Statement of Ownership (sc 13g)

October 29 2015 - 5:25PM

Edgar (US Regulatory)

|

|

UNITED STATES |

|

|

|

SECURITIES AND EXCHANGE COMMISSION |

|

|

|

Washington, D.C. 20549 |

|

SCHEDULE 13G

Under the Securities Exchange Act of 1934

(Amendment No. )*

(Name of Issuer)

Common Stock, par value $0.001 per share

(Title of Class of Securities)

(CUSIP Number)

(Date of Event Which Requires Filing of this Statement)

Check the appropriate box to designate the rule pursuant to which this Schedule is filed:

|

o |

Rule 13d-1(b) |

|

x |

Rule 13d-1(c) |

|

o |

Rule 13d-1(d) |

*The remainder of this cover page shall be filled out for a reporting person’s initial filing on this form with respect to the subject class of securities, and for any subsequent amendment containing information which would alter disclosures provided in a prior cover page.

The information required on the remainder of this cover page shall not be deemed to be “filed” for the purpose of Section 18 of the Securities Exchange Act of 1934 (“Act”) or otherwise subject to the liabilities of that section of the Act but shall be subject to all other provisions of the Act (however, see the Notes).

|

CUSIP No. 39153L106 |

|

|

|

|

(1) |

Name of Reporting Person

Accellent Holdings LLC |

|

|

|

|

(2) |

Check the Appropriate Box if a Member of a Group |

|

|

|

(a) |

o |

|

|

|

(b) |

o |

|

|

|

|

(3) |

SEC Use Only |

|

|

|

|

(4) |

Citizenship or Place of Organization

Delaware |

|

|

|

|

|

Number of

Shares

Beneficially

Owned by

Each

Reporting

Person With |

(5) |

Sole Voting Power

2,946,709 |

|

|

|

(6) |

Shared Voting Power

-0- |

|

|

|

(7) |

Sole Dispositive Power

2,946,709 |

|

|

|

(8) |

Shared Dispositive Power

-0- |

|

|

|

|

(9) |

Aggregate Amount Beneficially Owned by Each Reporting Person

2,946,709 |

|

|

|

|

(10) |

Check Box if the Aggregate Amount in Row (9) Excludes Certain Shares (See Instructions) o |

|

|

|

|

(11) |

Percent of Class Represented by Amount in Row (9)

9.64% |

|

|

|

|

(12) |

Type of Reporting Person (See Instructions)

OO |

|

|

|

|

|

|

2

|

CUSIP No. 39153L106 |

|

|

|

|

(1) |

Name of Reporting Person

KKR Millennium Fund L.P. |

|

|

|

|

(2) |

Check the Appropriate Box if a Member of a Group |

|

|

|

(a) |

o |

|

|

|

(b) |

o |

|

|

|

|

(3) |

SEC Use Only |

|

|

|

|

(4) |

Citizenship or Place of Organization

Delaware |

|

|

|

|

|

Number of

Shares

Beneficially

Owned by

Each

Reporting

Person With |

(5) |

Sole Voting Power

2,946,709 |

|

|

|

(6) |

Shared Voting Power

-0- |

|

|

|

(7) |

Sole Dispositive Power

2,946,709 |

|

|

|

(8) |

Shared Dispositive Power

-0- |

|

|

|

|

(9) |

Aggregate Amount Beneficially Owned by Each Reporting Person

2,946,709 |

|

|

|

|

(10) |

Check Box if the Aggregate Amount in Row (9) Excludes Certain Shares (See Instructions) o |

|

|

|

|

(11) |

Percent of Class Represented by Amount in Row (9)

9.64% |

|

|

|

|

(12) |

Type of Reporting Person (See Instructions)

PN |

|

|

|

|

|

|

3

|

CUSIP No. 39153L106 |

|

|

|

|

(1) |

Name of Reporting Person

KKR Associates Millennium L.P. |

|

|

|

|

(2) |

Check the Appropriate Box if a Member of a Group |

|

|

|

(a) |

o |

|

|

|

(b) |

o |

|

|

|

|

(3) |

SEC Use Only |

|

|

|

|

(4) |

Citizenship or Place of Organization

Delaware |

|

|

|

|

|

Number of

Shares

Beneficially

Owned by

Each

Reporting

Person With |

(5) |

Sole Voting Power

2,946,709 |

|

|

|

(6) |

Shared Voting Power

-0- |

|

|

|

(7) |

Sole Dispositive Power

2,946,709 |

|

|

|

(8) |

Shared Dispositive Power

-0- |

|

|

|

|

(9) |

Aggregate Amount Beneficially Owned by Each Reporting Person

2,946,709 |

|

|

|

|

(10) |

Check Box if the Aggregate Amount in Row (9) Excludes Certain Shares (See Instructions) o |

|

|

|

|

(11) |

Percent of Class Represented by Amount in Row (9)

