SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 11-K

(Mark One)

| |

x |

ANNUAL REPORT PURSUANT TO SECTION 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

|

For the Fiscal Year Ended December 31, 2014

OR

| |

o |

TRANSITION REPORT PURSUANT TO SECTION 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

|

For the Transition Period from __________ to ____________

Commission File No. 001-15185

FIRST HORIZON NATIONAL CORPORATION SAVINGS PLAN

(Full Title of Plan)

FIRST HORIZON NATIONAL CORPORATION

(Issuer of Securities Held Pursuant to Plan)

165 MADISON AVENUE

MEMPHIS, TENNESSEE 38103

(Address of Principal Executive Office of Issuer

and of Plan)

first horizon national

corporation

savings plan

Financial Statements and Supplemental Schedule

December 31, 2014 and 2013

(With Report of Independent Registered Public Accounting Firm Thereon)

Index to Financial

Statements and Supplemental Schedule

| Note: |

All other schedules required by the Department of Labor’s Rules and Regulations for Reporting and Disclosure under the Employee Retirement Income Security Act of 1974 have been omitted because there is nothing to report. |

Report of Independent Registered Public Accounting

Firm

To the Pension, Savings and Flexible Compensation Committee

First Horizon National Corporation Savings Plan

Memphis, Tennessee

We have audited the

accompanying statements of net assets available for benefits of the First Horizon National Corporation Savings Plan

(the “Plan”) as of December 31, 2014 and 2013, and the related statement of changes in net assets available

for benefits for the year ended December 31, 2014. These financial statements are the responsibility of the

Plan’s management. Our responsibility is to express an opinion on these financial statements based on our audits.

We conducted our audits in accordance with the standards of the Public Company Accounting Oversight Board (United States). Those standards require that we plan and perform the

audit to obtain reasonable assurance about whether the financial statements are free of material misstatement. The Plan is not

required to have, nor were we engaged to perform, an audit of its internal control over financial reporting. Our audits included

consideration of internal control over financial reporting as a basis for designing audit procedures that are appropriate in the

circumstances, but not for the purpose of expressing an opinion on the effectiveness of the Plan’s internal control over

financial reporting. Accordingly, we express no such opinion. An audit includes examining, on a test basis, evidence supporting

the amounts and disclosures in the financial statements. An audit also includes assessing the accounting principles used and significant estimates made

by management, as well as evaluating the overall financial statement presentation. We believe that our audits provide a reasonable

basis for our opinion.

In our opinion, the financial

statements referred to above present fairly, in all material respects, the net assets available for benefits of the Plan as

of December 31, 2014 and 2013, and the changes in net assets available for benefits for the year ended December 31, 2014, in conformity with accounting principles generally accepted in the United States of America.

The supplemental information in the

accompanying schedule of assets (held at end of year) as of December 31, 2014, has been subjected to audit

procedures performed in conjunction with the audit of the Plan’s financial statements. The supplemental information is

presented for the purpose of additional analysis and is not a required part of the financial statements but includes

supplemental information required by the Department of Labor’s Rules and Regulations for Reporting and Disclosure under

the Employee Retirement Income Security Act of 1974. The supplemental information is the responsibility of the Plan’s

management. Our audit procedures included determining whether the supplemental information reconciles to the financial statements or the

underlying accounting and other records, as applicable, and performing procedures to test the completeness and accuracy of

the information presented in the supplemental information. In forming our opinion on the supplemental information in the accompanying

schedule, we have evaluated whether the supplemental information, including its form and content, is presented in conformity

with the Department of Labor's Rules and Regulations for Reporting and Disclosure under the Employee Retirement Income Security

Act of 1974. In our opinion, the supplemental information is fairly stated in all material respects in relation to the basic

financial statements taken as a whole.

/s/ Mayer Hoffman McCann P.C.

Memphis, Tennessee

June 25, 2015

FIRST HORIZON

NATIONAL CORPORATION SAVINGS PLAN

Statements of Net

Assets Available for Benefits

December 31, 2014

and 2013

| | |

2014 | | |

2013 | |

| Assets: | |

| | | |

| | |

| Investments - at fair value: (Notes 2, 8 and 10) | |

| | | |

| | |

| First Horizon National Corporation, common stock fund | |

$ | 124,401,123 | | |

$ | 113,183,745 | |

| Mutual funds | |

| 153,775,956 | | |

| 154,774,221 | |

| Money market funds | |

| 20,022,471 | | |

| 22,370,025 | |

| Stable value fund (common/collective trust) | |

| 26,111,135 | | |

| 25,724,261 | |

| Common/collective trust funds | |

| 114,708,913 | | |

| 95,169,707 | |

| Segregated participant investments | |

| 1,199,871 | | |

| 1,376,931 | |

| Self-directed brokerage account | |

| | | |

| | |

| Short-term investments | |

| 3,035,659 | | |

| 1,802,658 | |

| Common stock | |

| 4,660,957 | | |

| 2,866,490 | |

| Preferred stock | |

| 24,241 | | |

| — | |

| Mutual funds | |

| 2,513,156 | | |

| 2,777,047 | |

| Partnerships | |

| 97,579 | | |

| 82,511 | |

| Total self directed brokerage account | |

| 10,331,592 | | |

| 7,528,706 | |

| Total investments - at fair value | |

| 450,551,061 | | |

| 420,127,596 | |

| | |

| | | |

| | |

| Cash - brokerage account | |

| — | | |

| 16,160 | |

| | |

| | | |

| | |

| Receivables: | |

| | | |

| | |

| Employer contributions | |

| 437,516 | | |

| 320,435 | |

| Notes receivable from participants | |

| 8,813,829 | | |

| 8,091,371 | |

| Due from broker | |

| 95,479 | | |

| 105,287 | |

| Due from broker - brokerage account | |

| 137,884 | | |

| 344,236 | |

| Interest and dividends - brokerage account | |

| 6,636 | | |

| 4,021 | |

| Total receivables | |

| 9,491,344 | | |

| 8,865,350 | |

| Total assets | |

| 460,042,405 | | |

| 429,009,106 | |

| Liabilities: | |

| | | |

| | |

| Expense accrual | |

| 107,910 | | |

| 219,347 | |

| Due to broker - brokerage account | |

| 201,773 | | |

| 77,717 | |

| Total liabilities | |

| 309,683 | | |

| 297,064 | |

| Net assets reflecting investments at fair value | |

| 459,732,722 | | |

| 428,712,042 | |

| | |

| | | |

| | |

| Adjustment to contract value from fair value for interest in common/collective trust relating to fully benefit-responsive investment contracts | |

