Filed by FMC Technologies, Inc.

pursuant to Rule 425 under the Securities Act of 1933, as amended

and deemed filed pursuant to Rule 14a-12 under the Securities Exchange Act of 1934, as amended

Subject Companies: FMC Technologies, Inc., Technip S.A. and FMC Technologies SIS Limited

Date: May 19, 2016

This filing

relates to a proposed business combination involving

FMC Technologies, Inc., Technip S.A. and FMC Technologies SIS Limited

(Subject Company Commission File No.: 001-16489)

Driving Change by Redefining the Production and Transformation of Oil and Gas

May 19th, 2016

Disclaimer

Forward-Looking Statements

This communication contains “forward-looking statements”. All statements other than statements of historical

fact contained in this report are forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended (the “Securities Act”), and Section 21E of the Securities Exchange Act of 1934, as amended

(the “Exchange Act”). Forward-looking statements usually relate to future events and anticipated revenues, earnings, cash flows or other aspects of our operations or operating results. Forward-looking statements are often identified by the

words “believe,” “expect,” “anticipate,” “plan,” “intend,” “foresee,” “should,” “would,” “could,” “may,” “estimate,” “outlook”

and similar expressions, including the negative thereof. The absence of these words, however, does not mean that the statements are not forward-looking. These forward-looking statements are based on our current expectations, beliefs and assumptions

concerning future developments and business conditions and their potential effect on us. While management believes that these forward-looking statements are reasonable as and when made, there can be no assurance that future developments affecting us

will be those that we anticipate.

Factors that could cause actual results to differ materially from those in

the forward-looking statements include failure to obtain applicable regulatory or stockholder approvals in a timely manner or otherwise; failure to satisfy other closing conditions to the proposed transactions; failure to obtain favorable opinions

from counsel for each company to the effect of how TechnipFMC PLC (“TechnipFMC”) should be treated for U.S. tax purposes as a result of the proposed transaction; risks associated with tax liabilities, or changes in U.S. federal or

international tax laws or interpretations to which they are subject, including the risk that the Internal Revenue Service disagrees that TechnipFMC is a foreign corporation for U.S. federal tax purposes; risks that the new businesses will not be

integrated successfully or that the combined companies will not realize estimated cost savings, value of certain tax assets, synergies and growth or that such benefits may take longer to realize than expected; failure to realize anticipated benefits

of the combined operations; risks relating to unanticipated costs of integration; reductions in client spending or a slowdown in client payments; unanticipated changes relating to competitive factors in the companies’ industries; ability to

hire and retain key personnel; ability to successfully integrate the companies’ businesses; the potential impact of announcement or consummation of the proposed transaction on relationships with third parties, including clients, employees and

competitors; ability to attract new clients and retain existing clients in the manner anticipated; reliance on and integration of information technology systems; changes in legislation or governmental regulations affecting the companies;

international, national or local economic, social or political conditions that could adversely affect the companies or their clients; conditions in the credit markets; risks associated with assumptions the parties make in connection with the

parties’ critical accounting estimates and legal proceedings; and the parties’ international operations, which are subject to the risks of currency fluctuations and foreign exchange controls.

All of our forward-looking statements involve risks and uncertainties (some of which are significant or beyond our

control) and assumptions that could cause actual results to differ materially from our historical experience and our present expectations or projections. You should carefully consider the foregoing factors and the other risks and uncertainties that

affect the parties’ businesses, including those described in FMC Technologies’ (“FMC Technologies”) Annual Report on Form 10-K, Quarterly Reports on Form 10-Q, Current Reports on Form 8-K and other documents filed from time to

time by FMC Technologies and TechnipFMC with the United States Securities and Exchange Commission (the “SEC”) and those described in Technip S.A.’s (“Technip”) annual reports, registration documents and other documents filed

from time to time with the French financial markets regulator (Autoritédes Marchés Financiers or the “AMF”). We wish to caution you not to place undue reliance on any forward-looking statements, which speak only as of the

date hereof. We undertake no obligation to publicly update or revise any of our forward-looking statements after the date they are made, whether as a result of new information, future events or otherwise, except to the extent required by law.

