Filed

by Technip S.A.

pursuant

to Rule 425 under the Securities Act of 1933, as amended

Subject

Companies: Technip S.A., FMC Technologies, Inc. and TechnipFMC Limited

Date:

September 1, 2016

This

filing relates to a proposed business combination involving

Technip

S.A., FMC Technologies, Inc. and TechnipFMC Limited

(Subject

Company Commission File No.: 001-16489)

Important Information for

Investors and Securityholders

Forward-Looking Statements

This communication contains “forward-looking

statements.” All statements other than statements of historical fact contained in this report are forward-looking statements

within the meaning of Section 27A of the United States Securities Act of 1933, as amended (the “Securities Act”),

and Section 21E of the United States Securities Exchange Act of 1934, as amended (the “Exchange Act”). Forward-looking

statements usually relate to future events and anticipated revenues, earnings, cash flows or other aspects of our operations or

operating results. Forward-looking statements are often identified by the words “believe,” “expect,” “anticipate,”

“plan,” “intend,” “foresee,” “should,” “would,” “could,”

“may,” “estimate,” “outlook” and similar expressions, including the negative thereof. The

absence of these words, however, does not mean that the statements are not forward-looking. These forward-looking statements are

based on our current expectations, beliefs and assumptions concerning future developments and business conditions and their potential

effect on us. While management believes that these forward-looking statements are reasonable as and when made, there can be no

assurance that future developments affecting us will be those that we anticipate.

Factors that could cause actual

results to differ materially from those in the forward-looking statements include failure to obtain applicable regulatory or stockholder

approvals in a timely manner or otherwise; failure to satisfy other closing conditions to the proposed transactions; failure to

obtain favorable opinions from counsel for each company to the effect of how TechnipFMC Limited (to be renamed TechnipFMC plc)

(“TechnipFMC”) should be treated for U.S. tax purposes as a result of the proposed transaction; risks associated with

tax liabilities, or changes in U.S. federal or international tax laws or interpretations to which they are subject, including

the risk that the Internal Revenue Service disagrees that TechnipFMC is a foreign corporation for U.S. federal tax purposes; risks

that the new businesses will not be integrated successfully or that the combined companies will not realize estimated cost savings,

value of certain tax assets, synergies and growth or that such benefits may take longer to realize than expected; failure to realize

anticipated benefits of the combined operations; risks relating to unanticipated costs of integration; reductions in client spending

or a slowdown in client payments; unanticipated changes relating to competitive factors in the companies’ industries; ability

to hire and retain key personnel; ability to successfully integrate the companies’ businesses; the potential impact of announcement

or consummation of the proposed transaction on relationships with third parties, including clients, employees and competitors;

ability to attract new clients and retain existing clients in the manner anticipated; reliance on and integration of information

technology systems; changes in legislation or governmental regulations affecting the companies; international, national or local

economic, social or political conditions that could

adversely affect the companies

or their clients; conditions in the credit markets; risks associated with assumptions the parties make in connection with the

parties’ critical accounting estimates and legal proceedings; and the parties’ international operations, which are

subject to the risks of currency fluctuations and foreign exchange controls.

All of our forward-looking statements

involve risks and uncertainties (some of which are significant or beyond our control) and assumptions that could cause actual

results to differ materially from our historical experience and our present expectations or projections. You should carefully

consider the foregoing factors and the other risks and uncertainties that affect the parties’ businesses, including those

described in FMC Technologies’ (“FMC Technologies”) Annual Report on Form 10-K, Quarterly Reports on Form 10-Q,

Current Reports on Form 8-K and other documents filed from time to time by FMC Technologies and TechnipFMC with the United States

Securities and Exchange Commission (the “SEC”) and those described in Technip S.A.’s (“Technip”)

annual reports, registration documents and other documents filed from time to time with the French financial markets regulator

(Autorité des Marchés Financiers or the “AMF”). We wish to caution you not to place undue reliance on

any forward-looking statements, which speak only as of the date hereof. We undertake no obligation to publicly update or revise

any of our forward-looking statements after the date they are made, whether as a result of new information, future events or otherwise,

except to the extent required by law.

