First Horizon National Prepares for Finra Arbitration Loss

October 26 2015 - 9:20AM

Dow Jones News

First Horizon National Corp. said Monday in a regulatory filing

that it believed it had lost an arbitration hearing before Wall

Street's watchdog agency and was facing a possible $11.5 million

penalty.

The bank said it faced claims of fraud and breach of contract

tied to the purchase of preferred term securities by First United

Bank & Trust from First Horizon unit FTN Financial Securities

Corp.

First Horizon said it was advised that the Financial Industry

Regulatory Authority, or Finra, had reached a decision which it had

not yet seen. First Horizon said that after consulting with its

lawyers, following the proceedings, it appeared that it would face

as much as an $11.5 million award, far less than the $46.5 million

being sought by plaintiffs.

In the filing submitted to the Securities and Exchange

Commission, First Horizon said it hadn't established a liability or

reserve for this arbitration in its financial statements.

Write to Ezequiel Minaya at ezequiel.minaya@wsj.com

Subscribe to WSJ: http://online.wsj.com?mod=djnwires

(END) Dow Jones Newswires

October 26, 2015 09:05 ET (13:05 GMT)

Copyright (c) 2015 Dow Jones & Company, Inc.

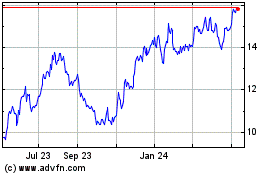

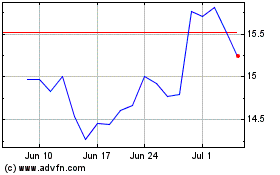

First Horizon (NYSE:FHN)

Historical Stock Chart

From Mar 2024 to Apr 2024

First Horizon (NYSE:FHN)

Historical Stock Chart

From Apr 2023 to Apr 2024