| (510,831 | ) | |

| (328,006 | ) |

| Net Assets Available for Benefits | |

$ | 459,221,891 | | |

$ | 428,384,036 | |

See accompanying notes to financial statements.

FIRST HORIZON

NATIONAL CORPORATION SAVINGS PLAN

Statement

of Changes in Net Assets Available for Benefits

Year ended

December 31, 2014

| | |

2014 | |

| Additions: | |

| | |

| Additions to net assets attributed to: | |

| | |

| Investment income: | |

| | |

| Net appreciation in investments (See note 8) | |

$ | 22,225,323 | |

| Interest and dividend income | |

| 12,592,767 | |

| Total investment income | |

| 34,818,090 | |

| | |

| | |

| Interest income on notes receivable from participants | |

| 278,134 | |

| | |

| | |

| Contributions: | |

| | |

| Participants | |

| 17,801,802 | |

| Employer | |

| 13,003,794 | |

| Rollovers | |

| 1,110,233 | |

| Total contributions | |

| 31,915,829 | |

| Total additions | |

| 67,012,053 | |

| Deductions: | |

| | |

| Deductions from net assets attributed to: | |

| | |

| Benefits paid to participants or beneficiaries | |

| 35,451,233 | |

| Administrative expenses | |

| 722,965 | |

| Total deductions | |

| 36,174,198 | |

| | |

| | |

| Net increase | |

| 30,837,855 | |

| | |

| | |

| Net assets available for benefits: | |

| | |

| Beginning of year | |

| 428,384,036 | |

| End of year | |

$ | 459,221,891 | |

See accompanying notes to financial statements.

FIRST HORIZON

NATIONAL CORPORATION SAVINGS PLAN

Notes to Financial Statements

December 31, 2014 and 2013

(1) Plan Description

The following description of First Horizon National Corporation

Savings Plan (the “Plan”) provides only general information. Participants should refer to the Plan document for a more

complete description of the Plan’s provisions.

The Plan is a defined contribution retirement savings

plan established April 23, 1978, for qualified employees of First Horizon National Corporation and certain affiliates (the “Company”

or “Plan Sponsor”) to provide a savings plan for those employees. The Plan is subject to the provisions of the Employee

Retirement Income Security Act of 1974, as amended (ERISA). Since inception, the Plan agreement has been amended periodically to

conform with provisions of ERISA and other laws and regulations. The Plan is administered by the Pension, Savings and Flexible

Compensation Committee of the Company. Wilmington Trust served as trustee of the Plan through March 31, 2015. Pursuant to the Plan

document, certain retirees are allowed to segregate and direct their accounts into investments outside the investment options available

to active participants and defer payment of benefits. These segregated accounts are presented in a single line item in the financial

statements and are trusteed by First Tennessee Bank National Association (FTBNA), the Company’s primary affiliate. Aon Hewitt

served as the recordkeeper of the Plan through March 31, 2015.

Effective November 14, 2014, the Plan eliminated the

BlackRock Life Path Index 2015 Fund. Any funds remaining in the fund being eliminated were mapped to the BlackRock Life Path Index

Retirement Fund. Also effective November 14, 2014, the Plan added the BlackRock Life Path Index 2050 Fund and the BlackRock Life

Path Index 2055 Fund.

Under the terms of the Plan, full-time employees are

eligible to participate in the Plan immediately. Part-time employees are eligible to participate upon completion of twelve months

of service in which they have worked 1,000 hours or more. A participant may authorize payroll deductions from 1% to 60% of eligible

pay (subject to certain legal limitations) as contributions, to be invested as authorized by the participant. The Plan allows participants

to make Pre-tax and Roth contributions (from 1% to 50% of eligible pay) and other after-tax contributions (from 1% to 10% of eligible

pay). Participants may also rollover amounts representing distributions from other defined benefit and/or defined contribution

plans. Participants direct their contributions into various investment options offered by the Plan and may elect to change their

investment authorizations at any time.

Effective January 1, 2014, automatic savings plan enrollment

deferrals for new hires, rehires, and newly eligible enrollees increased from 1% to 3%.

The Company makes three types of contributions on behalf

of participants to the Plan.

FIRST HORIZON NATIONAL CORPORATION SAVINGS PLAN

Notes to Financial Statements

December 31, 2014 and 2013

(1) Plan Description (continued)

Company matching contributions - After one year of service

all participants are eligible for matching contributions. Effective January 1, 2013, all participants receive 100% matching of

the first 1% to 6% of participant pre-tax, catch-up, and Roth 401(k) contributions. These contributions will be invested according

to a participant’s current investment elections. Prior to 2013, matching contributions were received for 50% of the first

1% to 6% of eligible participant contributions and were invested in the First Horizon National Corporation Stock Fund (ESOP) but

could be redirected into the other investment options within the plan. Effective January 1, 2013, these contributions are subject

to a three-year vesting schedule for new hires. For all other savings plan participants, these contributions are 100% vested at

all times.

Company savings contributions – The Company provides

Flexible Dollars to employees to spend on benefits or to deposit into the Plan. Participants’ Flexible Dollars deposited

into the Plan are identified as Company savings contributions and are not eligible for matching contributions. These contributions

are 100% vested at all times.

