UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

PURSUANT TO SECTION 13 or 15(d) OF THE SECURITIES

EXCHANGE ACT OF 1934

Date of Report (Date of earliest event reported):

February 24, 2016

GREATBATCH, INC.

(Exact name of registrant as specified in its charter)

| Delaware |

1-16137 |

16-1531026 |

|

(State or Other Jurisdiction of

incorporation) |

(Commission File Number) |

(IRS Employer Identification No.) |

| 2595 Dallas Parkway, Suite 310, Frisco, Texas |

75034 |

| (Address of principal executive offices) |

(Zip Code) |

Registrant’s telephone number, including area code (716) 759-5600

| |

Not Applicable |

|

| |

(Former name or former address, if changed since last report) |

|

Check the appropriate box below if the Form 8-K filing is intended to

simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

☐ Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐ Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐ Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17

CFR 240.14d-2(b))

☐ Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act

(17 CFR 240.13e-4(c))

| Item 5.04 | | Temporary Suspension of Trading Under Registrant’s Employee Benefit

Plans. |

On February 24, 2016, Greatbatch, Inc. (the “Company”)

sent a notice (the “Blackout Notice”) to its directors and officers who are subject to Section 16 of the Securities

Exchange Act of 1934, as amended. This Blackout Notice informs these directors and officers that they will be subject to certain

trading restrictions with respect to shares of Company common stock as a result of a blackout imposed on participants in the Company’s

401(k) Plan (the “Plan”) holding units of the Greatbatch Stock Fund in connection with the spin-off of QiG Group, LLC,

which will convert into Nuvectra Corporation prior to the completion of the spin-off (“Nuvectra”). The blackout period

is expected to begin on March 10, 2016 and end during the week of March 13, 2016.

The Blackout Notice was sent pursuant to Section 306(a) of the Sarbanes-Oxley

Act and Regulation BTR, which generally impose restrictions on trading in issuer equity securities by directors and officers who

are subject to Section 16 of the Securities Exchange Act of 1934, as amended, in the event that 50% or more of an issuer’s

plan participants are so restricted with respect to the shares in their plan accounts. Federal law generally requires 30 days advance

notice of a blackout period. The Plan administrator was unable to provide this amount of advance notice because the timing with

respect to the blackout period was dependent on a closing date for the spin-off transaction, which was not identified until February

23, 2016.

On February 24, 2016, the Plan administrator delivered notice to the Company of the trading

restrictions relating to the Plan pursuant to Section 101(i)(2)(E) of the Employee Retirement Income Security Act of 1974, as amended.

A copy of the Blackout Notice is attached as Exhibit 99.1 to this

Current Report on Form 8-K and is incorporated herein by reference.

On February 24, 2016, the Company issued a press release announcing that the Company’s

Board of Directors has approved the spin-off of Nuvectra from the Company in the form of a tax-free pro rata dividend involving

the distribution on March 14, 2016 of all outstanding shares of Nuvectra common stock to holders of the Company’s common

stock as of the close of business on March 7, 2016.

The full text of the Company’s press release is attached as Exhibit 99.2 to

this Current Report on Form 8-K and is incorporated herein by reference.

| Item 9.01 | | Financial Statements and Exhibits. |

| (d) |

Exhibits |

|

|

|

| |

|

| Exhibit Number |

Description of Exhibit |

| |

|

| 99.1 |

Form of Notice of Blackout Period, dated February 24, 2016

|

| 99.2 |

Press Release issued by Greatbatch, Inc., dated February 24, 2016 |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934,

the Registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

| Date: |

February 24, 2016 |

GREATBATCH, INC. |

|

| |

|

|

|

| |

|

By: |

/s/ Michael Dinkins |

|

| |

|

|

Michael Dinkins |

|

| |

|

|

Executive Vice President & Chief Financial Officer |

|

| |

|

|

|

|

EXHIBIT INDEX

|

|

|

| Exhibit Number |

Description of Exhibit |

| |

|

| 99.1 |

Form of Notice of Blackout Period, dated February 24, 2016

|

| 99.2 |

Press Release issued by Greatbatch, Inc., dated February 24, 2016 |

EXHIBIT 99.1

| TO: | | Directors and Section 16 Officers |

| RE: | | Notice of Blackout Period |

As a director or officer who is subject to Section 16 of the Securities Exchange Act of 1934,

as amended (an “officer”) of Greatbatch, Inc. (the “Company”), you are subject to the restrictions under

Section 306(a) of the Sarbanes-Oxley Act of 2002, which prohibits certain trades in the Company’s equity securities during

"blackout" periods under the Company’s 401(k) Retirement Plan (the “Plan”). Please note the following:

| 1. |

The prohibition is imposed because more than 50% of the participants in the Company's Plan will be temporarily

prohibited from directing or changing the portion of their Plan account that is invested in the Greatbatch Stock Fund and entering

into transactions under the Plan with respect to the portion of their Plan account that is invested in the Greatbatch Stock Fund.

