Filed by FMC Technologies, Inc.

pursuant to Rule 425 under the Securities Act of 1933, as amended

and deemed filed pursuant to Rule 14a-12 under the Securities Exchange Act of 1934, as amended

Subject Companies: FMC Technologies, Inc., Technip S.A. and TechnipFMC Limited

Date: September 7, 2016

This

filing relates to a proposed business combination involving

FMC Technologies, Inc., Technip S.A. and TechnipFMC Limited

(Subject Company Commission File No.: 001-16489;

Commission File No. for Registration Statement on Form S-4: 333-213067)

|

|

|

|

|

|

|

FMC Technologies, Inc. & Technip S.A.

Barclays CEO Energy – Power Conference

September 06, 2016

01:05 PM EDT

|

|

|

|

|

|

|

|

David:

|

|

Okay. Good afternoon. Next up, we have a joint presentation with FMC Technologies and Technip. So, Mr. Thierry — Mr. Pilenko will be starting first. Mr. Pilenko joined – he is Chairman and CEO of Technip. Before joining

Technip in 2007, Mr. Pilenko was Chairman and CEO of Veritas, a seismic services company, where he managed the merger with CGG. Prior to Veritas, he had various executive positions within Schlumberger, where he started in 1984.

|

|

|

|

|

|

|

Mr. Pferdehirt, who is CEO — recently named CEO of FMC, also has a background in Schlumberger — interesting how that works out — and he succeeded Mr. John Gremp, who was Chairman of the Board of Directors. Doug was

with Schlumberger for 26 years prior to joining FMC back in August 2012 as COO, and was then appointed President in 2015.

|

|

|

|

|

|

|

So, without further, I will introduce Mr. Pilenko, who will be followed by Mr. Pferdehirt. Please, gentlemen. Thank you.

|

|

|

|

|

Thierry Pilenko:

|

|

Thank you, David. Good afternoon, everyone. Thank you for being with us. So, I’m Thierry Pilenko. I’m the Chairman and CEO of Technip, and Doug will be talking in the second half of this presentation, and then

we’ll have a breakout session where Maryann Mannen, the CFO of FMC Technologies, and Julian Waldron, the CFO of Technip, will be also joining us and answering your questions.

|

|

|

|

|

|

|

So, thank you very much for attending this presentation. So, we are both very excited about our pending merger, and I think it’s a great opportunity today for us to talk about how we’re going to create value, and how

we’re going to differentiate ourselves through this merger by combining forces and creating something which we believe is absolutely unique in the industry; but more importantly, which is going to be ahead of the curve as we get out of this

downturn.

|

|

|

|

|

|

|

Now, we’re going to go through a number of disclaimers here. Pretty unusual in length; it’s probably because we are in a merger process. But I start with this slide, which shows basically the three main segments of

activities of our combined company, TechnipFMC. So, as you know, we’re going to have leading capabilities in subsea, in onshore/offshore, and in surface. We have already identified a lot of opportunities to actually enhance all these

businesses. But — we see opportunities across our markets, but the focus today will really be on subsea. And why that? It’s because, actually, the deep relationship between Technip and FMC Technologies started around — about close to

three years ago, when we started thinking about, how could we impact the cost of projects of our clients by working together? And this is where we started thinking about what we could do together at the conceptual

stage.

|

1

|

|

|

|

|

|

|

|

|

|

And it all started, actually, with our joint venture, Forsys Subsea, that we created in 2015 after a very in-depth analysis, and I’ll come back later on that; and combining Technip’s SURF capabilities and FMC

Technologies’ SPS technologies, and really breaking silos and putting those solutions together so that we could significantly impact the way our clients were designing and planning those projects.

|

|

|

|

|

|

|

So, it became very clear that, after a short period of time working together, we had to take this joint venture further, and this alliance further, and by combining the two companies I think we’re going to demonstrate that

we’re actually taking the concept much beyond what we had initially thought with Forsys Subsea.

|

|

|

|

|

|

|

So — but let me put things in context first, and what’s happening in our space, and particularly with our clients. I think we’ve been communicating — both companies have been communicating quite extensively

around that, you know, and it’s about clients being still very much focused on their cash flow — their balance sheet; and, of course, preserving their dividend. However, our clients trying to find value in projects at a much lower oil

price.

