

165,874 |

|

|

$ |

147,790 |

|

|

12 |

% |

| Adjusted EBITDA as a %

Sales |

21.7 |

% |

|

21.4 |

% |

|

|

|

20.7 |

% |

|

21.5 |

% |

|

|

|

* Refer to Tables A and B at the end of this release for a

reconciliation of adjusted amounts to GAAP.

CEO CommentsThomas J. Hook,

president & CEO, commented, “The fourth quarter marked the

completion of two major strategic initiatives for the

Company. First, we received PMA approval from the FDA for our

Algovita SCS system. This is the first ever PMA device

developed at Greatbatch, demonstrating our extensive capabilities

in bringing critical medical device technology to the market

addressing the needs of patients worldwide. The FDA approval of the

Algovita device facilitates the pending spin-off of Nuvectra, which

is targeted for completion in March 2016. Second, we

completed the transformative acquisition of Lake Region Medical on

October 27. The deal significantly expands our capabilities in

the Cardiac, Vascular and Orthopaedic markets and also extends our

reach into the Advanced Surgical market with a portfolio of

minimally invasive devices used in laparoscopic and drug delivery

applications. Completing the Lake Region acquisition marked

the achievement of a key strategic milestone. The combination

of the two companies under the new Integer brand establishes the

Company as the premier global medical device outsource partner,

with the scale and breadth of capabilities to meet the demands of

our customers and the patients they serve. Our primary focus in

2016 will be to integrate our cultures and operations into one

single integrated entity. Thus far the merger of the organizations

has gone extremely well and I’m confident that we will be able to

leverage the combined expertise to accelerate our growth over the

long term.”

CFO CommentsMichael Dinkins,

executive vice president and CFO, commented, “In the fourth

quarter, excluding the impact of our acquisition of Lake Region

Medical and foreign currency fluctuations, we achieved 7% organic

constant currency growth for our legacy Greatbatch business. While

sales fell short of expectations, legacy Greatbatch sales of $179

million represented a record quarter for the Company. We saw a

sequential increase in all of our product lines with growth

continuing to be fueled by demand for our neurostimulation

devices. We successfully invested to increase our

manufacturing capacity at CCC Medical and ramped production

throughout the year to meet this accelerated neurostimulation

customer demand. For the fourth quarter, adjusted

earnings per diluted share of $0.92 increased by 19% compared to

last year, primarily resulting from the higher sales volume and

reduced compensation expenses. It is important to note that the

acquisition of Lake Region, which was completed on October 27,

2015, was dilutive to our reported adjusted fourth quarter earnings

per share by $0.08 due to the additional interest expense and

shares issued in connection with the acquisition. Excluding Lake

Region, adjusted earnings per share would have been $1.00 for the

quarter, representing an increase of 30% compared to last

year.”

Dinkins continued “For the year, Neuromodulation

growth was offset by the downturn in the Energy market, coupled

with inventory and market adjustments, primarily in our Cardiac

market. With the addition of $800 million in diversified Lake

Region revenues, we will be in a better position to extend our

market reach and add critical medical device capabilities that our

customers require. Despite the headwinds that we faced in

2015, we were able to organically grow our adjusted diluted

earnings per share by 3% over 2014, which demonstrates our ability

to control costs and improve efficiencies. We will continue

this focus and leverage the strengths of the new Integer

organization to drive long-term growth and profitability.”

Dinkins concluded, “Looking ahead to 2016, we

are actively working on the integration of the two companies. The

integration is going extremely well and we are on track to achieve

the targeted first year synergies of $25 million. In

addition, we are in the process of conducting top-to-top meetings

with our major customers and are very encouraged by the

opportunities to deepen our partnerships. Lastly, we are finalizing

the sales organization structure and plans for the upcoming year

and expect these plans to be concluded in the next few weeks.”

Fourth Quarter and Full Year

ResultsDuring the fourth quarter of 2015, we completed our

acquisition of Lake Region Medical Holdings, Inc. (“Lake Region

Medical”) for a total purchase price, including debt assumed, of

approximately $1.77 billion. Lake Region Medical offers fully

integrated outsourced manufacturing and engineering services,

contract manufacturing, finished device assembly, original device

development and supply chain management services from concept to

point-of-care in the cardio & vascular and advanced surgical

markets. After completing the acquisition, Greatbatch is one of the

largest medical device outsource manufacturers in the world. In

connection with our acquisition of Lake Region Medical, we have

recast our revenue by product line disclosures into the following

four categories: Advanced Surgical, Orthopaedics, and Portable

Medical; Cardio and Vascular; Cardiac/Neuromodulation; and

Electrochem. Prior period amounts have been recast to be presented

on a comparable basis. The combined company of Greatbatch and Lake

Region Medical is expected to be renamed Integer Holdings

Corporation later this year following shareholder approval.