This period is referred to as the "Blackout Period". The Blackout Period will occur in order to enable the Plan administrator

to accommodate the anticipated spin-off of QiG Group, LLC (which will convert into Nuvectra Corporation prior to the spin-off). |

|

| |

|

|

| 2. |

During the Blackout Period described below, you are generally not permitted, directly or indirectly, to purchase,

sell or otherwise acquire or transfer any equity securities of the Company (or derivative securities of those equity securities)

that you have acquired in connection with your service or employment as a director or officer of the Company. For example, you

are not permitted to exercise Company stock options during the Blackout Period. |

|

| |

|

|

| |

It is important to note that any such security you sell or otherwise transfer will

be automatically treated as acquired in connection with your service or employment unless you establish that the securities were

acquired from another source and this identification is consistent with your treatment of the securities for tax purposes and

all other disclosure and reporting requirements. In addition, the rule against the “indirect” sales or purchases,

etc., can extend these prohibitions to transfers or acquisitions of Company equity securities by immediate family members living

with you or trusts or other entities in which you have an interest. |

|

| |

|

|

| 3. |

You may obtain, without charge, information as to whether the Blackout Period has begun or ended by contacting

me. Also, during the Blackout Period and for a period of two years after the ending date of the Blackout Period, a Company security

holder or other interested person may obtain, without charge, the actual beginning and ending dates of the Blackout Period by contacting

me at the address below. Please keep in mind that the expected end of the Blackout Period will in no way affect other prohibitions

on trading of Company equity securities, including the normal prohibition on trading in Company equity securities while in possession

of material non-public information. |

|

| |

|

|

| 4. |

The Blackout Period is expected to commence at 1 p.m., Eastern time, on March 10, 2016 and end during the

week of March 13, 2016. I will notify you when the Blackout Period has ended. |

|

| |

|

|

There are a limited number of exempt transactions which may occur during the Blackout Period,

including the quarterly vesting of restricted shares to directors pursuant to the annual retainer program. The rules, however,

are complex, and the criminal and civil penalties that could be imposed upon directors and officers who violate them could be severe.

If

you have any questions regarding the Blackout Period. please let me know.

10000 Wehrle Drive / Clarence, New York 14031 / phone • 716.759.5600

/ fax • 716.759.5672 / www.greatbatch.com

EXHIBIT 99.2

Greatbatch’s Board of Directors Declares Spin-off Dividend of the Nuvectra Shares

Sets Record Date of March 7, 2016 and Nuvectra Share Distribution Date of March 14, 2016

FRISCO, Texas, Feb. 24, 2016 (GLOBE NEWSWIRE) -- Greatbatch, Inc. (NYSE:GB) today announced that its Board of Directors has approved the spin-off of QiG Group, LLC, which will convert into Nuvectra Corporation prior to the completion of the spin-off (“Nuvectra”), in the form of a tax-free pro rata dividend involving the distribution of all of the outstanding shares of Nuvectra common stock to holders of Greatbatch common stock. Under the approved terms of the spin-off:

- Nuvectra common stock will be distributed on March 14, 2016 to Greatbatch stockholders of record as of the close of business on March 7, 2016, the record date for the spin-off.

- Greatbatch stockholders will receive one share of Nuvectra common stock for every three shares of Greatbatch common stock held.

Nuvectra is a neuromodulation medical device company initially focused on the development and commercialization of a neurostimulation technology platform for treatment of various disorders through stimulation of tissues associated with the nervous system. The Algovita spinal cord stimulation system is the first application of this neurostimulation technology platform and has received FDA approval for the treatment of chronic pain of the trunk and limbs.

“This announcement marks an important milestone in Greatbatch’s strategy of developing complete active implantable medical device systems for our customers,” said Thomas J. Hook, president and CEO of Greatbatch. “This spin-off reaffirms Greatbatch’s commitment to ensuring its strategic priorities remain aligned with stockholders’ best interests while continuing to create enhanced value for customers, healthcare providers and other key stakeholders.”

Immediately after the spin-off is completed, Nuvectra will be an independent publicly traded company and neither company will have any ownership interest in the other. Nuvectra’s common stock will be listed on the Nasdaq Global Market (“NASDAQ”) under the symbol “NVTR.”

Distribution of Nuvectra Shares to Greatbatch Stockholders

Greatbatch stockholders of record as of the close of business on March 7, 2016 will be entitled to receive one share of Nuvectra common stock for every three shares of Greatbatch common stock held.

No action is required by Greatbatch stockholders to receive the shares of Nuvectra common stock in the spin-off. Greatbatch stockholders will not be required to pay anything for the Nuvectra shares or to surrender any shares of Greatbatch stock. The distribution will be made in book-entry form only.

Fractional shares of Nuvectra common stock will not be distributed in the spin-off. Any fractional shares of Nuvectra common stock that would otherwise be distributed to Greatbatch stockholders will be aggregated and sold in the public market by the distribution agent. The aggregate net proceeds of these sales will be distributed ratably as cash payments to the stockholders who would otherwise have received fractional shares. These cash payments will be taxable to those stockholders.

