U.S. SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

PURSUANT TO SECTION 13 or 15(d) OF THE SECURITIES

EXCHANGE ACT OF 1934

Date of Report (Date of earliest event reported):

August 27, 2015

GREATBATCH, INC.

(Exact name of registrant as specified in its charter)

| Delaware |

1-16137 |

16-1531026 |

|

(State or Other Jurisdiction of

incorporation) |

(Commission File Number) |

(IRS Employer Identification No.) |

| 2595 Dallas Parkway, Suite 310, Frisco, Texas |

75034 |

| (Address of principal executive offices) |

(Zip Code) |

Registrant’s telephone number, including area code (716) 759-5600

| |

Not Applicable |

|

| |

(Former name or former address, if changed since last report) |

|

Check the appropriate box below if the Form 8-K filing is intended to

simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

☐ Written communications pursuant to Rule 425 under the Securities Act (17

CFR 230.425)

☐ Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR

240.14a-12)

☐ Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange

Act (17 CFR 240.14d-2(b))

☐ Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange

Act (17 CFR 240.13e-4(c))

Item 8.01 Other Events.

On August 27, 2015, Greatbatch, Inc. (the “Company”) issued a press release announcing

the execution of an Agreement and Plan of Merger (the “Merger Agreement”), dated as of August 27, 2015, by and among

the Company, Provenance Merger Sub Inc., a Delaware corporation and an indirect wholly owned subsidiary of the Company (“Merger

Sub”) and Lake Region Medical Holdings, Inc., a Delaware corporation (“Lake Region”), pursuant to which the Company

will acquire Lake Region (the “Merger”), on the terms and subject to the conditions set forth in the Merger Agreement.

A copy of the press release is attached hereto as Exhibit 99.1 and is incorporated herein by reference. In addition, on August

27, 2015, the Company made available supplemental information regarding the proposed transaction in connection with a presentation

to analysts and investors. A copy of the presentation is attached hereto as Exhibit 99.2 and is incorporated herein by reference.

Cautionary Statement Regarding Forward-Looking Statements

Some of the statements contained in this Current Report on Form

8-K are “forward-looking statements” within the meaning of Section 27A of the Securities Act of 1933, as amended, and

Section 21E of the Securities Exchange Act of 1934, as amended.

You can identify forward-looking statements by terminology such

as “may,” “will,” “should,” “could,” “expects,” “intends,”

“plans,” “anticipates,” “believes,” “estimates,” “predicts,” “potential”

or “continue” or “variations” or the negative of these terms or other comparable terminology. These forward-looking

statements include, but are not limited to, statements about the benefits of the proposed Merger, including future financial and

operating results, the combined company’s plans, objectives, expectations and intentions, the expected timing of completion

of the transaction and other statements that are not historical facts. Such statements are based upon the current beliefs and expectations

of the Company’s management and are subject to significant risks and uncertainties that could cause actual outcomes and results

to differ materially. These risks and uncertainties include, but are not limited to: the possibility that the anticipated synergies

and other benefits from the proposed Merger will not be realized, or will not be realized within the anticipated time periods;

the inability to obtain regulatory approvals of the Merger (including the approval of antitrust authorities necessary to complete

the transaction) on the terms desired or anticipated; the timing of such approvals and the risk that such approvals may result

in the imposition of conditions that could adversely affect the combined company or the expected benefits of the transaction; the

risk that a condition to closing the transaction may not be satisfied on a timely basis or at all; the risk that the proposed transaction

fails to close for any other reason; the risks and uncertainties related to the Company’s ability to successfully integrate

the operations, products and employees of the Company and Lake Region; the effect of the potential disruption of management’s

attention from ongoing business operations due to the pending Merger; the effect of the announcement of the proposed Merger on

the Company’s and Lake Region’s relationships with their respective customers, vendors and lenders and on their respective

operating results and businesses generally; risks relating to the value of the Company shares to be issued in the transaction;

access to available financing (including financing for the acquisition or refinancing of the Company’s or Lake Region’s

debt) on a timely basis and on reasonable terms; and the following factors that may impact the Company’s and the combined

company’s business: dependence upon a limited number of customers; customer ordering patterns; product obsolescence; inability