9.64% |

|

|

|

|

(12) |

Type of Reporting Person (See Instructions)

PN |

|

|

|

|

|

|

4

|

CUSIP No. 39153L106 |

|

|

|

|

(1) |

Name of Reporting Person

KKR Millennium GP LLC |

|

|

|

|

(2) |

Check the Appropriate Box if a Member of a Group |

|

|

|

(a) |

o |

|

|

|

(b) |

o |

|

|

|

|

(3) |

SEC Use Only |

|

|

|

|

(4) |

Citizenship or Place of Organization

Delaware |

|

|

|

|

|

Number of

Shares

Beneficially

Owned by

Each

Reporting

Person With |

(5) |

Sole Voting Power

2,946,709 |

|

|

|

(6) |

Shared Voting Power

-0- |

|

|

|

(7) |

Sole Dispositive Power

2,946,709 |

|

|

|

(8) |

Shared Dispositive Power

-0- |

|

|

|

|

(9) |

Aggregate Amount Beneficially Owned by Each Reporting Person

2,946,709 |

|

|

|

|

(10) |

Check Box if the Aggregate Amount in Row (9) Excludes Certain Shares (See Instructions) o |

|

|

|

|

(11) |

Percent of Class Represented by Amount in Row (9)

9.64% |

|

|

|

|

(12) |

Type of Reporting Person (See Instructions)

OO |

|

|

|

|

|

|

5

|

CUSIP No. 39153L106 |

|

|

|

|

(1) |

Name of Reporting Person

KKR Fund Holdings L.P. |

|

|

|

|

(2) |

Check the Appropriate Box if a Member of a Group |

|

|

|

(a) |

o |

|

|

|

(b) |

o |

|

|

|

|

(3) |

SEC Use Only |

|

|

|

|

(4) |

Citizenship or Place of Organization

Cayman Islands |

|

|

|

|

|

Number of

Shares

Beneficially

Owned by

Each

Reporting

Person With |

(5) |

Sole Voting Power

2,946,709 |

|

|

|

(6) |

Shared Voting Power

-0- |

|

|

|

(7) |

Sole Dispositive Power

2,946,709 |

|

|

|

(8) |

Shared Dispositive Power

-0- |

|

|

|

|

(9) |

Aggregate Amount Beneficially Owned by Each Reporting Person

2,946,709 |

|

|

|

|

(10) |

Check Box if the Aggregate Amount in Row (9) Excludes Certain Shares (See Instructions) o |

|

|

|

|

(11) |

Percent of Class Represented by Amount in Row (9)

9.64% |

|

|

|

|

(12) |

Type of Reporting Person (See Instructions)

PN |

|

|

|

|

|

|

6

|

CUSIP No. 39153L106 |

|

|

|

|

(1) |

Name of Reporting Person

KKR Fund Holdings GP Limited |

|

|

|

|

(2) |

Check the Appropriate Box if a Member of a Group |

|

|

|

(a) |

o |

|

|

|

(b) |

o |

|

|

|

|

(3) |

SEC Use Only |

|

|

|

|

(4) |

Citizenship or Place of Organization

Cayman Islands |

|

|

|

|

|

Number of

Shares

Beneficially

Owned by

Each

Reporting

Person With |

(5) |

Sole Voting Power

2,946,709 |

|

|

|

(6) |

Shared Voting Power

-0- |

|

|

|

(7) |

Sole Dispositive Power

2,946,709 |

|

|

|

(8) |

Shared Dispositive Power

-0- |

|

|

|

|

(9) |

Aggregate Amount Beneficially Owned by Each Reporting Person

2,946,709 |

|

|

|

|

(10) |

Check Box if the Aggregate Amount in Row (9) Excludes Certain Shares (See Instructions) o |

|

|

|

|

(11) |

Percent of Class Represented by Amount in Row (9)

9.64% |

|

|

|

|

(12) |

Type of Reporting Person (See Instructions)