No Offer or Solicitation

This communication is not intended

to and does not constitute an offer to sell or the solicitation of an offer to subscribe for or buy or an invitation to purchase

or subscribe for any securities or the solicitation of any vote in any jurisdiction pursuant to the proposed transactions or otherwise,

nor shall there be any sale, issuance or transfer of securities in any jurisdiction in contravention of applicable law. No offer

of securities shall be made except by means of a prospectus meeting the requirements of Section 10 of the Securities Act and applicable

European regulations. Subject to certain exceptions to be approved by the relevant regulators or certain facts to be ascertained,

the public offer will not be made directly or indirectly, in or into any jurisdiction where to do so would constitute a violation

of the laws of such jurisdiction, or by use of the mails or by any means or instrumentality (including without limitation, facsimile

transmission, telephone and the internet) of interstate or foreign commerce, or any facility of a national securities exchange,

of any such jurisdiction.

Additional Information

Important Additional Information

Will be Filed with the SEC

TechnipFMC has filed with

the SEC a registration statement on Form S-4, which includes the preliminary proxy statement of FMC Technologies that also

constitutes a preliminary prospectus of TechnipFMC (the “proxy statement/prospectus”). A definitive proxy

statement/prospectus will be delivered as required by applicable law after the registration statement on Form S-4 is declared

effective by the SEC.

INVESTORS AND STOCKHOLDERS ARE URGED TO CAREFULLY READ THE PROXY STATEMENT/PROSPECTUS, AND

OTHER RELEVANT DOCUMENTS FILED OR TO BE FILED WITH THE SEC, IN THEIR ENTIRETY WHEN THEY BECOME AVAILABLE

BECAUSE THEY CONTAIN OR WILL

CONTAIN IMPORTANT INFORMATION ABOUT FMC TECHNOLOGIES, TECHNIP, TECHNIPFMC, THE PROPOSED TRANSACTIONS AND RELATED MATTERS

.

Investors and stockholders will be able to obtain free copies of the proxy statement/prospectus and other documents filed with

the SEC by the parties through the website maintained by the SEC at www.sec.gov. In addition, investors and stockholders will

be able to obtain free copies of the proxy statement/prospectus and other documents filed with the SEC on FMC Technologies’

website at www.fmctechnologies.com (for documents filed with the SEC by FMC Technologies) or on Technip’s website at www.technip.com

(for documents filed with the SEC by Technip).

Important Additional Information

Will be Made Available in an Information Document

Technip will prepare an information

document to be made available in connection with the Technip meeting of stockholders called to approve the proposed transaction

(the “Report”).

INVESTORS AND STOCKHOLDERS ARE URGED TO CAREFULLY READ THE INFORMATION DOCUMENT, AND OTHER RELEVANT

DOCUMENTS TO BE PUBLISHED ON THE TECHNIP WEBSITE, IN THEIR ENTIRETY WHEN THEY BECOME AVAILABLE BECAUSE THEY WILL CONTAIN IMPORTANT

INFORMATION ABOUT FMC TECHNOLOGIES, TECHNIP, TECHNIPFMC, THE PROPOSED TRANSACTIONS AND RELATED MATTERS.

Investors and stockholders

will be able to obtain free copies of the information document from Technip on its website at

www.technip.com

.

Important Additional Information

Will be Made Available in an Prospectus Prepared in accordance with the EU Prospectus Directive

TechnipFMC will make publicly

available a prospectus, prepared in accordance with the EU Prospectus Directive 2003/71/EC, with respect to the issuance of new

shares as a result of the proposed transaction and their admission to trading on the regulated market of Euronext Paris (including

any supplement thereto, the “Admission Prospectus”).