The Company may also make Employer Non Elective Contributions

(ENEC) for employees not participating in a regular bonus program provided by the Company. ENEC contributions, which are based

upon Company performance from the previous year, are determined annually as a percentage of an eligible participant’s eligible

earnings. These contributions are subject to a two-year vesting schedule at which point they become 100% vested.

On termination of service due to death, disability,

retirement or termination of service for other reasons, a participant or beneficiary may elect to receive a lump-sum amount equal

to the value of the participant’s vested interest in their account, or a direct rollover into an eligible retirement plan,

as defined. Qualified retirees are also given the option of partial distributions. The Plan also provides for in-service and hardship

withdrawals. A participant may request a withdrawal of all or part of their after-tax, rollover and vested ENEC contributions at

any time. Upon obtaining the age of 59 ½, a participant may request a withdrawal of all or a portion of the value of their

vested account. Hardship withdrawals are allowed at any time for certain financial needs, as defined. Account balances invested

in the ESOP may be received in the form of shares of Company common stock.

Each participant’s account is credited with the

participant’s contributions, the Company’s contributions and Plan earnings or losses, and is charged with an allocation

of asset management fees and certain other recordkeeping expenses. Allocations are based upon participant contributions or account

balances, as defined. The benefit to which a participant is entitled is the benefit that can be provided from the participant’s

vested account balance.

FIRST HORIZON NATIONAL CORPORATION SAVINGS PLAN

Notes to Financial Statements

December 31, 2014 and 2013

(1) Plan Description (continued)

Participants are vested immediately in their personal

contributions, plus actual earnings thereon. Effective January 1, 2013, company matching contributions are subject to a three-year

vesting schedule for new hires. For all other savings plan participants, these contributions are 100% vested at all times. Vesting

in the ENEC portion of a participant’s account is based on years of continuous service. ENEC contributions are subject to

a two year vesting schedule at which point the contributions become 100% vested.

At December 31, 2014 forfeited nonvested accounts totaled

$126,060. Forfeited amounts may be reallocated to eligible participants based upon eligible compensation as defined by the plan

agreement, used to offset employer contributions, be applied to restore participant’s non-vested account upon timely exercise

of a buy-back right, or be applied towards expenses of administration of the Plan or its related trust.

| (f) | Participant Notes Receivable |

Active employee participants may borrow from their accounts

a minimum of $1,000 up to the lesser of $50,000 or 50% of their vested account balance. General purpose loan terms range from 6

to 60 months and primary residence loan terms range from 6 to 120 months. The loans are secured by the balance in the participant’s

account. Interest rates are set quarterly based on the interest rate on the 15th day of the month preceding the new

quarter and is based on the prime rate as published in the Wall Street Journal. At December 31, 2014, interest rates ranged from

3.25% to 8.25%. Principal and interest is paid ratably through payroll deductions. Prior to April 1, 2009, participants could have

up to 3 loans outstanding at one time. After April 1, 2009, up to two loans may be outstanding at one time, but participants can

have only one general purpose loan and one primary residence loan per calendar year. Participants who rolled over three outstanding

loans prior to April 1, 2009 will be allowed to keep the outstanding loans.

(2) Summary of Significant Accounting Policies

The financial statements of the Plan are prepared under

the accrual method of accounting, with the exception of benefit payments which are recorded when paid.

As described in Accounting Standard Codification 962

(ASC 962), formerly known as Financial Accounting Standards Board (FASB) Staff Position AAG INV-1 and SOP 94-4-1, Reporting

of Fully Benefit-Responsive Investment Contracts Held by Certain Investment Companies Subject to the AICPA Investment Company Guide

and Defined-Contribution Health and Welfare and Pension Plans (the “FSP”), investments in fully benefit-responsive

investment contracts are required to be presented at fair value. However, contract value is the relevant measurement attribute

for that portion of the net assets available for benefits of a defined contribution plan attributable to fully benefit-responsive

investment contracts

FIRST HORIZON NATIONAL CORPORATION SAVINGS PLAN

Notes to Financial Statements

December 31, 2014 and 2013

(2) Summary of Significant Accounting

Policies (continued)

because contract value is the amount participants would

receive if they were to initiate permitted transactions under the terms of the Plan. The Plan invests in fully benefit responsive

contracts in the stable value fund. As required by ASC 962, the accompanying Statements of Net Assets Available for Benefits present

the fair value of the investments in the stable value fund as well as the adjustment to contract value relating to the investment

contracts. The accompanying Statement of Changes in Net Assets Available for Benefits is prepared on a contract value basis.

The preparation of financial statements in conformity

with accounting principles generally accepted in the United States of America requires management to make estimates and assumptions

that affect the reported amounts of net assets available for benefits and changes therein, and disclosure of contingent assets

and liabilities. Actual results could differ from those estimates.

| (c) | Investment Valuation and Income Recognition |

Investments in mutual funds are recorded at fair value

based on the funds’ reported closing net asset values as of the last business day of the year. The mutual funds held by the

Plan are deemed to be actively traded. Investments in money market funds are stated at fair value based on the closing net asset

value of shares held by the Plan at year end. The investment in the stable value fund is stated at contract value as determined

by the issuer based on the cost of the underlying investments in guaranteed investment contracts plus accrued interest income less

amounts withdrawn to pay benefits. The fair value of the stable value fund is based on discounting the related cash flows of the

underlying guaranteed investment contracts based on current yields of similar instruments with comparable durations. The investments

in other common/collective trust funds are valued at the closing net asset values determined by the trustees of such funds based

upon the fair value of the underlying securities held by a fund less its liabilities. Investments in common stocks are valued at

the last reported sales price on the active market on which the individual securities are traded on the last business day of the

year. The ESOP is accounted for on a unit accounting basis for which the investment is stated at the closing net asset value determined

by the Plan’s trustee as of the last business day of the year. U.S. government agency securities are valued at the mean of

the bid and ask prices on the last business day of the year. Investments held in the self-directed brokerage account constitute

of a broad array of stocks, mutual funds, money market funds, and partnerships/joint venture interests. Fair values of these investments

are determined based on evaluated prices using observable, market-based inputs such as data from Interactive Data. Investments held in relation to segregated participant accounts include money market funds and common stock,

which are valued as discussed above in reference to other Plan assets. There were no

changes in the valuation methodologies used at December 31, 2014 and 2013.