OO |

|

|

|

|

|

|

7

|

CUSIP No. 39153L106 |

|

|

|

|

(1) |

Name of Reporting Person

KKR Group Holdings L.P. |

|

|

|

|

(2) |

Check the Appropriate Box if a Member of a Group |

|

|

|

(a) |

o |

|

|

|

(b) |

o |

|

|

|

|

(3) |

SEC Use Only |

|

|

|

|

(4) |

Citizenship or Place of Organization

Cayman Islands |

|

|

|

|

|

Number of

Shares

Beneficially

Owned by

Each

Reporting

Person With |

(5) |

Sole Voting Power

2,946,709 |

|

|

|

(6) |

Shared Voting Power

-0- |

|

|

|

(7) |

Sole Dispositive Power

2,946,709 |

|

|

|

(8) |

Shared Dispositive Power

-0- |

|

|

|

|

(9) |

Aggregate Amount Beneficially Owned by Each Reporting Person

2,946,709 |

|

|

|

|

(10) |

Check Box if the Aggregate Amount in Row (9) Excludes Certain Shares (See Instructions) o |

|

|

|

|

(11) |

Percent of Class Represented by Amount in Row (9)

9.64% |

|

|

|

|

(12) |

Type of Reporting Person (See Instructions)

PN |

|

|

|

|

|

|

8

|

CUSIP No. 39153L106 |

|

|

|

|

(1) |

Name of Reporting Person

KKR Group Limited |

|

|

|

|

(2) |

Check the Appropriate Box if a Member of a Group |

|

|

|

(a) |

o |

|

|

|

(b) |

o |

|

|

|

|

(3) |

SEC Use Only |

|

|

|

|

(4) |

Citizenship or Place of Organization

Cayman Islands |

|

|

|

|

|

Number of

Shares

Beneficially

Owned by

Each

Reporting

Person With |

(5) |

Sole Voting Power

2,946,709 |

|

|

|

(6) |

Shared Voting Power

-0- |

|

|

|

(7) |

Sole Dispositive Power

2,946,709 |

|

|

|

(8) |

Shared Dispositive Power

-0- |

|

|

|

|

(9) |

Aggregate Amount Beneficially Owned by Each Reporting Person

2,946,709 |

|

|

|

|

(10) |

Check Box if the Aggregate Amount in Row (9) Excludes Certain Shares (See Instructions) o |

|

|

|

|

(11) |

Percent of Class Represented by Amount in Row (9)

9.64% |

|

|

|

|

(12) |

Type of Reporting Person (See Instructions)

OO |

|

|

|

|

|

|

9

|

CUSIP No. 39153L106 |

|

|

|

|

(1) |

Name of Reporting Person

KKR & Co. L.P. |

|

|

|

|

(2) |

Check the Appropriate Box if a Member of a Group |

|

|

|

(a) |

o |

|

|

|

(b) |

o |

|

|

|

|

(3) |

SEC Use Only |

|

|

|

|

(4) |

Citizenship or Place of Organization

Delaware |

|

|

|

|

|

Number of

Shares

Beneficially

Owned by

Each

Reporting

Person With |

(5) |

Sole Voting Power

2,946,709 |

|

|

|

(6) |

Shared Voting Power

-0- |

|

|

|

(7) |

Sole Dispositive Power

2,946,709 |

|

|

|

(8) |

Shared Dispositive Power

-0- |

|

|

|

|

(9) |

Aggregate Amount Beneficially Owned by Each Reporting Person

2,946,709 |

|

|

|

|

(10) |

Check Box if the Aggregate Amount in Row (9) Excludes Certain Shares (See Instructions) o |

|

|

|

|

(11) |

Percent of Class Represented by Amount in Row (9)

9.64% |

|

|

|

|

(12) |

Type of Reporting Person (See Instructions)

PN |

|

|

|

|

|

|

10

|

CUSIP No. 39153L106 |

|

|

|

|

(1) |

Name of Reporting Person

KKR Management LLC |

|

|

|

|

(2) |

Check the Appropriate Box if a Member of a Group |

|

|

|

(a) |

o |

|

|

|

(b) |

o |

|

|

|

|

(3) |

SEC Use Only |

|

|

|

|

(4) |

Citizenship or Place of Organization

Delaware |

|

|

|

|

|

Number of

Shares

Beneficially

Owned by

Each

Reporting

Person With |

(5) |

Sole Voting Power

2,946,709 |

|

|

|

(6) |

Shared Voting Power

-0- |

|

|

|

(7) |

Sole Dispositive Power

2,946,709 |

|

|

|

(8) |

Shared Dispositive Power

-0- |

|

|

|

|

(9) |

Aggregate Amount Beneficially Owned by Each Reporting Person

2,946,709 |

|

|

|

|

(10) |

Check Box if the Aggregate Amount in Row (9) Excludes Certain Shares (See Instructions) o |

|

|

|

|

(11) |

Percent of Class Represented by Amount in Row (9)