|

|

|

|

|

|

|

And I think there is something which has been quite significant over the past two, three months is that we started to see much more interest in trying to identify those projects that could add value to our clients’

portfolio. And that means not only take advantage of the deflationary environment that we are in, but also to structurally impact the cost of the project, so that there is something sustainable that will come out of it. And therefore, that means, in

many cases, changing the way oil fields are being developed.

|

|

|

|

|

|

|

So, that means, on our side, we had to be very responsive to this change of environment. And in particular, our clients are talking about brownfield; they are talking about tie-backs, so we have to bring the capability to develop

those brownfield and those tie-backs. That is possible if you have a very early engagement with the customers.

|

|

|

|

|

|

|

And this is what we did with Forsys Subsea, and we’re going to see that we will continue to do that as an integrated company. Integration is becoming more and more important. We realize that it is through integration that we

reduce interfaces and can reduce costs significantly. And of course, technology — technology, not just for the sake of technology, but technology to drive costs down, improve efficiency, and simplifying the overall development of

field.

|

|

|

|

|

|

|

So, over the past few months, actually, we started to see a shift in the way our clients are approaching their business. It was pure cost-cutting and postponing projects before; now, we start to see a much more — a more

dynamic engagement, thinking about, what are the projects that could be moving forward? And, you know, we have been talking about Technip and FMC, through their Forsys joint venture, being engaged together on a number of integrated projects through

Forsys Subsea, and I’m going to give you, in a minute, a few examples of what we are doing with Forsys Subsea. We do expect that one of these integrated project will actually convert into a final investment decision before year end.

|

|

|

|

|

|

|

So, Forsys Subsea, as I said, was created in — officially created in June of 2015, and we started working on a number of projects. And you’ve probably seen that we announced that we had won — very quickly after the

— putting the joint venture together, we announced an award of three FEED for fully-integrated projects. And so, those were focused on a fully-integrated solution. Now, you can see that over time we have seen an acceleration in the interest for

this integrated approach.

|

2

|

|

|

|

|

|

|

|

|

|

Now, of course, Forsys Subsea has some of our best brains. As, you know, companies, we put about 350 people in that joint venture. And, of course, they came up with a lot of innovation. And so, they don’t work only on

integrated projects; they also work on projects that could be driven either from FMC Technologies or from Technip.

|

|

|

|

|

|

|

But as you can see, up to date, we have about 16 integrated projects on which our joint venture is working on. Our clients have been welcoming this approach, and the market acceptance has been quite robust. And this is one of the

reasons for which we decided to go beyond Forsys Subsea and to the merger. But if you look at, actually, the mix of projects, we can see that there is one clear element, which is that those projects are extremely diversified, whether it is by

geography, by water depths, by type of customers — some of the customers are long-term alliance customers; some are new customers who are not necessarily part of the alliance. But we have seen even acceptance from national oil companies, who

generally have more difficulties to change their business and their engagement process; and yet they have shown interest in the approach.

|

|

|

|

|

|

|

So, I think you also see on this slide that there is a mix between brownfield and greenfield. I think this is probably something that shows the trend in our industry as we speak. As I said before, our clients are really looking

for taking advantage and full benefits from their brownfield developments. So, as you can see, it is not just one category of customer or one geography where we have seen the interest, but it’s pretty much across the board.

|

|

|

|

|

|

|

Now — but we think we can actually go way beyond what we saw with Forsys Subsea. And what our clients have been asking for is a clear interface, and a clear responsibility. So, the ability, as TechnipFMC, to present a single

contracting model is going to be a clear differentiator. Having everything under one roof — I’ll come back to that in a minute — is a clear value proposition for clients. This is a way — and several of our clients welcome the

— our joint venture first, and then the merger, or the idea of the merger — say, this is going to be a company that will have the capability to continue to innovate, and to innovate not only on individual products but as integrated

products and integrated processes.

|

|

|

|

|

|

|

And therefore, also as TechnipFMC, we should have and we will have, as Doug will show you in a minute, obviously a much more integrated operational model, and a much more cost-effective, because of the synergies. Not just the

cost synergies, but also the industrial synergies. And, of course, our focus today, as I said, is subsea; but we have identified opportunities going way beyond subsea.

|

|

|

|

|

|

|

So, I think it’s — to describe what we are doing, a picture is probably better than the long speech. You have here a typical image of a subsea field development, and you have the different boxes that go from the

inception of the project — the concept of the project to the subsea production system, SPS, which are coming from FMC Technologies; the SURF that is coming from Technip. Life of field — the ability not only to develop the field, but also

to look at, how do we optimize production over the life of field, and this is competencies that we have in both companies; and all the way even to platform design and topside design and so forth.