INVESTORS AND STOCKHOLDERS ARE URGED TO CAREFULLY READ THE

ADMISSION PROSPECTUS, AND OTHER RELEVANT DOCUMENTS, IN THEIR ENTIRETY WHEN THEY BECOME AVAILABLE BECAUSE THEY WILL CONTAIN IMPORTANT

INFORMATION ABOUT FMC TECHNOLOGIES, TECHNIP, TECHNIPFMC, THE PROPOSED TRANSACTIONS AND RELATED MATTERS

. Investors and stockholders

will be able to obtain free copies of the Admission Prospectus from TechnipFMC when available.

Participants in the Solicitation

FMC Technologies, Technip, TechnipFMC

and their respective directors and executive officers may be deemed to be participants in the solicitation of proxies from the

stockholders of FMC Technologies and Technip, respectively, in respect of the proposed transactions contemplated by the proxy

statement/prospectus and the Report. Information regarding the persons who are, under the rules of the SEC, participants in the

solicitation of the stockholders of FMC Technologies and Technip, respectively, in connection with the proposed transactions,

including a description of their direct or indirect interests, by security holdings or otherwise, will be set forth in the proxy

statement/prospectus when it is filed with the SEC. Information regarding FMC Technologies’ directors and executive officers

is contained in FMC

Technologies’ Annual Report

on Form 10-K for the year ended December 31, 2015 and its Proxy Statement on Schedule 14A, dated March 25, 2016, which are filed

with the SEC and can be obtained free of charge from the sources indicated above. Information regarding Technip’s directors

and executive officers is contained in Technip’s Annual Report for the year ended December 31, 2015 filed with the AMF and

can be obtained free of charge from the sources indicated above.

***

Merger FAQs #2

September

1, 2016

|

|

1.

|

Why

is this referred to as a merger of equals?

|

|

|

·

|

This

refers to how we are approaching the transaction of equals and how we’ve structured

our merger.

|

|

|

§

|

This

transaction expands on the success of our Forsys Subsea alliance and joint venture, which

was an equal partnership.

|

|

|

§

|

Each

company’s shareholders will own approximately 50 percent of the combined company.

|

|

|

§

|

We

will have operational headquarters in Paris, Houston and London (where the corporation

will be domiciled).

|

|

|

§

|

Thierry

Pilenko will serve as Executive Chairman, and Doug Pferdehirt will serve as CEO of the

combined TechnipFMC.

|

|

|

§

|

The

combined company’s Board of Directors will consist of seven board members appointed

by FMC Technologies and seven board members appointed by Technip.

|

|

|

·

|

We

believe this transaction will create significant additional value for the shareholders

of both companies by expanding on the success we have achieved through our Forsys Subsea

alliance and joint venture.

|

|

|

·

|

We

will bring together complementary systems and solutions, assets and strengths in Subsea,

Surface and Onshore/Offshore, driven by technology and innovation.

|

|

|

·

|

Please

note that the transaction is subject to and conditional upon regulatory and other approvals.

|

|

|

2.

|

How

will each company’s stock be handled upon closing?

|

|

|

·

|

TechnipFMC

will trade on the New York Stock Exchange (NYSE) and on the Paris Euronext Stock Exchange

(Euronext Paris).

|

|

|

·

|

Following

completion of the merger, FMC Technologies shares will be delisted from the NYSE and

Technip shares will be delisted from Euronext Paris.

|

|

|

·

|

Following

completion of the merger, based on the shares outstanding as of the date of the Memorandum

of Understanding entered into between the companies in connection with the transaction,

former shareholders of FMC Technologies will own approximately 49.1 percent of the combined

company and former shareholders of Technip will own approximately 50.9 percent of the

combined company.

|

|

|

·

|

Each

owner of one share of Technip will receive two shares of TechnipFMC, and each owner of

one share of FMC Technologies will receive one share of TechnipFMC.

|

|

|

·

|

Shareholders

of both companies will continue to participate in potential appreciation in equity value

of the combined company.