The preceding methods described may produce a fair value

calculation that may not be indicative of net realizable value or future fair values. Furthermore, although plan management believes

its valuation methods are appropriate and consistent with other market participants, the use of different methodologies or assumptions

to determine the fair value of

FIRST HORIZON NATIONAL CORPORATION SAVINGS PLAN

Notes to Financial Statements

December 31, 2014 and 2013

(2) Summary of Significant Accounting Policies (continued)

certain financial instruments could result in a different

fair value measurement at the reporting date.

Investment transactions are recorded on a trade-date

basis. Interest income is recorded on the accrual basis and is recognized when earned. Dividend income is accrued on the ex-dividend

date. Realized gains and losses from investment transactions are reported on the average cost method. Investment income includes

unrealized appreciation and depreciation of investments.

Pursuant to the Plan document, certain retirees are

allowed to segregate and direct the investment of their accounts and defer payment of benefits. These investments are individually

valued according to the accounts and are presented in a single line item in the financial statements.

The Plan also provides to plan participants a self-directed

brokerage account option, in which participants may invest in a broad array of stocks, mutual funds, money market funds, and partnership/joint

venture interests.

Participant and employer contributions are recognized

when earned. Rollovers are recognized when approved by the Plan Sponsor.

Benefits paid to participants or beneficiaries are recognized

when paid.

| (f) | Administrative Expenses |

Administrative expenses are recognized when incurred.

| (g) | Participant Notes Receivable |

Notes receivable from participants are measured at their

unpaid principal balances plus any accrued but unpaid interest. Delinquent participant loans are reclassified as distributions

based upon the terms of the plan agreement.

| (h) | Recent Accounting Pronouncements |

Effective January 2014, the Plan adopted the provisions

of FASB Accounting Standards Update (ASU) 2013-11 “Income Taxes: Presentation of an Unrecognized Tax Benefit When a Net Operating

Loss Carryforward, a Similar Tax Loss, or a Tax Credit Carryforward Exists.” ASU 2013-11 provides guidance on the financial

statement presentation of an unrecognized tax benefit when a net operating loss carryforward, a similar tax loss, or a tax credit

carryforward exists. Generally, ASU 2013-11 requires that an unrecognized tax benefit should reduce a deferred tax asset (DTA)

that has been established for a net operating loss (NOL), a tax credit carryforward, or other similar tax losses. However, if a

filer does not have such carryforwards or similar tax losses at the reporting date, the uncertain tax position

FIRST HORIZON NATIONAL CORPORATION SAVINGS PLAN

Notes to Financial Statements

December 31, 2014 and 2013

(2) Summary of Significant Accounting

Policies (continued)

should be recorded as a liability. If a filer does have

a DTA, but is not required by tax law of the applicable jurisdiction to use the DTA to settle additional taxes from the disallowance

of a tax position and that is the filer’s intent, the uncertain tax position should be recognized as a liability in that

situation as well and not netted with the DTA. The assessment of whether a DTA is available is based on the unrecognized tax benefit

and DTA that exist at the reporting date and should be made presuming disallowance of the tax position at the reporting date. The

adoption of the provisions of ASU 2013-11 had no effect on the Plan’s financial statements.

In May 2015, the FASB issued ASU 2015-07, “Fair

Value Measurement: Disclosures for Investments in Certain Entities That Calculate Net Asset Value per Share (or Its Equivalent).”

Currently, investments valued using the practical expedient are categorized within the fair value hierarchy, with diversity in

practice in how certain investments measured at net asset value with future redemption dates should be categorized within the fair

value hierarchy. Under ASU 2015-07, if an investment has its fair value measured at net asset value per share (or its equivalent)

using the practical expedient, it should not be categorized in the fair value hierarchy. By removing these types of investments

from the fair value hierarchy chart, ASU 2015-07 eliminates the diversity in classification of these investments and ensures that

all investments categorized in the fair value hierarchy are classified consistently. Investments that calculate net asset value

per share (or its equivalent) without the use of the practical expedient will continue to be included in the fair value hierarchy.

For public business entities, the amendments will be effective for annual periods, including interim periods within those annual

periods, beginning after December 15, 2015, and will be applied retrospectively to all periods presented. Early adoption

of ASU 2015-07 is permitted. The Company is currently evaluating the effects of ASU 2015-07 on the Plan’s financial statements.

(3) Risks and Uncertainties

Investment securities, including First Horizon National

Corporation common stock, are exposed to various risks, such as interest rate, market and credit risks. Due to the level of risk

associated with certain investment securities, it is at least reasonably possible that changes in their fair values could occur

in the near term and that such changes could materially affect participants’ account balances and the amounts reported in

the statement of net assets available for benefits.

(4) Concentration of Participant

Investments

The Plan has a significant portion of its assets invested

in First Horizon National Corporation common stock. This investment in First Horizon National Corporation common stock approximates

27% of the Plan’s net assets available for benefits as of December 31, 2014.

(5) Plan Termination

Although it has not expressed any intent to do so, the

Plan Sponsor has the right under the Plan to discontinue its contributions at any time and to terminate the Plan subject to the

provisions of ERISA. In the event of termination, the Plan provides that all affected participants’ interests will become

fully vested and nonforfeitable.

