FPL CEO: Gas Pipeline, Nuclear Project Hinge On Rate Case

December 03 2009 - 5:16PM

Dow Jones News

FPL Group Inc. (FPL) may decide against building a natural-gas

pipeline and new nuclear reactors in Florida if the company doesn't

get a favorable decision from state regulators on an electric-rate

proposal, said Lew Hay, the company's chairman and chief executive,

in an interview Thursday.

Florida's Public Service Commission, which oversees utilities in

the state, was rocked by allegations earlier this year that two of

its commissioners acted improperly by attending dinners and parties

hosted by executives of the utilities the PSC regulates. Gov.

Charlie Crist appointed two new commissioners to the PSC earlier

this month after deciding not to reappoint the commissioners who

had been accused of misconduct.

The upheaval has FPL executives concerned that Florida Power

& Light, the company's utility subsidiary, won't get fair

treatment from regulators. Florida Power & Light has asked to

raise annual base rates by about $1.3 billion, or 30%. Base rates

compensate utilities for investments in power plants, substations,

wires and other equipment, along with setting their allowed rate of

return.

"I think there is fair amount uncertainty about how the

commission is going to act," Hay said.

He said a recommendation by commission staff earlier this week

on a pending rate increase filed by Progress Energy Inc. (PGN)

"wasn't terrible." The staff backed a revenue increase of $174

million compared to $500 million requested by Progress, which

serves central Florida and the Gulf coast.

Yet staff recommendations in recent months have become less of a

barometer for the commission's final decision. In October, the PSC,

contrary to its staff's recommendation, voted to deny Florida Power

& Light's proposal to build a new $1.5 billion underground

natural-gas pipeline, arguing that the project wasn't the most

cost-effective and reliable way to bring more gas to the state.

The utility hasn't decided whether it will submit a new pipeline

proposal to regulators, Hay said.

The company's decision to build two new reactors at its Turkey

Point nuclear power plant in south Florida will also hinge on

Florida Power & Light's relationship with regulators, he said.

FPL estimates the project will cost $17 billion to $20 billion.

"That's a lot of money to put into a state where the politics of

the day determine how much you're going to earn on infrastructure

investment," Hay said.

FPL shares closed down 32 cents, or 0.6%, at $53.00

Thursday.

-By Christine Buurma, Dow Jones Newswires; 212-416-2143;

christine.buurma@dowjones.com

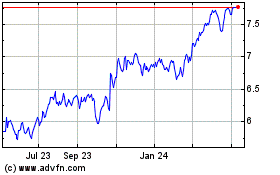

First Trust New Opportun... (NYSE:FPL)

Historical Stock Chart

From Mar 2024 to Apr 2024

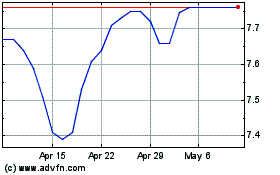

First Trust New Opportun... (NYSE:FPL)

Historical Stock Chart

From Apr 2023 to Apr 2024