|

|

|

3.

|

How

and when will the core values be developed for the new company?

|

|

|

·

|

An

exercise to begin planning for the development of the new brand and core values is currently

underway led by the Executive Team with the participation of Communication departments

from both companies, as well as an external consultant.

|

|

|

·

|

The

complementary values, cultures and behaviors shared by both companies will be taken into

consideration during this process.

|

|

|

4.

|

How

are we going to get to know each company and our future colleagues?

|

|

|

·

|

We

believe FMC Technologies and Technip are a great fit — we share many of the same

values and have similar cultures.

|

|

|

·

|

We

have been engaged in the Forsys Subsea alliance and joint venture since mid-2015, and

believe the success of this partnership and demand from customers have demonstrated there

are additional opportunities through a combination of our two companies.

|

|

|

·

|

You

will get to know your future colleagues as you work side-by-side with them, either as

part of the integration planning process or post-merger.

|

|

|

·

|

We

will also share information about each company during the integration planning process.

|

|

|

5.

|

How

will three headquarters work together effectively and where specifically will they be

located?

|

|

|

·

|

We

are both global companies with operations all over the world.

|

|

|

·

|

TechnipFMC

will have its operational headquarters in Paris, France (where the Executive Chairman

will have his principal office); in Houston, Texas, USA (where the CEO will have his

principal office); and in London, United Kingdom (where the Forsys Subsea alliance and

joint venture is headquartered and the new corporation will be domiciled).

|

|

|

·

|

Being

co-located allows us to have the advantage of more face-to-face communication, which

we believe will be useful as we continue to develop our new teams and organization.

|

|

|

·

|

Following

the closing of the transaction, we believe that having multiple headquarters will leverage

our distributed leadership team to increase responsiveness to our customers and employees

across the company.

|

|

|

6.

|

What

changes will we expect as a result of the company being domiciled in the UK? Does Brexit

have an impact?

|

|

|

·

|

London

is a natural place to domicile the new company and recent developments have no material

impact on our operations, our plans or the pending merger.

|

|

|

·

|

The

significant benefits of the merger are not dependent on where we are headquartered, nor

will they be diminished if the UK leaves the European Union.

|

|

|

·

|

We

remain confident in the timeline and are moving toward closing the transaction.

|

|

|

7.

|

When

can we expect more communication about organizational structure and key appointments?

|

|

|

·

|

Designing

the new company organization is a key part of the integration planning process.

|

|

|

·

|

The

first step is to define the new company’s operating model and related structure.

We will then identify the individuals who will lead each of the key business areas.

|

|

|

·

|

We

will update you once those decisions have been made and confirmed by the Executive Sponsor

Team (EST).

|

|

|

8.

|

What

will happen to my compensation and benefits package?

|

|

|

·

|

This

combination is about positioning our business for growth, which we expect to translate

into increased opportunities for many employees as we benefit from being part of a larger,

more diverse company.

|

|

|

·

|

We

recognize that compensation and benefits are on the minds of employees and we are committed

to keeping you informed as we move through this process.

|

|

|

·

|

We

are always addressing compensation and benefits issues with the goal of providing competitive

packages that allow us to attract and retain the talent we need to succeed.

|

|

|

9.

|

When

will each company reveal its internal vacancies?

|

|

|

·

|

After

completing the transaction, we expect to communicate opportunities to employees as they

are identified.

|

|

|

·

|

The

most important thing everyone can do is stay engaged, flexible and focused on day-to-day

responsibilities.

|

|

|

10.

|

Which

messages have been resonating most with our customers and investors?

|

|

|

·

|

We

continue focusing on simplicity, transparency, value creation and driving structural

and sustainable change by making bold moves in our industry.

|

|

|

·

|

The

simplicity in our value proposition is what has been resonating most with our customers

and investors.

|

|

|

·

|

News

and analyst reports following the announcement of our plans to merge suggest that the

benefits of the combination are very clear and well understood.