9.64% |

|

|

|

|

(12) |

Type of Reporting Person (See Instructions)

OO |

|

|

|

|

|

|

11

|

CUSIP No. 39153L106 |

|

|

|

|

(1) |

Name of Reporting Person

Henry R. Kravis |

|

|

|

|

(2) |

Check the Appropriate Box if a Member of a Group |

|

|

|

(a) |

o |

|

|

|

(b) |

o |

|

|

|

|

(3) |

SEC Use Only |

|

|

|

|

(4) |

Citizenship or Place of Organization

United States |

|

|

|

|

|

Number of

Shares

Beneficially

Owned by

Each

Reporting

Person With |

(5) |

Sole Voting Power

-0- |

|

|

|

(6) |

Shared Voting Power

2,946,709 |

|

|

|

(7) |

Sole Dispositive Power

-0- |

|

|

|

(8) |

Shared Dispositive Power

2,946,709 |

|

|

|

|

(9) |

Aggregate Amount Beneficially Owned by Each Reporting Person

2,946,709 |

|

|

|

|

(10) |

Check Box if the Aggregate Amount in Row (9) Excludes Certain Shares (See Instructions) o |

|

|

|

|

(11) |

Percent of Class Represented by Amount in Row (9)

9.64% |

|

|

|

|

(12) |

Type of Reporting Person (See Instructions)

IN |

|

|

|

|

|

|

12

|

CUSIP No. 39153L106 |

|

|

|

|

(1) |

Name of Reporting Person

George R. Roberts |

|

|

|

|

(2) |

Check the Appropriate Box if a Member of a Group |

|

|

|

(a) |

o |

|

|

|

(b) |

o |

|

|

|

|

(3) |

SEC Use Only |

|

|

|

|

(4) |

Citizenship or Place of Organization

United States |

|

|

|

|

|

Number of

Shares

Beneficially

Owned by

Each

Reporting

Person With |

(5) |

Sole Voting Power

-0- |

|

|

|

(6) |

Shared Voting Power

2,946,709 |

|

|

|

(7) |

Sole Dispositive Power

-0- |

|

|

|

(8) |

Shared Dispositive Power

2,946,709 |

|

|

|

|

(9) |

Aggregate Amount Beneficially Owned by Each Reporting Person

2,946,709 |

|

|

|

|

(10) |

Check Box if the Aggregate Amount in Row (9) Excludes Certain Shares (See Instructions) o |

|

|

|

|

(11) |

Percent of Class Represented by Amount in Row (9)

9.64% |

|

|

|

|

(12) |

Type of Reporting Person (See Instructions)

IN |

|

|

|

|

|

|

13

STATEMENT ON SCHEDULE G

Pursuant to Rule 13d-1(c) under the Securities Exchange Act of 1934, as amended (the “Act”), each of the persons listed below under Item 2 (each a “Reporting Person,” and collectively the “Reporting Persons”), have agreed to file one statement with respect to their beneficial ownership of Common Stock, par value $0.001 per share (“Common Stock”), of Greatbatch, Inc. (the “Issuer”).

|

Item 1. |

|

|

(a) |

Name of Issuer.

Greatbatch, Inc.

|

|

|

(b) |

Address of Issuer’s Principal Executive Offices.

2595 Dallas Parkway

Suite 310

Frisco, Texas 75034 |

|

|

|

Item 2. |

|

|

(a) |

Name of Persons Filing.

Accellent Holdings LLC

KKR Millennium Fund L.P.

KKR Associates Millennium L.P.

KKR Millennium GP LLC

KKR Fund Holdings L.P.

KKR Fund Holdings GP Limited

KKR Group Holdings L.P.

KKR Group Limited

KKR & Co. L.P.

KKR Management LLC

Henry R. Kravis

George R. Roberts |

|

|

(b) |

Address of Principal Business Office, or, if none, Residence.

The principal business office for all persons filing (other than George R. Roberts) is:

c/o Kohlberg Kravis Roberts & Co. L.P.

9 West 57th Street, Suite 4200

New York, NY 10019

The principal business office for George R. Roberts is:

c/o Kohlberg Kravis Roberts & Co. L.P.

2800 Sand Hill Road, Suite 200

Menlo Park, CA 94025 |

|

|

(c) |

Citizenship.

See Item 4 of each cover page.

|

|

|

(d) |

Title of Class of Securities.

Common stock, par value $0.001 per share (“Common Stock”). |

|

|

(e) |

CUSIP Number.