|

|

|

|

|

|

|

So, basically, everything you see on this slide — all the system that is here, and all the individual complements — are now going to be under a single roof. So, from the conceptual stage, where we can engage with, I

would say, very high-level expert and consultant, all the way to delivery, there is not a single company today which is capable to deliver a solution which is as complete. It doesn’t mean that our clients are going to — necessarily going

to buy the fully integrated solution, but they will have the option. They will have the option to go from the very early stage to the full delivery, to have a tailor-made approach, depending on how they want to execute their

projects.

|

3

|

|

|

|

|

|

|

|

|

|

So, now, in terms of capabilities, I think it’s quite important to realize that it’s not just about delivering a project or a set of equipment and tools. As I said, it’s about early engagement — the ability to

influence the design in a structural manner so that the — we have the fit-for-purpose system with the right level of complexity, or rather, the right level of simplicity, and — so that, as we get into project execution, our clients get

something, and other times something which is robust and sustainable in terms of cost.

|

|

|

|

|

|

|

We are not talking about — here, about inflation or deflation of — we are talking about something which is structural, and which is long-lasting. So, that’s for the project part. But what is also quite important is

that, once you have this ability to influence the architecture, deliver the full project, you’re in the best possible position to actually offer life-of-field services and production enhancement over the life of field.

|

|

|

|

|

|

|

And actually, this is where the strategy is going to continue to expand. It’s not just about the equipment. It’s not just about the project. It’s about the life of field. With a tremendous advantage to accelerate

first oil, I think this is tremendous for our customers. Schedule and time is of the essence. Very strong, robust execution; and of course, ultimately, maximizing production for our customers.

|

|

|

|

|

|

|

And with this, I will now give the stage to Doug, who is going to show you how we’re going to make it happen practically. How do we make it real? Thank you, Doug.

|

|

|

|

|

Doug Pferdehirt:

|

|

Thank you, Thierry. So, in the spirit of a true merger of equals, Thierry is right on time: 50/50, equitable allocation of time. So, not — my job now is not to go over time, and to deliver the remaining part of our

presentation.

|

|

|

|

|

|

|

Thierry set the stage. He talked about why we are so confident, based upon our customers’ response. Our customers’ reaction to our integrated FEED studies that we’re conducting through Forsys Subsea, and how much

they have accelerated their rate of acceptance in the past several months, has really increased our level of confidence in coming together to be able to deliver, now, the integrated execution as well, as one company. Thierry also described what the

value proposition is, the different roles, and how our technologies are complementary to each other.

|

|

|

|

|

|

|

What I’ll do now is, I’ll spend the remaining part of the presentation demonstrating how these are material, real, tangible savings. It’s not another slogan. It’s not another promise. What our customers are

asking us for is material, tangible savings, demonstrated in a FEED study, that can be put into a tender or a direct award of a contract, and then delivered through superior execution. And that is exactly what TechnipFMC will be positioned to

provide.

|

|

|

|

|

|

|

So, how will we go about this? Over the past decades, our companies, as leaders in our respective portions of the market, have really been focused on expanding the operating envelope for subsea. This was important, and you would

expect this from the leaders — respective leaders in our portion of the industry, being — meaning SPS and SURF. So, we’ve focused on going deeper; producing hotter reservoirs; and safely and economically delivering production at even

higher pressures.

|

|

|

|

|

|

|

But that’s simply not good enough. Our customers need to see savings now. We need to structurally change. We need to change our behavior, and we need to drive an improvement in subsea project economics. So, we’ll

continue to lead in pressure, temperature, flow rate, depth; but in addition to that, we’ll do that by being a low-cost provider, by creating value for our customers, and unlocking the potential of subsea by radically changing the subsea

project economics.

|

4

|

|

|

|

|

|

|

|

|

|

The first thing we need to do is to reinvent our products. I’m going to give an example of how we’re doing that — how we’re taking real, substantial cost out of our products and, more importantly, reducing the

delivery schedule, thus allowing our customers to accelerate first oil, which is the primary component of their economic equation. Not the cost of the equipment, but the time to first oil. I’ll give an example of that in a moment.

|

|

|

|

|

|

|

The second thing we need to do is to take these technologies and we need to integrate them. We need to integrate them into a seamless offering that allows us to reduce unnecessary interfaces which exist on the sea floor today.

