UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

______________________

Form 8-K

______________________

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

Date of Report (Date of earliest event Reported): March 7, 2016

GREATBATCH, INC.

(Exact Name of Registrant as Specified in Charter)

| DELAWARE | 1-16137 | 16-1531026 |

| (State or Other Jurisdiction of Incorporation) | (Commission File Number) | (I.R.S. Employer Identification Number) |

| 2595 Dallas Parkway, Suite 310, Frisco, Texas, , Delaware 75034 |

| (Address of Principal Executive Offices) (Zip Code) |

(716) 759-5600

(Registrant's telephone number, including area code)

Not Applicable

(Former name or former address, if changed since last report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

|

| | [ ] | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| | [ ] | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| | [ ] | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| | [ ] | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Item 2.02. Results of Operations and Financial Condition.

On March 7, 2016, Greatbatch, Inc. (“Greatbatch” or the “Company”) issued a press release which updated its previously issued 2016 guidance and taking into account its acquisition of Lake Region Medical Holdings, Inc. (“Lake Region Medical”) and its pending spin-off of a portion of its QiG segment, which will be known as Nuvectra Corporation (“Nuvectra”). The Company’s press release is attached as Exhibit 99.1 and is also available on the Company’s website at www.greatbatch.com and is incorporated into this Item by reference.

Item 7.01. Regulation FD Disclosure.

The information set forth under Item 2.02 of this report is incorporated into this Item by reference.

Item 9.01. Financial Statements and Exhibits.

(d) Exhibits.

| Exhibit No. | |

| | |

| 99.1 | Press Release dated March 7, 2016 |

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| | GREATBATCH, INC. |

| | | |

| | | |

| Date: March 7, 2016 | By: | /s/ Michael Dinkins |

| | | Name: Michael Dinkins |

| | | Title: Executive Vice President & Chief Financial Officer |

| | | |

EXHIBIT 99.1

Greatbatch, Inc. Updated Guidance 2016

FRISCO, Texas, March 07, 2016 (GLOBE NEWSWIRE) -- Greatbatch, Inc. (NYSE:GB), announced today that it has updated guidance for 2016.

Thomas J. Hook, president & chief executive officer, commented, “With the completion of the acquisition of Lake Region Medical and the spin-off of Nuvectra, Greatbatch is now optimally positioned to focus on sustainable growth and profitability. We have the scale, full systems capabilities and broad product offerings that will allow us to deepen our customer partnerships and establish ourselves as the world’s leading medical device outsource manufacturer. With the integration plans off to such a productive start, we are well positioned to accelerate our strategic growth plans and provide long term benefits for our shareholders, customers and our associates. Over the past month, I have been visiting our locations and meeting with many of our major customers to share the Greatbatch story and get valuable feedback.”

Hook concluded, “I’m extremely pleased with the way the integration of Lake Region Medical is progressing. The new Greatbatch leadership team has been in place for approximately one month and is highly focused on assimilating the business and executing our strategic growth initiatives. We have a clear line of sight to deliver the targeted $25 million of integration synergies for 2016 with the primary focus on organization structures, contracts spend and infrastructure costs. Our longer term focus will be manufacturing footprint optimization, continued supply chain optimization and process improvements. Given our established track record of integrating operations, I remain confident that we will be able to exceed our long term synergy expectations. We look forward to meeting with shareholders over the next several months to further reinforce our strategic direction.”

First Quarter Sales and Full-Year 2016 Sales and Earnings Guidance:

- For the full year 2016, on a constant currency basis, the Company expects net sales to be in the $1.425 billion range to $1.475 billion versus its prior guidance of approximately $1.47 billion. For the first quarter of 2016 the Company expects constant currency revenue to be in the range of $335 million.

- For the full year 2016, the Company expects Adjusted EBITDA to be in the range of $320 million to $335 million versus its previous guidance of approximately $327 million.

- For the full year 2016, we expect adjusted earnings per diluted share to be in the range of $3.00 to $3.35 on 31.5 million fully diluted shares outstanding. Note, adjusted EPS guidance was not previously provided.

- Adjusted EPS for 2016 is expected to consist of GAAP EPS excluding items such as intangible amortization (approximately $40 million), IP related litigation costs, and Nuvectra results prior to the spin-off, consolidation, acquisition, integration, and asset disposition/write down charges totaling approximately $110 million. The after tax impact of these items is estimated to be approximately $77 million or approximately $2.44 per diluted share.

Selected Financial Guidance Items Affecting Cash Flow

- Maintenance Capital Expenditures to be in the range of $50 million - $60 million per year.

- Depreciation & Amortization is expected to be $100 million - $105 million for 2016.

- Stock compensation expense is expected to be approximately $14 million for 2016.

- Working Capital is expected to be consistent with the prior year.

- The 2016 adjusted effective tax rate is expected to be approximately 30%; cash taxes are expected to be approximately $10 million for the full year 2016.

- Other Operating expense is expected to be $55 million - $65 million for the full year 2016.

- Cash payment for Nuvectra Spin-off is $75 million.