39153L106 |

|

|

|

Item 3. |

|

|

|

|

Not applicable. |

14

|

Item 4. |

Ownership. |

|

|

(a) |

Accellent Holdings LLC holds 2,946,709 shares of Common Stock. Each of KKR Millennium Fund L.P. (as the managing member of Accellent Holdings LLC), KKR Associates Millennium L.P. (as the general partner of KKR Millennium Fund L.P.), KKR Millennium GP LLC (as the general partner of KKR Associates Millennium L.P.), KKR Fund Holdings L.P. (as the designated member of KKR Millennium GP LLC), KKR Fund Holdings GP Limited (as a general partner of KKR Fund Holdings L.P.), KKR Group Holdings L.P. (as a general partner of KKR Fund Holdings L.P. and the sole shareholder of KKR Fund Holdings GP Limited), KKR Group Limited (as the sole general partner of KKR Group Holdings L.P.), KKR & Co. L.P. (as the sole shareholder of KKR Group Limited), KKR Management LLC (as the sole general partner of KKR & Co. L.P.), and Henry R. Kravis and George R. Roberts may be deemed to share voting and dispositive power with respect to the shares of Common Stock held by Accellent Holdings LLC, but each disclaims beneficial ownership of such shares. |

|

|

(b) |

Percent of class:

See Item 11 of each cover page. |

|

|

(c) |

Number of shares as to which the person has: |

|

|

|

(i) |

Sole power to vote or to direct the vote

See Item 5 of each cover page. |

|

|

|

(ii) |

Shared power to vote or to direct the vote

See Item 6 of each cover page. |

|

|

|

(iii) |

Sole power to dispose or to direct the disposition of

See Item 7 of each cover page. |

|

|

|

(iv) |

Shared power to dispose or to direct the disposition of

See Item 8 of each cover page. |

|

|

|

Item 5. |

Ownership of Five Percent or Less of a Class: |

|

Not applicable |

|

|

|

Item 6. |

Ownership of More than Five Percent on Behalf of Another Person. |

|

See Item 4 above. To the best knowledge of the Reporting Persons, no one other than such reporting persons, the partners, members, affiliates or shareholders of such reporting persons and any other person listed in Item 4 has the right to receive or the power to direct the receipt of dividends from, or the proceeds, from, the sale of Common Stock. |

|

|

|

Item 7. |

Identification and Classification of the Subsidiary Which Acquired the Security Being Reported on By the Parent Holding Company. |

|

|

Not applicable. |

|

|

|

Item 8. |

Identification and Classification of Members of the Group. |

|

|

Not applicable. |

|

|

|

Item 9. |

Notice of Dissolution of Group. |

|

|

Not applicable. |

|

|

|

Item 10. |

Certifications. |

|

By signing below I certify that, to the best of my knowledge and belief, the securities referred to above were not acquired and are not held for the purpose of or with the effect of changing or influencing the control of the issuer of the securities and were not acquired and are not held in connection with or as a participant in any transaction having that purpose or effect, other than activities solely in connection with a nomination under § 240.14a-11. |

15

SIGNATURE

After reasonable inquiry and to the best of my knowledge and belief, I certify that the information set forth in this statement is true, complete and correct.