Disclaimer

Additional Information

Important Additional Information Will be Filed with the SEC

TechnipFMC will file with the SEC a registration statement on Form S-4, which will include the proxy statement of FMC

Technologies that also constitutes a prospectus of TechnipFMC (the “proxy statement/prospectus”). INVESTORS AND STOCKHOLDERS ARE URGED TO CAREFULLY READ THE PROXY STATEMENT/PROSPECTUS, AND OTHER RELEVANT DOCUMENTS TO BE FILED WITH THE SEC,

IN THEIR ENTIRETY WHEN THEY BECOME AVAILABLE BECAUSE THEY WILL CONTAIN IMPORTANT INFORMATION ABOUT FMC TECHNOLOGIES, TECHNIP, TECHNIPFMC, THE PROPOSED TRANSACTIONS AND RELATED MATTERS. Investors and stockholders will be able to obtain free copies of

the proxy statement/prospectus and other documents filed with the SEC by the parties through the website maintained by the SEC at www.sec.gov. In addition, investors and stockholders will be able to obtain free copies of the proxy

statement/prospectus and other documents filed with the SEC on FMC Technologies’ website at www.fmctechnologies.com (for documents filed with the SEC by FMC Technologies) or on Technip’s website at www.technip.com (for documents filed with

the SEC by Technip).

Additional Information Will be Made Available in an Information Document

Technip will prepare an information document to be made available in connection with the Technip meeting of stockholders

called to approve the proposed transaction (the “Report”). INVESTORS AND STOCKHOLDERS ARE URGED TO CAREFULLY READ THE INFORMATION DOCUMENT, AND OTHER RELEVANT DOCUMENTS TO BE PUBLISHED ON THE TECHNIP WEBSITE, IN THEIR ENTIRETY WHEN THEY

BECOME AVAILABLE BECAUSE THEY WILL CONTAIN IMPORTANT INFORMATION ABOUT FMC TECHNOLOGIES, TECHNIP, TECHNIPFMC, THE PROPOSED TRANSACTIONS AND RELATED MATTERS. Investors and stockholders will be able to obtain free copies of the information document

from Technip on its website at www.technip.com.

Important Additional Information Will be Made Available in an

Prospectus Prepared in accordance with the EU Prospectus Directive

TechnipFMC will make publicly available a

prospectus, prepared in accordance with the EU Prospectus Directive 2003/71/EC, with respect to the issuance of new shares as a result of the proposed transaction and their admission to trading on the regulated market of Euronext Paris (including

any supplement thereto, the

“Admission Prospectus”). INVESTORS AND STOCKHOLDERS ARE URGED TO

CAREFULLY READ THE ADMISSION PROSPECTUS, AND OTHER RELEVANT DOCUMENTS, IN THEIR ENTIRETY WHEN THEY BECOME AVAILABLE BECAUSE THEY WILL CONTAIN IMPORTANT INFORMATION ABOUT FMC TECHNOLOGIES, TECHNIP, TECHNIPFMC, THE PROPOSED TRANSACTIONS AND RELATED

MATTERS. Investors and stockholders will be able to obtain free copies of the Admission Prospectus from TechnipFMC when available.

Disclaimer

No Offer or Solicitation

This communication is not intended to and does not constitute an offer to sell or the solicitation of an offer to

subscribe for or buy or an invitation to purchase or subscribe for any securities or the solicitation of any vote in any jurisdiction pursuant to the proposed transactions or otherwise, nor shall there be any sale, issuance or transfer of securities

in any jurisdiction in contravention of applicable law. No offer of securities shall be made except by means of a prospectus meeting the requirements of Section 10 of the Securities Act and applicable European regulations. Subject to certain

exceptions to be approved by the relevant regulators or certain facts to be ascertained, the public offer will not be made directly or indirectly, in or into any jurisdiction where to do so would constitute a violation of the laws of such

jurisdiction, or by use of the mails or by any means or instrumentality (including without limitation, facsimile transmission, telephone and the internet) of interstate or foreign commerce, or any facility of a national securities exchange, of any

such jurisdiction.

Participants in the Solicitation

FMC Technologies, Technip, TechnipFMC and their respective directors and executive officers may be deemed to be

participants in the solicitation of proxies from the stockholders of FMC Technologies and Technip, respectively in respect of the proposed transactions contemplated by the proxy statement/prospectus and the Report. Information regarding the persons

who are, under the rules of the SEC, participants in the solicitation of the stockholders of FMC Technologies and Technip, respectively, in connection with the proposed transactions, including a description of their direct or indirect interests, by

security holdings or otherwise, will be set forth in the proxy statement/prospectus when it is filed with the SEC. Information regarding FMC Technologies’ directors and executive officers is contained in FMC Technologies’ Annual Report on

Form 10-K for the year ended December 31, 2015 and its Proxy Statement on Schedule 14A, dated March 25, 2016, which are filed with the SEC and can be obtained free of charge from the sources indicated above. Information regarding

Technip’s directors and executive officers is contained in Technip’s Annual Report for the year ended December 31, 2015 filed with the AMF and can be obtained free of charge from the sources indicated above.