to market current or future products; pricing pressure from customers; inability to timely and successfully implement cost reduction

and plant consolidation initiatives; reliance on third party suppliers for raw materials, products and subcomponents; fluctuating

operating results; inability to maintain high quality standards for products; challenges to intellectual property rights; product

liability claims; product field actions or recalls; inability to successfully consummate and integrate acquisitions and to realize

synergies and to operate these acquired businesses in accordance with expectations; our unsuccessful expansion into new markets;

failure to develop new products including system and device products; the timing, progress and ultimate success of pending regulatory

actions and approvals, inability to obtain licenses to key technology; regulatory changes, including health care reform, or consolidation

in the healthcare industry; global economic factors including currency exchange rates and interest rates; the resolution of various

legal actions; and other risks and uncertainties that arise from time to time and are described in the Company’s periodic

filings with the Securities and Exchange Commission. The Company assumes no obligation to update forward-looking statements in

this Current Report on Form 8-K whether to reflect changed assumptions, the occurrence of unanticipated events or changes in future

operating results, financial conditions or prospects, or otherwise.

Item 9.01. Financial Statements and Exhibits.

(d) Exhibits

| Exhibit |

|

|

| Number |

|

Description of Exhibit |

| 99.1 |

|

Press Release of Greatbatch, Inc., dated August 27, 2015. |

| |

|

|

| 99.2 |

|

Greatbatch, Inc. Investor Presentation, dated August 27, 2015. |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934,

the Registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

| Date: |

August 27, 2015 |

GREATBATCH, INC. |

|

| |

|

|

|

| |

|

By: |

/s/ Michael Dinkins |

|

| |

|

|

Michael Dinkins |

|

| |

|

|

Executive Vice President & Chief Financial Officer |

|

| |

|

|

|

|

EXHIBIT INDEX

| Exhibit |

|

|

| Number |

|

Description of Exhibit |

| 99.1 |

|

Press Release of Greatbatch, Inc., dated August 27, 2015. |

| |

|

|

| 99.2 |

|

Greatbatch, Inc. Investor Presentation, dated August 27, 2015. |

EXHIBIT 99.1

Greatbatch Signs Definitive Agreement to Acquire Lake Region Medical for $1.73 Billion

-

Transformative Deal will create one of the World's Largest Medical Device OEM Suppliers and will be led by current Greatbatch President and CEO, Thomas J. Hook

-

Newly Combined Company to offer substantially more Comprehensive Portfolio for Customers

-

Double-Digit Cash EPS Accretion to Greatbatch in 2016 and meaningfully more accretive thereafter

FRISCO, Texas, Aug. 27, 2015 (GLOBE NEWSWIRE) -- Greatbatch, Inc. (NYSE:GB) today announced that it has entered into a definitive agreement to acquire Lake Region Medical for approximately $1.73 billion in cash and stock, a transformative deal that will create one of the largest medical device OEM suppliers in the world serving the cardiac, neuromodulation, vascular, orthopaedics and advanced surgical markets.

Greatbatch develops and manufactures critical medical device technologies for the cardiac, neuromodulation, vascular and orthopaedic markets; and batteries for high-end niche applications in the portable medical, energy, military, and environmental markets. Lake Region Medical helps bring life changing products from concept to point-of-care in the cardio & vascular and advanced surgical markets. These include offerings in electrophysiology, vascular access, cardiovascular, urology, oncology, orthopaedics, laparoscopy, biopsy/drug delivery, and arthroscopy.

Once the transaction has closed, the combined company will employ over 9,000 individuals globally with revenues of approximately $1.5 billion.

"The combination of Greatbatch and Lake Region Medical brings together two highly complementary organizations that can provide a new level of industry leading capabilities and services to OEM customers while building value for shareholders," said Thomas J. Hook, president and chief executive officer, Greatbatch.

"Through this transformative deal, we are going to be at the forefront of innovating technologies and products that help change the face of healthcare, providing our customers with a distinct advantage as they bring complete systems and solutions to market. In turn, our customers will be able to accelerate patient access to life enhancing therapies."