|

|

|

11.

|

What

is the role of the Program Management Office (PMO) and how will the integration process

work?

|

|

|

·

|

On

Aug. 8, 2016, we announced that a Program Management Office (PMO) organization had been

established to oversee the joint integration planning activities required to position

TechnipFMC for ‘Day One’ success and beyond.

|

|

|

·

|

Since

then, our two companies have been working together to develop the PMO structure, governance

and operating principles, and identify key appointments.

|

|

|

·

|

The

PMO is also responsible for raising relevant issues and key decisions with the Executive

Sponsor Team to ensure that it meets synergy targets and achieves the strategic aspirations

and goals for the new company.

|

|

|

·

|

The

integration process has two major phases: the planning phase, which has already begun;

and the execution phase, which will begin following the close of the transaction.

|

|

|

·

|

The

PMO has made significant progress in setting up the integration architecture and teams,

and expects that this phase will be completed shortly.

|

|

|

12.

|

What

is a functional workstream?

|

|

|

·

|

Given

the scale of the integration effort, we have divided the work into multiple workstreams.

|

|

|

·

|

The

mandate of functional workstreams is to look at current practices at both companies with

input from businesses and regions, and propose the best way to merge those functions

and achieve the identified synergy targets.

|

|

|

·

|

Functional

workstreams include: Subsea Integration; Surface and Onshore/Offshore Integration; Global

Business Services (GBS); Supply Chain/Procurement; HR Policies and Sustainable Development;

Facilities; Communication/Branding; IT; Finance; Legal and Compliance; Research and Development;

Quality; Key Account Management; HSE; Security; and Insurance.

|

|

|

13.

|

What

is a business workstream?

|

|

|

·

|

Given

the scale of the integration effort, we have divided the business work into multiple

workstreams.

|

|

|

·

|

The

mandate of business workstreams is to tailor integration plans to the specific business

and regional needs and to ensure execution of these plans.

|

|

|

·

|

Business

workstreams include: Subsea Projects; Subsea Services; Subsea Products (including Manufacturing);

Onshore/Offshore; and Surface.

|

|

|

14.

|

How

will integration decisions be made?

|

|

|

·

|

The

integration planning team is responsible for developing a detailed and thoughtful integration

plan to make the post-close transition as seamless, efficient and productive as possible.

|

|

|

·

|

The

team and the EST group to which it reports, is comprised of leaders from both organizations

to ensure that it is fully appreciating and capturing the greatest strengths of both

organizations.

|

|

|

·

|

In

all of our decisions, we are committed to treating all employees at both companies fairly

and with respect as we move through this process.

|

|

|

·

|

Similarly,

we are committed to operating with transparency and keeping you informed throughout this

process.

|

|

|

15.

|

Will

each of the integration planning teams develop organization charts for their functions/business

units prior to ‘Day One’?

|

|

|

·

|

It

is important to remember that organizing a new company takes time, and we want to ensure

that we are putting in place the right organizational structure.

|

|

|

·

|

Once

we have decided the best structure for our combined businesses, we will begin to populate

the organization with the aim of ensuring that the positions are filled most effectively.

|

|

|

·

|

We

will announce those structural decisions and new roles as soon as possible.

|

|

|

16.

|

When

will the merger close? Do we anticipate any challenges between now and closing?

|

|

|

·

|

We

continue to expect the merger to close in early 2017, subject to the approvals of Technip

and FMC Technologies shareholders, regulatory bodies and consents, and other customary

closing conditions.

|

|

|

·

|

We

are pleased to have already received early approval from U.S. regulatory authorities

and will continue to make the appropriate filings.

|

|

|

17.

|

Do

we expect to consolidate facilities once we merge?

|

|

|

·

|

We

recognize the importance of maintaining our company’s respective footprints in

order for the combined company to be successful and develop its new culture in a productive

environment.