FIRST HORIZON NATIONAL CORPORATION SAVINGS PLAN

Notes to Financial Statements

December 31, 2014 and 2013

(6) Tax Status of Plan

The Internal Revenue Service (IRS) has determined and

informed the Plan Sponsor by a letter dated August 21, 2014, that the Plan and related trust are designed in accordance with applicable

sections of the Internal Revenue Code (IRC). The Plan has been amended since receipt of such letter; however, the Plan’s

management believes that the Plan remains in compliance with the applicable requirements of the IRC. Management is unaware of any

course of action or series of events that have occurred that might adversely affect the Plan’s qualified status.

Accounting principles generally accepted in the United

States of America require plan management to evaluate tax positions taken by the Plan and recognize a tax liability (or asset)

if the Plan has taken an uncertain position that more likely than not would not be sustained upon examination by the Internal Revenue

Service. The plan administrator has analyzed the tax positions taken by the Plan, and has concluded that as of December 31, 2014,

there are no uncertain positions taken or expected to be taken that would require recognition of a liability (or asset) or disclosure

in the financial statements. The Plan is subject to routine audits by taxing jurisdictions; however, there are currently no audits

for any tax periods in progress. The plan administrator believes it is no longer subject to income tax examinations for years prior

to December 31, 2011.

(7) Related Party and

Party in Interest Transactions

Certain plan investments are shares of First Horizon

National Corporation common stock and mutual funds and common collective trust funds managed by Wilmington Trust Company. First

Horizon National Corporation is the Plan sponsor and Wilmington Trust Company was the trustee and custodian through March 31, 2015

and, therefore, these transactions qualify as party-in-interest transactions. Additionally, through the self-directed brokerage

window, funds are held in short term investments managed by Aon Hewitt. Since Aon Hewitt was the recordkeeper of the plan through

March 31, 2015, such transactions also qualify as party-in-interest transactions.

The Company also provides the Plan with certain management

and administrative services for which no fees are charged.

(8) Investments

The following presents investments that represent 5 percent

or more of the Plan’s net assets as of December 31, 2014 and 2013:

| | |

2014 | | |

2013 | |

| First Horizon National Corporation - Common Stock | |

$ | 124,401,123 | | |

$ | 113,183,745 | |

| BlackRock S&P 500 Index Fund | |

| 63,893,935 | | |

| 55,832,693 | |

| Dodge & Cox Balanced Fund | |

| 43,737,110 | | |

| 39,027,740 | |

| Royce Premier Fund | |

| 38,245,722 | | |

| 44,342,024 | |

| Invesco Stable Value Fund | |

| 26,111,135 | | |

| 25,724,261 | |

| Thornburg Intl Value Fund-R5 | |

| 22,098,357 | * | |

| 27,179,535 | |

* Presented for comparative purposes only. Does not represent 5% or more of the fair value of the Plan's net assets as of December 31, 2014.

FIRST HORIZON NATIONAL CORPORATION SAVINGS PLAN

Notes to Financial Statements

December 31, 2014 and 2013

(8) Investments (continued)

For the year ended December 31, 2014, the Plan’s

investments, including gains and losses on investments bought and sold as well as held during the year, appreciated in value by

$ 22,225,323, as follows:

| | |

2014 | |

| First Horizon National Corporation - common stock fund | |

$ | 17,762,478 | |

| Common stock | |

| (187,443 | ) |

| Preferred stock | |

| 2,849 | |

| Common/collective trust funds | |

| 9,874,725 | |

| Mutual funds/money market funds | |

| (5,098,022 | ) |

| Partnerships/joint venture | |

| (22,164 | ) |

| Segregated participant investments | |

| (107,100 | ) |

| | |

$ | 22,225,323 | |

(9) Fully Benefit Responsive

Investments

The Plan invests in the Invesco Stable Value Trust which

is a collective trust fund in the Institutional Retirement Trust. The Trust’s primary investment objectives are to provide

preservation of principal, maintain a stable interest rate, and provide daily liquidity at contract value for participant withdrawals

and transfers. The Trust holds synthetic guaranteed investment contracts (GIC’s). The GIC’s are portfolios of securities

owned by the Trust with wrap contracts associated with the portfolios. The fair value of wrap contracts is determined by Invesco

National Trust Company based on issuer ratings determined by reference to credit ratings published by ratings agencies and on the

change in the present value of the contract’s replacement cost. The contract value is generally equal to the principal amounts

invested in the underlying investments, plus interest accrued at a crediting rate established under the contract, less any adjustment

for withdrawals.

The crediting rate on the wrap contracts is accrued daily

under the trust’s wrap agreements and is the product of the contract value of the wrap agreements multiplied by the crediting

rate as determined pursuant to the wrap agreement. The wrapper contract provides that the adjustments to the interest crediting

rate will not result in an interest crediting rate that is less than zero. Wrapper contracts’ interest crediting rates are

typically reset on a monthly or quarterly basis according to each contract.

In certain circumstances, the amount withdrawn from the

wrapper contract would be payable at fair value rather than at contract value. These events include termination of the Plan, a

material adverse change to the provisions of the Plan, the employer elects to withdraw from a wrapper contract in order to switch

to a different investment provider, or if the terms of a successor plan do not meet the wrapper contract issuer’s underwriting

criteria for issuance of a clone wrapper contract. Management of the trust believes it is not probable that such events would be

of sufficient magnitude to limit the ability of the trust to transact at contract value with the participants in the trust.

The average yield of the stable value fund was 1.374%

for 2014 and 1.256% for 2013 and the crediting interest rate was 1.626% for 2014 and 1.449% for 2013.

FIRST HORIZON NATIONAL CORPORATION SAVINGS PLAN

Notes to Financial Statements

December 31, 2014 and 2013

(10) Fair Value Measurements

ASC 820, Fair Value Measurements and Disclosures,

establishes a framework for measuring fair value. That framework provides a fair value hierarchy that prioritizes the inputs to

valuation techniques used to measure fair value. The hierarchy gives the highest priority to unadjusted quoted prices in active

markets for identical assets or liabilities (level 1 measurements) and the lowest priority to unobservable inputs (level 3 measurements).