The transaction is consistent with Greatbatch's strategy of achieving profitable growth and continuous improvement to drive margin expansion.

"I am very proud of the Lake Region Medical team and what they have accomplished over many years," said Donald J. Spence, chairman and chief executive officer, Lake Region Medical. "Today marks the start of an important new chapter for the Company and I am confident the combination of Lake Region Medical and Greatbatch will form an even stronger entity with unmatched technology and manufacturing capabilities to better serve our customers into the future."

"We expect considerable operating synergies resulting in sustained profitable growth, as well as double-digit adjusted cash EPS growth," said Michael Dinkins, executive vice president and chief financial officer of Greatbatch.

Strategic and Financial Benefits of the Transaction

Greatbatch and Lake Region Medical believe the combination positions the company for enhanced product development and manufacturing services to customers across multiple medical device segments, as well as the energy and portable medical markets. The combination adds diversification and scale across product lines, customers, industries and geographies. The transaction is double-digit accretive to Greatbatch adjusted cash EPS in 2016 and meaningfully more accretive thereafter.

-

More comprehensive portfolio of solutions and services to OEM customers: Both companies have highly-regarded positions with OEM customers in different sub-segments of the cardiac rhythm management, neuromodulation, vascular, orthopaedics and advanced surgical market segments. As a result, the newly combined company will be able to offer a substantially more comprehensive portfolio for customers utilizing the best technologies, providing a single point of support, and driving optimal outcomes.

-

Added scale and diversification: The combination creates a company with operations in the United States, Latin America, Europe and Asia-Pacific. The combination also broadens proprietary technologies and high volume, world-class manufacturing capabilities. In addition, it diversifies Greatbatch into the advanced surgical, vascular and interventional cardiology segments of medical technology.

-

Enhanced customer access and experience: Both Greatbatch and Lake Region Medical bring decades of innovation, R&D design excellence, operating excellence and committed partnerships with customers. Greatbatch expects to leverage the expanded R&D resources, manufacturing capabilities and reputation for innovation, quality and reliability to increase partnership opportunities with legacy customers. The combined company in partnership through OEM customers is ultimately expected to help hospitals, physicians and the healthcare systems improve patient outcomes in a cost-effective manner.

-

Stronger financial profile and solid earnings accretion: 2014 combined revenues of Greatbatch and Lake Region Medical were approximately $1.5 billion. The transaction is expected to be double-digit accretive to cash EPS in 2016, the first full fiscal year post closing and meaningfully more accretive thereafter. The combined company expects to achieve net annual synergies at the operating profit level of $25 million in 2016 which is expected to increase to at least $60 million in 2018.

-

Strong balance sheet and cash flow generation: The combined company is expected to generate strong cash flow from operations resulting from the continued operating profitability, operating synergies and approximately $360 million of net operating loss carryforwards (NOL's) at Lake Region Medical acquired in the transaction. The NOL's will be subject to traditional Section 382 limitations. The company expects the strong cash flow to enhance future financial flexibility.

In the transaction, Greatbatch will pay approximately $478 million in cash, issue an aggregate of 5.1 million shares of common stock and options to Lake Region Medical's equity holders and assume approximately $1 billion of Lake Region Medical net debt.

The agreement has been unanimously approved by the Boards of Directors of both companies. The cash portion of the transaction will be financed with existing cash on hand as well as proceeds from a fully committed financing loan package led by M&T Bank, Credit Suisse and KeyBanc Capital Markets. At closing, current Greatbatch stockholders are expected to own approximately 83.4% of the combined company and current Lake Region Medical shareholders are expected to own approximately 16.6%. The transaction is expected to close in the fourth quarter of 2015 subject to customary closing conditions and pending completion of all necessary regulatory reviews.

Piper Jaffray is acting as exclusive financial advisor and Hodgson Russ LLP is acting as legal advisor to Greatbatch. Simpson Thacher & Bartlett LLP is acting as legal advisor to Lake Region Medical.

Greatbatch President & Chief Executive officer, Thomas J. Hook, and Executive Vice President and Chief Financial Officer, Michael Dinkins, will host a conference call today at 8:30 a.m. EDT to discuss the definitive agreement. The conference call can be accessed from the Greatbatch website at www.greatbatch.com. The conference line is (866) 562-8327and the conference ID is 22878619.