The reason they exist on the sea floor today is very simple: commercially, our two work packages have been held separately, tendered separately, and we didn’t come together until we met on the sea floor. Because of that, contingencies needed to

be built in; additional interfaces need to be built in; very costly connection systems needed to be deployed. No one had the view, and no one had the incentive, to look at this as it is: one complete subsea production system, composed not only of

trees, umbilicals, controls from FMC Technologies, but also umbilical risers and flowlines from Technip. The new company, TechnipFMC, indeed will have the incentive to do that.

|

|

|

|

|

|

|

Once we are able to integrate these technologies, then we can redesign the subsea architecture. I’ll show how we’re doing that today. And this is what has our customers convinced that what we’re doing is driving

structural and sustainable change. It’s not just a deflationary or a procurement exercise; that this is ultimately going to result in a lighter, more efficient subsea production system. This is how we will redefine our industry.

|

|

|

|

|

|

|

So, let me start with how we’re reinventing our products. What you see here is a subsea manifold. This is a primary component of any subsea development. It has a relatively basic function. It’s there to commingle the

flow rate from several wells into a manifold, and then to be able to distribute that to a flowline. An important piece of technology, but one that, because of different requirements, and because of some engineering specifications, has grown in size,

has grown in complexity, has grown in cost over the years, to a point that it is no longer sustainable.

|

|

|

|

|

|

|

So, on the left-hand side is that piece of equipment that I’m talking about, weighing in at approximately 200 tons, a very large structure. Many, many different pieces, components, and welds, and bends, and connection

systems.

|

|

|

|

|

|

|

What you see on the right-hand side of the page is the future. This piece of equipment is a compact manifold. It has the exact same functionality as the piece of equipment on the left. It is much simpler. We’ve reduced part

count by over 50%. We’ve increased deliverability, and we’ll be able to deliver this in one-half the time of a conventional manifold that you see on the left. And the installability is much less, and can use vessels of opportunity, because

it’s 50% lighter as well.

|

|

|

|

|

|

|

This isn’t a dream. This isn’t a prototype. This is an actual product that we are manufacturing for customers today, and taking orders, and will be including in our tenders going forward. This is substantial change, and

this is just the beginning of how we’ll reinvent our products.

|

|

|

|

|

|

|

As I said, the next step is to integrate the technologies between our companies. Here you see three different examples of how we can do that. The first is by tying in the subsea processing system with electrically trace heated

pipe-in-pipe from Technip. This is important, because one of the biggest challenges we have in the subsea environment is extremely cold temperatures, so we have to deal with flow assurance issues. The way that we can do that, between the processing

technology and the electrically trace heated pipe-in-pipe, will allow us to greatly simplify the subsea architecture and increase the operating efficiency and uptime.

|

|

|

|

|

|

|

Another example is how we are bringing together connectors with the flexible pipe offering from Technip. We can integrate these two together in a seamless fashion, improving the install time and reducing the overall

cost.

|

5

|

|

|

|

|

|

|

|

|

|

And finally, simplifying the subsea architecture, physically removing components from the sea floor that were there only because these packages were historically commercially tendered separately, and they were interfaces that

were required to be able to mate up with different people’s equipment and products. As one company, we can eliminate that and simplify the architecture.

|

|

|

|

|

|

|

What does this result in? This results in a very different subsea architecture. On the left, you see the as is, and on the future you see the Forsys Subsea, or what we are able to design now for our customers going forward: a 30%

reduction in the total cost, or more; fewer interfaces; faster installation; and lower execution risk; and the ability to be able to monitor this equipment over the life of field as one holistic subsea production system. This is how we will redefine

subsea.

|

|

|

|

|

|

|

In the remaining time, let me give you an update on the merger and on some of the financial metrics within the merger. The first is on the cost synergies. We estimate $400 million of cost synergies that we’ll realize in

2019. We’ll deliver those by the end of 2018; realizing those in 2019. We expect to achieve 50% of that value in the first year.

|

|

|

|

|

|

|

One of the benefits we have is, through the alliance and joint venture, we’ve been working together. We aren’t companies that compete naturally. We are complementary in our offering. So, we’re able to share

together information so that we can be assured that we will have a successful merger, and we’ll be able to deliver synergies starting on day one.