The three levels of the fair value hierarchy under ASC 820 are described as follows:

| |

Level 1 |

Inputs to the valuation methodology are unadjusted quoted prices for identical assets or liabilities in active markets that

the plan has the ability to access. |

| |

Level 2 |

Inputs to the valuation methodology include: |

| · | quoted

prices for similar

assets or liabilities

in active markets; |

| · | quoted

prices for identical

or similar assets or

liabilities in inactive

markets; |

| · | inputs

other than quoted prices

that are observable

for the asset or liability; |

| · | inputs

that are derived principally

from or corroborated

by observable market

data by correlation

or other means. |

If the asset or liability has a specified (contractual)

term, the level 2 input must be observable for substantially the full term of the asset or liability.

| |

Level 3 |

Inputs to the valuation methodology are unobservable and significant to the fair value measurement. |

first horizon

national corporation savings Plan

Notes to Financial Statements

December 31, 2014 and 2013

(10) Fair Value Measurements (continued)

The asset or liability’s

fair value measurement level within the fair value hierarchy is based upon the lowest level of any input that is significant to

the fair value measurement. Valuation techniques used need to maximize the use of observable inputs and minimize the use of unobservable

inputs. The following table sets forth by level, within the fair value hierarchy, the Plan’s investments at fair value as

of December 31, 2014:

Investments

at Fair Value as of December 31, 2014

| | |

Level 1 | | |

Level 2 | | |

Level 3 | | |

Total | |

| Mutual funds | |

| | | |

| | | |

| | | |

| | |

| Balanced fund | |

$ | 43,737,110 | | |

$ | — | | |

$ | — | | |

$ | 43,737,110 | |

| Large cap funds | |

| 21,343,812 | | |

| — | | |

| — | | |

| 21,343,812 | |

| Small cap funds | |

| 38,245,722 | | |

| — | | |

| — | | |

| 38,245,722 | |

| Fixed income funds | |

| 14,232,505 | | |

| — | | |

| — | | |

| 14,232,505 | |

| International funds | |

| 22,098,357 | | |

| — | | |

| — | | |

| 22,098,357 | |

| Growth funds | |

| 14,118,450 | | |

| — | | |

| — | | |

| 14,118,450 | |

| Total mutual funds | |

| 153,775,956 | | |

| — | | |

| — | | |

| 153,775,956 | |

| Common stocks | |

| | | |

| | | |

| | | |

| | |

| Banking/financial services | |

| 124,401,123 | | |

| — | | |

| — | | |

| 124,401,123 | |

| Other | |

| 1,016,857 | | |

| — | | |

| — | | |

| 1,016,857 | |

| Total common stocks | |

| 125,417,980 | | |

| — | | |

| — | | |

| 125,417,980 | |

| | |

| | | |

| | | |

| | | |

| | |

| Money market funds | |

| 20,205,485 | | |

| — | | |

| — | | |

| 20,205,485 | |

| Common/collective trust funds | |

| | | |

| | | |

| | | |

| | |

| Index funds | |

| — | | |

| 114,708,913 | | |

| — | | |

| 114,708,913 | |

| Stable value funds | |

| — | | |

| 26,111,135 | | |

| — | | |

| 26,111,135 | |

| Total common/collective trust funds | |

| — | | |

| 140,820,048 | | |

| — | | |

| 140,820,048 | |

| Self directed brokerage account | |

| | | |

| | | |

| | | |

| | |

| Short-term investments | |

| 3,035,659 | | |

| — | | |

| — | | |

| 3,035,659 | |

| Common stock | |

| 4,660,957 | | |

| — | | |

| — | | |

| 4,660,957 | |

| Preferred stock | |

| 24,241 | | |

| | | |

| | | |

| 24,241 | |

| Mutual funds | |

| 2,513,156 | | |

| — | | |

| — | | |

| 2,513,156 | |

| Partnerships | |

| 97,579 | | |

| — | | |

| — | | |

| 97,579 | |

| Total self directed brokerage account | |

| 10,331,592 | | |

| — | | |

| — | | |

| 10,331,592 | |

| | |

| | | |

| | | |

| | | |

| | |

| | |

| | | |

| | | |

| | | |

| | |

| | |

$ | 309,731,013 | | |

$ | 140,820,048 | | |

$ | — | | |

$ | 450,551,061 | |

first horizon

national corporation savings Plan

Notes to Financial Statements

December 31, 2014 and 2013

(10) Fair Value Measurements (continued)

The following table sets forth

by level, within the fair value hierarchy, the Plan’s investments at fair value as of December 31, 2013:

Investments

at Fair Value as of December 31, 2013

| | |

Level 1 | | |

Level 2 | | |

Level 3 | | |

Total | |

| Mutual funds | |

| | | |

| | | |

| | | |

| | |

| Balanced fund | |

$ | 39,027,740 | | |

$ | — | | |

$ | — | | |

$ | 39,027,740 | |

| Large cap funds | |

| 17,914,897 | | |

| — | | |

| — | | |

| 17,914,897 | |

| Small cap funds | |

| 44,342,024 | | |

| — | | |

| — | | |

| 44,342,024 | |

| Fixed income funds | |

| 13,064,047 | | |

| — | | |

| — | | |

| 13,064,047 | |

| International funds | |

| 27,179,535 | | |

| — | | |

| — | | |

| 27,179,535 | |

| Growth funds | |

| 13,245,978 | | |

| — | | |

| — | | |

| 13,245,978 | |

| Total mutual funds | |

| 154,774,221 | | |

| — | | |

| — | | |

| 154,774,221 | |

| Common stocks | |

| | | |

| | | |

| | | |

| | |

| Banking/financial services | |

| 113,183,745 | | |

| — | | |

| — | | |

| 113,183,745 | |

| Other | |

| 1,224,553 | | |

| — | | |

| — | | |

| 1,224,553 | |

| Total common stocks | |

| 114,408,298 | | |

| — | | |

| — | | |

| 114,408,298 | |

| | |

| | | |

| | | |

| | | |

| | |

| Money market funds | |

| 22,522,403 | | |

| — | | |

| — | | |

| 22,522,403 | |

| Common/collective trust funds | |

| | | |

| | | |

| | | |

| | |

| Index funds | |

| — | | |

| 95,169,707 | | |

| — | | |

| 95,169,707 | |

| Stable value funds | |

| — | | |

| 25,724,261 | | |

| — | | |

| 25,724,261 | |

| Total common/collective trust funds | |

| — | | |

| 120,893,968 | | |

| — | | |

| 120,893,968 | |

| Self directed brokerage account | |

| | | |

| | | |

| | | |

| | |

| Short-term investments | |

| 1,802,658 | | |

| — | | |

| — | | |

| 1,802,658 | |

| Common stock | |

| 2,866,490 | | |

| — | | |

| — | | |

| 2,866,490 | |

| Mutual funds | |

| 2,777,047 | | |

| — | | |

| — | | |

| 2,777,047 | |

| Partnerships | |

| 82,511 | | |

| — | | |

| — | | |

| 82,511 | |

| Total self directed brokerage account | |

| 7,528,706 | | |

| — | | |

| — | | |

| 7,528,706 | |

| | |

| | | |

| | | |

| | | |

| | |

| | |

| | | |

| | | |

| | | |

| | |

| | |

$ | 299,233,628 | | |

$ | 120,893,968 | | |

$ | — | | |

$ | 420,127,596 | |

first horizon

national corporation savings Plan

Notes to Financial Statements

December 31, 2014 and 2013

(11) Benefits Payable

Included in net assets available

for benefits are amounts allocated to individuals who have elected to withdraw from the Plan, but have not been paid as of December

31, 2014 or 2013. Plan assets allocated to these participants were $351,393 for 2014 and $620,819 for 2013.

(12) Reconciliation of Financial Statements to Form 5500

The following is a reconciliation

of net assets available for benefits per the financial statements to the Form 5500 expected to be filed for 2014:

| | |

2014 | | |

2013 | |

| | |

| | |

| |

| Net assets available for benefits per the financial statements | |

$ | 459,221,891 | | |

$ | 428,384,036 | |

| Less: Benefit payable | |

| (351,393 | ) | |

| (620,819 | ) |

| Add: Adjustment to contract value | |

| 510,831 | | |

| 328,006 | |

| Net assets available for benefits per the Form 5500 | |

$ | 459,381,329 | | |

$ | 428,091,223 | |

The following is a reconciliation

of benefits paid to participants per the financial statements to the Form 5500 expected to be filed for 2014:

| | |

2014 | |

| | |

| |

| Benefits paid to participants per the financial statements | |

$ | 35,451,233 | |

| Less: accrual for prior year | |

| (620,819 | ) |

| Add: accrual for current year | |

| 351,393 | |

| Benefits paid to participants per the Form 5500 | |

$ | 35,181,807 | |

The following is a reconciliation

of the total increase (decrease) in net assets of the plan per the financial statements to the Form 5500 expected to be filed for

2014:

| | |

2014 | |

| | |

| |

| Total increase in assets per the financial statements | |

$ | 30,837,855 | |

| Cumulative adjustment to contract value | |

| 182,825 | |

| Cumulative benefits payable | |

| 269,426 | |

| Net income (loss) per the Form 5500 | |

$ | 31,290,106 | |

first horizon

national corporation savings Plan

Notes to Financial Statements

December 31, 2014 and 2013

(13) Subsequent Events Evaluation

Effective April 1, 2015, the Company

replaced the trustee of the Plan, Wilmington Trust, with State Street Bank and Trust Company. The Company also replaced the recordkeeper

of the Plan, Aon Hewitt, with Transamerica Retirement Solutions Corporation.

Prior to April 1, 2015, participants

could have loan terms that ranged from 6 months for both general purpose and primary residence loans. Additionally, participants

could only have one general purpose loan and one primary residence loan per calendar year. After April 1, 2015, the minimum loan

term increased to 12 months for both general purpose and primary residence loans. Also effective April 1, 2015, while the two loans

outstanding maximum remains in effect (for loans approved after April 1, 2009), participants may have either two general purpose

loans outstanding or one general purpose loan and one primary residence loan.

The Plan has evaluated subsequent

events through the date that the financial statements were filed with the Securities and Exchange Commission.

FIRST HORIZON NATIONAL CORPORATION SAVINGS

PLAN

Schedule H, Line 4i - Schedule of Assets

(Held at End of Year)