Fourth quarter 2015 sales increased 87% in

comparison to the prior year period. Fourth quarter 2015 revenue

includes two months of operations from our acquisition of Lake

Region Medical, which added $138.6 million to sales. Additionally,

sales for the quarter continued to be impacted by foreign currency

exchange rate fluctuations, which reduced sales by approximately

$2.5 million ($14.5 million for full year 2015) in comparison to

the prior year. Excluding the impact of our acquisition of Lake

Region Medical and foreign currency exchange rates, fourth quarter

2015 sales increased 7% over the prior year primarily due to

increased Cardiac/Neuromodulation (26% organic constant currency

growth), and Cardio and Vascular (10% organic constant currency

growth) revenue growth. The increase in Cardiac/Neuromodulation

sales was primarily driven by a neuromodulation customer product

launch, while the increase in Cardio and Vascular revenue was

primarily due to customers building safety stock in anticipation of

our product line transfers to our Tijuana, Mexico facility in the

first quarter of 2016. These increases were partially offset by a

43% decline in Electrochem sales due to a slowdown in the energy

markets, which has caused customers to reduce drilling and

exploration volumes. For fiscal year 2015, sales declined 2% on an

organic constant currency basis in comparison to 2014 as the

benefit of the neuromodulation customer product launch was offset

by the runoff of end of life products from our legacy cardiac

customers, as well as a 27% decline in Electrochem sales due to the

slowdown in the energy markets.

Gross profit for the fourth quarter of 2015

increased 28% in comparison to the prior year period. This increase

was primarily due to the increase in sales as discussed above, as

well as lower performance-based compensation. Our gross profit as a

percentage of sales for the fourth quarter of 2015 was 23.0%

compared to 33.7% for the fourth quarter of 2014. Excluding the

impact of the Lake Region Medical acquisition, which included $23.0

million of inventory step-up amortization, our gross profit as a

percentage of sales for the fourth quarter of 2015 would have been

approximately 37.1%. For fiscal year 2015, gross profit increased

2% due to the Lake Region Medical acquisition. For fiscal year

2015, our gross profit as a percentage of sales was 29.4%.

Excluding the impact of the Lake Region Medical acquisition and

inventory step-up amortization, our gross profit as a percentage of

sales for fiscal year 2015 would have been approximately 34.5%,

primarily due to a lower level of performance-based compensation

and on-going continuous improvement projects.

Selling, general and administrative (“SG&A”)

expenses for the fourth quarter of 2015 increased $8.7 million or

35% in comparison to the same period of 2014. Excluding the impact

of the Lake Region Medical acquisition, which added $12.6 million

to SG&A expenses, SG&A decreased $3.9 million. This

decrease was primarily due to lower performance-based compensation

($2.1 million), as well as cost savings from our various

consolidation initiatives. For fiscal year 2015, SG&A expenses

increased $11.9 million primarily due to our acquisition of Lake

Region Medical, the full year impact of CCC Medical Devices ($2.2

million), which was acquired in August 2014, as well as

higher legal fees in connection with intellectual property (“IP”)

related litigation ($1.9 million). These increases were partially

offset by lower performance-based compensation ($4.1 million) as

well as cost savings from our various consolidation

initiatives.

Net research, development and engineering

(“RD&E”) costs for the fourth quarter of 2015 increased $3.2

million or 32% in comparison to the same period of 2014. Excluding

the impact of the Lake Region Medical acquisition, which added $1.8

million to RD&E expenses, RD&E increased $1.4 million. This

increase was primarily attributable to a decrease in customer cost

reimbursements of $1.2 million. For fiscal year 2015, RD&E

expenses increased $3.2 million primarily due to our acquisition of

Lake Region Medical and lower customer cost reimbursements of $2.4

million. These increases were partially offset by lower

performance-based compensation of $2.5 million.

Other operating expenses, net (“OOE”) for the

fourth quarter of 2015 increased $31.9 million in comparison to the

same period of 2014. This increase was primarily due to costs

incurred in connection with our acquisition of Lake Region Medical

($28.0 million), which included change in control payments,

investment banking fees and other professional and consulting fees.

This increase can also be attributed to costs incurred in

connection with our pending spin-off of Nuvectra ($1.4 million), as

well as an increase in consolidation costs incurred by both

Greatbatch and Lake Region Medical ($3.0 million). For fiscal year

2015, OOE expenses increased $51.1 million primarily due to costs

incurred in connection with our acquisition of Lake Region Medical

($33.1 million), our pending spin-off of Nuvectra ($6.0 million)

and increased consolidation costs ($14.1 million) in connection

with the transfer of our portable medical and vascular product

lines to Tijuana, Mexico.

Interest expense for the fourth quarter and full

year of 2015 increased $24.3 million and $29.3 million,

respectively, in comparison to the same periods of 2014. These

increases were due to higher debt levels in connection with the

Lake Region Medical acquisition as well as transaction costs (i.e.

debt commitment fees, interest rate swap termination costs, debt

extinguishment charges) incurred in connection with our acquisition

of Lake Region Medical of $4.7 million for the fourth quarter of

2015 and $9.5 million for full year 2015.

The effective tax rate for fiscal year 2015 was

51.6% compared to 27.6% for fiscal year 2014. On an adjusted basis,

our effective tax rate was 22.1% for 2015 compared to 28.8% for

2014. The 2015 and 2014 GAAP and adjusted effective tax rates

include the benefit of the Federal research and development tax

credit (“R&D Tax Credit”), which was reinstated in the fourth

quarter of 2015 and fourth quarter of 2014 for each respective

year. As required, the R&D Tax Credit is recognized in the

quarter the legislation is enacted. In addition to the above, the

2015 GAAP and adjusted effective tax rates benefited from higher

income in lower tax jurisdictions, which was partially offset by

nondeductible transaction costs in connection with the acquisition

of Lake Region Medical and the pending spin-off of Nuvectra. These

nondeductible transaction costs are not tax-effected for purposes

of calculating adjusted diluted EPS amounts. Refer to Table A at

the end of this release for a reconciliation of GAAP net income

(loss) to adjusted amounts and the “Use of Non-GAAP Financial

Information” section below.