October 29, 2015

|

ACCELLENT HOLDINGS LLC |

|

|

|

By: |

KKR Millennium Fund L.P., its managing member |

|

|

|

|

|

|

By: |

KKR Associates Millennium L.P., its general partner |

|

|

|

|

|

|

By: |

KKR Millennium GP LLC, its general partner |

|

|

|

|

|

|

By: |

/s/ Terence P. Gallagher |

|

|

|

Name: Terence P. Gallagher |

|

|

|

Title: Attorney-in-fact for Henry R. Kravis, Manager |

|

|

|

|

|

|

|

|

|

|

By: |

/s/ Terence P. Gallagher |

|

|

|

Name: Terence P. Gallagher |

|

|

|

Title: Attorney-in-fact for George R. Roberts, Manager |

|

|

|

|

|

|

|

KKR MILLENNIUM FUND L.P. |

|

|

|

|

|

|

By: |

KKR Associates Millennium L.P., its general partner |

|

|

|

|

|

|

By: |

KKR Millennium GP LLC, its general partner |

|

|

|

|

|

|

By: |

/s/ Terence P. Gallagher |

|

|

|

Name: Terence P. Gallagher |

|

|

|

Title: Attorney-in-fact for Henry R. Kravis, Manager |

|

|

|

|

|

|

By: |

/s/ Terence P. Gallagher |

|

|

|

Name: Terence P. Gallagher |

|

|

|

Title: Attorney-in-fact for George R. Roberts, Manager |

|

|

|

|

|

|

|

|

|

|

|

KKR ASSOCIATES MILLENNIUM L.P. |

|

|

|

|

|

|

By: |

KKR Millennium GP LLC, its general partner |

|

|

|

|

|

|

By: |

/s/ Terence P. Gallagher |

|

|

|

Name: Terence P. Gallagher |

|

|

|

Title: Attorney-in-fact for Henry R. Kravis, Manager |

|

|

|

|

|

|

By: |

/s/ Terence P. Gallagher |

|

|

|

Name: Terence P. Gallagher |

|

|

|

Title: Attorney-in-fact for George R. Roberts, Manager |

|

|

|

|

|

|

|

|

|

|

|

KKR MILLENNIUM GP LLC |

|

|

|

|

|

|

By: |

/s/ Terence P. Gallagher |

|

|

|

Name: Terence P. Gallagher |

|

|

|

Title: Attorney-in-fact for Henry R. Kravis, Manager |

|

|

|

|

|

|

By: |

/s/ Terence P. Gallagher |

|

|

|

Name: Terence P. Gallagher |

|

|

|

Title: Attorney-in-fact for George R. Roberts, Manager |

|

|

|

|

|

|

|

|

|

|

|

KKR FUND HOLDINGS L.P. |

|

|

|

|

|

|

By: |

KKR Fund Holdings GP Limited, its general partner |

|

|

|

|

|

|

By: |

/s/ Terence P. Gallagher |

|

|

|

Name: Terence P. Gallagher |

|

|

|

Title: Attorney-in-fact for William J. Janetschek, Director |

|

16

|

|

KKR FUND HOLDINGS GP LIMITED |

|

|

|

|

|

|

By: |

/s/ Terence P. Gallagher |

|

|

|

Name: Terence P. Gallagher |

|

|

|

Title: Attorney-in-fact for William J. Janetschek, Director |

|

|

|

|

|

|

|

|

|

|

|

KKR GROUP HOLDINGS L.P. |

|

|

|

|

|

|

By: |

KKR Group Limited, its general partner |

|

|

|

|

|

|

By: |

/s/ Terence P. Gallagher |

|

|

|

Name: Terence P. Gallagher |

|

|

|

Title: Attorney-in-fact for William J. Janetschek, Director |

|

|

|

|

|

|

|

|

|

|

|

KKR GROUP LIMITED |

|

|

|

|

|

|

By: |

/s/ Terence P. Gallagher |

|

|

|

Name: Terence P. Gallagher |

|

|

|

Title: Attorney-in-fact for William J. Janetschek, Director |

|

|

|

|

|

|

|

|

|

|

|

KKR & CO. L.P. |

|

|

|

|

|

|

By: |

KKR Management LLC, general partner |

|

|

|

|

|

|

By: |

/s/ Terence P. Gallagher |

|

|

|

Name: Terence P. Gallagher |

|

|

|

Title: Attorney-in-fact for William J. Janetschek, Chief Financial Officer |

|

|

|

|

|

|

|

|

|

|

|

KKR MANAGEMENT LLC |

|

|

|

|

|

|

By: |

/s/ Terence P. Gallagher |

|

|

|

Name: Terence P. Gallagher |

|

|

|

Title: Attorney-in-fact for William J. Janetschek, Chief Financial Officer |

|

|

|

|

|

|

|

|

|

|

|

HENRY R. KRAVIS |

|

|

|

|

|

|

By: |

/s/ Terence P. Gallagher |

|

|

|

Name: Terence P. Gallagher |

|

|

|

Title: Attorney-in-fact |

|

|

|

|

|

|

|

|

|

|

|

GEORGE R. ROBERTS |

|

|

|

|

|

|

By: |

/s/ Terence P. Gallagher |

|

|

|

Name: Terence P. Gallagher |

|

|

|

Title: Attorney-in-fact |

|

17

EXHIBIT INDEX

|

Exhibit

Number |

|

Title |

|

|

|

|

|

1 |

|

Joint Filing Agreement, dated October 29, 2015 |

|

2 |

|

Powers of Attorney |

18

Exhibit 1

JOINT FILING AGREEMENT

In accordance with Rule 13d-1(k) of the Securities Exchange Act of 1934, as amended, the undersigned agree to the joint filing on behalf of each of them of a Statement on Schedule 13G (including any and all amendments thereto) with respect to the common stock of Greatbatch, Inc. and further agree that this Joint Filing Agreement shall be included as an Exhibit to such joint filing. In evidence thereof, the undersigned, being duly authorized, hereby execute this Joint Filing Agreement as of October 29, 2015.