|

|

|

·

|

That

said, a result of co-locating may be consolidation in locations where both companies

have facilities also so that we may deliver on our savings targets.

|

|

|

18.

|

Is

there a plan for ‘Day One’ and beyond for TechnipFMC?

|

|

|

·

|

We're

creating a unique offering with a unique set of competencies and skills that is unparalleled

in the industry.

|

|

|

·

|

We

are as much focused on ‘Day One’ as we are on ‘Day 100’, ‘Day

365’, and even two years out.

|

|

|

·

|

Though

there are still a number of things we have to address, we are pleased with the progress

we’re making in our integration planning, which will ensure a smooth transition

for all of our stakeholders.

|

|

|

·

|

We

look forward to realizing the significant operational and strategic benefits inherent

in this combination.

|

|

|

19.

|

Will

there be redundancies as a result of the merger?

|

|

|

·

|

This

combination is about positioning FMC Technologies and Technip for growth, which we expect

to translate into increased opportunities for many employees as we benefit from being

part of a larger, more diverse company.

|

|

|

·

|

As

we plan for the integration after closing, we cannot rule out that there may be some

areas of overlap in certain job functions, but it’s too early to assess this.

|

|

|

·

|

Overall,

we expect that with greater scale and an enhanced global presence, there will be expanded

opportunities for personal development and career growth for employees of the combined

company.

|

|

|

·

|

We

are dedicated to making all decisions promptly and committed to treating all employees

at both companies fairly and with respect as we move through this process.

|

|

|

20.

|

How

will we manage the relationships with existing clients and suppliers after closing?

|

|

|

·

|

In

most cases, client relationships will remain with their current team after the merger

is complete.

|

|

|

·

|

If

dual agreements create conflicts, management of the combined company will work with clients

and suppliers to resolve issues fairly.

|

|

|

·

|

Please

remember that, until this transaction closes, we will continue operating as separate

companies, and our alliance and joint venture will continue unchanged.

|

|

|

·

|

Our

customer relationships remain our top priority.

|

|

|

·

|

We

will continue providing updates as they become available.

|

Important Information for

Investors and Securityholders

Forward-Looking Statements

This communication contains

“forward-looking statements.” All statements other than statements of historical fact contained in this report are

forward-looking statements within the meaning of Section 27A of the United States Securities Act of 1933, as amended (the “Securities

Act”), and Section 21E of the United States Securities Exchange Act of 1934, as amended (the “Exchange Act”).

Forward-looking statements usually relate to future events and anticipated revenues, earnings, cash flows or other aspects of

our operations or operating results. Forward-looking statements are often identified by the words “believe,” “expect,”

“anticipate,” “plan,” “intend,” “foresee,” “should,” “would,”

“could,” “may,” “estimate,” “outlook” and similar expressions, including the negative

thereof. The absence of these words, however, does not mean that the statements are not forward-looking. These forward-looking

statements are based on our current expectations, beliefs and assumptions concerning future developments and business conditions

and their potential effect on us. While management believes that these forward-looking statements are reasonable as and when made,

there can be no assurance that future developments affecting us will be those that we anticipate.

Factors that could cause actual

results to differ materially from those in the forward-looking statements include failure to obtain applicable regulatory or stockholder

approvals in a timely manner or otherwise; failure to satisfy other closing conditions to the proposed transactions; failure to

obtain favorable opinions from counsel for each company to the effect of how TechnipFMC Limited (to be renamed TechnipFMC plc)

