Ahead of the Tape: FedEx's Express Unit Delivers the Goods -- WSJ

September 20 2016 - 3:02AM

Dow Jones News

By Steven Russolillo

Don't underestimate FedEx Corp.'s air game.

Its ground segment has gotten all the attention lately, with

revenue nearly doubling over the past five years thanks to booming

e-commerce growth. But what arguably matters more is FedEx's

air-shipping Express division, its largest unit, where rising

margins are making the unit more profitable overall.

While keeping up with e-commerce growth is always important,

Express's continued momentum is the key indicator to watch in

fiscal first-quarter results, due Tuesday. Analysts polled by

FactSet estimate adjusted earnings for the period ended in August

of $2.78 a share, up 15% from a year ago. Revenue is expected to

have increased 19% to $14.6 billion.

Express accounts for more than half of FedEx's overall revenue.

It will get a boost from the $4.8 billion acquisition of TNT

Express NV, the largest deal in its history, completed earlier this

year. TNT gives FedEx a stronger footprint in Europe. Analysts at

Cowen & Co. forecast TNT will initially dilute earnings. The

company expects it to be accretive by fiscal 2018.

Express has shown promise of late. Its international airfreight

generates revenue of $54.16 per package, otherwise known as

"yield." That is the most among all of FedEx's segments and triple

what a domestic package yields. Volumes also have increased.

But what has really stood out is growth in Express's overall

operating income, surging about 170% over its past three fiscal

years. In its most recent year that ended in May, it exceeded

Ground's for the first time in six years.

FedEx shares have outperformed the S&P 500 by 3 percentage

points this year. That includes a 12% surge after its March

earnings report, its largest one-day percentage gain since 1993,

following a strong holiday season. Wall Street has gotten more

bullish, too. Some 71% of analysts who cover the company have "buy"

ratings on FedEx, the highest in four years.

Granted, FedEx's growth doesn't come cheap. The company expects

to increase capital spending 6% year over year to $5.1 billion to

keep up with e-commerce. That is almost double what it was 10 years

ago, not including TNT integration costs, which is pressuring

margins in the Ground segment. Including TNT, this projection jumps

to $5.6 billion, according to FedEx's latest forecast.

But it is FedEx's air strategy that should help this stock keep

delivering.

tape@wsj.com

(END) Dow Jones Newswires

September 20, 2016 02:47 ET (06:47 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

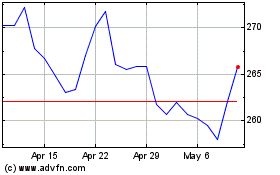

FedEx (NYSE:FDX)

Historical Stock Chart

From Mar 2024 to Apr 2024

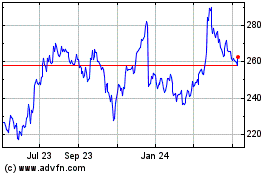

FedEx (NYSE:FDX)

Historical Stock Chart

From Apr 2023 to Apr 2024