ACCELLENT HOLDINGS LLC

|

By: |

KKR Millennium Fund L.P., its managing member |

|

|

|

|

|

|

By: |

KKR Associates Millennium L.P., its general partner |

|

|

|

|

|

|

By: |

KKR Millennium GP LLC, its general partner |

|

|

|

|

|

|

By: |

/s/ Terence P. Gallagher |

|

|

|

Name: Terence P. Gallagher |

|

|

|

Title: Attorney-in-fact for Henry R. Kravis, Manager |

|

|

|

|

|

|

By: |

/s/ Terence P. Gallagher |

|

|

|

Name: Terence P. Gallagher |

|

|

|

Title: Attorney-in-fact for George R. Roberts, Manager |

|

|

|

|

|

|

|

KKR MILLENNIUM FUND L.P. |

|

|

|

|

|

|

By: |

KKR Associates Millennium L.P., its general partner |

|

|

|

|

|

|

By: |

KKR Millennium GP LLC, its general partner |

|

|

|

|

|

|

By: |

/s/ Terence P. Gallagher |

|

|

|

Name: Terence P. Gallagher |

|

|

|

Title: Attorney-in-fact for Henry R. Kravis, Manager |

|

|

|

|

|

|

By: |

/s/ Terence P. Gallagher |

|

|

|

Name: Terence P. Gallagher |

|

|

|

Title: Attorney-in-fact for George R. Roberts, Manager |

|

|

|

|

|

|

|

|

|

|

|

KKR ASSOCIATES MILLENNIUM L.P. |

|

|

|

|

|

|

By: |

KKR Millennium GP LLC, its general partner |

|

|

|

|

|

|

By: |

/s/ Terence P. Gallagher |

|

|

|

Name: Terence P. Gallagher |

|

|

|

Title: Attorney-in-fact for Henry R. Kravis, Manager |

|

|

|

|

|

|

By: |

/s/ Terence P. Gallagher |

|

|

|

Name: Terence P. Gallagher |

|

|

|

Title: Attorney-in-fact for George R. Roberts, Manager |

|

|

|

|

|

|

|

|

|

|

|

KKR MILLENNIUM GP LLC |

|

|

|

|

|

|

By: |

/s/ Terence P. Gallagher |

|

|

|

Name: Terence P. Gallagher |

|

|

|

Title: Attorney-in-fact for Henry R. Kravis, Manager |

|

|

|

|

|

|

By: |

/s/ Terence P. Gallagher |

|

|

|

Name: Terence P. Gallagher |

|

|

|

Title: Attorney-in-fact for George R. Roberts, Manager |

|

|

|

|

|

|

|

|

|

|

|

KKR FUND HOLDINGS L.P. |

|

|

|

|

|

|

By: |

KKR Fund Holdings GP Limited, its general partner |

|

|

|

|

|

|

By: |

/s/ Terence P. Gallagher |

|

|

|

Name: Terence P. Gallagher |

|

|

|

Title: Attorney-in-fact for William J. Janetschek, Director |

|

|

|

KKR FUND HOLDINGS GP LIMITED |

|

|

|

|

|

|

By: |

/s/ Terence P. Gallagher |

|

|

|

Name: Terence P. Gallagher |

|

|

|

Title: Attorney-in-fact for William J. Janetschek, Director |

|

|

|

|

|

|

|

|

|

|

|

KKR GROUP HOLDINGS L.P. |

|

|

|

|

|

|

By: |

KKR Group Limited, its general partner |

|

|

|

|

|

|

By: |

/s/ Terence P. Gallagher |

|

|

|

Name: Terence P. Gallagher |

|

|

|

Title: Attorney-in-fact for William J. Janetschek, Director |

|

|

|

|

|

|

|

|

|

|

|

KKR GROUP LIMITED |

|

|

|

|

|

|

By: |

/s/ Terence P. Gallagher |

|

|

|

Name: Terence P. Gallagher |

|

|

|

Title: Attorney-in-fact for William J. Janetschek, Director |

|

|

|

|

|

|

|

|

|

|

|

KKR & CO. L.P. |

|

|

|

|

|

|

By: |

KKR Management LLC, general partner |

|

|

|

|

|

|

By: |

/s/ Terence P. Gallagher |

|

|

|

Name: Terence P. Gallagher |

|

|

|

Title: Attorney-in-fact for William J. Janetschek, Chief Financial Officer |

|

|

|

|

|

|

|

|

|

|

|

KKR MANAGEMENT LLC |

|

|

|

|

|

|

By: |

/s/ Terence P. Gallagher |

|

|

|

Name: Terence P. Gallagher |

|

|

|

Title: Attorney-in-fact for William J. Janetschek, Chief Financial Officer |

|

|

|

|

|

|

|

|

|

|

|

HENRY R. KRAVIS |

|

|

|

|

|

|

By: |

/s/ Terence P. Gallagher |

|

|

|

Name: Terence P. Gallagher |

|

|

|

Title: Attorney-in-fact |

|

|

|

|

|

|

|

|

|

|

|

GEORGE R. ROBERTS |

|

|

|

|

|

|

By: |

/s/ Terence P. Gallagher |

|

|

|

Name: Terence P. Gallagher |

|

|

|

Title: Attorney-in-fact |

|

Exhibit 2

POWER OF ATTORNEY