GAAP and adjusted diluted EPS for the fourth

quarter of 2015 were a loss of $0.85 and earnings of $0.92,

respectively, compared to earnings of $0.54 and $0.77,

respectively, for the fourth quarter of 2014. For fiscal year 2015,

GAAP and adjusted diluted EPS were a loss of $0.29 and earnings of

$2.90, respectively, compared to earnings of $2.14 and $2.86,

respectively, for fiscal year 2014. The Company estimates that the

Lake Region Medical acquisition was approximately 2% dilutive to

2015 adjusted diluted EPS, and that excluding this impact, adjusted

diluted EPS would have increased approximately 3% in comparison to

2014. Refer to Table A at the end of this release for a

reconciliation of GAAP net income (loss) and diluted EPS to

adjusted amounts and the “Use of Non-GAAP Financial Information”

section below.

Cash flows provided by operating activities for

2015 was $12 million compared to $81 million for 2014. This

decrease was primarily due to the significant increase in

consolidation and acquisition related costs. Similar to cash flow

from operations, our earnings before interest, taxes, depreciation

and amortization (“EBITDA”) decreased to $62.4 million in 2015

compared to $118.0 million in 2014. However, on an adjusted basis,

which excludes, among others, these consolidation and acquisition

related costs, our adjusted EBITDA increased 12% to $165.9 million.

Refer to Table B at the end of this release for a reconciliation of

GAAP net income (loss) to adjusted EBITDA amounts and the “Use of

Non-GAAP Financial Information” section below.

Product Line SalesThe following

table summarizes the Company’s sales by major product lines

(dollars in thousands):

| |

Three Months Ended |

| |

January 1,2016 |

|

January 2, 2015 |

|

|

| Product

Line |

Legacy Greatbatch |

|

Lake Region |

|

Total |

|

Total |

|

%Change |

| Advanced Surgical,

Orthopaedics, and Portable Medical |

$ |

54,729 |

|

|

$ |

37,861 |

|

|

$ |

92,590 |

|

|

$ |

56,415 |

|

|

64 |

% |

| Cardio and

Vascular |

17,094 |

|

|

88,796 |

|

|

105,890 |

|

|

15,560 |

|

|

581 |

% |

|

Cardiac/Neuromodulation |

93,888 |

|

|

13,726 |

|

|

107,614 |

|

|

74,493 |

|

|

44 |

% |

| Electrochem |

13,217 |

|

|

— |

|

|

13,217 |

|

|

23,258 |

|

|

(43 |

)% |

| Elimination of

Interproduct Line Sales |

— |

|

|

(1,744 |

) |

|

(1,744 |

) |

|

— |

|

|

NA |

|

| Total Sales |

$ |

178,928 |

|

|

$ |

138,639 |

|

|

$ |

317,567 |

|

|

$ |

169,726 |

|

|

87 |

% |

| |

|

|

|

|

|

|

|

|

|

| Organic Constant

Currency Sales Increase (Decrease) |

|

|

|

|

7 |

% |

|

(5 |

)% |

|

|

| Advanced Surgical,

Orthopaedics, and Portable MedicalOrganic Constant Currency Sales

Increase |

|

|

|

|

1 |

% |

|

10 |

% |

|

|

| |

Year Ended |

| |

January 1,2016 |

|

January 2, 2015 |

|

|

| Product

Line |

Legacy Greatbatch |

|

Lake Region |

|

Total |

|

Total |

|

%Change |

| Advanced Surgical,

Orthopaedics, and Portable Medical |

$ |

205,524 |

|

|

$ |

37,861 |

|

|

$ |

243,385 |

|

|

$ |

216,339 |

|

|

13 |

% |

| Cardio and

Vascular |

54,464 |

|

|

88,796 |

|

|

143,260 |

|

|

58,770 |

|

|

144 |

% |

|

Cardiac/Neuromodulation |

342,338 |

|

|

13,726 |

|

|

356,064 |

|

|

330,921 |

|

|

8 |

% |

| Electrochem |

59,449 |

|

|

— |

|

|

59,449 |

|

|

81,757 |

|

|

(27 |

)% |

| Elimination of

Interproduct Line Sales |

— |

|

|

(1,744 |

) |

|

(1,744 |

) |

|

— |

|

|

NA |

|

| Total Sales |

$ |

661,775 |

|

|

$ |

138,639 |

|

|

$ |

800,414 |

|

|

$ |

687,787 |

|

|

16 |

% |

| |

|

|

|

|

|

|

|

|

|

|

|

| Organic Constant

Currency Sales Increase (Decrease) |

|

|

|

|

(2 |

)% |

|

3 |

% |

|

|

| Advanced Surgical,

Orthopaedics, and Portable MedicalOrganic Constant Currency Sales

Increase |

|

|

|

|

2 |

% |

|

12 |

% |

|

|

In connection with our acquisition of Lake

Region Medical, we have recast our revenue by product line into the

following four categories:

- Advanced Surgical, Orthopaedics, and Portable Medical -

Includes legacy Greatbatch Orthopaedics and Portable Medical

product line sales plus the legacy Lake Region Medical Advanced

Surgical product line sales.