|

|

|

|

|

|

|

In addition to the synergies you see noted here, we also see the potential for additional synergies, both in terms of additional cost reduction opportunities, financial upside, and revenue synergies.

|

|

|

|

|

|

|

Speaking of revenue synergies, we have the opportunity to demonstrate what we have been discussing this morning. We can reduce the project cost. We can reduce project lead times. But most importantly, we can accelerate time to

first oil, all of which will lower the project breakeven price. But beyond the savings, we are bringing to market a truly differentiated offering that is not currently available from any other service provider. It’s truly unique. This means we

will now be involved earlier in the engagement process with our customers, in the concept, pre-FEED and FEED stages. We will offer them differentiated technologies, as we discussed earlier in the presentation, all of which create opportunities for

more projects, more scope, and greater involvement over the entire life of field. This will truly be a unique commercial offering.

|

|

|

|

|

|

|

And finally, in summary, the merger of Technip and FMC Technologies will create a company with unique competencies that can deliver a compelling value proposition to our customers. We will be one of the largest oil field services

providers worldwide, and we will have an industry-leading balance sheet from which to deliver and execute this new platform.

|

|

|

|

|

|

|

Together, we can accelerate and fully integrate technology innovation, interface as a single accountable partner with our clients, build a more cost-effective operating structure that further lowers our own costs, and provide a

fully integrated model that lowers project costs, drives differentiation within the marketplace, and provides clear opportunities to expand current markets.

|

|

|

|

|

|

|

And looking even further ahead, we see the potential to develop integrated offerings that push beyond subsea. Since we announced the merger in May, we have achieved several major milestones, and continue to progress towards a

closing in early 2017. With every day that passes, we not only validate the industrial logic behind the deal, but we gain greater confidence in the combination and the strength of our shared culture, strategic alignment, and potential upside we see

of bringing these two great organizations together.

|

6

|

|

|

|

|

|

|

|

|

|

Thank you very much for your time, and thank you for your attendance.

|

|

|

|

|

David:

|

|

Thank you, Doug. So, we have a few minutes for some questions here in the audience. Let me just start with one. Kind of more of a bigger picture, in terms of conceptual of this deal — and I guess one way that I kind of look

at it is, with — as you said, it’s a unique offering out here. It seems to me that your offering is, kind of — really, kind of, wellhead to the topside, and everything in between. If I look at Schlumberger’s OneSubsea, you could

argue that they are wellhead to reservoir. Is that a fair way to look at this, in terms of kind of comparing the two offerings?

|

|

|

|

|

Doug Pferdehirt:

|

|

So, great question David. You know, clearly, there’s two different approaches. They’re both an integrated model. We believe that there’s place in the market for both of those. But as I started the presentation,

what our customers are looking for is material, tangible cost savings that they can put into their development plans today. That’s what we are delivering. And that’s the ability to be able to show that through the integrated FEED study,

and then to be able to deliver that through the new company, TechnipFMC.

|

|

|

|

|

|

|

So, they both have value. But it’s very, very clear: we wanted to focus on the part of the value chain that was clearly complementary in nature, that was literally connected, reduce those interfaces, improve the subsea

project economics, and improve the life-of-field solution for our customer. That is our approach. The market will react as the market will. What we have seen is a strong acceptance from our customer base for this approach.

|

|

|

|

|

Thierry Pilenko:

|

|

We believe there are stronger and faster gains by having — or, I used the word “under one roof” — the full set, in the subsea space. So, that integration has very strong potential to reduce costs dramatically,

and have a much more secure delivery scheme than any other alliances or loose processes. So, I think this was a top priority for us, to make sure that we had everything together. We cover everything on — in the subsea space, from the wellhead

to the platform.

|

|

|

|

|

David:

|

|

I really liked your slide you showed of the Forsys — the 16 FEED studies, and you showed how different they all are. I guess that was kind of one of the questions we were wondering is, what do these look like? So, mix of

brownfield, you know, greenfield; sizes. Fair to say that brownfield will be the first to go here? Is that where your customers are focused on right now — some of the smaller trees with brownfield — things that can kind of generate cash

flow quickest? Is that — (inaudible)?

|

|

|

|

|

Thierry Pilenko:

|

|

I don’t want to guess which project is going to first. Could be a greenfield; could be brownfield. But I think what we showed on that slide is that, probably unlike maybe what was the market three, four years ago, where

there were a lot of greenfield developments, large developments, we can see that the importance of brownfield and the innovation that needs to take place, including in brownfield development, is there.