About Lake Region Medical

Lake Region Medical collaborates with the world's leading medical device companies to deliver life-changing innovations that enhance the lives of patients. Backed by decades of experience and clinical expertise, the company helps customers bring products from concept to point-of-care in the cardio & vascular and advanced surgical markets. Lake Region Medical offers fully integrated outsourced manufacturing and engineering services, contract manufacturing, finished device assembly, original device development and supply chain management services. For more information, please visit www.lakeregionmedical.com.

About Greatbatch, Inc.

Greatbatch, Inc. (NYSE: GB) provides top-quality technologies to industries that depend on reliable, long-lasting performance through its brands Greatbatch Medical, Electrochem and QiG Group. The company develops and manufactures critical medical device technologies for the cardiac, neuromodulation, vascular and orthopaedic markets; and batteries for high-end niche applications in the portable medical, energy, military, and environmental markets. Additional information is available at www.greatbatch.com.

Forward-Looking Statements

Some of the statements contained in this press release are "forward-looking statements" within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended.

You can identify forward-looking statements by terminology such as "may," "will," "should," "could," "expects," "intends," "plans," "anticipates," "believes," "estimates," "predicts," "potential" or "continue" or "variations" or the negative of these terms or other comparable terminology. These forward-looking statements include, but are not limited to, statements about the benefits of the proposed merger between Greatbatch and Lake Region, including future financial and operating results, the combined company's plans, objectives, expectations and intentions, the expected timing of completion of the transaction and other statements that are not historical facts. Such statements are based upon the current beliefs and expectations of Greatbatch's management and are subject to significant risks and uncertainties that could cause actual outcomes and results to differ materially. These risks and uncertainties include, but are not limited to: the possibility that the anticipated synergies and other benefits from the proposed merger of Greatbatch and Lake Region will not be realized, or will not be realized within the anticipated time periods; the inability to obtain regulatory approvals of the merger (including the approval of antitrust authorities necessary to complete the transaction) on the terms desired or anticipated; the timing of such approvals and the risk that such approvals may result in the imposition of conditions that could adversely affect the combined company or the expected benefits of the transaction; the risk that a condition to closing the transaction may not be satisfied on a timely basis or at all; the risk that the proposed transaction fails to close for any other reason; the risks and uncertainties related to Greatbatch's ability to successfully integrate the operations, products and employees of Greatbatch and Lake Region; the effect of the potential disruption of management's attention from ongoing business operations due to the pending merger; the effect of the announcement of the proposed merger on Greatbatch's and Lake Region's relationships with their respective customers, vendors and lenders and on their respective operating results and businesses generally; risks relating to the value of the Greatbatch shares to be issued in the transaction; access to available financing (including financing for the acquisition or refinancing of Greatbatch's or Lake Region's debt) on a timely basis and on reasonable terms; and the following factors that may impact Greatbatch's and the combined company's business: dependence upon a limited number of customers; customer ordering patterns; product obsolescence; inability to market current or future products; pricing pressure from customers; inability to timely and successfully implement cost reduction and plant consolidation initiatives; reliance on third party suppliers for raw materials, products and subcomponents; fluctuating operating results; inability to maintain high quality standards for products; challenges to intellectual property rights; product liability claims; product field actions or recalls; inability to successfully consummate and integrate acquisitions and to realize synergies and to operate these acquired businesses in accordance with expectations; our unsuccessful expansion into new markets; failure to develop new products including system and device products; the timing, progress and ultimate success of pending regulatory actions and approvals, inability to obtain licenses to key technology; regulatory changes, including health care reform, or consolidation in the healthcare industry; global economic factors including currency exchange rates and interest rates; the resolution of various legal actions; and other risks and uncertainties that arise from time to time and are described in Greatbatch's periodic filings with the Securities and Exchange Commission. Greatbatch assumes no obligation to update forward-looking statements in this press release whether to reflect changed assumptions, the occurrence of unanticipated events or changes in future operating results, financial conditions or prospects, or otherwise.