- Cardio and Vascular - Includes the legacy Greatbatch Vascular

product line sales plus the legacy Lake Region Medical Cardio and

Vascular product line sales less the legacy Lake Region Medical

Cardiac/Neuromodulation sales.

- Cardiac/Neuromodulation - Includes the legacy Greatbatch

Cardiac/Neuromodulation and QiG sales plus the legacy Lake Region

Medical Cardiac/Neuromodulation sales previously included in their

Cardio and Vascular product line sales.

- Electrochem - Includes the legacy Greatbatch Energy, Military

and Environmental product line sales.

Product Line Sales

HighlightsFourth quarter 2015 Advanced Surgical,

Orthopaedics, and Portable Medical sales increased $36.2 million in

comparison to the prior year period and includes $37.9 million of

sales from the former Lake Region Medical since the date of

acquisition. Additionally, during the quarter this product line

continued to be impacted by the weakening Euro, which reduced sales

by approximately $2.5 million ($14.5 million for full year 2015) in

comparison to the prior year. On an organic constant currency

basis, our Advanced Surgical, Orthopaedics, and Portable Medical

product line fourth quarter sales increased 1% in comparison to the

prior year. For fiscal year 2015, Advanced Surgical,

Orthopaedics, and Portable Medical sales increased 2% on an organic

constant currency basis in comparison to 2014 primarily due to

market growth.

Fourth quarter 2015 Cardio and Vascular sales

increased $90.3 million in comparison to the prior year period and

includes $88.8 million of sales from the former Lake Region Medical

since the date of acquisition. On an organic constant currency

basis, our Cardio and Vascular sales increased 10% during the

quarter as customers built safety stock in anticipation of our

product line transfers to our Tijuana, Mexico facility scheduled to

occur during the first half of 2016. For fiscal year 2015, Cardio

and Vascular sales decreased 7% on an organic constant currency

basis in comparison to 2014 due to the end of life on some legacy

products.

Fourth quarter 2015 Cardiac/Neuromodulation

sales increased $33.1 million in comparison to the prior year

period and includes $13.7 million of sales from the former Lake

Region Medical since the date of acquisition. On an organic

constant currency basis, our Cardiac/Neuromodulation sales

increased 26% during the quarter primarily due to a neuromodulation

customer product launch, which is expected to normalize beginning

in the first quarter of 2016. For fiscal year 2015,

Cardiac/Neuromodulation sales increased 2% on an organic constant

currency basis in comparison to 2014 as the benefit of the

neuromodulation customer product launch was partially offset by the

runoff of end of life products from our legacy cardiac

customers.

Fourth quarter and full year 2015 Electrochem

sales declined 43% and 27%, respectively. This decrease was

primarily due to the slowdown in the energy markets, which has

caused customers to reduce drilling and exploration volumes. We

currently expect the slowdown in the energy markets to continue to

be a headwind to Electrochem sales throughout 2016.

Conference CallThe Company will

host a conference call on Monday, February 29, 2016 at 5:00 p.m.

E.T. to discuss these results. The scheduled conference call will

be webcast live and is accessible through the Company’s website at

www.greatbatch.com or by dialing 866-562-8327 and the

participant passcode is 32338707. An audio replay will also be

available beginning from 8:00 p.m. E.T. on February 29, 2016 until

March 7, 2016. To access the replay, dial 855-859-2056 and enter

the passcode 32338707.

About Greatbatch, Inc.Greatbatch, Inc.

(NYSE:GB) is one of the largest medical device outsource

manufacturers in the world serving the cardiac, neuromodulation,

orthopaedics, vascular, advanced surgical and portable medical

markets. The Company provides innovative, high quality medical

technologies that enhance the lives of patients worldwide. In

addition, it develops batteries for high-end niche applications in

energy, military, and environmental markets. The Company’s brands

include Greatbatch Medical, Lake Region Medical and Electrochem.

Additional information is available at www.greatbatch.com.

Use of Non-GAAP Financial

InformationIn addition to our results reported in

accordance with generally accepted accounting principles (“GAAP”),

we provide adjusted net income, adjusted earnings per diluted

share, EBITDA, adjusted EBITDA and organic constant currency sales

growth rates. Adjusted net income and adjusted earnings per diluted

share consist of GAAP amounts adjusted for the following to the

extent occurring during the period: (i) acquisition-related

charges, (ii) amortization of intangible assets (iii) facility

consolidation, optimization, manufacturing transfer and system

integration charges, (iv) asset write-down and disposition charges,

(v) charges in connection with corporate realignments or a

reduction in force, (vi) certain litigation expenses, charges and

gains, (vii) unusual or infrequently occurring items, (viii)

gain/loss on cost and equity method investments, (ix) the income

tax (benefit) related to these adjustments and (x) certain tax

items related to the Federal research and development tax credit

which are outside the normal benefit received for the period.

Adjusted earnings per diluted share are calculated by dividing

adjusted net income by diluted weighted average shares outstanding.