|

|

|

|

|

|

|

And I think what we see with this market snapshot of Forsys Subsea, even if it’s only 16 project — which is, by the way, a very good number of project — but it’s actually pretty indicative of what the market

is at the moment. You know, a mix — it’s not only deep water. It’s also shallow water. You see that we have projects in the North Sea as well. And it’s a mix between brown and greenfield.

|

|

|

|

|

Doug Pferdehirt:

|

|

And I think, just to add, when you think about the new company, you have a unique combination when it comes to brownfields. So, you know, what is a brownfield typically? It’s a tie-back to a host. It’s a number of, you

know, four to eight wells, tied into a manifold, with typically a very long flowline back to the host facility. It’s a step-out, if you will.

|

7

|

|

|

|

|

|

|

|

|

|

Well, we’ll be uniquely positioned to offer that as a combined offering — if you will, a tie-back solution. And if you put together that small compact manifold with the trees, and then the electrically trace heated

pipe-in-pipe, you eliminate a second flowline, you have a much simpler subsea architecture, and you’re able to get it all done by one company who can install it in a single trip. No one else will be able to provide that for brownfield

tie-backs.

|

|

|

|

|

Thierry Pilenko:

|

|

And in some cases you even eliminate the platform, because a lot of field developments - our clients were planning in the under (inaudible) oil environment, they were planning to build a new platform. Today, they are saying no.

No new platform; let’s take advantage of the existing facilities just to work with us on these long tie-backs. And I think this is going to be a great opportunity. Because it’s not just about the pipe. It’s all the system — all

the energy that you need to have in the system. So, great opportunities.

|

|

|

|

|

David:

|

|

Any questions in the audience? Well, maybe I’ll just ask one more, if there’s no questions. You had an announcement this morning. I didn’t get a chance to go through it in too great a detail. Can you expand a

little bit about what this — I believe it was a multiphase boosting pump, which typically has been — the other guy does a lot of that stuff. You guys seem to be good at doing that now. Can you expand a little bit there?

|

|

|

|

|

Doug Pferdehirt:

|

|

So, we think, in this case, two is better than one. So, what was announced this morning — FMC Technologies made an announcement of an award from Eni for the 15/06 West field development in Angola. Ties in very well with your

earlier question, David. This is a brownfield opportunity that the customer saw, by the addition of putting energy on the sea floor in the terms of a multiphase boosting pump, that they could actually increase production from the field.

|

|

|

|

|

|

|

We’ve worked with them to design the subsea equipment. It was put out to tender. We won the award, and we announced the award this morning. We’re very excited about that. It is true that we came into the subsea boosting

market second. We were the first in the subsea processing market in terms of separation, and we remain — we retain that title, if you will. In the area of boosting, there’s been four awards in the last twelve months. We’ve won two,

and, as you refer to, the other guy, has won two, and we think that’s a reasonable distribution going forward.

|

|

|

|

|

Thierry Pilenko:

|

|

And by the way, Technip was involved in 15/06 as well, because we won the supply. We won the install. Actually, this is a project that we completed ahead of time. And I can imagine that, you know, in the future, we will have

plenty of opportunities to actually combine forces and make a much more comprehensive offering. And, you know, this boosting that we are talking about — this is exactly what we need, for example, for these long tie-backs.

|

|

|

|

|

|

|

So, I mean, everything seems to be, you know, gelling together at a time where the market needs that new type of offering, more cost-effective, innovative, and fit for purpose.

|

|

|

|

|

David:

|

|

Fantastic. Thank you very much, gentlemen.

|

|

|

|

|

Doug Pferdehirt:

|

|

Thank you.

|

8

Important Information for Investors and Securityholders

Forward-Looking Statements

This communication contains

“forward-looking statements.” All statements other than statements of historical fact contained in this report are forward-looking statements within the meaning of Section 27A of the United States Securities Act of 1933, as amended

(the “Securities Act”), and Section 21E of the United States Securities Exchange Act of 1934, as amended (the “Exchange Act”). Forward-looking statements usually relate to future events and anticipated revenues, earnings,

cash flows or other aspects of our operations or operating results. Forward-looking statements are often identified by the words “believe,” “expect,” “anticipate,” “plan,” “intend,”

“foresee,” “should,” “would,” “could,” “may,” “estimate,” “outlook” and similar expressions, including the negative thereof. The absence of these words, however, does not mean

that the statements are not forward-looking. These forward-looking statements are based on our current expectations, beliefs and assumptions concerning future developments and business conditions and their potential effect on us. While management

believes that these forward-looking statements are reasonable as and when made, there can be no assurance that future developments affecting us will be those that we anticipate.

