GE Strikes Deals to Sell Most of U.S. Restaurant Finance Assets

June 27 2016 - 6:42PM

Dow Jones News

By Maria Armental

General Electric Co. has struck three different deals to sell

the bulk of its U.S. restaurant finance assets, the latest deal in

its broader strategic move to focus on its industrial

businesses.

The sale would represent an ending net investment of about $1.4

billion at March 31, GE said.

Under the deals announced Monday, Tennessee-based First Horizon

National Corp. would acquire about $637 million of restaurant

franchise loans in the Southwest and Southeast, Illinois-based

Wintrust Financial Corp. would acquire about $581 million in assets

in the Midwest and part of the West, and New York-based Sterling

National Bank would acquire the roughly $190 million Eastern U.S.

restaurant franchise financing loan portfolio.

The deals are expected to close in the third quarter. The

companies didn't disclose additional terms.

The rest of GE Capital's Western portfolio is to be sold

separately, GE said.

Since GE announced plans last year to sell off about $200

billion of GE Capital, what was then a $500 billion lending

business, it has signed agreements for about $180 billion and

completed about $156 billion of those. The company, which expects

to complete the process by the end of the year, said the breakup

would ultimately allow it to send about $35 billion in dividends

from GE Capital to the corporate parent, subject to regulatory

approval.

Shares, down 6% this year, edged down 7 cents to $29.25 in

after-hours trading.

Write to Maria Armental at maria.armental@wsj.com

(END) Dow Jones Newswires

June 27, 2016 18:27 ET (22:27 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

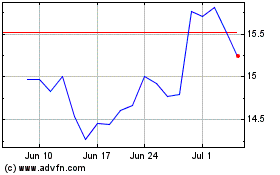

First Horizon (NYSE:FHN)

Historical Stock Chart

From Mar 2024 to Apr 2024

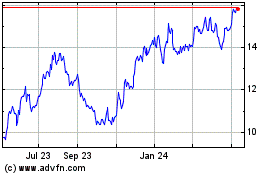

First Horizon (NYSE:FHN)

Historical Stock Chart

From Apr 2023 to Apr 2024