Legal Documentation

The Memorandum of Understanding will be available on the Securities Exchange Commission (“SEC”) website (www.sec.gov).

Agenda

1 Strategic Vision

2 Key Terms of the Combination

3 TechnipFMC Going Forward

4 Appendix

5

Agenda

1 Strategic Vision

2 Key Terms of the Combination

3 TechnipFMC Going Forward

4 Appendix

6

FMC Technologies and Technip to combine

Builds a

comprehensive and flexible offering across each market from concept to project delivery and beyond

Best-in-class equipment and systems provider Products Leading and highly complementary equipment offering Scaling up best-in-class technology through enhanced R&D

Unique capabilities throughout project life-cycle Subsea

From concept to project delivery and beyond

Projects

Setting new project economic standards

Enhanced service proposition

Subsea Leveraging FMC Technologies’ leading solutions to service a

Services larger installed base

Expanding scope of

service offering

Strong midstream/downstream footprint Onshore /

Leveraging further on Technip’s engineering capabilities

Offshore

From concept to technology to project delivery

Global product and service platform Surface Enhanced offering in North America Strengthened international presence

Driving Change by Redefining the Production and Transformation of O&G

Taking the Forsys Subsea Concept Further …

Integrated Business Model drives Simplification & Cost Reduction

? Flexible risers and flowlines

Expanded resource / asset base

?

Umbilicals? Significantly lower ? the cost of subsea Pipeline / flowline / jumper installation Integrated field development commercial approach through integration ? Subsea equipment installation and reduced Reinforced full EPC complexity? Platform

design, fabrication, installation execution capabilities? Topsides design and fabrication? Maximize client Improved project success over the life economics of the field

Further process and

? Subsea

production systems? Foster technological product standardization innovation to lower ? Subsea services development costs Deeper life-of-field and increase ? Control and automation systems Monitoring efficiency? Subsea well intervention Stronger

R&D

? Subsea separation and boosting Systems capabilities

Building on proven success …

Accelerating Benefits to A Unique, Comprehensive Offering Our Clients

FEED Execution

From Concept:

Drilling & Further

accelerate

Reservoir

Downhole project economics

Development

Completion

Seismic & Reservoir Subsea

& Subsea

Field

Informa- Concept Tender Production To Project Delivery: Downhole Development tion

Selection Prepara- Systems Deeper into project Gathering Capabili- tion

ties execution

SURF Field

SURF Development

And Beyond:

Strengthening and

Topsides & Topsides &

Facilities Facilities solidifying innovation and technology

Forsys Subsea JV Scope Combined Entity Scope

9

… and Creating Value for All Stakeholders

People

Stronger, multicultural and technology advanced company? Highly skilled engineering capabilities of the combined company including manufacturing, project management Strategic Highlights

and R&D headquartered in France? Leadership across Subsea, Surface and ? Rapid integration built on working together and sharing

Onshore/Offshore, each supported by technology the same values and innovation

Comprehensive and flexible offering, from concept Clients to project delivery and beyond

Integrated, flexible and innovative solutions driving

Growth accelerator: Increasing innovation, improving project efficiency and economics execution, reducing costs and therefore enhancing customer success Stronger partner to our clients

Builds on proven alliance and joint success

Shareholders

Significant value creation

One of the strongest

balance sheets in the industry

10

Agenda

1 Strategic Vision

2 Key Terms of the Combination

3 TechnipFMC Going Forward

4 Appendix

11

Key Proposed Transaction Terms

Company Name?

TechnipFMC

All-stock merger

Transaction

NewCo incorporated in the UK

Merger Structure

US reverse triangular merger for FMC Technologies and European cross-border merger for Technip

Stock Listing? Shares listed on the NYSE and Euronext Paris with NewCo seeking inclusion in S&P 500 and CAC40 indices

All -

At closing, each share of Technip common stock will be converted into 2.0 ordinary shares of TechnipFMC and Transaction Terms each common share of FMC Technologies will be exchanged for

1.0 ordinary share of TechnipFMC

Each company’s shareholders will own close to 50% of the combined entity

Management team: and Management and – Executive Chairman – Thierry Pilenko Corporate – Chief

Executive Officer – Doug Pferdehirt

Governance – Other senior executives identified, to be announced

Governance Board: 14 members with an equal number of FMC Technologies and Technip Directors

Leadership

Headquarters Headquarters in Paris, Houston and London

Clear Balanced Full support of the Board of Directors of both companies and of cornerstone investors for Technip

Support

(Bpifrance, IFPEN)

Consultation of work council, regulatory approvals and other customary closing conditions Closing Next Steps?