CONTACT: Investor Relations Contact:

Elizabeth Cowell

ecowell@greatbatch.com

tel 214-618-4982

Media Contact:

Christopher Knospe

cknospe@greatbatch.com

tel 716-759-5727

EXHIBIT 99.2

1 Creating a Global Leader to Advance the Medical Device Industry August 27, 2015

2 Forward-Looking Statements Some of the statements made in this presentation whether written or oral maybe“forward-lookingstatements”withinthemeaningofSection27Aof theSecuritiesActof1933,asamended,andSection21EoftheSecurities Exchange Act of 1934, as amended, and involve a number of risks and uncertainties. These statements can be identified by terminology such as

“may,” “will,” “should,” “could,” “expects,” “intends,” “plans,” “anticipates,” “believes,”“estimates,” “predicts,”“potential”,or“continue”,orvariationsor thenegativeofthesetermsorothercomparableterminology. These statements are based on the company’s current expectations. The company’sactualresultscoulddiffermateriallyfromthosestatedorimplied insuchforward-lookingstatements.Thecompanyassumesnoobligationsto updateforward-lookinginformation,includinginformationinthispresentation, toreflectchangedassumptions,theoccurrence ofunanticipatedeventsor changes in future operating results, financial conditions, prospects or otherwise.

3 Call Participants THOMAS J. HOOK President & CEO MICHAEL DINKINS Executive Vice President &

Chief Financial Officer

4 Creating a Global Leader to Advance the Medical Device Industry 1) $1.5 billion of revenue based on 2014 pro forma 2) $1.73 billion consists of $478 million cash, $1 billion of net debt pay-off, and 5.1M shares and options issued valued at $253million based on August 26, 2015 closing price of $49.89 3) Cash EPS excluding transaction related expenses, purchase accounting, intangible amortization, stock based compensation expenses, and non- recurring adjustments ▪ Market-leading portfolio of products and services to OEM customers

▪ Lake Region’s market focus complements Greatbatch technology portfolio ▪ Added scale and diversification across geographies, markets and customers with $1.5 billion of combined revenue (1) ▪ Decades of experience and full capabilities in innovating, designing and manufacturing products for OEM customers ▪ Excellence in R&D product development and innovation ▪ Cash and stock transaction valued at approximately $1.73 billion (2) ▪ Approximately $25 million pre-tax synergies in 2016, increasing to at least $60 million in 2018 ▪ Transaction expected to be double-digit adjusted cash EPS (3) accretive to shareholders in 2016 and meaningfully more accretive thereafter

5 Transaction Overview 1) Greatbatch to issue 5.1 million shares and options at closing valued at $253million based on the August 26, 2015 closing price of $49.89 •Cash consideration totaling $1.47 billion •Lake Region shareholders own approximately 16.6% of the combined entity or 5.1 million Greatbatch shares and options valued at $253million (1) Consideration

•Committed financing from M&T Bank, Credit Suisse, and KeyBancCapital Markets •Pro forma leverage of approximately 5.0x net debt to adjusted EBITDA at closing Financing ▪ Closing expected in the fourth quarter of 2015 (subject to regulatory approvals)

6 ▪ Cardio and Vascular – Electrophysiology and stimulation – Vascular access – Cardiovascular and structural heart – Peripheral, neuro, urology, oncology ▪ Advanced Surgical – Joint preservation and reconstruction – Laparoscopy and general surgery – Arthroscopy – Biopsy / drug delivery Revenue (LTM 6/30/15) Greatbatch and Lake Region at a Glance Highly Complementary Markets Served Employees Manufacturing Facilities ▪ Cardiac and Neuromodulation ▪ Vascular ▪ Portable Medical ▪ Orthopaedics ▪

Environmental, Military, Energy $678M $806M 11 17 ~3,700 ~5,500 Adj. EBITDA (LTM 6/30/15) $149M$160M

7 Highly Compelling Strategic Rationale Manufacturing Scalability Revenue Growth Acceleration Diversification Comprehensive Portfolio of Solutions Lake Region Fits Greatbatch’s Acquisition Criteria. Leverages & Enhances its Core Medical Manufacturing Capabilities