Adjusted EBITDA consists of GAAP net income plus (i) the same

adjustments as listed above except for items (ix), and (x), (ii)

GAAP stock-based compensation, interest expense, and depreciation,

(iii) GAAP provision (benefit) for income taxes and (iv) cash gains

received from cost and equity method investments. To calculate

organic constant currency sales growth rates, which exclude the

impact of changes in foreign currency exchange rates, as well as

the impact of any acquisitions or divestitures of product lines on

sales growth rates, we convert current period sales from local

currency to U.S. dollars using the previous periods’ foreign

currency exchange rates and exclude the amount of sales

acquired/divested during the period from the current/previous

period amounts, respectively. We believe that the presentation of

adjusted net income, adjusted diluted earnings per share, EBITDA,

adjusted EBITDA and organic constant currency sales growth rates

provides important supplemental information to management and

investors seeking to understand the financial and business trends

relating to our financial condition and results of operations.

Forward-Looking StatementsSome

of the statements contained in this press release and other written

and oral statements made from time to time by us and our

representatives are not statements of historical or current fact.

As such, they are “forward-looking statements” within the meaning

of Section 27A of the Securities Act of 1933, as amended, and

Section 21E of the Securities Exchange Act of 1934, as

amended. We have based these forward-looking statements on our

current expectations, and these statements are subject to known and

unknown risks, uncertainties and assumptions. Forward-looking

statements include statements relating to:

- future sales, expenses and profitability;

- future development and expected growth of our business and

industry;

- our ability to execute our business model and our business

strategy;

- our ability to identify trends within our industries and to

offer products and services that meet the changing needs of those

markets; and

- projected capital expenditures.

You can identify forward-looking statements by

terminology such as “may,” “will,” “should,” “could,” “expects,”

“intends,” “plans,” “anticipates,” “believes,” “estimates,”

“predicts,” “potential” or “continue” or “variations” or the

negative of these terms or other comparable terminology. These

statements are only predictions. Actual events or results may

differ materially from those stated or implied by these

forward-looking statements. In evaluating these statements and our

prospects, you should carefully consider the factors set forth

below. All forward-looking statements attributable to us or persons

acting on our behalf are expressly qualified in their entirety by

these cautionary factors and to others contained throughout this

report. We are under no duty to update any of the forward-looking

statements after the date of this release or to conform these

statements to actual results.

Although it is not possible to create a

comprehensive list of all factors that may cause actual results to

differ from the results expressed or implied by our forward-looking

statements or that may affect our future results, some of these

factors include the following: our high level of indebtedness

following the acquisition of Lake Region Medical, our inability to

pay principal and interest on this high level of outstanding

indebtedness, and the risk that this high level of indebtedness

limits our ability to invest in our business and overall financial

flexibility; our dependence upon a limited number of customers;

customer ordering patterns; product obsolescence; our inability to

market current or future products; pricing pressure from customers;

our ability to timely and successfully implement cost reduction and

plant consolidation initiatives; our reliance on third party

suppliers for raw materials, products and subcomponents;

fluctuating operating results; our inability to maintain high

quality standards for our products; challenges to our intellectual

property rights; product liability claims; product field actions or

recalls; our inability to successfully consummate and integrate

acquisitions, including the acquisition of Lake Region Medical, and

to realize synergies and benefits from these acquisitions and to

operate these acquired businesses in accordance with expectations;

our unsuccessful expansion into new markets; our failure to develop

new products including system and device products; the timing,

progress and ultimate success of pending regulatory actions and

approvals, including with respect to Algovita; risks associated

with the pending spin-off of Nuvectra including our ability to

execute the spin-off successfully, the timing and taxable nature of

the spin-off, and the performance of Nuvectra post spin-off; our

inability to obtain licenses to key technology; regulatory changes,

including Health Care Reform, or consolidation in the healthcare

industry; global economic factors including currency exchange rates

and interest rates; the resolution of various legal actions brought

against the Company; and other risks and uncertainties that arise

from time to time and are described in Item 1A “Risk Factors”

of the Company’s Annual Report on Form 10-K and in other periodic

filings with the Securities and Exchange Commission. The Company

assumes no obligation to update forward-looking statements in this

press release whether to reflect changed assumptions, the

occurrence of unanticipated events or changes in future operating

results, financial conditions or prospects, or otherwise.

Table A: Net Income (Loss) and Diluted EPS

Reconciliation

| |

Three Months Ended |

|

Year Ended |

| |

January 1, 2016 |

|

January 2, 2015 |

|

January 1, 2016 |

|

January 2, 2015 |

| (in thousands

except per share amounts) |

NetIncome (Loss) |

|

PerDilutedShare |

|

NetIncome |

|

PerDilutedShare |

|

NetIncome (Loss) |

|

PerDilutedShare |

|

NetIncome |

|

PerDilutedShare |

| Net income (loss) as

reported |

$ |

(24,907 |

) |

|

$ |

(0.85 |

) |

|

$ |

14,176 |

|

|

$ |

0.54 |

|

|

$ |

(7,594 |

) |

|

$ |

(0.29 |

) |

|

$ |

55,458 |

|

|

$ |

2.14 |

|

| Adjustments: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Amortization of