Shareholders’ approval from both Technip and FMC Technologies

Timelineto Closing expected early in 2017

12

Clear Leadership and Balanced Governance

Board of

Directors Technip FMC Technologies

Board of Directors

Douglas Pferdehirt Thierry Pilenko

14 Board members with an equal number of Technip and FMC Technologies appointees

Management Team

Thierry Pilenko Douglas

Pferdehirt Executive Chairman Chief Executive Officer

Organisation

Subsea Surface Onshore / Offshore

Products Projects Services

Five Business Units:

Three headquartered in Paris and two in Houston Other senior executives identified

13

Significant Potential for Synergies

Pre-Tax Cost

Synergies of at least $400mm p.a.

Overview Annual Pre-Tax Cost Synergies

Expected to deliver at least $400m in annual pre-tax cost synergies in 2019 on top of ongoing restructuring initiatives

– 3% of the combined cost structure¹ Corporate

& Others Supply Chain

– 50% achieved in 2018

Infrastructure

– Implementation costs of $250mm

? Key areas of potential cost synergies include

– Supply chain improvement Phasing of Net Synergies

– Reduction of infrastructure costs $400mm+

– Others costs including procurement, corporate overheads, etc. $200mm? Revenue synergies are expected to be achieved from the integrated subsea project execution model

2018 2019

1 Cost structure defined as YE2015 Revenue less underlying adjusted EBITDA for both companies as reported. Average 2015 USD/EUR FX rate of 1.1097.

14

Agenda

1 Strategic Vision

2 Key Terms of the Combination

3 TechnipFMC Going Forward

4 Appendix

15

Strong Financial Profile

TechnipFMC

Backlog $16bn $4bn c.$20bn

Revenue $13.5bn $6.4bn c.$20bn

EBITDA¹

$1.4bn $1.0bn $2.4bn

Margin (%) 10.6% 15.2% 12.1%

Gross Cash $4.7bn $1.0bn $5.7bn

Position

Shareholder Attractive shareholder

return policy

Return Offer shareholders an attractive and Share repurchase including market based dividend;

Mechanism sustainable dividend program and share buy-back in line with

cash flow generation

Credit Rating BBB+ BBB / Baa2 Target solid investment grade

credit rating

Notes: Revenue and operating profit

as of YE2015. Backlog, debt and cash position as of 31-Mar-2016

EBITDA before restructuring, impairment and

other exceptional items as defined by both companies in their respective previous public filings

16

Key Success Factors for Driving Change

Reliable

and Efficient Differentiated Equipment Execution and Technologies

Concept

Highly complementary portfolio? Project Delivery

Scaling up best-in-class R&D

Beyond

TechnipFMC

Comprehensive, flexible Buiding on proven success offering

Complementarity Robust Financial

Profile Subsea

Existing alliance

Combined revenue of c.$20bn? Surface? Talented employees

Strong backlog providing visibility? Onshore/Offshore? Solid balance sheet? Synergies

Compelling Combination of Two Market Leaders

Notes: Revenue as of YE2015.

17

Agenda

1 Strategic Vision

2 Key Terms of the Combination

3 TechnipFMC Going Forward

4 Appendix

18

Overview of TechnipFMC

Building on

Complementarity to Create a Broad-Based Market Leader

Subsea Surface Onshore / Offshore

Products: trees, manifolds, control, ? Drilling, completion and production ? Offshore products, technologies and

templates, flowline systems, umbilicals wellheads: services and flexibles

– Surface integrated services

– Fixed facilities: Conventional platforms, ? Subsea processing self-elevating platforms, GBS, artificial

– Frac stacks, arm manifold islands

ROV’s and manipulator systems

– Frac

flowback services – Floating facilities: FPSO, semi ? Subsea services submersibles, Spar, TLP, FLNG

– Separation systems

– Drilling systems – Services: Floatover installation, HUC

– Metering systems

Modifications

– Installation

Fluid control

Onshore products, technologies and

– Asset management and production

– Treating iron, temporary pipe restraints, services optimization pumps, fluid ends

– Gas monetization, refining,

– Field IMR and well services

– Water

processing, advanced separation petrochemicals, onshore pipelines, etc.