▪ Expanded medical device and systems capabilities ▪ Stronger technical and operational position ▪ Full continuum of services for OEMs ▪ A broader range of cardiac and neuro component solutions ▪ A broader range of vascular access products (introducers and guidewires) and catheter applications ▪ Broader range of orthopaedic solutions spanning recon, spine, trauma and sports medicine ▪ Energy, laparoscopic, biopsy and drug delivery devices ▪ Cardiac/Neuro & Vascular combination creates more diversified platform for growth ▪ Broader product offering in orthopaedics ▪ Partner of choice for reliable, high quality products ▪ Wide breadth of markets served ▪ Multiple high-quality clean rooms and high-volume manufacturing facilities ▪ Expands production to Asia and further penetrates Europe ▪ Unique precious metals capabilities and precision machining/fabrication

8 Greatbatch Lake Region Medical (1) Complementary Portfolio of Solutions To Fuel Growth Pro Forma Company –2014 Pro Forma Combined $792M $688M $1,480M 31% 13% 6% 31% 7% 12% Cardiac/Neuromodulation Orthopaedics Portable Medical Cardio & Vascular Energy/Env./Military Advanced Surgical 1) Lake Region Medical 2014 revenue is pro-forma to include the full year impact of the Lake Region Medical acquisition in March 2014 2) Portable Medical includes other medical (2) 48% 21% 10% 9% 12% Cardiac/Neuromodulation Orthopaedics Portable Medical Vascular Energy/Env./Military 31% 19% 23% 17% 6% 2% 2% Vascular Access / Implants Catheters Advanced Surgical Leads / Connectors / Heads Orthopaedics Non-Medical Other Medical

9 World-Class Medical Operating Capabilities & Infrastructure ▪ Operational Excellence:

– Global footprint (America’s, Europe, Asia) – Scalable operating infrastructure – Multiple award winning sites – Proven low cost offerings – Enterprise lean manufacturing practices ▪ Unmatched technical and operational capabilities ▪ Long standing reputation for quality and reliability ▪ Agile and integrated supply chain ▪ Excellence in R&D design and innovation ▪ Decades-long customer partnerships

10 Creates Meaningful Value for Shareholders Revenue growth acceleration ▪ Stronger and more diversified platform for growth Synergies ▪ Approximately $25 million annual pre-tax operating synergies by 2016,increasing to at least $60 million in 2018 ▪ Manufacturing & supply chain optimization and overlapping corporate costs Adjusted EPS impact ▪ Double-digit adjusted cash EPS (1) accretive in 2016 ▪ Meaningfully higher adjusted EPS accretion thereafter Balance Sheet ▪ Pro forma net debt to adjusted EBITDA leverage of ~5.0x ▪ Compelling financial profile with robust cash flow generation ▪ Approximately $360 million of gross NOLs subject to limitations ▪

Focused on cash flowgeneration and lower leverage position 1) Cash EPS excluding transaction related expenses, purchase accounting, intangible amortization, stock based compensation expenses, and non-recurring adjustments

11 ▪ $25 million of annual pre-tax operating synergies in 2016

▪ At least $60 million of annual pre-tax operating synergies to be delivered by the end of 2018 ▪ Investment to achieve synergies estimated at $69 million which consists of $22 million in capital and $47 million in expense over the course of 3 years Overview of Anticipated Synergies ▪ Improved manufacturing overhead utilization ▪ Facility optimization ▪ Procurement savings ▪ In-sourcing opportunities Manufacturing and Supply Chain ▪ Back-office synergies ▪ Efficient global corporate overhead structure Corporate Overhead ▪ Integrated product development ▪ Leverage combined intellectual property portfolio R&D Optimization Synergies Deliver Net Positive Operating Contribution in 2017

12 Imagine What We Will Innovate and Build Together 12

13 Questions and Answers

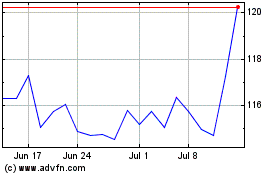

Integer (NYSE:ITGR)

Historical Stock Chart

From Mar 2024 to Apr 2024

Integer (NYSE:ITGR)

Historical Stock Chart

From Apr 2023 to Apr 2024