Factors that could cause actual results to differ materially from those in the forward-looking statements include failure to obtain applicable regulatory or

stockholder approvals in a timely manner or otherwise; failure to satisfy other closing conditions to the proposed transactions; failure to obtain favorable opinions from counsel for each company to the effect of how TechnipFMC Limited (to be

renamed TechnipFMC plc) (“TechnipFMC”) should be treated for U.S. tax purposes as a result of the proposed transaction; risks associated with tax liabilities, or changes in U.S. federal or international tax laws or interpretations to which

they are subject, including the risk that the Internal Revenue Service disagrees that TechnipFMC is a foreign corporation for U.S. federal tax purposes; risks that the new businesses will not be integrated successfully or that the combined companies

will not realize estimated cost savings, value of certain tax assets, synergies and growth or that such benefits may take longer to realize than expected; failure to realize anticipated benefits of the combined operations; risks relating to

unanticipated costs of integration; reductions in client spending or a slowdown in client payments; unanticipated changes relating to competitive factors in the companies’ industries; ability to hire and retain key personnel; ability to

successfully integrate the companies’ businesses; the potential impact of announcement or consummation of the proposed transaction on relationships with third parties, including clients, employees and competitors; ability to attract new clients

and retain existing clients in the manner anticipated; reliance on and integration of information technology systems; changes in legislation or governmental regulations affecting the companies; international, national or local economic, social or

political conditions that could adversely affect the companies or their clients; conditions in the credit markets; risks associated with assumptions the parties make in connection with the parties’ critical accounting estimates and legal

proceedings; and the parties’ international operations, which are subject to the risks of currency fluctuations and foreign exchange controls.

All of

our forward-looking statements involve risks and uncertainties (some of which are significant or beyond our control) and assumptions that could cause actual results to differ materially from our historical experience and our present expectations or

projections. You should carefully consider the foregoing factors and the other risks and uncertainties that affect the parties’ businesses, including those described in FMC Technologies’ (“FMC Technologies”) Annual Report on Form

10-K, Quarterly Reports on Form 10-Q, Current Reports on Form 8-K and other documents filed from time to time by FMC Technologies and TechnipFMC with the United States Securities and Exchange Commission (the “SEC”) and those described in

Technip S.A.’s (“Technip”) annual reports, registration documents and other documents filed from time to time with the French financial markets regulator (Autorité des Marchés Financiers or the “AMF”). We wish

to caution you not to place undue reliance on any forward-looking statements, which speak only as of the date hereof. We undertake no obligation to publicly update or revise any of our forward-looking statements after the date they are made, whether

as a result of new information, future events or otherwise, except to the extent required by law.

9

No Offer or Solicitation

This communication is not intended to and does not constitute an offer to sell or the solicitation of an offer to subscribe for or buy or an invitation to

purchase or subscribe for any securities or the solicitation of any vote in any jurisdiction pursuant to the proposed transactions or otherwise, nor shall there be any sale, issuance or transfer of securities in any jurisdiction in contravention of

applicable law. No offer of securities shall be made except by means of a prospectus meeting the requirements of Section 10 of the Securities Act and applicable European regulations. Subject to certain exceptions to be approved by the relevant

regulators or certain facts to be ascertained, the public offer will not be made directly or indirectly, in or into any jurisdiction where to do so would constitute a violation of the laws of such jurisdiction, or by use of the mails or by any means

or instrumentality (including without limitation, facsimile transmission, telephone and the internet) of interstate or foreign commerce, or any facility of a national securities exchange, of any such jurisdiction.

Additional Information

Important Additional

Information Will be Filed with the SEC

TechnipFMC has filed with the SEC a registration statement on Form S-4, which includes the preliminary proxy

statement of FMC Technologies that also constitutes a preliminary prospectus of TechnipFMC (the “proxy statement/prospectus”). A definitive proxy statement/prospectus will be delivered as required by applicable law after the registration

statement on Form S-4 is declared effective by the SEC.

