Southern Banks Post Mixed Results; Continuing Financial Woes

January 21 2011 - 7:15PM

Dow Jones News

SunTrust Banks Inc. (STI) cemented its return to profitability

with rising revenue in the fourth quarter, but earnings for two

other Southern banks indicate that overcoming the financial crisis

remains a painfully slow process.

The results show that the South is struggling longer to leave

the mortgage meltdown behind than even the Midwest, a region that

was considered less attractive before the financial crisis because

the economy there was less robust.

The Southern economy was fueled by population growth and the

services industry, which resulted in a residential and commercial

real estate boom. "The mortgage problems are largely rooted in the

South," as were commercial real estate and construction loan

losses, said Kenneth Usdin, an analyst with Jefferies & Co.

"The Midwest emerged earlier" from the crisis.

Not only had the Southeastern banks more delinquent loans, "but,

more importantly, they were slower in addressing those issues than

financial institutions in the Midwest," said Frank Barkocy, the

director of research at Mendon Capital Advisors.

However, like in other parts of the U.S., Southern lenders said

loan demand is returning, particularly from businesses, adding to

the optimism about the banking industry's improving revenue outlook

for this year.

SunTrust stood out, analysts said. Revenue at the Atlanta bank,

the largest bank that solely operates in Southern states, rose

almost 20% from a year earlier, and was flat from the third

quarter. (Revenue at several banks fell from the third quarter.)

SunTrust reported a $185 million profit, its third consecutive

profitable quarter, and the results beat analysts' expectations. A

year earlier, it lost $248 million.

BB&T Corp. (BBT) of Winston-Salem, N.C., one of the first

banks to have repaid TARP last year, reported a 12% rise in

fourth-quarter profit from a year earlier, to $217 million. Revenue

was flat, at $2.3 billion. The bank put away more money for

delinquent loans than several analysts had expected.

First Horizon National (FHN) reported a loss of $48.7 million,

compared with a prior-year loss of $70.6 million. The latest period

included $63 million in costs related to its TARP repayment. The

bank had aggressively expanded its mortgage business, until the

board of directors changed course in 2007 and forced management

changes. Fourth-quarter revenue fell 10%. to $393 million,

following an 18% decline a year earlier.

Shares of SunTrust and BB&T rose on Friday, partly because

short sellers covered their positions, analysts said. But "there

was some real buying," particularly in BB&T's stock, Usdin

said.

SunTrust shares closed up 5.9%, BB&T rose 4.8%, First

Horizon fell 1.7% and Bank of America fell 2%.

BB&T, which had surprised investors last year with a sharp

increase in losses from loans that aren't paid back, set aside $643

million for future loan losses, 11% less than a year earlier, and

Chief Risk Officer Clark Starnes told analysts during a conference

call he expects the provision to decline further now that the

economy improved. (BB&T had bought Colonial BancGroup Inc.,

which collapsed under the weight of soured real estate loans.)

First Horizon Chief Financial Officer BJ Losch said in an

interview, "We've turned a corner on our road to recovery, but it

will still take a few years to get to the level of profitability

and returns we want to be at."

--Tess Stynes and Corrie Driebusch contributed to this

article.

-By Matthias Rieker, Dow Jones Newswires; 212-416-2471;

matthias.rieker@dowjones.com

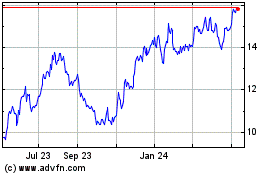

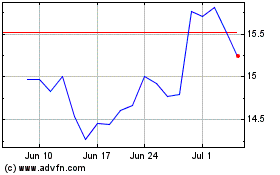

First Horizon (NYSE:FHN)

Historical Stock Chart

From Mar 2024 to Apr 2024

First Horizon (NYSE:FHN)

Historical Stock Chart

From Apr 2023 to Apr 2024