Know all men by these presents that Henry R. Kravis does hereby make, constitute and appoint William J. Janetschek, David J. Sorkin, Terence P. Gallagher, and Christopher B. Lee, or any one of them, as a true and lawful attorney-in-fact of the undersigned with full powers of substitution and revocation, for and in the name, place and stead of the undersigned (both in the undersigned’s individual capacity and as a manager or member of any limited liability company, as a partner of any partnership, as an officer of any corporate or other entity, or in the undersigned’s capacity in a position similar to the foregoing at any entity, in each case, for which the undersigned is otherwise authorized to sign), to execute and deliver such forms, schedules, statements and other documents as may be required to be filed from time to time with the Securities and Exchange Commission with respect to: (i) Sections 13(d), 13(g), 13(f), 13(h) and 16(a) of the Securities Exchange Act of 1934, as amended, including without limitation, Schedule 13D, Schedule 13G, Form 13F, Form 13H, Form 3, Form 4 and Form 5 and (ii) in connection with any applications for EDGAR access codes, including without limitation the Form ID.

|

|

/s/ Henry R. Kravis |

|

|

Name: Henry R. Kravis |

Date: May 28, 2014

POWER OF ATTORNEY

Know all men by these presents that George R. Roberts does hereby make, constitute and appoint William J. Janetschek, David J. Sorkin, Terence P. Gallagher, and Christopher B. Lee, or any one of them, as a true and lawful attorney-in-fact of the undersigned with full powers of substitution and revocation, for and in the name, place and stead of the undersigned (both in the undersigned’s individual capacity and as a manager or member of any limited liability company, as a partner of any partnership, as an officer of any corporate or other entity, or in the undersigned’s capacity in a position similar to the foregoing at any entity, in each case, for which the undersigned is otherwise authorized to sign), to execute and deliver such forms, schedules, statements and other documents as may be required to be filed from time to time with the Securities and Exchange Commission with respect to: (i) Sections 13(d), 13(g), 13(f), 13(h) and 16(a) of the Securities Exchange Act of 1934, as amended, including without limitation, Schedule 13D, Schedule 13G, Form 13F, Form 13H, Form 3, Form 4 and Form 5 and (ii) in connection with any applications for EDGAR access codes, including without limitation the Form ID.

|

|

/s/ George R. Roberts |

|

|

Name: George R. Roberts |

Date: May 28, 2014

POWER OF ATTORNEY

Know all men by these presents that William J. Janetschek does hereby make, constitute and appoint David J. Sorkin, Terence P. Gallagher, and Christopher B. Lee, or any one of them, as a true and lawful attorney-in-fact of the undersigned with full powers of substitution and revocation, for and in the name, place and stead of the undersigned (both in the undersigned’s individual capacity and as a manager or member of any limited liability company, as a partner of any partnership, as an officer of any corporate or other entity, or in the undersigned’s capacity in a position similar to the foregoing at any entity, in each case, for which the undersigned is otherwise authorized to sign), to execute and deliver such forms, schedules, statements and other documents as may be required to be filed from time to time with the Securities and Exchange Commission with respect to: (i) Sections 13(d), 13(g), 13(f), 13(h) and 16(a) of the Securities Exchange Act of 1934, as amended, including without limitation, Schedule 13D, Schedule 13G, Form 13F, Form 13H, Form 3, Form 4 and Form 5 and (ii) in connection with any applications for EDGAR access codes, including without limitation the Form ID.

|

|

/s/ William J. Janetschek |

|

|

Name: William J. Janetschek |

Date: May 28, 2014

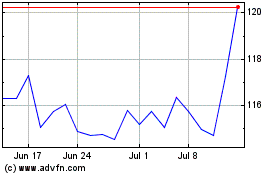

Integer (NYSE:ITGR)

Historical Stock Chart

From Mar 2024 to Apr 2024

Integer (NYSE:ITGR)

Historical Stock Chart

From Apr 2023 to Apr 2024