(“TechnipFMC”) should be treated for U.S. tax purposes as a result of the proposed transaction; risks associated with

tax liabilities, or changes in U.S. federal or international tax laws or interpretations to which they are subject, including

the risk that the Internal Revenue Service disagrees that TechnipFMC is a foreign corporation for U.S. federal tax purposes; risks

that the new businesses will not be integrated successfully or that the combined companies will not realize estimated cost savings,

value of certain tax assets, synergies and growth or that such benefits may take longer to realize than expected; failure to realize

anticipated benefits of the combined operations; risks relating to unanticipated costs of integration; reductions in client spending

or a slowdown in client payments; unanticipated changes relating to competitive factors in the companies’ industries; ability

to hire and retain key personnel; ability to successfully integrate the companies’ businesses; the potential impact of announcement

or consummation of the proposed transaction on relationships with third parties, including clients, employees and competitors;

ability to attract new clients and retain existing clients in the manner anticipated; reliance on and integration of information

technology systems; changes in legislation or governmental regulations affecting the companies; international, national or local

economic, social or political conditions that could adversely affect the companies or their clients; conditions in the credit

markets; risks associated with assumptions the parties make in connection with the parties’ critical accounting estimates

and legal proceedings; and the parties’ international operations, which are subject to the risks of currency fluctuations

and foreign exchange controls.

All of our forward-looking

statements involve risks and uncertainties (some of which are significant or beyond our control) and assumptions that could cause

actual results to differ materially from our historical experience and our present expectations or projections. You should carefully

consider the foregoing factors and the other risks and uncertainties that affect the parties’ businesses, including those

described in FMC Technologies’ (“FMC Technologies”) Annual Report on Form 10-K, Quarterly Reports on Form 10-Q,

Current Reports on Form 8-K and other documents filed from time to time by FMC Technologies and TechnipFMC with the United States

Securities and Exchange Commission (the “SEC”) and those described in Technip S.A.’s (“Technip”)

annual reports, registration documents and other documents filed from time to time with the French financial markets regulator

(Autorité des Marchés Financiers or the “AMF”). We wish to caution you not to place undue reliance on

any forward-looking statements, which speak only as of the date hereof. We undertake no obligation to publicly update or revise

any of our forward-looking statements after the date they are made, whether as a result of new information, future events or otherwise,

except to the extent required by law.

No Offer or Solicitation

This communication

is not intended to and does not constitute an offer to sell or the solicitation of an offer to subscribe for or buy or an invitation

to purchase or subscribe for any securities or the solicitation of any vote in any jurisdiction pursuant to the proposed transactions

or otherwise, nor shall there be any sale, issuance or transfer of securities in any jurisdiction in contravention of applicable

law. No offer of securities shall be made except by means of a prospectus meeting the requirements of Section 10 of the Securities

Act and applicable European regulations. Subject to certain exceptions to be approved by the relevant regulators or certain facts

to be ascertained, the public offer will not be made

directly or indirectly, in

or into any jurisdiction where to do so would constitute a violation of the laws of such jurisdiction, or by use of the mails

or by any means or instrumentality (including without limitation, facsimile transmission, telephone and the internet) of interstate

or foreign commerce, or any facility of a national securities exchange, of any such jurisdiction.

Additional Information

Important Additional Information

Will be Filed with the SEC

TechnipFMC has filed with the

SEC a registration statement on Form S-4, which includes the preliminary proxy statement of FMC Technologies that also constitutes

a preliminary prospectus of TechnipFMC (the “proxy statement/prospectus”). A definitive proxy statement/prospectus

will be delivered as required by applicable law after the registration statement on Form S-4 is declared effective by the SEC.

INVESTORS AND STOCKHOLDERS ARE URGED TO CAREFULLY READ THE PROXY STATEMENT/PROSPECTUS, AND OTHER RELEVANT DOCUMENTS FILED OR

TO BE FILED WITH THE SEC, IN THEIR ENTIRETY WHEN THEY BECOME AVAILABLE BECAUSE THEY CONTAIN OR WILL CONTAIN IMPORTANT INFORMATION

ABOUT FMC TECHNOLOGIES, TECHNIP, TECHNIPFMC, THE PROPOSED TRANSACTIONS AND RELATED MATTERS

. Investors and stockholders will

be able to obtain free copies of the proxy statement/prospectus and other documents filed with the SEC by the parties through

the website maintained by the SEC at www.sec.gov. In addition, investors and stockholders will be able to obtain free copies of

the proxy statement/prospectus and other documents filed with the SEC on FMC Technologies’ website at www.fmctechnologies.com

(for documents filed with the SEC by FMC Technologies) or on Technip’s website at www.technip.com (for documents filed with

the SEC by Technip).