Use of Non-GAAP Financial Information

In addition to our results reported in accordance with generally accepted accounting principles (“GAAP”), we provide adjusted net income, adjusted earnings per diluted share, EBITDA, adjusted EBITDA and organic constant currency sales growth rates. Adjusted net income and adjusted earnings per diluted share consist of GAAP amounts adjusted for the following to the extent occurring during the period: (i) acquisition-related charges, (ii) amortization of intangible assets (iii) facility consolidation, optimization, manufacturing transfer and system integration charges, (iv) asset write-down and disposition charges, (v) charges in connection with corporate realignments or a reduction in force, (vi) certain litigation expenses, charges and gains, (vii) unusual or infrequently occurring items, (viii) gain/loss on cost and equity method investments, (ix) the income tax (benefit) related to these adjustments and (x) certain tax items related to the Federal research and development tax credit which are outside the normal benefit received for the period. Adjusted earnings per diluted share are calculated by dividing adjusted net income by diluted weighted average shares outstanding. Adjusted EBITDA consists of GAAP net income plus (i) the same adjustments as listed above except for items (ix), and (x), (ii) GAAP stock-based compensation, interest expense, and depreciation, (iii) GAAP provision (benefit) for income taxes and (iv) cash gains received from cost and equity method investments. To calculate organic constant currency sales growth rates, which exclude the impact of changes in foreign currency exchange rates, as well as the impact of any acquisitions or divestitures of product lines on sales growth rates, we convert current period sales from local currency to U.S. dollars using the previous periods’ foreign currency exchange rates and exclude the amount of sales acquired/divested during the period from the current/previous period amounts, respectively. We believe that the presentation of adjusted net income, adjusted diluted earnings per share, EBITDA, adjusted EBITDA and organic constant currency sales growth rates provides important supplemental information to management and investors seeking to understand the financial and business trends relating to our financial condition and results of operations.

Forward-Looking Statements

Some of the statements contained in this press release and other written and oral statements made from time to time by us and our representatives are not statements of historical or current fact. As such, they are “forward-looking statements” within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended. We have based these forward-looking statements on our current expectations, and these statements are subject to known and unknown risks, uncertainties and assumptions. Forward-looking statements include statements relating to:

- future sales, expenses and profitability;

- future development and expected growth of our business and industry;

- our ability to execute our business model and our business strategy;

- our ability to identify trends within our industries and to offer products and services that meet the changing needs of those markets; and

- projected capital expenditures.

You can identify forward-looking statements by terminology such as “may,” “will,” “should,” “could,” “expects,” “intends,” “plans,” “anticipates,” “believes,” “estimates,” “predicts,” “potential” or “continue” or “variations” or the negative of these terms or other comparable terminology. These statements are only predictions. Actual events or results may differ materially from those stated or implied by these forward-looking statements. In evaluating these statements and our prospects, you should carefully consider the factors set forth below. All forward-looking statements attributable to us or persons acting on our behalf are expressly qualified in their entirety by these cautionary factors and to others contained throughout this report. We are under no duty to update any of the forward-looking statements after the date of this release or to conform these statements to actual results.

Although it is not possible to create a comprehensive list of all factors that may cause actual results to differ from the results expressed or implied by our forward-looking statements or that may affect our future results, some of these factors include the following: our high level of indebtedness following the acquisition of Lake Region Medical, our inability to pay principal and interest on this high level of outstanding indebtedness, and the risk that this high level of indebtedness limits our ability to invest in our business and overall financial flexibility; our dependence upon a limited number of customers; customer ordering patterns; product obsolescence; our inability to market current or future products; pricing pressure from customers; our ability to timely and successfully implement cost reduction and plant consolidation initiatives; our reliance on third party suppliers for raw materials, products and subcomponents; fluctuating operating results; our inability to maintain high quality standards for our products; challenges to our intellectual property rights; product liability claims; product field actions or recalls; our inability to successfully consummate and integrate acquisitions, including the acquisition of Lake Region Medical, and to realize synergies and benefits from these acquisitions and to operate these acquired businesses in accordance with expectations; our unsuccessful expansion into new markets; our failure to develop new products including system and device products; the timing, progress and ultimate success of pending regulatory actions and approvals, including with respect to Algovita; risks associated with the proposed spin-off of Nuvectra including our ability to execute the spin-off successfully, the timing and taxable nature of the spin-off, and the performance of Nuvectra post spin-off; our inability to obtain licenses to key technology; regulatory changes, including Health Care Reform, or consolidation in the healthcare industry; global economic factors including currency exchange rates and interest rates; the resolution of various legal actions brought against the Company; and other risks and uncertainties that arise from time to time and are described in Item 1A “Risk Factors” of the Company’s Annual Report on Form 10-K and in other periodic filings with the Securities and Exchange Commission. The Company assumes no obligation to update forward-looking statements in this press release whether to reflect changed assumptions, the occurrence of unanticipated events or changes in future operating results, financial conditions or prospects, or otherwise.

About Greatbatch, Inc.

Greatbatch, Inc. (NYSE:GB) is one of the largest medical device outsource manufacturers in the world serving the cardiac, neuromodulation, orthopaedics, vascular, advanced surgical and portable medical markets. The Company provides innovative, high quality medical technologies that enhance the lives of patients worldwide. In addition, it develops batteries for high-end niche applications in energy, military, and environmental markets. The Company’s brands include Greatbatch Medical, Lake Region Medical and Electrochem. Additional information is available at www.greatbatch.com.

Contact Information

Anthony Borowicz

VP Business Development

Greatbatch, Inc.

716-759-5809

tborowicz@greatbatch.com

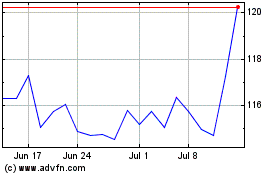

Integer (NYSE:ITGR)

Historical Stock Chart

From Mar 2024 to Apr 2024

Integer (NYSE:ITGR)

Historical Stock Chart

From Apr 2023 to Apr 2024