Greatbatch expects that, for U.S. federal income tax purposes, the distribution of the Nuvectra common stock will be tax-free to Greatbatch and to its stockholders, except for any cash received in lieu of fractional shares. Stockholders should consult their tax advisors with respect to U.S. federal, state, local and non-U.S. tax consequences of the spin-off of Nuvectra.

Trading of Greatbatch and Nuvectra Common Stock

There is currently no market for Nuvectra common stock. Nuvectra expects its common stock to begin trading on a “when-issued” basis shortly before the March 7, 2016 record date under the ticker “NVTRV.” “When-issued” trading of Nuvectra common stock will continue until the distribution occurs. On March 14, 2016, Nuvectra common stock will begin “regular-way” trading on NASDAQ under the symbol “NVTR.”

Beginning on or around the record date and continuing up to the distribution date, it is anticipated that there will be two ways to trade Greatbatch common stock – either with or without the right to receive shares of Nuvectra common stock in the spin-off distribution. Stockholders who sell their shares of Greatbatch common stock in the “regular-way” market (that is, the normal trading market on the New York Stock Exchange under the symbol “GB”) after the record date and prior to the distribution date will be selling their right to receive shares of Nuvectra common stock in connection with the spin-off. If an “ex-distribution” market is established, stockholders may also trade their shares of Greatbatch common stock ex-distribution (that is, without the right to receive the shares of Nuvectra common stock in the distribution) prior to the distribution date.

Investors are encouraged to consult with their financial advisors regarding the specific implications of buying or selling Greatbatch or Nuvectra common stock prior to the completion of the spin-off.

The completion of the spin-off is subject to the satisfaction or waiver of a number of conditions, including Nuvectra’s Registration Statement on Form 10 being declared effective by the U.S. Securities and Exchange Commission, Nuvectra’s common stock being accepted for listing on NASDAQ, the receipt of an opinion from Greatbatch’s third party tax advisor confirming the tax-free nature of the spin-off transaction, and other conditions described in Nuvectra’s Registration Statement on Form 10. Greatbatch expects that all conditions to the spin-off will be satisfied by the distribution date.

The Registration Statement on Form 10 includes material information regarding the spin-off and Nuvectra’s business following the spin-off.

Nuvectra’s management team plans to host investor conferences beginning on March 2, 2016 and concluding the following week to present the company’s management team, strategy, competitive positioning and outlook.

Piper Jaffray & Co. is acting as financial advisor and Hodgson Russ LLP is acting as legal counsel to Greatbatch for the spin-off.

Forward-Looking Statements

This release contains statements relating to future actions and results, which are “forward-looking” statements within the meaning of the Securities Exchange Act of 1934, as amended, and the Private Securities Litigation Reform Act of 1995. These statements may be identified by the use of words like “expects,” “will,” “believes,” “intends,” “estimates,” or other words of similar meaning. Forward-looking statements are not guarantees of future performance and are based on assumptions and expectations of future events that may not be realized. Forward-looking statements are subject to inherent risks and uncertainties that could cause actual results to differ materially from current expectations, including, but not limited to, the fact that the spin-off distribution may not be completed as anticipated or at all and that delays or difficulties in completing the spin-off may be experienced; market conditions in general and those applicable to the spin-off; factors affecting the expected timeline for completing the spin-off; the effect the spin-off may have on Greatbatch’s stock price; the risk that the anticipated benefits from the spin-off may not be fully realized or may take longer to realize than expected; and the risk that the conditions precedent for the completion of the spin-off are not satisfied. Greatbatch refers you to the documents that it files from time to time with the U.S. Securities and Exchange Commission, such as its reports on Form 10-K, Form 10-Q and Form 8-K, as well as the “Risk Factors” section of Nuvectra’s Registration Statement on Form 10, for a discussion of these and other risks and uncertainties. Except as required by applicable law, neither Greatbatch nor Nuvectra undertakes any duty to update any such forward-looking statements as a result of future developments or new information.

About Greatbatch, Inc.

Greatbatch, Inc. (NYSE:GB) is one of the largest medical device outsource (MDO) manufacturers in the world serving the cardiac, neuromodulation, orthopaedics, vascular, advanced surgical and portable medical markets. The company provides innovative, high quality medical technologies that enhance the lives of patients worldwide. In addition, it develops batteries for high-end niche applications in energy, military, and environmental markets. The company’s brands include Greatbatch Medical, Lake Region Medical and Electrochem. Additional information is available at www.greatbatch.com.

In October 2015, Greatbatch, Inc. completed its acquisition of Lake Region Medical, with the combined company expected to be renamed Integer Holdings Corporation later this year following stockholder approval.

CONTACT:

Investor Relations Contact:

Anthony Borowicz

tborowicz@greatbatch.com

tel 716-759-5809

Media Contact:

Christopher Knospe

cknospe@greatbatch.com

tel 716-759-5727

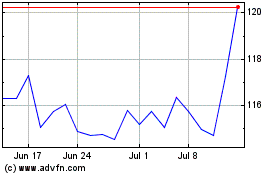

Integer (NYSE:ITGR)

Historical Stock Chart

From Mar 2024 to Apr 2024

Integer (NYSE:ITGR)

Historical Stock Chart

From Apr 2023 to Apr 2024