56% 9% 35%

Backlog: $13.2bn Backlog: $0.4bn Backlog: $7.1bn

Revenue contribution: Revenue contribution: Revenue contribution:

19

Seamless Reach Across Geographies

Orkanger

Stavanger Pori

Evanton St. Petersburg Calgary Aberdeen Zoetermeer Oslo Moscow

St.John’s Milton London

Warsaw Newfoundland Keynes Frankfurt Boston Paris Lyon

Le Trait Barcelona Marseille Seoul Claremont Weymouth Rome (Flexi France) Lisbon Missaoud Athens Mobile Shanghai Cairo Kuwait Al-Khobar New Delhi

Houston Doha Abu Dhabi

Mexico City Ciudad del Carmen Mumbai Bangkok Rayong Caracas Chennai

Ho Chi Minh City Port-Of-Spain Ivory Coast Kuala Lumpur Bogota Lagos Batam Accra Singapore Balikpapan

Subsea Manufacturing Facility Dande

Congo Jakarta

Subsea Service Base Vitória Luanda Tanjung Langsat Lobito (Angoflex) (Asiaflex Products)

Subsea

Technology Centre (Flexibras) Macaé Açu (Flexibras) Port of Angra Rio de Janeiro

Regional

Headquarters

Operating Centers Perth Umbilicals Plants Spoolbases Pipe Plants Logistic Bases Construction Yard

20

A Diversified Client Base

Strong

Complementarities—Estimated Combined Revenue Breakdown¹

Others include:

— Independents

International Oil

— Midstream Companies

— OFS players 23%

38%

38%

National Oil Companies

Combined Revenue of c.$20bn (2015)

Notes: Based

on 2015A revenues and estimated split between IOC/NOC/Independent, Midstream and OFS of 35%/35%/30% for FMC Technologies and 40%/40%/20% for Technip.

|

1

|

|

Average 2015 USD/EUR FX rate of 1.1097.

|

21

Overview of FMC Technologies

A Global Market

Leader in Subsea Systems and a Leading Provider of Technologies and Services to the Oil and Gas Industry

Subsea Surface Technologies Energy Infrastructure

2015 Adjusted 2015 Adjusted 2015 Adjusted

Revenue: $4,509mm Revenue: $1,488mm Revenue: $395mm Operating income: $630mm Operating income: $61mm Operating income:

$3mm

Subsea production systems Drilling, completion and production Measurement solutions designs products

wellheads: and systems used to measure and control

– Trees, Manifolds, Control Systems, Template the flow

of liquids and gases Systems, Flowline Connection – Surface integrated services

Loading systems transfer

petroleum, LNG, Subsea separation and boosting systems – Frac stacks Subsea services – Frac flowback services and chemical products between fixed and Segment mobile installations Activity – Installation, Asset Management, Well –

Separation systems Systems designed for separation of oil, gas, Services, Production Optimization sand, and water in surface, subsea and

– Metering systems

Multi-phase meters

topside applications Fluid control

Remotely operated vehicles (“ROVs”) and

– Treating iron, temporary pipe restraints, manipulator systems pumps, fluid ends

22

Overview of Technip

A World Leader in Project

Management, Engineering and Construction for Oil & Gas, Chemicals and Energy Companies

Subsea Onshore

/ Offshore

Ultra-Deep Water Deepwater

Deep-to-Shore Infield Lines Infield Lines

2015

Adjusted 2015 Adjusted

Revenue: €5,876mm Revenue: €6,333mm

Operating income¹: €851mm Operating income¹: €218mm

Subsea field architecture and integrated subsea design

Segment Preliminary studies to detail design Manufacturing, spooling & installation pipelines

Activity / Project management: Engineering, procurement, construction Know-how Project management: engineering,

procurement, Technology supply and project management construction, logistics and installation using our high-end fleet

Key Proprietary pipe technologies (rigid & flexible) High added-value process design skills Differentia Leading industrial plants and operational facilities Proficiency in design

of all platform types

-tors Alliances with industry leading partners Proprietary technology, know-how and

license partners

|

1

|

|

Adjusted operating income from recurring activities after Income/(Loss) of Equity Affiliates.

|

23

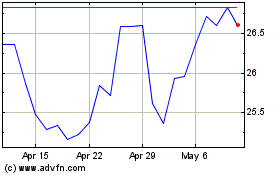

TechnipFMC (NYSE:FTI)

Historical Stock Chart

From Mar 2024 to Apr 2024

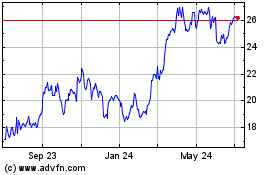

TechnipFMC (NYSE:FTI)

Historical Stock Chart

From Apr 2023 to Apr 2024