Important Additional Information

Will be Made Available in an Information Document

Technip will prepare an information

document to be made available in connection with the Technip meeting of stockholders called to approve the proposed transaction

(the “Report”).

INVESTORS AND STOCKHOLDERS ARE URGED TO CAREFULLY READ THE INFORMATION DOCUMENT, AND OTHER RELEVANT

DOCUMENTS TO BE PUBLISHED ON THE TECHNIP WEBSITE, IN THEIR ENTIRETY WHEN THEY BECOME AVAILABLE BECAUSE THEY WILL CONTAIN IMPORTANT

INFORMATION ABOUT FMC TECHNOLOGIES, TECHNIP, TECHNIPFMC, THE PROPOSED TRANSACTIONS AND RELATED MATTERS.

Investors and stockholders

will be able to obtain free copies of the information document from Technip on its website at www.technip.com.

Important Additional Information

Will be Made Available in an Prospectus Prepared in accordance with the EU Prospectus Directive

TechnipFMC will make publicly

available a prospectus, prepared in accordance with the EU Prospectus Directive 2003/71/EC, with respect to the issuance of new

shares as a result of the proposed transaction and their admission to trading on the regulated market of Euronext Paris (including

any supplement thereto, the “Admission Prospectus”).

INVESTORS AND STOCKHOLDERS ARE URGED TO CAREFULLY READ THE

ADMISSION PROSPECTUS, AND OTHER RELEVANT DOCUMENTS, IN THEIR ENTIRETY WHEN THEY BECOME AVAILABLE BECAUSE THEY WILL CONTAIN IMPORTANT

INFORMATION ABOUT FMC TECHNOLOGIES, TECHNIP, TECHNIPFMC, THE PROPOSED TRANSACTIONS AND RELATED MATTERS

. Investors and stockholders

will be able to obtain free copies of the Admission Prospectus from TechnipFMC when available.

Participants in the Solicitation

FMC Technologies, Technip,

TechnipFMC

and their respective directors and executive officers may be deemed to be participants in the solicitation of

proxies from the stockholders of FMC Technologies and Technip, respectively, in respect of the proposed transactions contemplated

by the proxy statement/prospectus and the report. Information regarding the persons who are, under the rules of the SEC, participants

in the solicitation of the stockholders of FMC Technologies and Technip, respectively, in connection with the proposed transactions,

including a description of their direct or indirect interests, by security holdings or otherwise, will be set forth in the proxy

statement/prospectus when it is filed with the SEC. Information regarding FMC Technologies’ directors and executive officers

is contained in FMC Technologies’ Annual Report on Form 10-K for the year ended December 31, 2015 and its Proxy Statement

on Schedule 14A, dated March 25, 2016, which are filed with the SEC and can be obtained free of charge from the sources indicated

above. Information regarding Technip’s directors and executive officers is contained in Technip’s Annual Report for

the year ended December 31, 2015 filed with the AMF and can be obtained free of charge from the sources indicated above.

Ends/

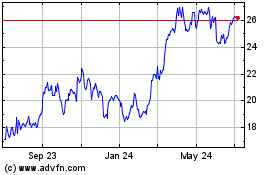

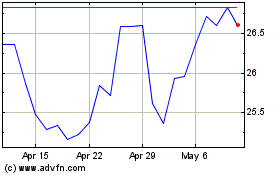

TechnipFMC (NYSE:FTI)

Historical Stock Chart

From Mar 2024 to Apr 2024

TechnipFMC (NYSE:FTI)

Historical Stock Chart

From Apr 2023 to Apr 2024