Executives world-wide returned to work Wednesday to face a

radically changed political landscape as they weighed the

ramifications of Donald Trump's surprise election win—the second

big shift for global businesses in recent months after the U.K.'s

Brexit vote.

The upset victory by the Republican nominee, who was down in

most polls heading into Election Day, took markets and many

corporate leaders by surprise—and will leave them unsettled, given

the uncertainty behind many of Mr. Trump's policy positions. Shares

of auto makers and some industrial conglomerates fell early

Wednesday, while pharmaceutical companies, some energy firms and

bank stocks rose.

"The market wanted the certainty and clarity of a Clinton win—it

may not agree with all of her policy proposals, but it was

comfortable with gridlock," said Brian Gardner, head of Washington

research for the investment bank Keefe, Bruyette Woods.

Mr. Trump has criticized global trade, the North American Free

Trade Agreement and the Trans-Pacific Partnership, a trade

agreement to lower or eliminate tariffs between the U.S. and 11

other countries including Japan and Vietnam.

Any push by the Trump administration to craft new bilateral

agreements is a potential headache for firms such as General

Electric Co. and Caterpillar Inc. that have supported free trade as

a way to gain access to overseas markets, analysts said.

"Obviously we are concerned about the antitrade rhetoric, a lot

of the antibusiness positions and it's very worrisome," FedEx Corp.

CEO Fred Smith said of both candidates in a recent earnings call.

"But hopefully, after the election cooler heads will prevail."

Global stock markets fell sharply overnight, but the Dow

industrials were largely unchanged, up 0.8% to 18347.86 shortly

after trading opened. The dollar initially sold off against the

euro, yen and sterling in Asian trading but recouped much of those

losses.

In Asia, shares fell sharply in Japanese and South Korean auto

makers such as Toyota Motor Corp., Honda Motor Co. and Nissan Motor

Co., which lean heavily on manufacturing U.S.-bound exports from

Mexico. On the campaign trail, Mr. Trump criticized big U.S.

companies like Ford Motor Co. and United Technologies Corp. for

moving jobs and operations overseas. He threatened to slap 35%

tariffs on cars imported from Mexico.

For many investors and executives, a victory by Hillary Clinton

was expected to provide more immediate clarity despite her

targeting big businesses on the campaign trail—including

pharmaceuticals firms—as ripe for scrutiny.

Big drug stocks shot higher in Europe after being weighed down

for months by the prospect of a pricing crackdown during a Clinton

presidency. And U.S. defense stocks rallied early as the prospect

of a short-term bump in military spending from the incoming Trump

administration outweighed concerns about a possible hit to export

sales.

Mr. Trump has vowed to dismantle the Affordable Care Act—a move

that could hinge on Democrats' ability to block legislation in the

Senate—and to allow health insurers, which currently are regulated

by the states, the ability to compete across state lines. Either

has the potential to upend the U.S. health-insurance market, which

is still coming to grips with the changes wrought by the ACA.

Mr. Trump's election promises relief for U.S. coal miners, a

boost for American oil producers and fresh uncertainty for Western

energy companies' plans to return to Iran.

Whether any of the market moves early Wednesday end up being

knee-jerk reactions, or early signals of which global sectors may

benefit from a Trump presidency, is far from clear. Many of Mr.

Trump's policy statements so far have been vague and open to

interpretation, and he has been known to swerve on positions

radically.

After the election result, more than 1,100 chief executives said

in an open letter to Mr. Trump that he can count on business to

promote "healing and reconciliation."

"To be sure, we are aware that there will be times when we

disagree on the specifics of important policies, and we will

respectfully make our voices heard when we do," they wrote. "We do

believe, however, that we can be constructive—both when we agree

and when we do not—if we can all approach challenging situations in

good faith, guided by an unwavering commitment to a greater

purpose."

The letter was organized by the National Association of

Manufacturers, a major Washington trade group. The signers include

Dennis A. Muilenburg of Boeing Co., Wes Bush, CEO of Northrop

Grumman Corp., David Taylor, CEO of Procter Gamble Co. and Gregory

Hayes of United Technologies Corp.

Mr. Trump has proposed overhauling U.S. corporate taxes by

reducing the corporate rate to 15% from 35%. His plan also provides

for a one-time tax rate of 10% for repatriated corporate profits,

which would help fund plans to spend on new infrastructure

projects.

Mr. Trump's campaign argues that in addition to forestalling

inversions—acquisitions that enable companies to re-domicile

abroad—the plan would accelerate U.S. economic growth.

"His view is if you lower the tax rate at the corporate level,

more money is coming back into the country," said Scott Kaplowitch,

a partner at Edelstein Company LLP. "You would think twice about

investing overseas if the tax rate came down in the U.S."

Mr. Trump has spoken out against media consolidation, saying his

administration would seek to block AT&T Inc.'s proposed $85

billion acquisition of Time Warner Inc. "It's too much

concentration of power in the hands of too few," he said in

October. Shares of Time Warner fell 1.5% to $86.45 early Wednesday,

while AT&T shares were up 0.4% at $37.15.

Alex MacDonald contributed to this article.

Write to Theo Francis at theo.francis@wsj.com, Denise Roland at

Denise.Roland@wsj.com, Andrew Tangel at Andrew.Tangel@wsj.com and

Sean McLain at sean.mclain@wsj.com

(END) Dow Jones Newswires

November 09, 2016 10:55 ET (15:55 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

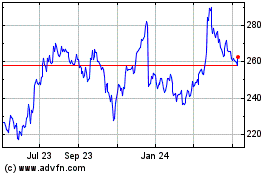

FedEx (NYSE:FDX)

Historical Stock Chart

From Mar 2024 to Apr 2024

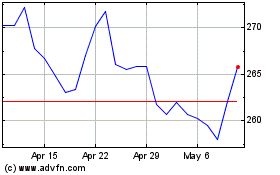

FedEx (NYSE:FDX)

Historical Stock Chart

From Apr 2023 to Apr 2024