intangibles(a)(c) |

5,277 |

|

|

0.18 |

|

|

2,432 |

|

|

0.09 |

|

|

12,273 |

|

|

0.45 |

|

|

9,637 |

|

|

0.37 |

|

| Inventory step-up amortization

(COS)(c) |

15,605 |

|

|

0.52 |

|

|

138 |

|

|

0.01 |

|

|

15,605 |

|

|

0.57 |

|

|

195 |

|

|

0.01 |

|

| IP related litigation

(SG&A)(b)(c) |

735 |

|

|

0.02 |

|

|

628 |

|

|

0.02 |

|

|

2,871 |

|

|

0.11 |

|

|

1,626 |

|

|

0.06 |

|

| Consolidation and optimization

expenses (OOE)(c)(d) |

5,736 |

|

|

0.19 |

|

|

2,804 |

|

|

0.11 |

|

|

21,158 |

|

|

0.77 |

|

|

6,567 |

|

|

0.25 |

|

| Acquisition and integration

expenses (OOE)(c)(e) |

20,924 |

|

|

0.69 |

|

|

222 |

|

|

0.01 |

|

|

25,885 |

|

|

0.95 |

|

|

61 |

|

|

— |

|

| Asset dispositions, severance and

other (OOE)(c)(f) |

1,499 |

|

|

0.05 |

|

|

1,187 |

|

|

0.05 |

|

|

5,099 |

|

|

0.19 |

|

|

3,463 |

|

|

0.13 |

|

| Lake Region Medical transaction

costs (interest expense)(c)(g) |

3,039 |

|

|

0.10 |

|

|

— |

|

|

— |

|

|

6,151 |

|

|

0.23 |

|

|

— |

|

|

— |

|

| (Gain) loss on cost and equity

method investments, net (other income, net)(c)(h) |

1,150 |

|

|

0.04 |

|

|

(290 |

) |

|

(0.01 |

) |

|

(2,177 |

) |

|

(0.08 |

) |

|

(2,841 |

) |

|

(0.11 |

) |

| R&D Tax Credit(i) |

(1,200 |

) |

|

(0.04 |

) |

|

(1,200 |

) |

|

(0.05 |

) |

|

— |

|

|

— |

|

|

— |

|

|

— |

|

| Adjusted net income and diluted

EPS(j) |

$ |

27,858 |

|

|

$ |

0.92 |

|

|

$ |

20,097 |

|

|

$ |

0.77 |

|

|

$ |

79,271 |

|

|

$ |

2.90 |

|

|

$ |

74,166 |

|

|

$ |

2.86 |

|

| Adjusted diluted weighted average

shares(k) |

30,125 |

|

|

|

|

26,071 |

|

|

|

|

27,304 |

|

|

|

|

25,975 |

|

|

|

(a) Given our acquisition of Lake Region Medical

in the fourth quarter of 2015 and in order to present our financial

results in a form more comparable to other medical device companies

and less acquisitive companies, during the third quarter of 2015,

we began excluding intangible asset amortization for purposes of

calculating adjusted net income and adjusted diluted EPS. Prior

period adjusted amounts have been recalculated to exclude

intangible amortization for all periods presented.(b) In 2013, we

filed suit against AVX Corporation alleging they were infringing on

our intellectual property. Given the complexity and significant

costs incurred pursuing this litigation, during the second quarter

of 2015, we began excluding these litigation expenses from adjusted

amounts. Total costs incurred in connection with this litigation in

2015 was $4.4 million pre-tax. This matter proceeded to trial

during the first quarter of 2016 and a federal jury awarded

Greatbatch $37.5 million in damages. Prior period adjusted amounts

have been recalculated to exclude these costs for all periods

presented.(c) Net of tax amounts computed using a 35% U.S., Mexico,

and France statutory tax rate, a 25% Uruguay statutory tax rate,

and a 12.5% Ireland statutory tax rate. Expenses that are not

deductible for tax purposes (i.e. permanent tax differences) are

added back at 100%.(d) During 2015 and 2014, we incurred costs

primarily related to the transfer of our Beaverton, OR portable

medical and Plymouth, MN vascular manufacturing operations to

Tijuana, Mexico. Additionally, with the acquisition of Lake Region

Medical, these costs now include expenses incurred in connection

with the closure of Lake Region Medical’s Arvada, Colorado site and

the consolidation of its two Galway, Ireland sites initiated by

Lake Region Medical in 2014.(e) During 2015, we incurred costs

related to the acquisition of Lake Region Medical ($28.0 million

pre-tax during the fourth quarter of 2015 and $33.1 million pre-tax

for fiscal year 2015) and the integration of CCC Medical Devices.

During 2014, we incurred costs related to the integration of CCC

Medical Devices.(f) 2015 costs primarily include legal and

professional fees incurred in connection with the pending spin-off

of Nuvectra ($1.4 million pre-tax during the fourth quarter of 2015

and $6.0 million pre-tax for fiscal year 2015). 2014 costs

primarily include costs in connection with our business

reorganization to realign our contract manufacturing operations.(g)

We recorded $4.7 million pre-tax and $9.5 million pre-tax for the

2015 fourth quarter and full-year periods, respectively, in

transaction costs (i.e. debt commitment fees, interest rate swap

termination costs, debt extinguishment charges) in connection with

our acquisition of Lake Region Medical.(h) Pre-tax amount is a loss

of $1.8 million and a gain of $3.4 million for the 2015 fourth

quarter and full-year periods, respectively, and a gain of $445

thousand and $4.4 million for the 2014 fourth quarter and full-year

periods, respectively.(i) The 2015 Federal R&D tax credit was

enacted during the fourth quarter of 2015 and the 2014 Federal

R&D tax credit was enacted in the fourth quarter of 2014.

