FedEx Lifts Outlook as It Integrates TNT Express--Update

September 20 2016 - 6:10PM

Dow Jones News

By Anne Steele

FedEx Corp. increased its earnings forecast for the year as the

package-delivery giant works to integrate the Dutch parcel firm TNT

Express NV amid a tepid economic outlook.

The company also reported revenue and adjusted earnings for the

August quarter that topped expectations, lifting shares of FedEx by

2.3% to $166.45 in after-hours trading.

FedEx bought TNT in May for nearly $5 billion. For the fiscal

year ending in May, the Memphis, Tenn., company said it now expects

earnings excluding TNT-related integration and other costs of

$11.85 to $12.35 a share. Previously, it had forecast adjusted

per-share earnings of $11.75 to $12.25.

Chief Executive Frederick Smith said the integration of TNT

Express is "proceeding smoothly." He said results were strong,

"especially given the global economy's continued low growth."

For the quarter ended Aug. 31, FedEx reported a profit of $715

million, or $2.65 a share, up from $692 million, or $2.42 a share,

a year ago. FedEx said costs from TNT's integration and

restructuring program dented earnings by 17 cents a share, while an

intangible asset amortization expense for TNT shaved another 8

cents off per-share profit.

Excluding those items, adjusted per-share earnings rose to $2.90

a share. Revenue rose 20% to $14.7 billion. Analysts polled by

Thomson Reuters had projected adjusted per-share profit of $2.81 on

$14.61 billion in revenue.

Chief Financial Officer Alan Graf said that as FedEx continues

to integrate TNT, there will be opportunities to improve

earnings.

Write to Anne Steele at Anne.Steele@wsj.com

(END) Dow Jones Newswires

September 20, 2016 17:55 ET (21:55 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

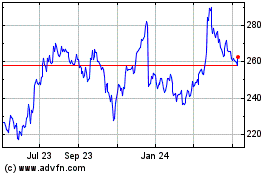

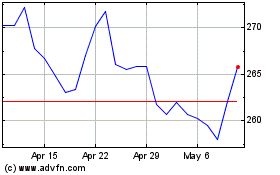

FedEx (NYSE:FDX)

Historical Stock Chart

From Mar 2024 to Apr 2024

FedEx (NYSE:FDX)

Historical Stock Chart

From Apr 2023 to Apr 2024