INVESTORS AND STOCKHOLDERS ARE URGED TO CAREFULLY READ THE PROXY STATEMENT/PROSPECTUS, AND OTHER RELEVANT DOCUMENTS FILED OR TO BE FILED WITH THE SEC, IN THEIR ENTIRETY WHEN THEY BECOME

AVAILABLE BECAUSE THEY CONTAIN OR WILL CONTAIN IMPORTANT INFORMATION ABOUT FMC TECHNOLOGIES, TECHNIP, TECHNIPFMC, THE PROPOSED TRANSACTIONS AND RELATED MATTERS

. Investors and stockholders will be able to obtain free copies of the proxy

statement/prospectus and other documents filed with the SEC by the parties through the website maintained by the SEC at www.sec.gov. In addition, investors and stockholders will be able to obtain free copies of the proxy statement/prospectus and

other documents filed with the SEC on FMC Technologies’ website at www.fmctechnologies.com (for documents filed with the SEC by FMC Technologies) or on Technip’s website at www.technip.com (for documents filed with the SEC by Technip).

Important Additional Information Will be Made Available in an Information Document

Technip will prepare an information document to be made available in connection with the Technip meeting of stockholders called to approve the proposed

transaction (the “Report”).

INVESTORS AND STOCKHOLDERS ARE URGED TO CAREFULLY READ THE INFORMATION DOCUMENT, AND OTHER RELEVANT DOCUMENTS TO BE PUBLISHED ON THE TECHNIP WEBSITE, IN THEIR ENTIRETY WHEN THEY BECOME AVAILABLE BECAUSE THEY

WILL CONTAIN IMPORTANT INFORMATION ABOUT FMC TECHNOLOGIES, TECHNIP, TECHNIPFMC, THE PROPOSED TRANSACTIONS AND RELATED MATTERS.

Investors and stockholders will be able to obtain free copies of the information document from Technip on its website

at

www.technip.com

.

10

Important Additional Information Will be Made Available in an Prospectus Prepared in accordance with the EU

Prospectus Directive

TechnipFMC will make publicly available a prospectus, prepared in accordance with the EU Prospectus Directive 2003/71/EC, with

respect to the issuance of new shares as a result of the proposed transaction and their admission to trading on the regulated market of Euronext Paris (including any supplement thereto, the “Admission Prospectus”).

INVESTORS AND

STOCKHOLDERS ARE URGED TO CAREFULLY READ THE ADMISSION PROSPECTUS, AND OTHER RELEVANT DOCUMENTS, IN THEIR ENTIRETY WHEN THEY BECOME AVAILABLE BECAUSE THEY WILL CONTAIN IMPORTANT INFORMATION ABOUT FMC TECHNOLOGIES, TECHNIP, TECHNIPFMC, THE PROPOSED

TRANSACTIONS AND RELATED MATTERS

. Investors and stockholders will be able to obtain free copies of the Admission Prospectus from TechnipFMC when available.

Participants in the Solicitation

FMC Technologies,

Technip, TechnipFMC and their respective directors and executive officers may be deemed to be participants in the solicitation of proxies from the stockholders of FMC Technologies and Technip, respectively, in respect of the proposed transactions

contemplated by the proxy statement/prospectus and the Report. Information regarding the persons who are, under the rules of the SEC, participants in the solicitation of the stockholders of FMC Technologies and Technip, respectively, in connection

with the proposed transactions, including a description of their direct or indirect interests, by security holdings or otherwise, will be set forth in the proxy statement/prospectus when it is filed with the SEC. Information regarding FMC

Technologies’ directors and executive officers is contained in FMC Technologies’ Annual Report on Form 10-K for the year ended December 31, 2015 and its Proxy Statement on Schedule 14A, dated March 25, 2016, which are filed with

the SEC and can be obtained free of charge from the sources indicated above. Information regarding Technip’s directors and executive officers is contained in Technip’s Annual Report for the year ended December 31, 2015 filed with the

AMF and can be obtained free of charge from the sources indicated above.

11

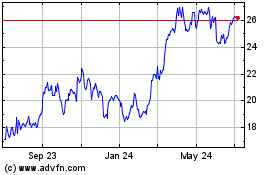

TechnipFMC (NYSE:FTI)

Historical Stock Chart

From Mar 2024 to Apr 2024

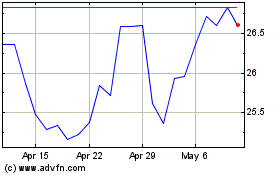

TechnipFMC (NYSE:FTI)

Historical Stock Chart

From Apr 2023 to Apr 2024