Amounts assume that the tax credit was effective at the beginning

of the year for 2015 and 2014. (j) The per share data in this table

have been rounded to the nearest $0.01 and therefore may not sum to

the total.(k) Fourth quarter and full year 2015 adjusted diluted

weighted average shares include 947,000 and 941,000 shares of

dilution, respectively, related to outstanding equity awards that

were not dilutive for GAAP EPS purposes.

Table B: EBITDA and Adjusted EBITDA

Reconciliation

| |

Three Months Ended |

|

Year Ended |

| |

January 1, |

|

January 2, |

|

January 1, |

|

January 2, |

| (dollars in

thousands) |

2016 |

|

2015 |

|

2016 |

|

2015 |

| Net income (loss) as

reported |

$ |

(24,907 |

) |

|

$ |

14,176 |

|

|

$ |

(7,594 |

) |

|

$ |

55,458 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Interest expense |

25,362 |

|

|

1,044 |

|

|

33,513 |

|

|

4,252 |

|

| Provision (benefit) for

income taxes |

(12,554 |

) |

|

3,310 |

|

|

(8,106 |

) |

|

21,121 |

|

| Depreciation |

10,203 |

|

|

5,915 |

|

|

27,136 |

|

|

23,320 |

|

| Amortization |

7,488 |

|

|

3,426 |

|

|

17,496 |

|

|

13,877 |

|

| EBITDA |

5,592 |

|

|

27,871 |

|

|

62,445 |

|

|

118,028 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Inventory step-up

amortization |

22,986 |

|

|

173 |

|

|

22,986 |

|

|

260 |

|

| IP related

litigation |

1,131 |

|

|

967 |

|

|

4,417 |

|

|

2,502 |

|

| Stock-based

compensation |

288 |

|

|

2,655 |

|

|

9,287 |

|

|

12,893 |

|

| Consolidation and

optimization expenses |

7,191 |

|

|

4,218 |

|

|

26,393 |

|

|

11,188 |

|

| Acquisition and

integration expenses |

28,083 |

|

|

251 |

|

|

33,449 |

|

|

3 |

|

| Asset dispositions,

severance and other |

1,741 |

|

|

605 |

|

|

6,622 |

|

|

4,106 |

|

| Noncash (gain) loss on

cost and equity method investments |

1,993 |

|

|

(445 |

) |

|

275 |

|

|

(1,190 |

) |

| Adjusted EBITDA |

$ |

69,005 |

|

|

$ |

36,295 |

|

|

$ |

165,874 |

|

|

$ |

147,790 |

|

| Adjusted EBITDA as a % of

sales |

21.7 |

% |

|

21.4 |

% |

|

20.7 |

% |

|

21.5 |

% |

During the year, we changed our calculation and

presentation of Adjusted EBITDA in order to present our financial

results in a form more consistent with other medical device

companies, as well as our debt covenant calculations. The primary

difference between the current and former calculation is that

stock-based compensation is now added back to GAAP net income

(loss) to derive Adjusted EBITDA. Prior period adjusted amounts

have been recalculated to be presented on a comparable basis.