Plan Number: 002

EIN: 62-0803242

December 31, 2014

| (a) | |

(b) | |

(c) | |

(e) | |

| | |

Identity of

issue, borrower,

lessor, or similar party | |

Description

of investment

including maturity date,

rate of interest, collateral,

par, or maturity value | |

Current

value | |

| | |

| |

| |

| | |

| * | |

Wilmington Prime Money Market Fund W Class | |

Money market fund | |

$ | 647,972 | |

| | |

Goldman Sachs Financial Square

Government | |

Money market fund | |

| 19,374,499 | |

| | |

| |

Total money market funds | |

| 20,022,471 | |

| | |

| |

| |

| | |

| * | |

First Horizon Self Directed Brokerage Account | |

Self-Directed Brokerage Account | |

| 10,331,592 | |

| | |

| |

| |

| | |

| | |

Invesco Stable Value Fund | |

Common/collective - stable value fund | |

| 26,111,135 | |

| | |

| |

| |

| | |

| | |

BlackRock Life Path Index 2020 Fund | |

Common/collective trust fund | |

| 7,324,719 | |

| | |

BlackRock Life Path Index 2025 Fund | |

Common/collective trust fund | |

| 8,546,787 | |

| | |

BlackRock Life Path Index 2030 Fund | |

Common/collective trust fund | |

| 4,564,367 | |

| | |

BlackRock Life Path Index 2035 Fund | |

Common/collective trust fund | |

| 3,570,275 | |

| | |

BlackRock Life Path Index 2040 Fund | |

Common/collective trust fund | |

| 3,502,719 | |

| | |

BlackRock Life Path Index 2045 Fund | |

Common/collective trust fund | |

| 4,404,605 | |

| | |

BlackRock Life Path Index 2050 Fund | |

Common/collective trust fund | |

| 4,349 | |

| | |

BlackRock Life Path Index 2055 Fund | |

Common/collective trust fund | |

| 9,086 | |

| | |

BlackRock Life Path Index Retirement | |

Common/collective trust fund | |

| 5,952,554 | |

| | |

BlackRock Aggregate Bond Index Fund | |

Common/collective trust fund | |

| 3,725,609 | |

| | |

BlackRock MSCI ACWI EX US Fund | |

Common/collective trust fund | |

| 3,846,972 | |

| | |

BlackRock Russell 2000 Index Fund | |

Common/collective trust fund | |

| 5,362,936 | |

| | |

BlackRock S&P 500 Index Fund | |

Common/collective trust fund | |

| 63,893,935 | |

| | |

| |

Total common/collective trust

funds | |

| 114,708,913 | |

| | |

| |

| |

| | |

| | |

Dodge & Cox Balanced Fund | |

Mutual fund | |

| 43,737,110 | |

| | |

T Rowe Price Institution Large Cap Value Fd | |

Mutual fund | |

| 14,259,156 | |

| | |

Mainstay Large Cap Growth Fund | |

Mutual fund | |

| 7,084,656 | |

| | |

Royce Premier Fund | |

Mutual fund | |

| 38,245,722 | |

| | |

Goldman Sachs Core Fixed Income | |

Mutual fund | |

| 14,232,505 | |

| | |

Lord Abbett Developing Growth Fund Inc | |

Mutual fund | |

| 14,118,450 | |

| | |

Thornburg Intl Value Fund-R5 | |

Mutual fund | |

| 22,098,357 | |

| | |

| |

Total mutual funds | |

| 153,775,956 | |

| | |

| |

| |

| | |

| * | |

First Horizon National Corporation | |

First Horizon

National Corporation common stock fund, 10,003,815.17 units | |

| 124,401,123 | |

| * | |

Participant Loans | |

Loan fund,

interest rates ranging from 3.25% to 8.25%, collateralized by participants’ right, title and interest in and to the

Plan | |

| 8,813,829 | |

| | |

| |

| |

| | |

| | |

Segregated participant investments: | |

| |

| | |

| | |

| |

| |

| | |

| | |

Fidelity Inst’l Govt Portfolio | |

Money market fund | |

| 183,014 | |

| | |

| |

| |

| | |

| | |

| |

| |

| | |

| | |

Exxon Mobil Corporation | |

Corporate stock, 8,801 shares | |

| 813,652 | |

| | |

Murphy Oil Corporation | |

Corporate stock, 3,000 shares | |

| 151,560 | |

| | |

Murphy USA Inc | |

Corporate stock, 750 shares | |

| 51,645 | |

| | |

| |

Total corporate stock | |

| 1,016,857 | |

| | |

| |

| |

| | |

| | |

| |

| |

$ | 459,364,890 | |

| * |

Indicates party-in-interest to the Plan. For First Horizon Self Directed Brokerage Account, this includes $3.0 million of short-term investments managed by Aon Hewitt, a related party. |

See accompanying report of independent registered public accounting

firm.

EXHIBITS

The following documents are filed

as exhibits to this Form 11-K:

| 1. | Consent of Independent Registered Public Accounting Firm [Mayer Hoffman McCann P.C.]. |

SIGNATURES

The Plan. Pursuant to the requirements of the

Securities Exchange Act of 1934, the Pension, Savings and Flexible Plan Committee of the First Horizon National Corporation Savings

Plan (“Plan”) has duly caused this annual report to be signed on behalf of the Plan by the undersigned hereunto duly

authorized.

| |

FIRST HORIZON NATIONAL CORPORATION SAVINGS PLAN |

| |

|

|

| Date: June 25, 2015 |

By: |

/s/ Tanya L. Hart |

| |

|

Tanya L. Hart |

| |

|

Senior Vice President – Executive Compensation Manager, and Member of the Pension, Savings and Flexible Compensation Committee |

EXHIBIT INDEX

| No. |

|

Description |

| |

|

|

| 23.1 |

|

Consent of Independent Registered Public Accounting Firm [Mayer Hoffman McCann P.C.] |

Exhibit 23.1

CONSENT OF INDEPENDENT REGISTERED PUBLIC

ACCOUNTING FIRM

To the Plan Administrator of the First Horizon National Corporation

Savings Plan:

We consent to the incorporation by reference

in the Registration Statement (No. 333-156614) on Form S-8 of First Horizon National Corporation of our report dated June 25, 2015

with respect to the statements of net assets available for benefits of the First Horizon National Corporation Savings Plan as of

December 31, 2014 and 2013, the related statement of changes in net assets available for benefits for the year ended December 31,

2014, and the related supplemental schedule as of December 31, 2014, which report appears in the December 31, 2014 annual report

on Form 11-K of the First Horizon National Corporation Savings Plan.

/s/ Mayer Hoffman McCann P.C.

Memphis, Tennessee

June 25, 2015

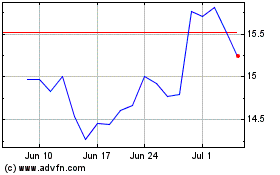

First Horizon (NYSE:FHN)

Historical Stock Chart

From Mar 2024 to Apr 2024

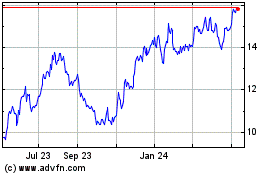

First Horizon (NYSE:FHN)

Historical Stock Chart

From Apr 2023 to Apr 2024