| CONDENSED CONSOLIDATED STATEMENTS OF

OPERATIONS - Unaudited |

| (in thousands except per share

data) |

|

|

|

|

|

|

|

Three Months Ended |

|

Year Ended |

|

|

January 1, |

|

January 2, |

|

January 1, |

|

January 2, |

|

|

2016 |

|

2015 |

|

2016 |

|

2015 |

| Sales |

$ |

317,567 |

|

|

$ |

169,726 |

|

|

$ |

800,414 |

|

|

$ |

687,787 |

|

| Cost of sales |

244,427 |

|

|

112,512 |

|

|

565,279 |

|

|

456,389 |

|

| Gross profit |

73,140 |

|

|

57,214 |

|

|

235,135 |

|

|

231,398 |

|

| Operating

expenses: |

|

|

|

|

|

|

|

| Selling, general and administrative

expenses |

33,509 |

|

|

24,849 |

|

|

102,530 |

|

|

90,602 |

|

| Research, development and

engineering costs, net |

13,088 |

|

|

9,883 |

|

|

52,995 |

|

|

49,845 |

|

| Other operating expenses, net |

37,015 |

|

|

5,074 |

|

|

66,464 |

|

|

15,297 |

|

| Total operating expenses |

83,612 |

|

|

39,806 |

|

|

221,989 |

|

|

155,744 |

|

| Operating income (loss) |

(10,472 |

) |

|

17,408 |

|

|

13,146 |

|

|

75,654 |

|

| Interest expense |

25,362 |

|

|

1,044 |

|

|

33,513 |

|

|

4,252 |

|

| (Gain) loss on cost and

equity method investments, net |

1,769 |

|

|

(445 |

) |

|

(3,350 |

) |

|

(4,370 |

) |

| Other income, net |

(142 |

) |

|

(677 |

) |

|

(1,317 |

) |

|

(807 |

) |

| Income (loss) before

provision (benefit) for income taxes |

(37,461 |

) |

|

17,486 |

|

|

(15,700 |

) |

|

76,579 |

|

| Provision (benefit) for

income taxes |

(12,554 |

) |

|

3,310 |

|

|

(8,106 |

) |

|

21,121 |

|

| Net income (loss) |

$ |

(24,907 |

) |

|

$ |

14,176 |

|

|

$ |

(7,594 |

) |

|

$ |

55,458 |

|

| |

|

|

|

|

|

|

|

| Earnings (loss) per

share: |

|

|

|

|

|

|

|

| Basic |

$ |

(0.85 |

) |

|

$ |

0.57 |

|

|

$ |

(0.29 |

) |

|

$ |

2.23 |

|

| Diluted |

$ |

(0.85 |

) |

|

$ |

0.54 |

|

|

$ |

(0.29 |

) |

|

$ |

2.14 |

|

| |

|

|

|

|

|

|

|

| Weighted average shares

outstanding: |

|

|

|

|

|

|

|

| Basic |

29,178 |

|

|

24,948 |

|

|

26,363 |

|

|

24,825 |

|

| Diluted |

29,178 |

|

|

26,071 |

|

|

26,363 |

|

|

25,975 |

|

| CONDENSED CONSOLIDATED BALANCE SHEETS -

Unaudited |

| (in thousands) |

|

|

|

|

|

As of |

|

|

January 1, |

|

January 2, |

|

ASSETS |

2016 |

|

2015 |

| Current assets: |

|

|

|

| Cash and cash equivalents |

$ |

82,478 |

|

|

$ |

76,824 |

|

| Accounts receivable, net |

207,342 |

|

|

124,953 |

|

| Inventories |

252,166 |

|

|

129,242 |

|

| Refundable income taxes |

11,730 |

|

|

1,716 |

|

| Deferred income taxes |

— |

|

|

6,168 |

|

| Prepaid expenses and other current

assets |

20,888 |

|

|

11,780 |

|

| Total current assets |

574,604 |

|

|

350,683 |

|

| Property, plant and

equipment, net |

379,492 |

|

|

144,925 |

|

| Amortizing intangible

assets, net |

893,977 |

|

|

65,337 |

|

| Indefinite-lived

intangible assets |

90,288 |

|

|

20,288 |

|

| Goodwill |

1,013,570 |

|

|

354,393 |

|

| Deferred income

taxes |

3,587 |

|

|

2,626 |

|

| Other assets |

26,618 |

|

|

16,870 |

|

| Total assets |

$ |

2,982,136 |

|

|

$ |

955,122 |

|

| |

|

|

|

| LIABILITIES AND

STOCKHOLDERS’ EQUITY |

|

|

|

| Current

liabilities: |

|

|

|

| Current portion of long-term

debt |

$ |

29,000 |

|

|

$ |

11,250 |

|

| Accounts payable |

84,362 |

|

|

46,436 |

|

| Income taxes payable |

3,221 |

|

|

2,003 |

|

| Deferred income taxes |

— |

|

|

588 |

|

| Accrued expenses |

97,257 |

|

|

48,384 |

|

| Total current liabilities |

213,840 |

|

|

108,661 |

|

| Long-term debt |

1,685,053 |

|

|

175,363 |

|

| Deferred income

taxes |

221,804 |

|

|

53,195 |

|

| Other long-term

liabilities |

10,814 |

|

|

4,541 |

|

| Total liabilities |

2,131,511 |

|

|

341,760 |

|

| Stockholders’

equity: |

|

|

|

| Preferred stock |

— |

|

|

— |

|

| Common stock |

31 |

|

|

25 |

|

| Additional paid-in capital |

620,470 |

|

|

366,073 |

|

| Treasury stock |

(3,100 |

) |

|

(1,307 |

) |

| Retained earnings |

231,854 |

|

|

239,448 |

|

| Accumulated other comprehensive

income |

1,370 |

|

|

9,123 |

|

| Total stockholders’ equity |

850,625 |

|

|

613,362 |

|

| Total liabilities and stockholders’

equity |

$ |

2,982,136 |

|

|

$ |

955,122 |

|

In the fourth quarter of 2015, we adopted

Accounting Standards Update (“ASU”) No. 2015-03,

“Interest-Imputation of Interest (Subtopic 835-30): Simplifying the

Presentation of Debt Issuance Costs,” which changes the

presentation of debt issuance costs in the financial statements.

Under this ASU, we now present debt issuance costs, except for

those incurred in connection with our revolving line of credit, in

the balance sheet as a direct deduction from the related debt

liability rather than as an asset. As allowed under this ASU, we

retrospectively adopted this accounting standard. Accordingly, we

reclassified $887 thousand of debt issuance costs from Other Assets

to Long-term Debt for the 2014 period. Additionally, in the fourth

quarter of 2015 we also prospectively adopted ASU No. 2015-17,

“Balance Sheet Classification of Deferred Taxes.” Under this

ASU, we now classify all deferred income taxes as noncurrent assets

or noncurrent liabilities. As allowed by this ASU, prior year

amounts have not been reclassified.

Contact Information

Anthony Borowicz

VP Business Development

Greatbatch, Inc.

716-759-5809

tborowicz@greatbatch.com

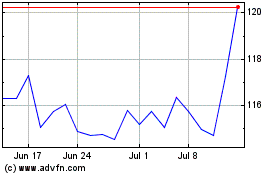

Integer (NYSE:ITGR)

Historical Stock Chart

From Mar 2024 to Apr 2024

Integer (NYSE:ITGR)

Historical Stock Chart

From Apr 2023 to Apr 2024